FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Do not give image format

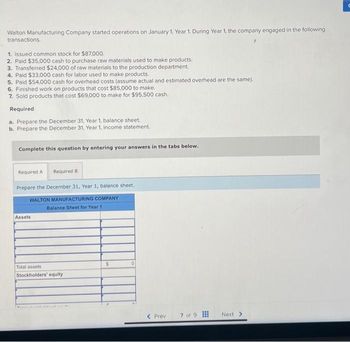

Transcribed Image Text:Walton Manufacturing Company started operations on January 1, Year 1. During Year 1, the company engaged in the following

transactions.

1. Issued common stock for $87,000.

2. Paid $35,000 cash to purchase raw materials used to make products.

3. Transferred $24,000 of raw materials to the production department.

4. Paid $33,000 cash for labor used to make products.

5. Paid $54,000 cash for overhead costs (assume actual and estimated overhead are the same).

6. Finished work on products that cost $85,000 to make.

7. Sold products that cost $69,000 to make for $95,500 cash.

Required

a. Prepare the December 31, Year 1, balance sheet.

b. Prepare the December 31, Year 1, income statement.

Complete this question by entering your answers in the tabs below.

Required A Required B

Prepare the December 31, Year 1, balance sheet.

WALTON MANUFACTURING COMPANY

Balance Sheet for Year 11

Assets

Total assets

Stockholders' equity

S

0

< Prev

7 of 9

Next >

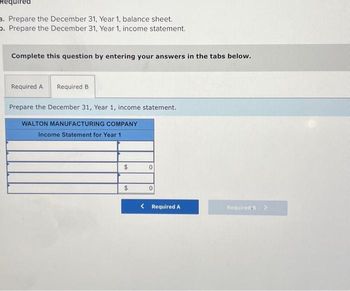

Transcribed Image Text:a. Prepare the December 31, Year 1, balance sheet.

o. Prepare the December 31, Year 1, income statement.

Complete this question by entering your answers in the tabs below.

Required A Required B

Prepare the December 31, Year 1, income statement.

WALTON MANUFACTURING COMPANY

Income Statement for Year 1

$

$

0

0

< Required A

Required. >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rooney Construction Company began operations on January 1, Year 1, when it acquired $10,000 cash from the issuance of common stock. During the year, Rooney purchased $2,700 of direct raw materials and used $2,500 of the direct materials. There were 106 hours of direct labor worked at an average rate of $8 per hour paid in cash. The predetermined overhead rate was $4.00 per direct labor hour. The company started construction on three prefabricated buildings. The job cost sheets reflected the following allocations of costs to each building. Direct Materials Direct Labor Hours Job 1 $ 600 28 Job 2 1,100 46 Job 3 800 32 The company paid $77 cash for indirect labor costs. Actual overhead cost paid in cash other than indirect labor was $341. Rooney completed Jobs 1 and 2 and sold Job 1 for $1,586 cash. The company incurred $150 of selling and administrative expenses that were paid in cash. Over- or underapplied overhead is closed to Cost of Goods Sold.…arrow_forwardprepare an income statementarrow_forwardStuart Manufacturing Company began operations on January 1. During the year, it started and completed 1,780 units of product. The financial statements are prepared in accordance with GAAP. The company incurred the following costs: 1. Raw materials purchased and used-$3,200. 2. Wages of production workers-$3,620. 3. Salaries of administrative and sales personnel-$1,990. 4. Depreciation on manufacturing equipment-$5,996. 5. Depreciation on administrative equipment-$1,750. Stuart sold 1,190 units of product. Required a. Determine the total product cost for the year. b. Determine the total cost of the ending inventory. (Do not round intermediate calculations.) c. Determine the total of cost of goods sold. (Do not round intermediate calculations.) Total product cost b. Total cost of ending inventory a. C. Total cost of goods soldarrow_forward

- Vernon Manufacturing Company began operations on January 1. During the year, it started and completed 1,710 units of product. The financial statements are prepared in accordance with GAAP. The company incurred the following costs: 1. Raw materials purchased and used-$3,130. 2. Wages of production workers-$3,570. 3. Salaries of administrative and sales personnel-$1,970. 4. Depreciation on manufacturing equipment-$6,125. 5. Depreciation on administrative equipment-$1,780. Vernon sold 1,140 units of product. Required a. Determine the total product cost for the year. b. Determine the total cost of the ending inventory. Note: Do not round intermediate calculations. c. Determine the total of cost of goods sold. Note: Do not round intermediate calculations. a. Total product cost b. Total cost of ending inventory c. Total cost of goods soldarrow_forwardThornton Manufacturing Company began operations on January 1. During the year, it started and completed 1,660 units of product. The financial statements are prepared in accordance with GAAP. The company incurred the following costs: Raw materials purchased and used—$3,140. Wages of production workers—$3,580. Salaries of administrative and sales personnel—$1,995. Depreciation on manufacturing equipment—$4,568. Depreciation on administrative equipment—$1,820. Thornton sold 1,070 units of product. Required Determine the total product cost for the year. Determine the total cost of the ending inventory. (Do not round intermediate calculations.) Determine the total of cost of goods sold. (Do not round intermediate calculations.)arrow_forwardAdams Manufacturing Company began operations on January 1. During the year, it started and completed 1,610 units of product. The financial statements are prepared in accordance with GAAP. The company incurred the following costs: Raw materials purchased and used—$3,220. Wages of production workers—$3,610. Salaries of administrative and sales personnel—$1,925. Depreciation on manufacturing equipment—$4,279. Depreciation on administrative equipment—$1,820. Adams sold 1,170 units of product. Determine the total product cost for the year. Determine the total cost of the ending inventory. (Do not round intermediate calculations.) Determine the total of cost of goods sold. (Do not round intermediate calculations.)arrow_forward

- Munoz Manufacturing Company began operations on January 1. During the year, it started and completed 1,730 units of product. The financial statements are prepared in accordance with GAAP. The company incurred the following costs: Raw materials purchased and used—$3,080. Wages of production workers—$3,510. Salaries of administrative and sales personnel—$1,970. Depreciation on manufacturing equipment—$5,520. Depreciation on administrative equipment—$1,755. Munoz sold 1,210 units of product. Required Determine the total product cost for the year. Determine the total cost of the ending inventory. (Do not round intermediate calculations.) Determine the total of cost of goods sold. (Do not round intermediate calculations.) a. Total product cost b. Total cost of ending inventory c. Total cost of goods soldarrow_forwardRooney Manufacturing Company began operations on January 1. During the year, it started and completed 1,620 units of product. The financial statements are prepared in accordance with GAAP. The company incurred the following costs: 1. Raw materials purchased and used-$3,170. 2. Wages of production workers-$3,600. 3. Salaries of administrative and sales personnel-$1,890. 4. Depreciation on manufacturing equipment-$5,056. 5. Depreciation on administrative equipment-$1,795. Rooney sold 1,160 units of product. Required a. Determine the total product cost for the year. b. Determine the total cost of the ending inventory. (Do not round intermediate calculations.) c. Determine the total of cost of goods sold. (Do not round intermediate calculations.) a. Total product cost b. Total cost of ending inventory C. Total cost of goods soldarrow_forwardLarned Corporation recorded the following transactions for the just completed month. a. Purchased $78,000 of raw materials on account. b. $76,000 in raw materials were used in production. Of this amount, $67,000 was direct materials and the remainder was indirect materials. c. Paid employees $124,500 cash. Of this amount, $104,400 was direct labor and the remainder was indirect labor. d. Depreciation of $190,000 was incurred on factory equipment. Required: Record the above transactions in journal entries. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list View journal entry worksheet i i V No 1 2 3 i 4 Transaction a b. C. d Raw materials Work in process Work in process General Journal Accumulated depreciation Debit 78,000 190,000 Credit 78,000 190,000arrow_forward

- Finch Manufacturing Company began operations on January 1. During the year, it started and completed 1,630 units of product. The financial statements are prepared in accordance with GAAP. The company incurred the following costs: Raw materials purchased and used—$3,070. Wages of production workers—$3,550. Salaries of administrative and sales personnel—$1,940. Depreciation on manufacturing equipment—$5,279. Depreciation on administrative equipment—$1,830. Finch sold 1,030 units of product. Required Determine the total product cost for the year. Determine the total cost of the ending inventory. (Do not round intermediate calculations.) Determine the total of cost of goods sold. (Do not round intermediate calculations.)arrow_forwardLarned Corporation recorded the following transactions for the just completed month. a. Purchased $89,000 of raw materials on account. b. $87,000 in raw materials were used in production. Of this amount, $79,000 was direct materials and the remainder was indirect materials. c. Paid employees $118,000 cash. Of this amount, $103,200 was direct labor and the remainder was indirect labor. d. Depreciation of $194,000 was incurred on factory equipment. Required: Record the above transactions in journal entries. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.arrow_forward1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education