FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

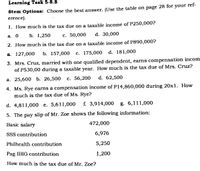

Transcribed Image Text:Learning Task 5-8.8

Stem Options: Choose the best answer. (Use the table on page 28 for your ref-

erence).

1. How much is the tax due on a taxable income of P250,000?

а. О

b. 1,250

с. 50,000

d. 30,000

2. How much is the tax due on a taxable income of P890,000?

а. 127,000

b. 157,000

с. 175,000

d. 181,000

3. Mrs. Cruz, married with one qualified dependent, earns compensation incom

of P530,00 during a taxable year. How much is the tax due of Mrs. Cruz?

а. 25,600 b. 26,500

с. 56,200

d. 62,500

4. Ms. Rye earns a compensation income of P14,860,000 during 20x1. How

much is the tax due of Ms. Rye?

d. 4,811,000 e. 5,611,000

f. 3,914,000 g. 6,111,000

5. The pay slip of Mr. Zoe shows the following information:

Basic salary

472,000

SSS contribution

6,976

Philhealth contribution

5,250

Pag-IBIG contribution

1,200

How much is the tax due of Mr. Zoe?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 10.arrow_forward2023 TAXABLE INCOME FIRST $53,359 OVER $53,359 TO $106,717 OVER $106,717 TO $165,430 OVER $ $165,430 TO $237,675 OVER $235,675 FILL IN THE BLANK TAX RATE 15.00% 20.50% 26.00% 29.32% 33.00% B) The new marginal rate of tax for someone making a salary of $100,000 and gets an $8,000 salary increase. type your text here Based on the Canadian Federal Income Tax Brackets for 2023 shown above, calculate and input the numeric answers to the questions below. Round off your answers to the nearest dollar. Do not use $, decimals or comma. For example, instead of $23,486.52, write 23487. For answers requiring a tax rate, enter only the numeric value with two decimal places, with "%" symbol. For example, 20.50%).arrow_forwardPlease show work and explainarrow_forward

- Mr. A provided you with the following information during the taxable year. a. P 144,400 b. P 250,000 c. P114,000 d. P 226,900 e. Answer not givenarrow_forwardWhat is the correct response A thru Darrow_forwardwhat is the annual real estate tax on a property that is valued at $135,000 and assessed for tax purposes at $47,250 with an equalization factor of 125%, when the tax rate is $2.50 per $100? a. $1,417.50 b. $1,476.56 c. $4,050 d. None of the above the answer is B but can you show the stepsarrow_forward

- How much is the gross income under cash basis? A. 2019:P1,400,000; 2020: P1,720,000 B. 2019: P1,370,000; 2020: P1,050,000 C. 2019: P1,100,000; 2020: P1,050,000 D. 2019: P900,000; 2020: P1,520,000arrow_forwardHow much is the OSD (assuming taxpayer opted to use OSD)? a. 1,240,000 b. 1,280,000 c. 1,288,000 d. 1,320,000arrow_forwardWhat is the maximum that can be deducted as an above the line deduction for the amount that you pay to social security for self-employment taxes? a. 25% b. 100% C. 50% d. none e. 75%arrow_forward

- The government of Lesotho charges 10% on income up to M75 000 plus 16% any amount over M70 000 up M300 000 and 26% of any amount over M300 000. Express the above as a tax function. Find the income tax for an income of M125 000. Compute the income tax of an income of M350 000.arrow_forwardHow much is the net taxable income using itemized deductions? a. 1,070,000 b. 1,550,000 c. 1,550,000 d. 2,000,000arrow_forwardPlease do stepwise and correct please ill like..arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education