FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

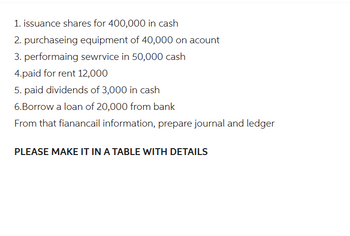

Transcribed Image Text:1. issuance shares for 400,000 in cash

2. purchaseing equipment of 40,000 on acount

3. performaing sewrvice in 50,000 cash

4.paid for rent 12,000

5. paid dividends of 3,000 in cash

6.Borrow a loan of 20,000 from bank

From that fianancail information, prepare journal and ledger

PLEASE MAKE IT IN A TABLE WITH DETAILS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Beginning balances were: Cash, $91,000; Taxes Receivable, $186,500; Accounts Payable, $50,750; and Fund Balance, $226,750. Note: Enter debits before credits. Transaction General Journal Debit Credit 01 .arrow_forwardbased on the attached what is the answer?arrow_forwardAs loan analyst for Carla Bank, you have been presented the following information. Toulouse Co. Lautrec Co. Assets Cash $124,000 $335,000 Receivables 214,000 305,000 Inventories 589,000 523,000 Total current assets 927,000 1,163,000 Other assets 482,000 582,000 Total assets $1,409,000 $1,745,000 Liabilities and Stockholders’ Equity Current liabilities $301,000 $368,000 Long-term liabilities 409,000 482,000 Capital stock and retained earnings 699,000 895,000 Total liabilities and stockholders’ equity $1,409,000 $1,745,000 Annual sales $946,000 $1,559,000 Rate of gross profit on sales 30 % 40 % Each of these companies has requested a loan of $50,000 for 6 months with no collateral offered. Because your bank has reached its quota for loans of this type, only one of these requests is to be…arrow_forward

- Cy loans Mookie The Beagle Concierge $1,000 at 6% annual interest. Record the transaction as a loan payable as follows. Required: 1. Complete a Deposit. a. Select (+) New icon > Bank Deposit b. Select Account: 1001 Checking c. Select Date: 01/12/2023 d. In Add Funds to This Deposit section, select Account: + Add New > Account Type: Other Current Liabilities > Detail Type: Loan Payable > Name: Loan Payable> Number: 2300 > Save and Close e. Select Payment Method: Check f. Enter Reference Number: 5002 g. Enter Amount: 1000.00 h. Select Save and close i. What is the Amount of the Loan Payable? Note: Answer this question in the table shown below. Round your answer to the nearest dollar amount. i. Amount of the loan payablearrow_forwardComplete the followin Common Size Balance Sheet: Amount Percent Cash $ 600 (c) _____________________________ Accounts Receivable 1,400 (d)_____________________________ Total Aseets $ 2,000 (e) _______________________________ Accounts Payable 400 (f) _______________________________ Notes Payable 800 (g)________________________________ Total Liabilities 1,200 (h)…arrow_forwardased on these items, what is the total of the (a) liquid assets and (b) current liabilities? Checking account balance $ 935 Savings account balance $ 3,425 Retirement account balance 58,500 Current student loan payment due 370 Credit card balance 192 Investment account balance 9,500 Rare jewelry 600 Mortgage 185,500arrow_forward

- As loan analyst for Wildhorse Bank, you have been presented the following information. Toulouse Co. Lautrec Co. Assets Cash $119,000 $332,000 Receivables 226,000 298,000 Inventories 562,000 536,000 Total current assets 907,000 1,166,000 Other assets 483,000 636,000 Total assets $1,390,000 $1,802,000 Liabilities and Stockholders' Equity. Current liabilities $319,000 $350,000 Long-term liabilities 419.000 483,000 Capital stock and retained earnings 652,000 969,000 Total liabilities and stockholders' equity $1,390,000 $1,802,000 Annual sales $948,000 $1,453,000 Rate of gross profit on sales 30 % 40 % Each of these companies has requested a loan of $50,000 for 6 months with no collateral offered. Because your bank has reached its quota for loans of this type, only one of these requests is to be granted. Compute the various ratios for each company. (Round answer to 2 decimal places, eg. 2.25.) Toulouse Co. Lautrec Co. Current ratio :1 Acid-test ratio Accounts receivable turnover times times…arrow_forwardFrom the following details prepare a summarized balance sheet of Anitha and Company as on 31.12.2018. Fixed assets to net-worth: 0.75:1 Current ratio 2:1 Liquid ratio 3:2 Reserves included in Proprietors" Fund 1:4 07 Page 2 of 4 Current Liabilities Rs.2, 00, 000 Cash and bank balancesRs .10,000 Fixed Assets Rs.6,00,000.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- As loan analyst for Waterway Bank, you have been presented the following information. Toulouse Co. Lautrec Co. Assets Cash $114,000 $328,000 Receivables 230,000 296,000 Inventories 582,000 493,000 Total current assets 926,000 1,117,000 Other assets 493,000 607,000 Total assets $1,419,000 $1,724,000 Liabilities and Stockholders' Equity Current liabilities $314,000 $340,000 Long-term liabilities 385,000 493,000 Capital stock and retained earnings 720,000 891,000 Total liabilities and stockholders' equity $1,419,000 $1,724,000 Annual sales $911,000 $1,440,000 Rate of gross profit on sales 30 % 40 % Each of these companies has requested a loan of $50,000 for 6 months with no collateral offered. Because your bank has reached its quota for loans of this type, only one of these requests is to be granted. Compute the various ratios for each company. (Round answer to 2 decimal places, e.g. 2.25.) Toulouse Co. Lautrec Co. Current ratio :1 :1 Acid-test ratio :1 :1 Accounts receivable turnover…arrow_forward1. The following accounts appeared on the partial Balance Sheet of Brandy Inc.: Accounts Payable Accounts Receivable $ 5,500 2,300 2,820 3,000 8,140 18,560 18,760 100 Bank Loan Cash Common Stock Inventory Long-term debt Machinery What is the total amount of all assets (rounded to the nearest dollar)?arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.]The August bank statement and cash T-account for Martha Company follow: BANK STATEMENT Date Checks Deposits Other Balance August 1 $ 13,600 August 2 $ 120 13,480 August 3 $ 9,300 22,780 August 4 220 22,560 August 5 160 22,400 August 9 530 21,870 August 10 130 21,740 August 15 3,100 24,840 August 21 220 24,620 August 24 15,500 9,120 August 25 5,650 14,770 August 30 620 14,150 August 30 Interest earned $ 20 14,170 August 31 Service charge 10 14,160 Cash (A) Debit Credit August 1 Balance 13,600 Deposits Checks written August 2 9,300 120 August 1 August 12 3,100 220 August 2 August 24 5,650 160 August 3 August 31 4,100 130 August 4 530 August 5 200 August 15 280 August 17 620 August 18 220 August 19…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education