FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

1. During year t, Parrothead Enterprises raised £270 in new long-term debt. How much long-term debt must Parrothead Enterprises have paid off during the year?

Long-term debt paid off

2. What is the

Cash flow from financing activities

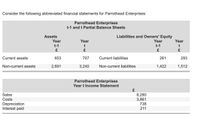

Transcribed Image Text:Consider the following abbreviated financial statements for Parrothead Enterprises:

Parrothead Enterprises

t-1 and t Partial Balance Sheets

Assets

Liabilities and Owners' Equity

Year

Year

Year

Year

t-1

t-1

Current assets

653

707

Current liabilities

261

293

Non-current assets

2,691

3,240

Non-current liabilities

1,422

1,512

Parrothead Enterprises

Year t Income Statement

8,280

3,861

738

Sales

Costs

Depreciation

Interest paid

211

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hh1.arrow_forwardSuppose a firm has the following information: Cash = $500,000; short-term investments = $2.5 million; accounts receivable = $1.2 million; net plant and equipment = $7.8 million. How much is tied up in operating current assets?arrow_forwardThe calculation of working capital requires the inclusion of: A.liabilities expected to be paid in more than 1 year B.current assets minus total liabilities C.assets expected to be used,sold or converted to cash within 1 year D.total assets and total liabilitiesarrow_forward

- ASSETS Non-current assets Property, plant and equipment Land 3. 130,000 Equipment at cost Depreciation 10,000 9.000 139,000 (1,000) Current assets Inventories 6,000 3,000 200 Receivables Prepaid expenses: Water Rates 200 Cash 29.400 168.400 20.000 Total assets Equity and Liabilities Equity Original Capital (Owner's Capital) Retained profit 120,000 25.400 145,400 Liabilities Long-term liabilities Mortgage 10,200 Short-term liabilities Trade payables Accrued expenses: Rent Tax payable Total Equity and Liabilities 2,500 500 9.800 12.800 168.400arrow_forwardQuestion Observe the following statement: STATEMENT OF CASH FLOW FOR "COUCH POTATO TECHNOLOGIES P/L" For the year ending June 30 2011 2010 2011 $000 $000 Receipts from customers (sales) Payments for purchases Payments to employees Purchase of assets 350 180 50 60 80 80 10 20 Payments for operating expenses 10 15 Additional Information: Industry Average Efficiency : 20% Net profit in 2010 : $21 000 a) Define the term working capital. b) Comment on the cash flow of Couch Potato Technologies P/L in 2010. c) Calculate and comment on the efficiency of Couch Potato Technologies P/L d) Calculate and comment on the net profit of Couch Potato Technologies P/L. e) Recommend TWO strategies that can be used to manage the working capital of Couch Potato Technologies P/L.arrow_forwardA7 i need all solution...... plase help....arrow_forward

- a) Calculate the free cash flow generated by a firm which has earnings before interest and taxes of £30m, has depreciated its fixed assets by £1m, has invested £10m in new fixed assets and £5m in working capital during 2019 when it paid corporate tax at 20%. Explain what you have assumed about the firm’s asset base. (b) During 2019 the firm in (a) generated revenue of £60m, its cost of goods sold was £20m and its selling, general and administrative costs were £10m. You anticipate that over the next five years revenue will grow at 5% each year, the cost of goods sold will continue to be a fixed percentage of revenue, but due to managerial efficiencies administrative costs will not change. All forms of investment, together with depreciation will have a consistent relationship with revenue. At the end of this five-year period you believe that free cash flow will grow at 2% each year. What is the company worth at the end of 2019, assuming that its weighted average cost of capital is 5%?arrow_forward24. Lense Laboratories' net income was $250,000. Given the account information below, what is the net operating cash flows for Lense Laboratories? Increase in Accounts Receivable Increase in Salaries Payable Decrease in Bond Discount Depreciation Expense Increase in Prepaid Insurance A. B. C. D. $152,000. $278,000. $312,000. $438,000. $60,000 $50,000 $30,000 $45,000 $3,000arrow_forwardFinance is Fun, Inc recently reported net income of $4.2 million, depreciation of $750,000, and amortization of $100,000. What was its net cash flow?arrow_forward

- 1. Calculate the following values for the company for the year ending in 20x9. Present evidence of all your calculations.a. NOPAT - Net Operating Profit after Taxesb. OCF - Operating Cash Flowc. FCF - Free Cash Flow2. Discuss what meaning each of the measures calculated in the previous question has, both for management and for investors and creditors, among other constituents.3. What is the main cause of the differences that exist between the company's earnings and the cash flows of the same evaluated period?arrow_forwardCash flow identity. Use the data from the following financial statements in the popup window, . The company paid interest expense of $17,100 for 2017 and had an overall tax rate of 40% for 2017. Verify the cash flow identity: cash flow from assets = cash flow to creditors + cash flow to owners The cash flow from assets is $ 24,380. (Round to the nearest dollar.) The cash flow to creditors is $ (Round to the nearest dollar.)arrow_forwardA & C Finance Ltd has given term loans of Rs.500000, invested Rs.800000 in equity shares of other companies and Rs.1000000 in computers. It eamed profit on sale of equity shares Rs.25000 and dividend of Rs.5000. What is the cash flow from investing activities? 1800000 1000000 1300000 O 1400000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education