FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

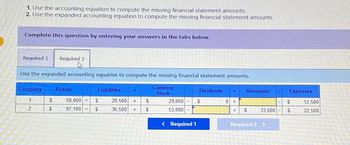

Transcribed Image Text:1. Use the accounting equation to compute the missing financial statement amounts.

2. Use the expanded accounting equation to compute the missing financial statement amounts.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Use the expanded accounting equation to compute the missing financial statement amounts.

Company Assets

1

2

$

$

Liabilities

58,000 L $

97,100 = $

20,500 +

36,500 +

$

$

Common

Stock

29,000

53,000

-

-

< Required 1

Dividends +

$

0 +

+

Revenues

$

33,000

Required 2 >

-

Expenses

$

$

12,500

22,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- Only complete Requirement 3 base on the information provided. The financial position, transactions, requirement 1 and requirement 2 are the supporting information.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardNippon Technology Balance Sheet As of December 31, 2022 (amounts in thousands) Cash 3,700 Liabilities 2,400 Other Assets 3,900 Equity Total Assets Total Liabilities & Equity What is the value for Equity? Please specify your answer in the same units as the balance sheet (i.e., enter the number from your completed balance sheet).arrow_forward

- Do not use chatgpt.arrow_forwardQ4. Analysis of Financial StatementsThere was a bit of concern about one of Big Rock’s newer entities – Big Rock PavingCompany. Management wants you to review the two financial statements below and giveyour analysis of the company’s performance.Big Rock Paving CompanyAssets LiabilitiesCurrent Assets: Current Liabilities:Cash 200,000 Accounts Payable 700,000Accounts Receivable 300,000 Notes Payable 600,000Inventory 800,000Total Current Assets 1,300,000 Total Current Liabilities 1,300,000Fixed Assets: Owners’ Equity:Property, Plant & Equipment 2,200,000 Common Stock ($1 Par) 600,000Less: Accumulated Depreciation 600,000 Capital Surplus 100,000Net Fixed Assets 1,600,000 Retained Earnings 100,000Total Assets 2,900,000 Total Owners’ Equity 800,000Total Liabilities and Owners’Equity2,900,000Big Rock Paving CompanyIncome Statement for Year Ending December 31, 2021Sales 3,400,000Less: Cost of Goods Sold 2,700,000Less: Administrative Expenses 700,000Less Depreciation 682,000Earnings Before…arrow_forwardRequired a. Select the definition that best matches each term. b. Calculate the missing amounts in the following table. Required A Required B Select the definition that best matches each term. a. b. C. d. le. f. Complete this question by entering your answers in the tabs below. 9. Term Answer is not complete. Assets Common Stock Creditors Liability Retained Earnings Stockholders Stockholders' Equity Definition Individuals or institutions that have contributed assets or services to a business in exchange for an ownership interest in the business. Common Stock + Retained Earnings. Individuals or institutions that have loaned goods or services to a business. Assets - Liabilities - Common Stock. An obligation to pay cash in the future. Certificates that evidence ownership in a company. Economic resources that will be used by a business to produce revenue. X X X Xarrow_forward

- education.wiley.com Ch 1: Ho... WP NWP AS... С Maria Q.. b Search.. The Acc... Cengag... financia... WileyPL... financia... BB Financi.. Accoun... X - Cha... e Ch 1: Homework Question 4 of 5 - / 20 View Policies Current Attempt in Progress Van Occupanther is the bookkeeper for Roscoe Company. Van has been trying to get the balance sheet of Roscoe Company to balance. Roscoe's balance sheet is as follows. ROSCOE COMPANY Balance Sheet December 31, 2022 Assets Liabilities Cash $ 9,400 Accounts payable $25,000 Supplies 7,100 Accounts receivable (19,500) Equipment 45,000 Common stock 40,000 Dividends 9,200 Retained earnings 25,200 Total assets $70,700 Total liabilities and stockholders' equity $70,700 Prepare a correct balance sheet. (List Assets in order of liquidity.) ROSCOE COMPANY Balance Sheet 田 IIarrow_forwardSanyu Sony started a new business and completed these transactions during December. Dec. 1 Sanyu Sony transferred $65,300 cash from a personal savings account to a checking account in the name of Sony Electric in exchange for its common stock. 2 The company paid $1,800 cash for the December rent. 3 The company purchased $14,200 of electrical equipment by paying $6,000 cash and agreeing to pay the $8,200 balance in 30 days. 5 The company purchased supplies by paying $1,000 cash. 6 The company completed electrical work and immediately collected $1,800 cash for these services. 8 The company purchased $2,820 of office equipment on credit. 15 The company completed electrical work on credit in the amount of $5,500. 18 The company purchased $450 of supplies on credit. 20 The company paid $2,820 cash for the office equipment purchased on December 8. 24 The company billed a client $900 for electrical work completed; the balance is due in 30 days. 28 The company received $5,500 cash for the work…arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Please help me fill out this table. I am very confused. Thank you so much.arrow_forwardProblem 1: Prepare a classified balance sheet for Sandpiper Corporation as of December 31, 2019 using columns 2 and 3 of the accounting paper supplied. Parenthetically show common shares authorized, issued, and outstanding. Use pencil only, place the units, tens, hundreds, thousands, etc. in the proper mini column, and leave the pennies blank. No commas are necessary when you use the accounting paper properly. Dollars signs used at the top of the column and after a total line. Use columns 2 for detail and column 3 for netting, totals, and grand totals. Leave column 1 and 4 blank. This balance sheet balances with these numbers. Bracketed notes are for the preparer and parathetical notes are for the reader of the financials. You are the preparer. Accounts Payable 13,580 47,280 15,740 1,595 Accounts Receivable Accumulated Depreciation Allowance for Doubtful Accounts Bonds Payable Cash and Cash Equivalents Common Stock at par $2 (authorized 100,000 shares, issued xxXXx shares, and XXXX…arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education