ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

***This is a three-part question - EACH PART requires a solution/explanation with visual representation on a GRAPH or TABLE; for the graph and table, examples of what is needed are provided***

1. Assume that the demand for cigarettes is Qd=1600-30P and the supply of cigarettes is Qs=1400+70P. Now, suppose the government levies a $2 tax for each unit of cigarettes sold.

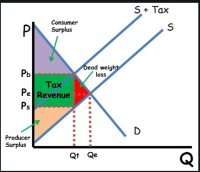

a. ON A GRAPH, identify the tax revenue generated by this tax. Label each area on the graph with a letter.

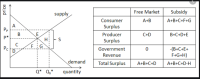

b. SHOW IN A TABLE the

c. ON THE GRAPH, indicate the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 4. Externalities - Definition and examples An externality arises when a firm or person engages in an activity that affects the well-being of a third party, yet neither pays nor receives any compensation for that effect. If the impact on the third party is beneficial, it is called a externality. The following graph shows the demand and supply curves for a good with this type of externality. The dashed drop lines on the graph reflect the market equilibrium price and quantity for this good. Shift one of the curves to reflect the presence of the externality. If there are external costs of production, then you should shift the supply curve to reflect the social costs of producing the good; similarly, if there are external benefits from production, then you should shift the demand curve to reflect the social benefits from consuming the good. PRICE (Dollars per unit) QUANTITY (Units) Supply Demand O Demand -- Supply ? With this type of externality, in the absence of government intervention,…arrow_forwardGraph B.5. shows the economics offects of a per-unit tax Refer to Graph B 5. to answer (38 following questions Graph B.5 P S P₁ D₂ D₁ Q Q₁ Q₂ Qs (a) is the tax levied on buyers or on sellers? (b) What is the price buyers pay after the tax is imposed? (c) What is the price the sellers receive after the tax is imposed? (d) What area represents government tax revenue after the tax is imposed? Ps ܘ ܘ ܘ ܘ ܘ P₂ B C F 11 J К H L Marrow_forwardThe figure below shows a market of good C. Suppose that the government levied a tax on C. Suppose that the consumers’ tax incidence is 15 and the price sellers receive is 8 when the size of the tax is T. Answer the value of T. Hint: Remember the relationship between the tax incidences and the size of tax.arrow_forward

- please solve a and barrow_forwardThe equation of demand is Q=10000-5p, supply is Q=-2000+10p Q represents the quantity of houses on the market and P the rental price. The equilibriumrental price equals 800 euros per month. if the government imposing a maximum price of 500 euro per month,What are the effects of each measure for both house owners and people renting ahouse? And what are the consequences for the government? Analyse the measuresgraphically and mathematically.arrow_forwardUSE FIGURE #1: A construction boom occurs and many of the new buildings need plywood for their framing. Which of the figures above best illustrates this change? Group of answer choices Figure A or Figure C Figure A Figure C Figure D Figure Barrow_forward

- On the following graph, use the black curve (plus symbols) to illustrate the deadweight loss in these cases. (Hint: Remember that the area of a triangle is equal to x Base × Height. In the case of a deadweight loss triangle found on the graph input tool, the base is the amount of the tax and the height is the reduction in quantity caused by the tax.) 2400 2160 1920 Deadweight Loss 1680 1440 1200 960 720 480 240 10 20 30 40 50 60 70 80 90 100 TAX (Dollars per bottle) As the tax per bottle increases, deadweight loss DEADWEIGHT LOSS (Dollars)arrow_forward1. Externalities - Definition and examples An externality arises when a firm or person engages in an activity that affects the wellbeing of a third party, yet neither pays nor receives any compensation for that effect. If the impact on the third party is adverse, it is called a externality. The following graph shows the demand and supply curves for a good with this type of externality. The dashed drop lines on the graph reflect the market equilibrium price and quantity for this good. Adjust one or both of the curves to reflect the presence of the externality. If the social cost of producing the good is not equal to the private cost, then you should drag the supply curve to reflect the social costs of producing the good; similarly, if the social value of producing the good is not equal to the private value, then you should drag the demand curve to reflect the social value of consuming the good. ? PRICE (Dollars per unit) QUANTITY (Units) Supply Demand Demand Supply With this type of…arrow_forwardA1-1. Imagine that a market for a good is characterized by the following supply and demand equations: QS = –35 + 35P QD =100 – 10P where QS and QD are quantities in units and P is the price per unit. (a) Graph the supply and demand curves with quantity on the horizontal and price on the vertical axis. Be sure to calculate the P and Q intercepts for demand and the P intercept for supply. Calculate and illustrate the equilibrium price and quantity. [Hint: Show your work.] (b) Calculate both the demand and supply elasticity around the equilibrium point. [Hint: you can use either the point method or the average arc (midpoint) method.] (c) If a regulator imposes a quantity restriction by granting quotas for 60 units of output to existing producers, what is the new price and quantity traded? Does this policy create deadweight loss (DWL) in the market? Briefly explain and identify any DWL in your diagram. (d) What is the value of a unit of quota? Illustrate in your diagram.…arrow_forward

- Read the following excerpt: 'In the UK, fuel duty is levied per unit of fuel purchased and is included in the price paid for petrol, diesel and other fuels used in vehicles or for heating. The rate depends on the type of fuel: the headline rate on standard petrol and diesel has been reduced from 57.95 pence to 52.95 pence per litre.' Suppose that, in order to reduce greenhouse gas emissions, the UK government is considering raising fuel duty on standard petrol and diesel. Suppose that the government intends to earmark the additional fuel tax revenue, not for subsidising less carbon-intensive energy production (e.g., wind energy) but for supporting higher education (e.g., reduction in university fees). Are there additional theoretical implications in terms of efficiency in resource allocation, due to the intended use of the revenue? Explain.arrow_forward5. Suppose that on a campus, girls' demand for an air freshener is P 10 - Q, and boys' demand is P = 10 - Q. The supply for the air freshener is P = 5+Q. (a) Suppose that the air freshener is a private good. Write down the combined demand of girls and boys for the air freshener. What would be the equilibrium quantity of air freshener traded? at what price? (b) Now suppose that the air freshener is a public good. Write down the combined demand of girls and boys for the air freshener. What would be the equilibrium quantity of air freshener traded? at what price?arrow_forwardQuestion 5 Suppose that the government imposes a tax on cigarettes. Use the diagram below to answer the questions. D is the demand curve before tax, S is the supply curve before tax and St is the supply curve after the tax. Price 18 12 10 10 12 Qua (a) For the market for cigarettes without the tax. Indicate: Price paid by consumers (1) Price paid by producers (ii) Quantity of cigarettes sold (iv) Buyer's reservation price (v) Seller's reservation price Seller's reservation price Choose. + Choose. + Choose. Price paid by consumers Choose. + 12 18 Quantity of cigarettes sold Choose. 10 7 Buyer's reservation price 3 Choose. 8 Price paid by producers Choose.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education