ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

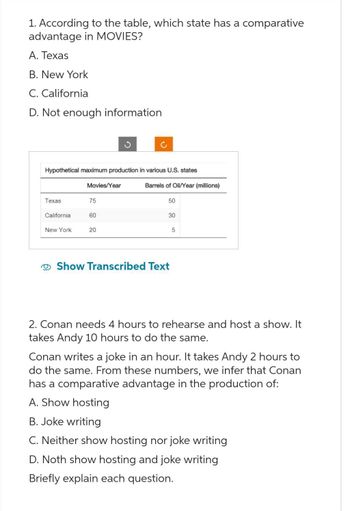

Transcribed Image Text:1. According to the table, which state has a comparative

advantage in MOVIES?

A. Texas

B. New York

C. California

D. Not enough information

Hypothetical maximum production in various U.S. states

Texas

California.

New York

Movies/Year

75

60

20

Barrels of Oil/Year (millions)

50

30

Show Transcribed Text

5

2. Conan needs 4 hours to rehearse and host a show. It

takes Andy 10 hours to do the same.

Conan writes a joke in an hour. It takes Andy 2 hours to

do the same. From these numbers, we infer that Conan

has a comparative advantage in the production of:

A. Show hosting

B. Joke writing

C. Neither show hosting nor joke writing

D. Noth show hosting and joke writing

Briefly explain each question.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- What is comparative advantage based on? A. dollar price B. labour costs C. opportunity costs D. capital costsarrow_forwardAnother name for a market economy is O the law of demand. the law of supply. comparative advantage. the price system.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- wine 90 80 70 60 50 40 30 20 10 0 0 10 20 30 40 50 60 cloth Portugal PPF CPF wine SERESSAD 90 Click Save and Submit to save and submit. Click Save All Answers to save all answers. 80 70 60 50 40- 30+ 20 O (a) Portugal has the absolute advantage and England has the comparative advantage Ⓒ (b) England has the absolute advantage and Portugal has the comparative advantage O (c) Neither country has the comparative advantage O (d) Neither country has the absolute advantage O (d) cannot tell from this diagram England PPF 10 0 0 10 20 30 40 50 60 cloth 12. If Portugal has a total of 180 man-hours of resources available for production, while England has only 60, which country has the absolute advantage, and which country has the comparative advantage in wine? CPF MacBook Air Save All Aarrow_forward52. Calculate the opportunity cost of one more railcar for Canada prior to trading.arrow_forwardEconomics The matrix given below represents the pay offs to two large countries, Zombec and Firan, each importing different set of products from the other. Each country's government must choose between two distinct trade policies, free trade and optimal tariffs. Each policy choice represents a game strategy. Firan Zombec Free trade Optim al tariff 50 60 Free trade 50 30 30 40 60 Optimal tariff 40 Determine the Nash equilibrium (if any) in the trade policy game described above. O a. The Nash cquilibrium cannot be determined. O b.Zombec will choose free trade and Firan will choose optimal tariff Oc Zombec will choose optimal tariff and Firan will choose free trade. Od. Both the countries will choose free trade. e. Both countries will choose optimal tariff.arrow_forward

- A ng.cengage.com + Welcome to Johnston Community College Bb Support Materials and Text Chapters Two and Three - .. * MindTap - Cengage Learning >> CENGAGE MINDTAP Q Search this course Homework (Ch 02) 4. Shifts in production possibilities Suppose Japan produces two types of goods: agricultural and capital. The following diagram shows its current production possibilities frontier for wheat, an agricultural good, and cars, a capital good. A-Z Drag the production possibilities frontier (PPF) on the graph to show the effects of a technological advance in medicine that allows workers to live longer and have extended careers. Note: Select either end of the curve on the graph to make the endpoints appear. Then drag one or both endpoints to the desired position. Points will snap into position, so if you try to move a point and it snaps back to its original position, just drag it a little farther. (?) 360 300 PPF 240 180 At 120 60 PPF 10 20 30 40 50 60 WHEAT (Millions of bushels) O 9 2 9 O E…arrow_forwardK Tory and Patty produce skis and snowboards. The tables show their production possibilities. Each week, Tony produces 4 snowboards and 8 skis and Patty produces 15 snowboards and 30 skis. Tony and Patty decide to specialize and trade. If Tony and Patty specialize and trade, what are the gains from trade? specializes in snowboards and produces OA Tony, 20 snowboards OB Tony, 4 snowboards OC. Patty; 15 snowboards OD. Patty: 30 snowboards OE Tony; 60 snowboards specializes in skis and produces CETTE OA. Patty; 60 skis OB. Patty, 30 skis OC. Tony: 8 skis OD. Tony, 10 skis OE. Patty: 20 skis By specializing and trading, total output Tony's Production Possibilities Snowboards (per week) Patty's Production Possibilities 20 16 12 B 4 0 Snowboards (per week) 30 15 0 and and and and and and and and and Skis (per week) 0 2 4 6 8 10 Skis (per week) 0 30 60arrow_forward24. In the real world we don't observe countries completely specializing in the production of goods for which they have a comparative advantage. One reason for this is a. Comparative advantage works better in theory than in practice. b. Some countries have more resources than other countries. c. Tastes for many traded goods are similar in many countries because of globalization. d. Production of most goods involves increasing opportunity costs.arrow_forward

- Answer the questions based on the figure below, which is for one of the small moons of the planet Quantz. Quantity of Coffee 70- 60- 50- 40- 30- 20- 10- 0 0 U Production Possibilities for Coffee and Tea V 80 W 160 Quantity of Tea 240 How much tea is gained at what cost of coffee? a. In moving from U to V b. In moving from W to X c. In moving from Y to Z 320 80 tea is gained at the cost of 80 tea is gained at the cost of 20 tea is gained at the cost of 55 coffee. 35 coffee. o coffee.arrow_forwardQuestion 1A. Define and explain the theory of comparative advantage (use an example ifnecessary).B. Discuss limitations of comparative advantage (Include in your answer at leastfive key limitations to this theory).C. Spencer Grant is a New York-based investor. He has been closely following hisinvestment in 100 shares of Vaniteux, a French firm that went public in Februaryof 2010. When he purchased his 100 shares at €17.25 per share, the euro wastrading at $1.360/€. Currently, the share is trading at €28.33 per share, and thedollar has fallen to $1.4170/€.a If Spencer sells his shares today, what percentage change in the share pricewould he receive?What is the percentage change in the value of euro versus the dollar overthis same period?What would be the total return Spencer would earn on his shares if he soldthem at these rates?arrow_forwardBased on the figure below, answer the following questions: A В 50 40 D 30 20 10 F 10 20 30 40 50 Food Production What this figure represents. Explain. а. b. How does the above curve illustrate the tradeoff we must make to increase food production? Clothing Productionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education