Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

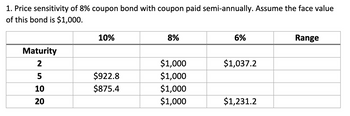

Transcribed Image Text:**Price Sensitivity of 8% Coupon Bond with Semi-Annual Payments**

This table illustrates the price sensitivity of an 8% coupon bond with varying interest rates and maturities. The bond has a face value of $1,000.

| | **10%** | **8%** | **6%** | **Range** |

|----------|---------|---------|-----------|-----------|

| **Maturity** | | | | |

| 2 | $1,000 | $1,000 | $1,037.2 | |

| 5 | $922.8 | $1,000 | $1,120 | |

| 10 | $875.4 | $1,000 | $1,231.2 | |

| 20 | | $1,000 | | |

**Explanation:**

- The columns represent different yield rates (10%, 8%, and 6%).

- The rows indicate years to maturity (2, 5, 10, and 20).

- The bond price changes with varying yield rates, showing how sensitive the bond price is to these changes.

- At an 8% yield rate, the bond price equates to its face value of $1,000 across all maturities.

- The "Range" column provides a comparison of bond prices at the lowest and highest yield rates.

This data assists in understanding the impact of interest rate fluctuations on bond pricing.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Calculate annual interest in dollars and current yield as a percent of the bond. Round your percentage to one decimal place?arrow_forwardGiven only the information provided, which bond would you suspect of having the lowest duration? Coupon Current Price Remaining Term Bond A 5% $ 703.11 20 years Bond B 7% $ 932.05 10 years Bond C 11% $ 1,078.63 3 years Bond D 11% $ 1,296.89 20 years Question 18 options: Bond A Bond B Bond C Bond Darrow_forwardMaturity (years) Price 2.83% 5.79% The above table shows the price per $100-face value bond of several risk-free, zero-coupon bonds. What is the yield to maturity of the four-year, zero- coupon, risk-free bond shown? 2.85% 12.07% 1 $97.25 2.89% 3 2 $94.53 $91.83 5 4 $89.23 $87.53arrow_forward

- Innovative Financial Inc. issues a bond with the following information: Par: $1,000 Time to maturity: 20 years Yield to maturity: 8 percent Current market price: $1,304.28 Quarterly payments What is the coupon rate? A. 10.12% B. 11.06% C. 14.38% D. 13.25%arrow_forward31 ation An 8%, 8-year bond pays annual coupons and has 6 years to maturity. If the market interest rate is 9%, calculate the price of this bond. Show the (abbreviated) time line, the key entries/steps of FCS, and the (abbreviated) equation/expression of NS. Typing tips:arrow_forwardWhat is the value of $1000 par value 8 3/8% Marriott Corporation bond for the for each of the following required rates of return and assuming that the investor will hold the bond to maturity assume the coupon is paid semiannually (every six months) and the mature the bond matures in three years?a. 6.50%b. 11.30%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education