FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

please provide step by step solutions using the table i provided because i want to know how to fill out that specific template

Transcribed Image Text:1 of 1

i.

ii.

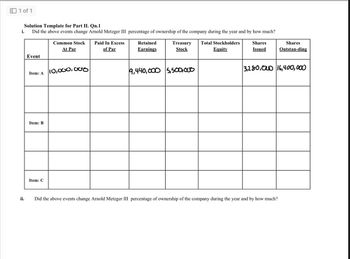

Solution Template for Part II. Qn.1

Did the above events change Arnold Metzger III percentage of ownership of the company during the year and by how much?

Event

Item: A

Item: B

Item: C

Common Stock

At Par

10,000,000

Paid In Excess

of Par

Retained

Earnings

Treasury Total Stockholders

Stock

Equity

9,440,000 5,500,000

Shares

Issued

Shares

Outstan-ding

3,280,00 16,400,000

Did the above events change Arnold Metzger III percentage of ownership of the company during the year and by how much?

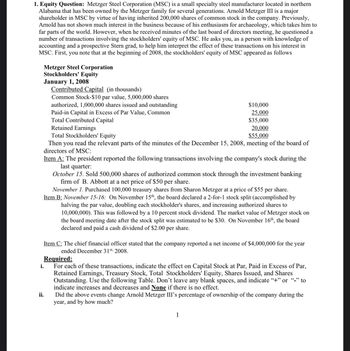

Transcribed Image Text:1. Equity Question: Metzger Steel Corporation (MSC) is a small specialty steel manufacturer located in northern

Alabama that has been owned by the Metzger family for several generations. Arnold Metzger III is a major

shareholder in MSC by virtue of having inherited 200,000 shares of common stock in the company. Previously,

Arnold has not shown much interest in the business because of his enthusiasm for archaeology, which takes him to

far parts of the world. However, when he received minutes of the last board of directors meeting, he questioned a

number of transactions involving the stockholders' equity of MSC. He asks you, as a person with knowledge of

accounting and a prospective Stern grad, to help him interpret the effect of these transactions on his interest in

MSC. First, you note that at the beginning of 2008, the stockholders' equity of MSC appeared as follows

i.

Metzger Steel Corporation

Stockholders' Equity

January 1, 2008

Contributed Capital (in thousands)

Common Stock-$10 par value, 5,000,000 shares

authorized, 1,000,000 shares issued and outstanding

Paid-in Capital in Excess of Par Value, Common

Total Contributed Capital

ii.

$10,000

25,000

$35,000

Retained Earnings

20,000

Total Stockholders' Equity

$55,000

Then you read the relevant parts of the minutes of the December 15, 2008, meeting of the board of

directors of MSC:

Item A: The president reported the following transactions involving the company's stock during the

last quarter:

October 15. Sold 500,000 shares of authorized common stock through the investment banking

firm of B. Abbott at a net price of $50 per share.

November 1. Purchased 100,000 treasury shares from Sharon Metzger at a price of $55 per share.

Item B: November 15-16: On November 15th, the board declared a 2-for-1 stock split (accomplished by

halving the par value, doubling each stockholder's shares, and increasing authorized shares to

10,000,000). This was followed by a 10 percent stock dividend. The market value of Metzger stock on

the board meeting date after the stock split was estimated to be $30. On November 16th, the board

declared and paid a cash dividend of $2.00 per share.

Item C: The chief financial officer stated that the company reported a net income of $4,000,000 for the year

ended December 31st, 2008.

Required:

For each of these transactions, indicate the effect on Capital Stock at Par, Paid in Excess of Par,

Retained Earnings, Treasury Stock, Total Stockholders' Equity, Shares Issued, and Shares

Outstanding. Use the following Table. Don't leave any blank spaces, and indicate "+" or "-" to

indicate increases and decreases and None if there is no effect.

Did the above events change Arnold Metzger III's percentage of ownership of the company during the

year, and by how much?

1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education