Accounting (Text Only)

26th Edition

ISBN: 9781285743615

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

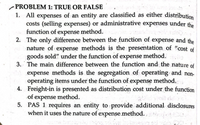

Transcribed Image Text:-PROBLEM 1: TRUE OR FALSE

1. All expenses of an entity are classified as either distribution

costs (selling expenses) or administrative expenses under the

function of expense method.

2. The only difference between the function of expense and the

nature of expense methods is the presentation of "cost of

goods sold" under the function of expense method.

3. The main difference between the function and the nature of

expense methods is the segregation of operating and non-

operating items under the function of expense method.

4. Freight-in is presented as distribution cost under the function

of expense method.

5. PAS 1 requires an entity to provide additional disclosures

when it uses the nature of expense.method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which is incorrect concerning the presentation of Income Statement? A. When items of income and expense are material, their nature and amount shall be disclosed separately. B. An entity shall present extraordinary items separately on the face of the income statement or in the notes to F/S. C. Natural presentation means that expenses are aggregated according to their nature like depreciation and employee benefits. D. Cost of sales method classifies expenses according to their function such as cost of sales, cost of distribution and cost of administrative activities. E. Both the natural presentation and functional presentation has their own merits for different types of entities, so the standard allows management to choose which they think is more relevant and reliable presentation.arrow_forwardWhich of the following is not an example of an operating expense? Select one: a. Salaries Expense b. Insurance Expense c. Rent Expense d. Cost of Goods Soldarrow_forwardWhich of the following statements correctly relate to the provisions of PAS 1?arrow_forward

- When is revenue recognized in the following situations?(a) Revenue from selling products, (b) revenue from servicesperformed, (c) revenue from permitting others to usecompany assets, and (d) revenue from disposing of assetsother than products.arrow_forwardKindly answer the following questions in problems 9-13 and 9-14.arrow_forwardThe combination of Selling Expenses and Administrative Expenses is referred to as Select one: a. Total expenses b. Administrative expenses c. Selling expenses d. Operating Expensesarrow_forward

- Activity 1: Sales revenue should be recognized when goods and services have been supplied; costs are incurred when goods and services have been received. Which accounting concept governs the above? A.The substance over form concept B.The materiality concept C.The accrual concept D. The historical cost conceptarrow_forwardWhat are the two most often used ways of accounting for revenue from by-products?arrow_forward1-Explain the meanings of (1) cost, (2) expense, (3) loss as used for financial reporting in conformity with GAAP. In your explanation, discuss the distinguishing characteristics of the terms and their similarities and interrelationships.arrow_forward

- eflects each situation. Principle or Assumption eports can be prepared for those Business entity assumption Expense recognition (matching) principle S. s reported. Going-concern assumption npact users' decisions. Measurement (cost) principle Monetary unit assumptionarrow_forwardWhich of the following principles matches expenses with associated revenues in the period in which the revenues were generated? Group of answer choices 1.revenue recognition principle 2.expense recognition (matching) principle 3.cost principle 4.full disclosure principlearrow_forwardWhich of the following accounts is an example of a contra-asset?A) Cost of Goods Sold B)Sales Discounts C) Purchases D) Deferred Revenue E) LIFO Reservearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning