ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

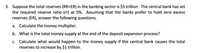

Transcribed Image Text:3. Suppose the total reserves (RR+ER) in the banking sector is $5 trillion. The central bank has set

the required reserve ratio (rr) at 5%. Assuming that the banks prefer to hold zero excess

reserves (ER), answer the following questions.

a. Calculate the money multiplier.

b. What is the total money supply at the end of the deposit expansion process?

c. Calculate what would happen to the money supply if the central bank causes the total

reserves to increase by $1 trillion.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 1. The growth rate of the money supply in a particular year was 8.5%. What was the growth rate of real GDP if the inflation rate in the same year was 4%? 2. During a recession, the Fed enacts countercyclical policy, by changing the quantity of reserves. To fight recession, how will the Fed adjust the quantity of reserves in the market (to S₁ or S₂)? Explain how the Fed can operationalize that. Fed funds rate () S I 1 I I 1 T I 1 1 1 1 I || I I 1 1 1 1 So I I 1 1 I 1 I I 1 1 I 1 1 J I I 1 1 + I I I I 2 D Quantity of reserves 3. Explain why the zero lower bound is a problem for monetary policy. If there's a recession and the Central Bank is at a zero lower bound, what monetary policies can it pursue to stimulate the economy?arrow_forwardIn 2019, a Federal reserve publications stated: " The federal reserve can no longer effectively influence the FFR by small changes in the supply of reserves." Is this statement true? 1. No, since the 2007-2009 financial crises, the Fed has fixed the FFR to match the level of reserves held in the banking system. 2. Yes, since the 2007-2009 financial crises, banks have held substantial excess reserves so small changes in reserves by the Fed do not significantly influence the FFR 3. No, the FFR always reacts to the level of reserves, so any changes in reserves by the Fed will impact the FFR 4. Yes, since the 2007-2009 financial crises, banks have stopped holding excess reserves altogether so small changes in reserves have no impact on the FFRarrow_forwardAssume that the banking system has total reserves of Rs.250 billion. Assume also that required reserves are 10 percent of checking deposits and that banks hold no excess reserves and households hold no currency. Calculate the money multiplier? Calculate the money supply?(If the State Bank of Pakistan now raises required reserves to 12.5 percent of deposits,) Calculate the money multiplier?arrow_forward

- its about economics. 8. The reserve requirement, open market operations, and the money supply Assume that banks do not hold excess reserves and that households do not hold currency, so the only form of money is demand deposits. To simplify the analysis, suppose the banking system has total reserves of $500. Determine the money multiplier and the money supply for each reserve requirement listed in the following table. Reserve Requirement Simple Money Multiplier Money Supply (Percent) (Dollars) 25 options (1,2.5,4,10,25) Options(500,1250,2000,5000,12500) 10 options(1, 2.5,4,10,25) options(500,1250,2000,5000,12500) A higher reserve requirement is associated with a _______(larger, smaller) money supply. Suppose the Federal Reserve wants to increase the money supply by $100. Again, you can assume that banks do not hold excess reserves and that households do not hold currency. If the reserve requirement is 10%, the Fed will use…arrow_forwardThe reserve requirement, open market operations, and the moneysupply Consider a system of banking in which the Federal Reserve uses required reserves to control the money supply (as was the case in the United States before 2008). Assume that banks do not hold excess reserves and that households do not hold currency, so the only money exists in the form of demand deposits. To further simplify, assume the banking system has total reserves of $300. Determine the money multiplier as well as the money supply for each reserve requirement listed in the following table. Reserve Requirement Simple Money Multiplier Money Supply (Percent) 5 (0.5, 1, 5, 10 or 20) (150, 300, 1500, 3000 or 6000) 10 (0.5, 1, 5, 10 or 20) (150, 300, 1500, 3000 or 6000) A higher reserve requirement is associated with a (LARGER or SMALLER) money supply. Suppose the Federal Reserve wants to increase the money supply by $200. Maintain the assumption that banks do not…arrow_forwardSuppose the simplified consolidated balance sheet shown below is for the entire commercial banking system and that all figures are in billions of dollars. The reserve ratio is 25 percent. Assets Reserves Securities Loans $ 1 52 48 100 (a) $ (b) Instructions: Enter your answers as a whole number. billion Liabilities and net worth Checkable deposits a. What is the amount of excess reserves in this commercial banking system? $ billion What is the maximum amount the banking system might lend? $ billion $ 1' 200 (a) Show in columns 1(a) and 1'(a) how the consolidated balance sheet would look after this amount has been lent. Enter these new values in the gray shaded cells of the given table. What is the size of the monetary multiplier? (b) b. Using the original figures, answer the questions in part a assuming the reserve ratio is 20 percent. What is the amount of excess reserves in this commercial banking system?arrow_forward

- M1 is the narrowest definition of the money supply. It includes currency in circulation, checking account deposits and travelers checks. The statements refer to factors that can affect the money multiplier. Label each statement as true or false. The total change in the M1 brought about by the money multiplier is affected by the amount of deposits made by households and businesses.Banks must lend out all their excess reserves in order to change the M1 money supply.The Federal Reserve (Fed) has very little effect on the money multiplier.The state of the economy can affect the amount of excess reserves that banks keep on reserve, thereby affecting the impact of the money multiplier.arrow_forwardThe reserve requirement, open market operations, and the money supply Assume that banks do not hold excess reserves and that households do not hold currency, so the only form of money is checkable deposits. To simplify the analysis, suppose the banking system has total reserves of $500. Determine the simple money multiplier and the money supply for each reserve requirement listed in the following table. Reserve Requirement Simple Money Multiplier Money Supply (Percent) (Dollars) 5 10 A lower reserve requirement is associated with a ______(SMALLER/LARGER) money supply. Suppose the Federal Reserve wants to increase the money supply by $200. Again, you can assume that banks do not hold excess reserves and that households do not hold currency. If the reserve requirement is 10%, the Fed will use open-market operations to _____(BUY/SELL)$ ________ worth of U.S. government bonds. Now, suppose that, rather than…arrow_forwardAssume that banks lend out all their excess reserves and individuals deposit all their money. If the Required Reserve Ratio is .20, what does the Fed have to do to decrease the supply of money by $300 billion? Select one: a. Sell $60 billion worth of government bonds to commercial banks b. Sell $80 billion worth of government bonds to commercial banks c. Sell $200 billion worth of government bonds to commercial banks d. Buy $100 billion worth of government bonds from commercial banks e. Buy $60 billion worth of government bonds from commercial banksarrow_forward

- The reserve requirement is 10%. Suppose that the Fed purchases $50,000 worth of U.S. government securities from a bond dealer, electronically crediting the dealer's deposit account at Reliable Bank. Which of the following correctly describes the immediate effect of this transaction? A. The required reserves of Reliable Bank increase by $50,000. B. The total reserves of Reliable Bank increase by $50,000. C. Reliable Bank can make $50,000 in new loans. D. The excess reserves of Reliable Bank increase by $50,000. -ம்arrow_forwardThe great expert image uploaded answer is not allowed pleasearrow_forwardWhich of the following is the most accurate description of events when monetary authorities increase the size of commercial banks' excess reserves? Select one: a. The money supply is decreased, which increases the interest rate, and causes investment spending, output, and employment to decrease b. The money supply is increased, which decreases the interest rate, and causes investment spending, output, and employment to increase c. A rise in interest rates increases the money supply, causing a decrease in investment spending, output, and employment d. A fall in interest rates decreases the money supply, causing an increase in investment spending, output, and employmentarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education