FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

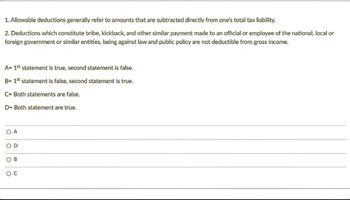

Transcribed Image Text:1. Allowable deductions generally refer to amounts that are subtracted directly from one's total tax liability.

2. Deductions which constitute bribe, kickback, and other similar payment made to an official or employee of the national, local or

foreign government or similar entities, being against law and public policy are not deductible from gross income.

A= 1st statement is true, second statement is false.

B= 1st statement is false, second statement is true.

C= Both statements are false.

D- Both statement are true.

O A

OD

OB

O C

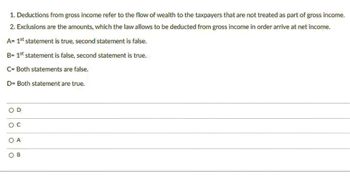

Transcribed Image Text:1. Deductions from gross income refer to the flow of wealth to the taxpayers that are not treated as part of gross income.

2. Exclusions are the amounts, which the law allows to be deducted from gross income in order arrive at net income.

A= 1st statement is true, second statement is false.

B= 1st statement is false, second statement is true.

C= Both statements are false.

D= Both statement are true.

O C

O A

OB

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 3 What is income tax payable? O A company's liability, based on profitability, that is paid in advance to the government O A payment to a company, based on profitability, that is paid in advance from the government A payment to a company, based on profitability, to be paid from the government O A company's liability, based on profitability, to be paid to the governmentarrow_forwardExplain the significance of Lucas v. Earl and Helvering v. Horst. C O A. Lucas v. Earl, the Supreme Court held that earnings from labor are taxed to the person who performs the services rather than the person who receives the income. In Helvering v. Horst, the Supreme Court held that income from property is taxed to the person who owns the property rather than the person who receives the income. One cannot assign income by arranging to have payment made to another person. O B. Lucas v. Earl, the Supreme Court held that income from property is taxed to the person who owns the property rather than the person who receives the income. Helvering v. Horst, the Supreme Court held that earnings from labor are taxed to the person who performs the services rather than the person who receives the income. OC. Helvering v. Horst, the Supreme Court held that earnings from labor are taxed to the person who performs the services rather than the person who receives the income. Lucas v. Earl, the…arrow_forward2arrow_forward

- In computing net business income for income tax purposes, which of the following statements is INCORRECT? Question 3Answer a. Income tax paid is not allowed as a business deduction. b. Depreciation is not allowed as a business deduction. c. Capital cost allowance is not allowed as a business deduction. d. An arbitrary reserve is not allowed as a business deduction.arrow_forward1 contiune Listed below are items that are commonly accounted for differently for financial reporting purposes than they are for tax purposes.For each item below, indicate whether it involves: 1. A temporary difference that will result in future deductible amounts and, therefore, will usually give rise to a deferred income tax asset. 2. A temporary difference that will result in future taxable amounts and, therefore, will usually give rise to a deferred income tax liability. 3. A permanent difference. (e) Installment sales of investments are accounted for by the accrual method for financial reporting purposes and the installment method for tax purposes.(f) For some assets, straight-line depreciation is used for both financial reporting purposes and tax purposes, but the assets’ lives are shorter for tax purposes.(g)…arrow_forwardWhich of the following would not be considered to be tax planning. An arrangement that: Group of answer choices Reduces or defers assessable income. Maximises or accelerates deductions. Utilises different tax rates. Maximises tax offsets. Splits or diverts income. Does not disclose income.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education