FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

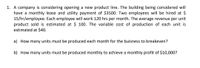

Transcribed Image Text:1. A company is considering opening a new product line. The building being considered will

have a monthly lease and utility payment of $3500. Two employees will be hired at $

15/hr/employee. Each employee will work 120 hrs per month. The average revenue per unit

product sold is estimated at $ 100. The variable cost of production of each unit is

estimated at $40.

a) How many units must be produced each month for the buisness to breakeven?

b) How many units must be produced monthly to achieve a monthly profit of $10,000?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ford Motor Company is considering purchasing a new piece equipment for one of its plants. The contribution margin is expected to increase from $275,000 to $330,000. Net income is expected to remain at $100,000 for each year. Compute the degree of operating leverage before and after the purchase of the new equipment. (Round answers to 2 decimal places, e.g. 15.25.) Degree of Operating Leverage Before Afterarrow_forwardA rotational molding operation has fixed costs of $10,000 per year and variable costs of $52 per unit. If the process is automated via conveyor, its fixed cost will be $43,000 per year, but its variable cost will be only $10 per unit. Determine the number of units each year necessary for the two operations to break even. The number of units each year necessary for the two operations to break even, (in units) Round to the nearest two (2) decimal placesarrow_forwardPauline Found Manufacturing, Inc., is moving to kanbans to support its telephone switching-board assembly lines. Determine the size of the kanban for subassemblies and the number of kanbans needed. Setup cost Annual holding cost Daily production Annual usage Lead time Safety stock $30 $120 per subassembly 25 subassemblies 4,000 (50 weeks x 5 days each x daily usage of 16 subassemblies) 12 days 4 days' productionarrow_forward

- 1. A manager has determined that a potential new product can be sold at a price of $25 each. The cost to produce the product is $17.5, but the equipment necessary for production must be leased for $75,000 per year. What is the break-even point? 2. In order to produce a new product, a firm must lease equipment at a cost of $175,000 per year. The managers feel that they can sell 65,000 units per year at a price of $90. What is the highest variable cost that will allow the firm to at least break even on this project? (Round your answer to 2 decimal places.)arrow_forwardA restaurant has 145 seats needs $60,000 to earn the annual interest payment to the bank. Its monthly fixed labor cost is $7,800 along with other annual fixed cost of $270,000. It has a guest check average of $22 and per guest average cost of $15.50. What revenue is needed to cover all costs? What average daily seat turnover will be needed, assuming the operation is closed 3 days a year?arrow_forwardLotus Development has a software rental plan called SmartSuite that is available on the world wide web. A number of programs are available at $2.99 for 48 hours. If a construction company uses the service an average of 48 hours per week, what is the present worth of the rental costs for 10 months at an interest rate of 1% per month compounded weekly? Assume 4 weeks per month.arrow_forward

- A project requires an initial investment in equipment of $96,600 and then requires an initial investment in working capital of $14,400 (at t= 0). You expect the project to produce sales revenue of $131,000 per year for three years. You estimate manufacturing costs at 60 percent of revenues. (Assume all revenues and costs occur at year-end [i.e., t= 1, t= 2, and t=3]). The equipment depreciates using straight-line depreciation over three years. At the end of the project, the firm can sell the equipment for $12,420 and recover the investment in net working capital. The corporate tax rate is 21 percent and the cost of capital is 15 percent. Calculate the NPV of the project. Multiple Choice O O O $4,679 -$3,574 $13,573arrow_forwardFlavor Enterprises has been approached about providing a new service to its clients. The company will bill clients $160 per hour; the related hourly variable and fixed operating costs will be $70 and $18, respectively. If all employees are currently working at full capacity on other client matters and average hourly profit margin is $88, should the company accept this new services or not, use calculation to support your answer.arrow_forward1.How many units of scooters, best calls, and rollerblades should summertime Inc. produce? 2.What is the maximum amount summertime and corporate would be willing to pay for another 1200 additional units of fun? info: The demand for the products far exceeds the direct materials available to produce the products. Fun cost $2 per pound and a maximum of 7975 pounds is available each month. Summertime Inc. must produce a minimum of 175 units of each productarrow_forward

- Hickory Manufacturing Company forecasts the following demand for a product (in thousands of units) over the next five years. 1 2 3 4 5 76 79 82 82 55 Year Forecast demand Currently the manufacturer has eight machines that operate on a two-shift (eight hours each) basis. Thirty days per year are available for scheduled maintenance of equipment with no process output. Assume there are 250 workdays in a year. Each manufactured good takes 25 minutes to produce. a. What is the effective capacity of the factory? Round your answer down to the nearest whole number. units/year b. Given the five-year forecast, how much extra capacity is needed each year? Use a minus sign to enter an answer, if there is excess capacity. Round your answers to the nearest whole number. Year Extra capacity needed (units) c. Does the firm need to buy more machines? If so, how many? When? If your answer is zero, enter "0". Round your answers up to the nearest whole number. Year Additional machines needed 1 1 2 2 3 3 4…arrow_forwardSuppose plant capacity were only 13,000 pieces instead of 15,000 pieces each month. Thespecial order must either be taken in full or be rejected completely. Should Carilla accept thespecial order? Show your calculationsarrow_forwardYour storage firm has been offered $96,900 in one year to store some goods for one year. Assume your costs are $95,200, payable immediately, and the cost of capital is 8.1%. Should you take the contract? The NPV will be $ Should you take the contract? The contract (Round to the nearest cent.) be taken (Select from the drop-down menu.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education