ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

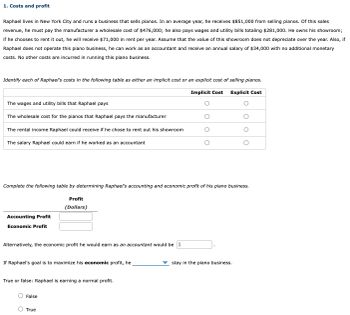

Transcribed Image Text:1. Costs and profit

Raphael lives in New York City and runs a business that sells pianos. In an average year, he receives $851,000 from selling pianos. Of this sales

revenue, he must pay the manufacturer a wholesale cost of $476,000; he also pays wages and utility bills totaling $281,000. He owns his showroom;

if he chooses to rent it out, he will receive $71,000 in rent per year. Assume that the value of this showroom does not depreciate over the year. Also, if

Raphael does not operate this piano business, he can work as an accountant and receive an annual salary of $34,000 with no additional monetary

costs. No other costs are incurred in running this piano business.

Identify each of Raphael's costs in the following table as either an implicit cost or an explicit cost of selling pianos.

Implicit Cost

Explicit Cost

The wages and utility bills that Raphael pays

The wholesale cost for the pianos that Raphael pays the manufacturer

The rental income Raphael could receive if he chose to rent out his showroom

The salary Raphael could earn if he worked as an accountant

Complete the following table by determining Raphael's accounting and economic profit of his piano business.

Accounting Profit

Economic Profit

Alternatively, the economic profit he would earn as an accountant would be $

Profit

(Dollars)

If Raphael's goal is to maximize his economic profit, he

True or false: Raphael is earning a normal profit.

False

O True

O

stay in the piano business.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Problem 18-01 (algo) Suppose that you own a 20-acre plot of land that you would like to rent out to wheat farmers. For them, bringing in a harvest involves $30 per acre for seed, $80 per acre for fertilizer, and $70 per acre for equipment rentals and labor. With these inputs, the land will yield 40 bushels of wheat per acre. Instructions: Enter your answers as a whole number. a. If the price at which wheat can be sold is $7 per bushel and if farmers want to earn a normal profit of $10 per acre, what is the most that any farmer would pay to rent your 20 acres? $ b. What price would the farmer pay to rent your 20 acres if the price of wheat rises to $8 per bushel? LAarrow_forwardTaylor used to work as a yoga instructor at the local gym earning $27,000 a year. Taylor quit that job and started working as a personal trainer. Taylor makes $60,000 in total annual revenue. Taylor's only out-of-pocket costs are $12,000 per year for rent and utilities, $1,000 per year for advertising and $1,500 per year for equipment. Taylor's accounting profit is _______, and Taylor's economic profit is _______.arrow_forwardChelsea Menken, of Providence, Rhode Island, recently graduated with a degree in food science and now works for a major consumer foods company earning $70,000 per year with about $54,000 in take-home pay. She rents an apartment for $1,200 per month. While in school, she accumulated about $38,000 in student loan debt on which she pays $385 per month. During her last fall semester in school, she had an internship in a city about 100 miles from her campus. She used her credit card for her extra expenses and has a current debt on the account of $7,000. She has been making the minimum payments on the account of about $240 a month. She has assets of $14,000. D a. Calculate Chelsea's debt payments-to-disposable income ratio. Round your answer to two decimal places. b. Calculate Chelsea's debt-to-income ratio. Round your answer to two decimal places. c. Comment on Chelsea's debt situation and her use of student loans and credit cards while in college.arrow_forward

- Solve this question step by step and proper way and correct answer......arrow_forward2. Definition of economic costs Van lives in Philadelphia and operates a small company selling scooters. On average, he receives $849,000 per year from selling scooters. Out of this revenue from sales, he must pay the manufacturer a wholesale cost of $390,000. He also pays several utility companies, as well as his employees wages totaling $359,000. He owns the building that houses his storefront; if he choose to rent it out, he would receive a yearly amount of $72,000 in rent. Assume there is no depreciation in the value of his property over the year. Further, if Van does not operate the scooter business, he can work as a programmer and earn a yearly salary of $25,000 with no additional monetary costs, and rent out his storefront at the $72,000 per year rate. There are no other costs faced by Van in running this scooter company. Identify each of Van's costs in the following table as either an implicit cost or an explicit cost of selling scooters. The wages that Van pays The salary Van…arrow_forward19. (Catalogue companies are the classic example of perfectly inflexible prices because once they print and ship out their catalogues, they are committed to selling at the prices printed in their catalogues. If a catalogue company finds its inventory of sweaters rising, what does that tell you about the demand for sweaters? If the inventories are rising for sweaters we know that demand for sweaters must be increasing, falling ). This is because prices are fixed, so this implies that people are buying less of the good due to a . increase, decrease ) in demand (see Figure 6.1b). In most circumstances, this accumulation of inventories suggests that the demand for sweaters was unexpectedly, high, unexpectedly low, as expected ) since companies try to smooth out production to minimize costs. If the company could change the price of sweaters, it would (raise the price, lower the price, keep the price the same ). Given that the company cannot change the price of sweaters, consider the number…arrow_forward

- 2. Definition of economic costs Jake lives in Detroit and runs a business that sells pianos. In an average year, he receives $726,000 from selling pianos. Of this sales revenue, he must pay the manufacturer a wholesale cost of $426,000; he also pays wages and utility bills totaling $264,000. He owns his showroom; if he chooses to rent it out, he will receive $13,000 in rent per year. Assume that the value of this showroom does not depreciate over the year. Also, if Jake does not operate this piano business, he can work as a paralegal and receive an annual salary of $22,000 with no additional monetary costs. No other costs are incurred in running this piano business. Implicit Cost Explicit Cost Identify each of Jake's costs in the following table as either an implicit cost or an explicit cost of selling pianos. The wholesale cost for the pianos that Jake pays the manufacturer The wages and utility bills that Jake pays The rental income Jake could receive if he chose to rent out his…arrow_forwardSuppose that you are the marketing manager of Citruscity, the only producer of grapefruits in the imaginary economy of Blockburg. As a monopolist, Citruscity's objective is to maximize its profit, so it is up to you devise a way to increase profits through price discrimination. As a former economics student, you know that many firms successfully practice price discrimination by separating their market into two identifiable types of consumers-what economists call third-degree price discrimination. Examples of this include student discounts, senior citizen discounts, and ladies' night discounts. After doing some research, you conclude that the demand for grapefruits varies greatly between consumers who clip coupons and those who do not. The following graphs show the overall dailly demand and marginal revenue (MR) for a pound of grapefruits for each group of consumers and the marginal cost (MC) for producing a pound of grapefruits. Assume that fixed costs are equal to zero. Note: You will…arrow_forward1. Definition of economic costs Shen lives in San Diego and operates a small company selling drones. On average, he receives $727,000 per year from selling drones. Out of this revenue from sales, he must pay the manufacturer a wholesale cost of $427,000. He also pays several utility companies, as well as his employees wages totaling $254,000. He owns the building that houses his storefront; if he choose to rent it out, he would receive a yearly amount of $31,000 in rent. Assume there is no depreciation in the value of his property over the year. Further, if Shen does not operate the drone business, he can work as a blogger and earn a yearly salary of $26,000 with no additional monetary costs, and rent out his storefront at the $31,000 per year rate. There are no other costs faced by Shen in running this drone company. Identify each of Shen's costs in the following table as either an implicit cost or an explicit cost of selling drones. Implicit Cost Explicit Cost The wholesale cost for…arrow_forward

- 1. Definition of economic costs Bob lives in Miami and runs a business that sells guitars. In an average year, he receives $793,000 from selling guitars. Of this sales revenue, he must pay the manufacturer a wholesale cost of $430,000; he also pays wages and utility bills totaling $301,000. He owns his showroom; if he chooses to rent it out, he will receive $15,000 in rent per year. Assume that the value of this showroom does not depreciate over the year. Also, if Bob does not operate this guitar business, he can work as a financial advisor, receive an annual salary of $50,000 with no additional monetary costs, and rent out his showroom at the $15,000 per year rate. No other costs are incurred in running this guitar business. Identify each of Bob's costs in the following table as either an implicit cost or an explicit cost of selling guitars. Implicit Cost Explicit Cost The wholesale cost for the guitars that Bob pays the manufacturer The wages and utility bills that Bob pays The…arrow_forward1. Suppose your current job pays you $300,000 a year. However, you are considering starting your own company. Based upon your research, you estimate your first year total revenue to be $7,500,000. There are however several costs of running the company during this first year, such as the cost of materials which will equal $2,750,000, employees who will receive in total $1,500,000, utilities which will cost $1,200,000, and rent that will be paid to the landlord that equals $1,800,000. Based on this information, solve for both your accounting profit and economic profit during this first year. Also, based upon these profit values, state whether you are better off starting this company or staying in your current job.arrow_forwardAs per given information, the table is completed:- (In $) Quantity Price Total Marginal Total Cost Marginal Revenue Revenue Cost 34 20 20 1 32 32 32 36 16 2 30 60 28 46 10 28 84 24 50 4 4 26 104 20 54 4 24 120 16 56 2 22 132 12 64 7 20 140 80 16 8 18 144 4 100 20 16 144 128 28 14 140 -4 160 32 (d) Generally, what are the relative values of price, ATC, and AVC when a monopolist experiences: a profit? a loss but continues to produce? a loss but ceases production? 10arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education