FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

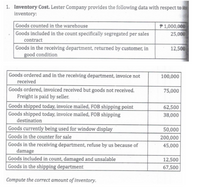

Transcribed Image Text:1. Inventory Cost. Lester Company provides the following data with respect to ins

inventory:

|Goods counted in the warehouse

Goods included in the count specifically segregated per sales

P 1,000,000

25,000

contract

Goods in the receiving department, returned by customer, in

good condition

12,500

Goods ordered and in the receiving department, invoice not

100,000

received

Goods ordered, invoiced received but goods not received.

Freight is paid by seller.

75,000

Goods shipped today, invoice mailed, FOB shipping point

Goods shipped today, invoice mailed, FOB shipping

62,500

38,000

destination

Goods currently being used for window display

50,000

Goods in the counter for sale

200,000

Goods in the receiving department, refuse by us because of

damage

Goods included in count, damaged and unsalable

Goods in the shipping department

45,000

12,500

67,500

Compute the correct amount of inventory.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Snow-Tech Inc. sells an Xpert ski that is popular with ski enthusiasts. The following information shows Snow-Tech's purchases and sales of Xpert skis during November: Date Nov. 1 Beginning inventory 5 12 19 22 Explanation 25 Purchases Sales Purchases Sales Purchases Unit Units Cost/Price $296 301 34 23 (40) 42 (48) 33 44 461 306 513 311arrow_forwardThe records of Cordova Corp. showed the following transactions, in the order given, relating to the major inventory item: Unit Cost Units 4,800 $7.80 9,600 8.10 6,700 8,600 8.40 14,400 16,400 8.56 14,400 9,600 8.70 1. 2. 3. 4. 5. 6. 7. Sale (at $19.80) 8. Purchase Inventory Purchase Sale (at $16.80) Purchase Sale (at $16.80) Purchase Required: Complete the following schedule for each independent assumption. (Round unit costs to the nearest cent.) Independent Assumptions a. FIFO b. Weighted average, periodic inventory system c. Moving average, perpetual inventory system Ending Inventory Units and Amounts Cost of Goods Sold Gross Marginarrow_forwardPresented below is information related to Headland Enterprises. Inventory at cost Inventory at LCNRV Purchases for the month Sales for the month *(a) Sales Revenue Cost of Goods Sold Inventory, Beginning Purchases Cost of Goods Available Jan. 31 Inventory, Ending Cost of Goods Sold Gross Profit $18,300 17,690 Feb. 28 $18,422 15,372 20,740 35,380 Gain (loss) due to Market Fluctuations of Inventory Your answer is partially correct. Try again. From the information, prepare (as far as the data permit) monthly income statements in columnar form for February, March, and April. The inventory is to be shown in the statement at cost; the gain or loss due to market fluctuations is to be shown separately (using a valuation account). (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) February $35380 [18300 20740 139040 [18422 20618 [14762 +2440 Mar. 31 $12322 $20,740 19,032 29,280 42,700 Apr. 30 March -1048 143466 $17,080 16,226 32,330…arrow_forward

- Required information [The following information applies to the questions displayed below.] Hemming Company reported the following current-year purchases and sales for its only product. Activities Beginning inventory Sales. Purchase Sales Purchase Sales Purchase Totals Date January 1 January 10 March 14 March 15 July 30 October 5 October 26 a) Cost of Goods Sold using Specific Identification Available for Sale Date January 1 March 14 July 30 October 26 Less: Equals: Activity Beginning Inventory Purchase Purchase Purchase b) Gross Margin using Specific Identification # of units 260 420 460 160 1,300 Units Acquired at Cost @$12.40 = @$17.40 = 260 units. 420 units 460 units 160 units 1,300 units Cost Per Unit $ 12.40 $17.40 $22.40 $ 27.40 3 @ $22.40 # of units sold @$27.40 Ending inventory consists of 45 units from the March 14 purchase, 75 units from the July 30 purchase, and all 160 units from the October 26 purchase. Using the specific identification method, calculate the following. = 0…arrow_forwardThe following inventory information is gathered from the accounting records of Tucker Enterprises: # of Units x Unit Cost = Total Beginning Inventory 4000 x 5 Purchases 6000 x 7 Sales 9000 x 10 Ending Inventory 1000 a. Calculate Ending Inventory # of Units Unit Cost Ending Inventory 1.FIFO 0 $- 2.LIFO 0 $- 3.Weighted Average Cost 0 $- $- $- $- b. Cost of Goods Sold # of Units # of Units Unit cost Unit cost Cost of Goods Sold 1.FIFO $- 2.LIFO $- 3.Weighted Average Cost $- $- 0 $- c.Gross profit using each of the following methods: Sales Cost of Goods Sold Gross Profit 1.FIFO $- $- $- 2.LIFO $- $- $- 3.Weighted Average Cost $- $- $-arrow_forwardplease solve with the FIFO method ( question 2)arrow_forward

- A. First In, First Out Number of Units Dollar Per Unit Value Total Value Cost of Goods Sold .. ... B. Last In, First Out Number of Units Dollar Per Unit Value Total Value Cost of Goods Sold ... ... C. Weighted Average Number of Units Dollar Per Unit Value Total Value Cost of Goods Sold ... ...arrow_forwardWeatarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education