ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

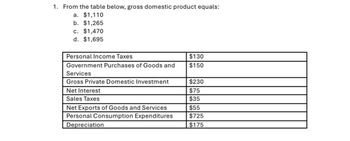

Transcribed Image Text:1. From the table below, gross domestic product equals:

a. $1,110

b. $1,265

c. $1,470

d. $1,695

Personal Income Taxes

$130

Government Purchases of Goods and

$150

Services

Gross Private Domestic Investment

$230

Net Interest

$75

Sales Taxes

Net Exports of Goods and Services

Personal Consumption Expenditures

Depreciation

$35

$55

$725

$175

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 6. Expenditures and Income Approaches Consumption Expenditures Wages Taxes on Production and Imports Government Purchases Statistical Discrepancy Imports Undistributed Corporate Profits Rent Proprietor's Exports Dividends Depreciation Income Interest Gross Private Domestic Investment Corporate Income Taxes Corporate Profits Net Foreign Factor Income $69000 $76000 $16000 $58000 $11000 $47000 $14000 $42000 $15000 $34000 $22000 $24000 $31000 $41000 $18000 $54000 $17000 Complete parts a and b. a. Given the numbers above, solve for Real GDP using the expenditures approach. Given the numbers above, solve for the National Income (NI). b.arrow_forward1. Study Questions and Problems #1 True or False: Transfer payments reallocate income from one individual to another and are included in government expenditures. Therefore, transfer payments are included in the calculations for GDP. True Falsearrow_forwardConsider the small economy represented in the following table. All values are in dollars. Firm A Wages paid to employees Taxes paid to government Input purchased from Firm C Revenue received Sold to Public (newly produced) Sold to Government Sold to Firm C Sold from inventory to Public Unsold production After-tax profit Firm B Wages paid to employees Taxes paid to government Input purchased from Firm C Input imported Revenue received Sold to Public (newly produced) Sold to Government Sold to Firm C Sold to a foreign country Sold from inventory to Public Unsold production After-tax profit Firm C Wages paid to employees Taxes paid to government Input purchased from Firm A Input purchased from Firm B Revenue received Sold to Public (newly produced) Sold to Government Sold to Firm A Sold to Firm B Sold to a foreign country Sold from inventory to Public After-tax profit Additional Information Government transfers Interest on government's debt Private Saving 162 96 79 691 61 354 175 124 93…arrow_forward

- 1. Suppose you are given the following data: Government Purchases $ 6.0 billion Imports $ 0.3 billion Transfer Payments $ 2.3 billion Consumption $11.9 billion Depreciation $ 2.2 billion Exports $ 0.5 billion Investment $ 3.7 billion Taxes $ 6.4 billion a) Calculate the value of government public savings. b) Calculate the value of household private savings. (arrow_forward1. Given the following national income and product accounts data, compute I, NX, NI, PI, DI, NNP, GNP, and GDP Depreciation Amount of national income not going to households Compensation of employees Corporate profits Dividends Exports Government consumption and gross investment Imports Indirect taxes minus subsidies Net business transfer payments Net interest Net private domestic investment Personal consumption expenditures Receipts of factor income from the rest of the world Personal income taxes Proprietors' income Payments of factor income to the rest of the world Rental income Statistical discrepancy Surplus of government enterprises 3. 12,532 2005 489.4 2006 505.7 12,746 2007 526.7 13,011 2008 553.0 13,275 2009 565.8 13,503 2010 563.1 2011 553.5 13,757 1,215 The following table provides information about Canadian economy for a seven-year period, given 2006 is the base year. Year Real GDP Labor force Unemployed Employed Unemployment Population (Billions) (Thousands) (Thousands)…arrow_forward2. Which of the following is NOT included in the calculation of GDP? a) Investment spending b) Government spendingarrow_forward

- What is the value for Gross Domestic Product if households receive $315 in net interest income, wages equal $10,169, rental receipts on land are $884, total business profits before taxes are $1,862, and indirect business taxes are $1,139? Assume depreciation and net foreign income are zero. Enter the value without a $ and without commas.arrow_forwardConsider below information about Jacaranda Economy and answer the question that follow. Components Value per annum Wages and salaries R12 000 Exports R50 000 Rentals R22 000 Imports R63 700 Interest R9 300 Consumer spending R85 250 Government spending R33 200 Gross capital formation R6600 Using the table above, which approach can be used to calculate Jacaranda’s Gross Domestic Product? A. Income B. Production C. Expenditure D. Depreciationarrow_forwardDepreciation equals ________. a. capital minus gross investment b. capital minus net investment c. net investment minus gross investment d. gross investment minus net investmentarrow_forward

- 7arrow_forward5 Use Table: National Income Accounts. The value of national savings is: Table 1: National Income Accounts $ Trillions GDP 20.00 Consumption 14 Government Spending 3 Budget Balance -1.2 a) $14 trillion b) $3 trillion c) $3.5 trillion d) $0.2 trillion e) $3.2 trillion.arrow_forward1. Based on this table, the Gross Domestic Product is $_______ billion.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education