FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:3

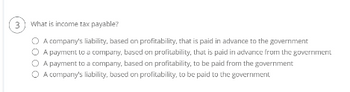

What is income tax payable?

O A company's liability, based on profitability, that is paid in advance to the government

O A payment to a company, based on profitability, that is paid in advance from the government

A payment to a company, based on profitability, to be paid from the government

O A company's liability, based on profitability, to be paid to the government

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of these is NOT a tax assessed by the state to earn revenue? A Sales Tax B Excise Tax C Hotel Occupancy Tax D Entertainment Ticket Taxarrow_forwardWhat is the difference in the tax treatment of interest anddividends paid by a corporation? Does this factor favor debt orequity financing?arrow_forwardWhich of the following statements are correct? i. A tax resident is normally liable to tax on their worldwide, profits, income, and gains, whether received. ii. Non-residents are generally liable to tax on certain income and profits generated from sources within the country. iii. A domiciled taxpayer is normally liable to tax on their worldwide, profits, income, and gains, whether received. iv. Tax is imposed on certain sources of income, such as interest, dividends, royalties, and fees, by way of withholding tax. a. i, ii and iv b. i only c. All of the above d. i, iii and ivarrow_forward

- Which of the following are reductions from the federal tax owed dollar -for - dollar. Select one: a. California estimated tax and California withholding from paycheck b. Federal withholding and the earned income credit c.Federal estimated tax and deductions FROM AGI d. California State Withholding from salary and Federal withholdingarrow_forward5arrow_forwardHow does the federal income tax system treat dividends receivedby a corporation versus those received by an individual?arrow_forward

- 1. Under IFRS companies are required to provide a reconciliation between actual tax expense and the applicable tax rate. The purpose(s) of this reconciliation include I. Making better prediction of future cash flow. II. Predicating future cash flows for operating loss carryforwards. III. Assessing the composition of the net deferred income tax liability. IV. Assessing quality of earnings. Select one: a.I, II, III and IV. b.I, III, and IV only. c.I, II and IV only. d.I and IV only. 2. Under IFRS deferred tax assets are recognized for I. Deductible temporary differences. II. Deductible permanent differences. III. Operating loss carryforwards. IV. Operating loss carrybacks Select one: a.I and III only. b.I and IV only. c.II and III only. d.I, II, and III. 3. In determining whether to adjust a deferred tax asset, a company should Select one: a.pass a recognition threshold, after assuming that it will be audited by taxing authorities. b.take an aggressive approach…arrow_forwardFor federal income tax purposes, the difference between the total income and total expenses reported by a C corporation may be referred to as what type of income?arrow_forwardWhy company tax rate is always different from company accounting income?arrow_forward

- Which of the following statements are correct? i. A tax is a statutory obligation that is imposed by an act of parliament in a country. ii. A tax is any deduction taken from a person’s salary by the government. iii. Taxation is the major source of government income. iv. Direct and indirect taxes are the two broad categories of taxation.arrow_forward1 contiune Listed below are items that are commonly accounted for differently for financial reporting purposes than they are for tax purposes.For each item below, indicate whether it involves: 1. A temporary difference that will result in future deductible amounts and, therefore, will usually give rise to a deferred income tax asset. 2. A temporary difference that will result in future taxable amounts and, therefore, will usually give rise to a deferred income tax liability. 3. A permanent difference. (e) Installment sales of investments are accounted for by the accrual method for financial reporting purposes and the installment method for tax purposes.(f) For some assets, straight-line depreciation is used for both financial reporting purposes and tax purposes, but the assets’ lives are shorter for tax purposes.(g)…arrow_forwardIt is talking about Hong Kong Tax, Special Business, Profit Tax Comuptaion of Financila instituition, please explain the DIPN 21 "Initiation" and "funding".arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education