Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:1

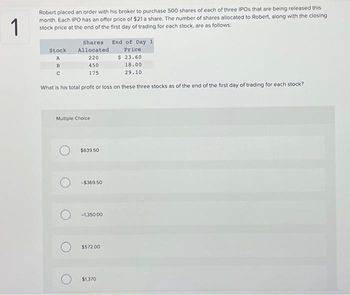

Robert placed an order with his broker to purchase 500 shares of each of three IPOs that are being released this

month. Each IPO has an offer price of $21 a share. The number of shares allocated to Robert, along with the closing

stock price at the end of the first day of trading for each stock, are as follows:

Stock

A

B

с

Shares End of Day 1

Allocated

220

450

175

What is his total profit or loss on these three stocks as of the end of the first day of trading for each stock?

Multiple Choice

$639.50

-$369.50

-1,350.00

$572.00

Price

$ 23.60

18.00

29.10

$1,370

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Computation of profit or loss at end of first day of trading of stock A

VIEW Step 2: Computation of profit or loss at end of first day of trading of stock B

VIEW Step 3: Computation of profit or loss at end of first day of trading of stock C

VIEW Step 4: Computation of total profit or loss at end of first day of trading

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Six months ago, you purchased 3,000 shares of ABC stock for $47.06 a share. You have received dividend payments equal to $0.80 a share. Today, you sold all of your shares for $49.74 a share. What is your total dollar return on this investment? $2,400 $10,050 $8,040 $10,440 $20,880arrow_forwardAs the same investor, you put in a limit order to purchase the above company at $12.00 per share at 12:00P.M. on June 15. At 3:00P.M. the stock was selling for 11¾. Was your order executed?arrow_forwardYou purchased 500 shares of stock at $27.00 per share. Later that stock paid a $3.00 per share dividend. What was your return for the year? purchased 500 shares of stock Per share 27,00 Later the stock paid 3.00arrow_forward

- An investor purchased 500 shares of common stock, $25 par, for $19,250. Subsequently, 100 shares were sold for $35 per share. What is the amount of gain or loss on the sale?arrow_forwardA stock is selling for $83 per share. One-month European calls and puts on the stock with the strike price of $80 are selling for $6 and $3, respectively. Kevin creates a straddle by buying 100 calls and 100 puts. What is his net profit if the stock price is $85 one month later? O A loss of $600 O A gain of $400 O A loss of $400 O A loss of $900arrow_forwardYou own 350 shares of Maslyn Tours stock that sells for $52.48 per share. If the stock has a dividend yield of 2.4 percent, how much do you expect to receive next year in dividend income from this investment? Multiple Choice $468.38 $489.81 $429.35 $455.53 $440.83arrow_forward

- Jolie has an outstanding order with her stock broker to purchase 1,000 shares of every IPO. The current three IPOs are each priced at $16 a share and all started trading this morning. Jolie was allocated 300 shares of IPO A, 100 shares of IPO B, and 1,000 shares of IPO C. IPO A opened at $17 a share this morning and ended the day at $17.50 a share. IPO B opened at $21 a share and finished the day at $23 a share. IPO C opened at $16 a share and ended the day at $14.50 a share. What is Jolie's total profit or loss on these three IPOS as of the end of the day? O a. -$400 O b. -$350 O c. -$200 O d. -$150 O e. -$100arrow_forwardYou currently own 600 shares of stock AAA. The stock currently trades at $3 a share. The company is contemplating a 1-for-3 reverse stock split. Which of the following best describes your position after the proposed stock split takes place? You will have 200 shares of stock with $9 a share. You will have 1,800 shares of stock with $1 a share. You will have 200 shares of stock with $9 a share. You will have 1,800 shares of stock with $9 a share.arrow_forwardPlease I want answer for this question of multiple choice. Big thanksarrow_forward

- Your corporation currently has 200,000 shares of stock outstanding that sells for $50.00 per share. What will be the amount of shares outstanding and the share price after the reverse stock split. Please show your calculations in the space provided.Your corporation declared a three-for-six reverse stock split.arrow_forward9arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education