FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

| ACCOUNT NAME | DEBIT | CREDIT | DEBIT | CREDIT | DEBIT | CREDIT | DEBIT | CREDIT | DEBIT | CREDIT | ||

| 1 | Cash | 5,702.00 | 0 | 0 | 0 | 5,702.00 | 0 | 0 | 0 | 5,702.00 | 0 | 1 |

| 2 | 809.00 | 0 | 0 | 0 | 809.00 | 0 | 0 | 0 | 809.00 | 0 | 2 | |

| 3 | Supplies | 551.00 | 0 | 0 | 240.00 | 311.00 | 0 | 0 | 0 | 311.00 | 0 | 3 |

| 4 | Prepaid Insurance | 1,320.00 | 0 | 0 | 545.00 | 775.00 | 0 | 0 | 0 | 775.00 | 0 | 4 |

| 5 | Equipment | 7,351.00 | 0 | 0 | 0 | 7,351.00 | 0 | 0 | 0 | 7,351.00 | 0 | 5 |

| 6 | Accum. Depr., Equipment | 0 | 2,722.00 | 0 | 740.00 | 0 | 3,462.00 | 0 | 0 | 0 | 3,462.00 | 6 |

| 7 | Van | 10,468.00 | 0 | 0 | 0 | 10,468.00 | 0 | 0 | 0 | 10,468.00 | 0 | 7 |

| 8 | 0 | 3,274.00 | 0 | 1,255.00 | 0 | 4,529.00 | 0 | 0 | 0 | 4,529.00 | 8 | |

| 9 | Accounts Payable | 0 | 1,536.00 | 0 | 0 | 0 | 1,536.00 | 0 | 0 | 0 | 1,536.00 | 9 |

| 10 | B. Vance, Capital | 0 | 19,748.00 | 0 | 0 | 0 | 19,748.00 | 0 | 0 | 0 | 19,748.00 | 10 |

| 11 | B. Vance, Drawing | 15,880.00 | 0 | 0 | 0 | 15,880.00 | 0 | 0 | 0 | 15,880.00 | 0 | 11 |

| 12 | Fees Earned | 0 | 37,218.00 | 0 | 0 | 0 | 37,218.00 | 0 | 37,218.00 | 0 | 0 | 12 |

| 13 | Salaries Expense | 18,295.00 | 0 | 660.00 | 0 | 18,955.00 | 0 | 18,955.00 | 0 | 0 | 0 | 13 |

| 14 | Advertising Expense | 2,119.00 | 0 | 0 | 0 | 2,119.00 | 0 | 2,119.00 | 0 | 0 | 0 | 14 |

| 15 | Van Operating Expense | 795.00 | 0 | 0 | 0 | 795.00 | 0 | 795.00 | 0 | 0 | 0 | 15 |

| 16 | Utilities Expense | 1,040.00 | 0 | 0 | 0 | 1,040.00 | 0 | 1,040.00 | 0 | 0 | 0 | 16 |

| 17 | Miscellaneous Expense | 168.00 | 0 | 0 | 0 | 168.00 | 0 | 168.00 | 0 | 0 | 0 | 17 |

| 18 | 64,498.00 | 64,498.00 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 18 | |

| 19 | Insurance Expense | 0 | 0 | 545.00 | 0 | 545.00 | 0 | 545.00 | 0 | 0 | 0 | 19 |

| 20 | Depr. Exp., Equipment | 0 | 0 | 740.00 | 0 | 740.00 | 0 | 740.00 | 0 | 0 | 0 | 20 |

| 21 | Depreciation Expense, Van | 0 | 0 | 1,255.00 | 0 | 1,255.00 | 0 | 1,255.00 | 0 | 0 | 0 | 21 |

| 22 | Salaries Payable | 0 | 0 | 0 | 660.00 | 0 | 660.00 | 0 | 0 | 0 | 660.00 | 22 |

| 23 | Supplies Expense | 0 | 0 | 240.00 | 0 | 240.00 | 0 | 240.00 | 0 | 0 | 0 | 23 |

| 24 | 0 | 0 | 3,440.00 | 3,440.00 | 67,153.00 | 67,153.00 | 25,857.00 | 37,218.00 | 41,296.00 | 29,935.00 | 24 | |

| 25 | Net Income | 0 | 0 | 0 | 0 | 0 | 0 | 11,361.00 | 0 | 0 | 11,361.00 | 25 |

| 26 | 0 | 0 | 0 | 0 | 0 | 0 | 37,218.00 | 37,218.00 | 41,296.00 | 41,296.00 | 26 |

Required:

( 2 attach images)

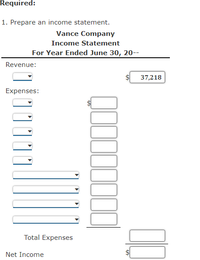

Transcribed Image Text:Required:

1. Prepare an income statement.

Vance Company

Income Statement

For Year Ended June 30, 20--

Revenue:

37,218

Expenses:

Total Expenses

Net Income

%24

%24

Transcribed Image Text:2. Prepare a statement of owner's equity. Assume that there was an additional investment of $2,400 on June 10.

Vance Company

Statement of Owner's Equity

For Year Ended June 30, 20--

Subtotal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- dndbr not use ai pleasearrow_forwardThe bank statement for Unique Fashion had an ending cash balance of $2,200 on April 30, 2022. On this date the cash balance in their general ledger was $3,678. After comparing the bank statement with the company records, the following information was determined. The bank returned an NSF cheque in the amount of $350 that Unique Fashion deposited on April 20. The NSF service fee was $9. A direct deposit received from a customer on April 29 in payment of their accounts totaling $3,780. This has not yet been recorded by the company. On April 29, the bank deposited $16 for interest earned. The bank withdrew $35 for bank service charges. Deposits in transit on April 30 totalled $4,880. Required Reconcile the ledger and bank statement and create the required journal entries. Do not enter dollar signs or commas in the input boxes. Do not use negative signs. Select the proper order for the headings of the Bank Reconciliation. Cash balance per bank statement Add Outstanding deposit Adjusted bank…arrow_forwardPlease Helparrow_forward

- Multiple choicearrow_forwardQuestion 3 of 8 > -/2 View Policies Current Attempt in Progress What is the journal entry to record an uncollectible accounts receivable? Bad Debt Expense XXX Allowance for Doubtful Accounts XXX Bad Debt Expenses XXX Accounts Receivable XXX Accounts Receivable XXX Allowance for Doubtful Accounts XXX Allowance for Doubtful Accounts XXX Accounts Receivable XXX Save for Later Attempts: 0 of 1 used Submit Ansarrow_forwardcan you help me with this please.arrow_forward

- 5:57 l LTE Assignment Details FINANCIAL ACCOUNTING II 1221_ACC1112_OL2 What are the three classifications of receivables? Which does your company have? Look in the notes to the financial statement to find out which method they use for writing off receivables. Part 2 Dan's Hardware is a small hardware store in the rural township of Twin Bridges. It rarely extends credit to its customers in the form of an account receivable. The few customers who are allowed to carry accounts receivable are long-time residents of Twin Bridges with a history of doing business at Dan's Hardware. What method of accounting for uncollectible receivables should Dan's Hardware use? Why?arrow_forwardOn November 1, 2022, the account balances of Blue Spruce Corp. were as follows. No. Debits No. Credits 101 Cash $2,880 154 Accumulated Depreciation-Equipment $2,400 112 Accounts Receivable 5,100 201 Accounts Payable 3,120 126 Supplies 2,160 209 Unearned Service Revenue 1,440 153 Equipment 14,400 212 Salaries and Wages Payable 840 311 Common Stock 12,000 320 Retained Earnings 4,740 $24,540 $24,540 During November, the following summary transactions were completed. Nov. 8 Paid $2,040 for salaries due employees, of which $840 is for October salarles. 10 Received $4.096 cash from customers on account. 12 Received $3,720 cash for services performed in November. 15 Purchased equipment on account $2,400. 17 Purchased supplies on account $840. 20 Paid creditors on account $3,240. 22 Paid November rent $480. 25 Paid salaries $2,040. 27 Performed services on account and billed customers $2,280 for these services. 29 Recelved $720 from customers for future service.arrow_forwardA5arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education