Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:1.

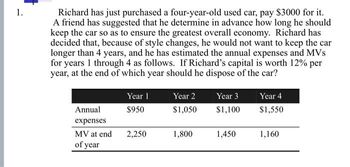

Richard has just purchased a four-year-old used car, pay $3000 for it.

A friend has suggested that he determine in advance how long he should

keep the car so as to ensure the greatest overall economy. Richard has

decided that, because of style changes, he would not want to keep the car

longer than 4 years, and he has estimated the annual expenses and MVs

for years 1 through 4 as follows. If Richard's capital is worth 12% per

year, at the end of which year should he dispose of the car?

Annual

expenses

MV at end

of year

Year 1

$950

2,250

Year 2

$1,050

1,800

Year 3

$1,100

1,450

Year 4

$1,550

1,160

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- George Robinson is a high school sophomore. He currently has $7,500 in a savings account that pays 5.97 percent annually. George plans to use his current savings plus what he can save over the next four years to buy a car. He estimates that the car will cost $12,545 in four years. How much money should George save each year if he wants to buy the car? (Round factor values to 6 decimal places, e.g. 1.521253 and the final answer to 2 decimal place e.g. 15.25.) George should save $arrow_forward1. Jose Garcia's lifelong dream is to own a fishing boat to use in hisretirement. Jose has recently come into an inheritance of $400,000. He estimatesthat the boat he wants will cost $300,000 when he retires in 5 years. How much of his inheritance must he invest at an annual rate of 8% compounded annually) to buy the boat at retirement? 2. Refer to the data in BE6.7. Assuming quarterly compounding of amounts invested at 8%, how much of Jose Garcia's in heritance must be invested to have enough at retirement to buy the boat?arrow_forward12. Marlon can purchase a company car for his real estate business for $30 000. Interest lost on the money used for the purchase is estimated at 6% per year, compounded quarterly. Alternatively, Marlon can lease the car for $4000 per year. a) Calculate the cost of keeping the car for five years, and then selling it for $12 000. Include the cost of lost interest on the money used for the purchase. b) Calculate the cost of leasing the car for five years. c) Which plan is a better deal for Marlon? How much more would he pay with the other plan?arrow_forward

- George has planned ahead and identified his dream house purchase in 3 years’ time. The current value of the house is $580 000. It is expected that the house will increase in value at a rate of 4.5% p.a. 4) How much does he need to borrow from the bank at the end of year 3 to buy the house? (Assume George will borrow 90% from the bank)arrow_forwardYou decide to make monthly payments into a retirement fund earning 4.75% compounded monthly. Note: Payments are made at the end of each period.arrow_forwardIn eight years, when he is discharged from the Air Force, Steve wants to buy a $30,000 power boat. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: What lump-sum amount must Steve invest now to have the $30,000 at the end of eight years if he can invest money at: (Round your final answer to the nearest whole dollar amount.) Present Value 1. Eleven percent 2. Twelve percentarrow_forward

- 1. Jose Garcia's life long dream is to own a fishing boat to use in his retirement. Jose has recently come into an in heritance of $400,000. He estimates that the boat he wants will cost $300,000 when he retires in 5 years. How much of his in heritance must he invest at an annual rate of 8% compounded annually) to buy the boat at retirement? 2. Refer to the data in BE6.7. Assuming quarterly compounding of amounts invested at 8%, how much of Jose Garcia's in heritance must be invested to have enough at retirement to buy the boat?arrow_forwardRonnie Cox has just inherited $27,000. How much of this money should he set aside today to have $19,000 to pay cash for a Ventura Van, which he plans to purchase in one year? He can invest at 1.7% annually, compounded annually.arrow_forwardJohnny's Lunches is considering purchasing a new energy-efficient grill. The grill will cost $32,000 and will be depreciated straight-line over 3 years. It will be sold for scrap metal after 5 years for $8,000. The grill will have no effect on revenues but will save Johnny's $16,000 in energy expenses. The tax rate is 30%. a). What are the operating cash flows each year? b). What are the total cash flows in each year? c). Assuming the discount rate is 12%, calculate the net present value of the cash flow stream. Should the grill be purchased?arrow_forward

- After several years of working, Katy has saved $125,000. If she invests that $125,000 in a savings fund that adds 4% each year, about how much will her savings account have after 15 years? For this question, ignore compounding and taxes, and assume Katy does not put additional money into savings. A) $185,000 B) $175,000 C) $200,000 D) $190,000arrow_forwardA father is trying to save for his daughter’s wedding in two years. (Long engagement!). He thinks he can make the following contributions to an account: $14,545.00 today and $13,130.00 in one year. The father thinks he can earn 7.00% in the market each of the next two years. If the wedding is expected to cost $52,815.00 two years from today, how much will he need to contribute at the time of the wedding to cover its cost?arrow_forwardFollowing the last question - John is evaluating the idea to open an ice cream shop on a piece of land. The followings are what he might include in the cash flows: Instead, John can earn $120,000 if he decides to sell the land today. He bought this land for $350,000 two years ago. • Outfitting the space for an ice cream shop would require a capital expenditure of $150,000 today. It'll require an investment of $30,000 in inventories for making the ice creams today. What are the opportunity costs of opening the ice cream shop? 1 · . -$120,000 O-$180,000 O-$350,000 O-$270,000 4arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education