Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

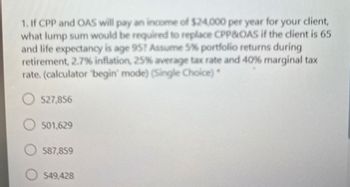

If CPP and OAS will pay an income of $24,000 per year for your client, what lump sum would be required to replace CPP&OAS if the client is 65 and life expectancy is age 958 Assume 5% pertfolio returns during retirement, 2.7% inflation, 25% average tax rate and 40% marginal tax rate. (calculator 'begin' mode) (Single Cheice) *

527,856

501,629

587,859

549,428

Transcribed Image Text:1. If CPP and OAS will pay an income of $24,000 per year for your client,

what lump sum would be required to replace CPP&OAS if the client is 65

and life expectancy is age 95? Assume 5% portfolio returns during

retirement, 2.7% inflation, 25% average tax rate and 40% marginal tax

rate. (calculator "begin' mode) (Single Choice)*

527,856

501,629

587,859

549,428

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose you have $1,000,000 in savings account when you retire. Your plan is to withdraw $6,000 a month as retirement income from this account. You expect to earn annual interest of 5%, compounded monthly, on your money during your retirement. How many months can you be retired until you run out of money? A-210.83 B-262.59 C-220.27 D-285.14arrow_forwardPlease answer using life-cycle problem. Suppose the interest rate is 5%, the income tax rate 35%, the tax rate on investment income is 20%, and the investment horizon 40 years. (a) What is the final payoff after tax if $100 pre-tax income is invested in a regular savings account? (b) What is the final payoff after tax if $100 pre-tax income is invested in a retirement account? (c) What is the final payoff after tax if $100 pre-tax income is invested in a Roth account?arrow_forward5. Determine the lump-sum amount needed to generate a retirement income of $30,000 per year for 20 years, assuming interest at 5% per year, compounded annually. 6. A furniture retailer offers a payment plan at 8.8% annual interest, compounded monthly. Customers can pay for a living room set by monthly payments of $288.15 for 2 years. a) Determine the total payments made by the customer to pay off the living room cot ))arrow_forward

- i need both solution....../.arrow_forwardQuestion 1Mr. and Mrs. Haddad have contributed $2025.00 per six months for the last eighteen years into RRSP accounts earning 6.92 % compounded semi - annually. a) How much will Mr. and Mrs. Haddad have in total in their RRSP accounts? b) How much did the Haddad's contribute? c) How much will be interest? PMT = $IY = CY = i = n = Total in RRSP account $Total Contibution =$ Interest =$ Blank 1: Blank 2: Blank 3: Blank 4: Blank 5: Blank 6: Blank 7: Blank 8:arrow_forwardOnly typed answer and please don't use chatgpt A $4,100 balance in a tax-deferred savings plan will grow to $ 89,070.45 in 40 years at an 8% per year interest rate. What would be the future worth if the $ 4,100 had been subject to a 22% income tax rate?.arrow_forward

- URE ic Gail Trevino expects to receive a $580,000 cash benefit when she retires seven years from today. Ms. Trevino's employer has offered an early retirement incentive by agreeing to pay her $310,000 today if she agrees to retire immediately. Ms. Trevino desires to earn a rate of return of 10 percent. (PV of $1& and PVA of $1) Note: Use appropriate factor(s) from the tables provided. raw Required a. Calculate the present value of the $580,000 future cash benefit. Assuming that the retirement benefit is the only consideration in making the retirement decision, should Ms. Trevino accept her employer's offer? Note: Round your final answer to the nearest whole dollar value. Present value Should Ms. Trevino accept the offer?arrow_forwardFind the expected net profit of an insurance company on a life-insurance policy whose death benefit is $1,000,000 if the annual premium for the policy is $2000 and the chance of the customer dying within the next year is 0.002. Interpret. (show work)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education