FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Pls do fast and i will rate instantly for sure

Solution must be in typed form

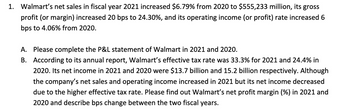

Transcribed Image Text:1. Walmart's net sales in fiscal year 2021 increased $6.79% from 2020 to $555,233 million, its gross

profit (or margin) increased 20 bps to 24.30%, and its operating income (or profit) rate increased 6

bps to 4.06% from 2020.

A. Please complete the P&L statement of Walmart in 2021 and 2020.

B. According to its annual report, Walmart's effective tax rate was 33.3% for 2021 and 24.4% in

2020. Its net income in 2021 and 2020 were $13.7 billion and 15.2 billion respectively. Although

the company's net sales and operating income increased in 2021 but its net income decreased

due to the higher effective tax rate. Please find out Walmart's net profit margin (%) in 2021 and

2020 and describe bps change between the two fiscal years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 12arrow_forwardPlease answer the following requirements on these general accounting questionarrow_forwardThe following information pertains to JCU Company. All dollar amounts are in thousands. If JCU is computing trend percentages with 2018 as the base year, what % will 2019 sales be? Sales Gross Margin Net operating income Net income Year 2020 $58,000 $17,500 $3,200 $1,750 2019 $51,000 $15,100 $2,850 $1,400 2018 $47,000 $13,800 $2,100 $1,100arrow_forward

- Abbott Laboratories’ Consolidated Statements of Earnings for the 3 fiscal year’s ending December 31, 2019. Required: Using the attached earnings statement, for each period presented, Compute the gross margin % Note: Gross margin % = [(Net sales – Cost of products sold)/Net sales] x 100 Compute the net profit margin on sales % Note: Net profit margin % = (Net earnings/Net sales) x 100 Considering the 3-year trend for a. and b. above, provide a brief comment about the company’s performance for: Gross margin % and Net profit margin %.arrow_forward4. The following common size income statement are available for Gaea Corporation for the two years ended December 2019, and 2018 2019 2018 Sales 100% 100% Cost of sales 55% 70% Gross profit on sales 45% 30% Operating (including income tax expense) expenses 20% 18% 25% 12% Net income The trend percentages for sales are as follows: 2017 130% 100% 2016 What should be the trend percentage for gross profit on sales for 2019 A. 58.5% В. 130% С. 150% D. 195% Answer:arrow_forwardCalculate the Sales Growth of the most recent year. Enter answer as decimal (not percent. Example: .1234 is ok, 12.34% is not ok).arrow_forward

- Rousseau Corporation has the following Statement of Income for the year ended May 31, 2020: Sales... $1,675,200 Cost of goods sold.. 887,600 Gross margin... 787,600 Selling & administrative expense.. 241,200 Interest expense. 65,000 Income before income taxes. 481,400 192,500 $288,900 Income taxes.. Net income.... Calculate the interest-coverage ratio for Rousseau Corporation for May31, 2020 (place answer at up to 2 decimal places in the space below). 신arrow_forward不 Net sales, net income, and total assets for Alex Shipping, Inc., for a five-year period follow: (Click the icon to view the data.) Read the requirements. Requirement 1. Calculate trend percentages for each item for 2018 through 2021. Use 2017 as the base year and round to the nearest percent. Alex Shipping, Inc. - Trend Percentages Net sales Net income Total assets 2021 2020 2019 2018 2017 199 % 161 % 115% 99% 100% 100 % 146 % 100% 123% 34 % 94% 100% 124 % 108 % 100% Requirement 2. Calculate the rate of return on net sales for 2019 through 2021, rounding to the nearest one-tenth percent. Explain what this means. Begin by selecting the rate of return on net sales (return on sales) formula and enter the amounts to calculate the percentages. (Enter amounts in thousands as provided to you in the problem statement. Complete all input fields. Enter "O" for any zero amounts and enter the return on sales amounts as percentages rounded to one-tenth percent, XX%.) ) 2019 2020 2021 ( ( Net…arrow_forwardPrepare a vertical analysis of the income statement data for Whispering Winds Corporation for both years. (Round percentages to 1 decimal place, e.g. 12.1%.) WHISPERING WINDS CORPORATIONComparative Income StatementsFor the Years Ended December 31 2022 2021 $ Percent $ Percent Net sales $688,000 Enter percentages % $576,000 Enter percentages % Cost of goods sold 445,000 Enter percentages % 417,000 Enter percentages % Gross profit 243,000 Enter percentages % 159,000 Enter percentages % Operating expenses 145,000 Enter percentages % 108,000 Enter percentages % Net income $98,000 Enter percentages % $51,000 Enter percentages %arrow_forward

- Selected information from Bigg Company's financial statements follows: Fiscal Year Ended December 31 2019 2018(in thousands) 2017 Gross sales $2,004,719 $1,937,021 $1,835,987 Less: Sales discounts 4,811 4,649 4,406 Less: Sales returns and allowances 2,406 2,324 2,203 Net sales $1,997,502 $1,930,048 $1,829,378 Cost of goods sold 621,463 619,847 660,955 Gross profit $1,376,039 $1,310,201 $1,168,423 Operating expenses 577,369 595,226 583,555 Operating income $798,670 $714,975 $584,868 Other income (expenses) 15,973 (6,140) (8,773) Net income $814,643 $708,835 $576,095 At December 31 2019 2018(in thousands) 2017 Accounts receivable $201,290 $195,427 $182,642 Less: Allowance for doubtful accounts 2,516 2,736 2,192 Net accounts receivable $198,774 $192,691 $180,450 Required: 1. Calculate the following ratios for 2018 and 2019. Round your answers…arrow_forwardUsing data available in the case, calculate the annual growth rate from 2020 to 2021 (in percentages). All calculations should be rounded to two decimals (e.g., 12.77%). > Answer is complete but not entirely correct. 2021 2020 2020-2021 Revenue 2,057,622 1,736,432 18.50 % Cost of Goods Sold 1,259,830 921,980 36.64 % Gross Profit 797,792 814,452 (1.02) % Operating Expenses 789,795 570,245 38.50 % Operating Income 7,997 244,207 2,953.73% Net Income 14,553 191,960 (92.42) %arrow_forwardObtain Target Corporation's annual report for its 2018 fiscal year (year ended February 2, 2019) at http://investors.target.com a. What was Target's gross margin percentage for the fiscal year ended February 2, 2019 (2018) and 2017? Use "Sales" for these computations b. What was Target's Return on Sales percentage for 2018 and 2017? Use "Total Revenue" for these computations. c. Target's return on ales percentage for 2017 was higher than it was in 2018. Ignoring taxes, how much higher would Target's 2018 net income have been if it's return on sales percentage in 2018 had been the same as for 2017?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education