FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:--/1

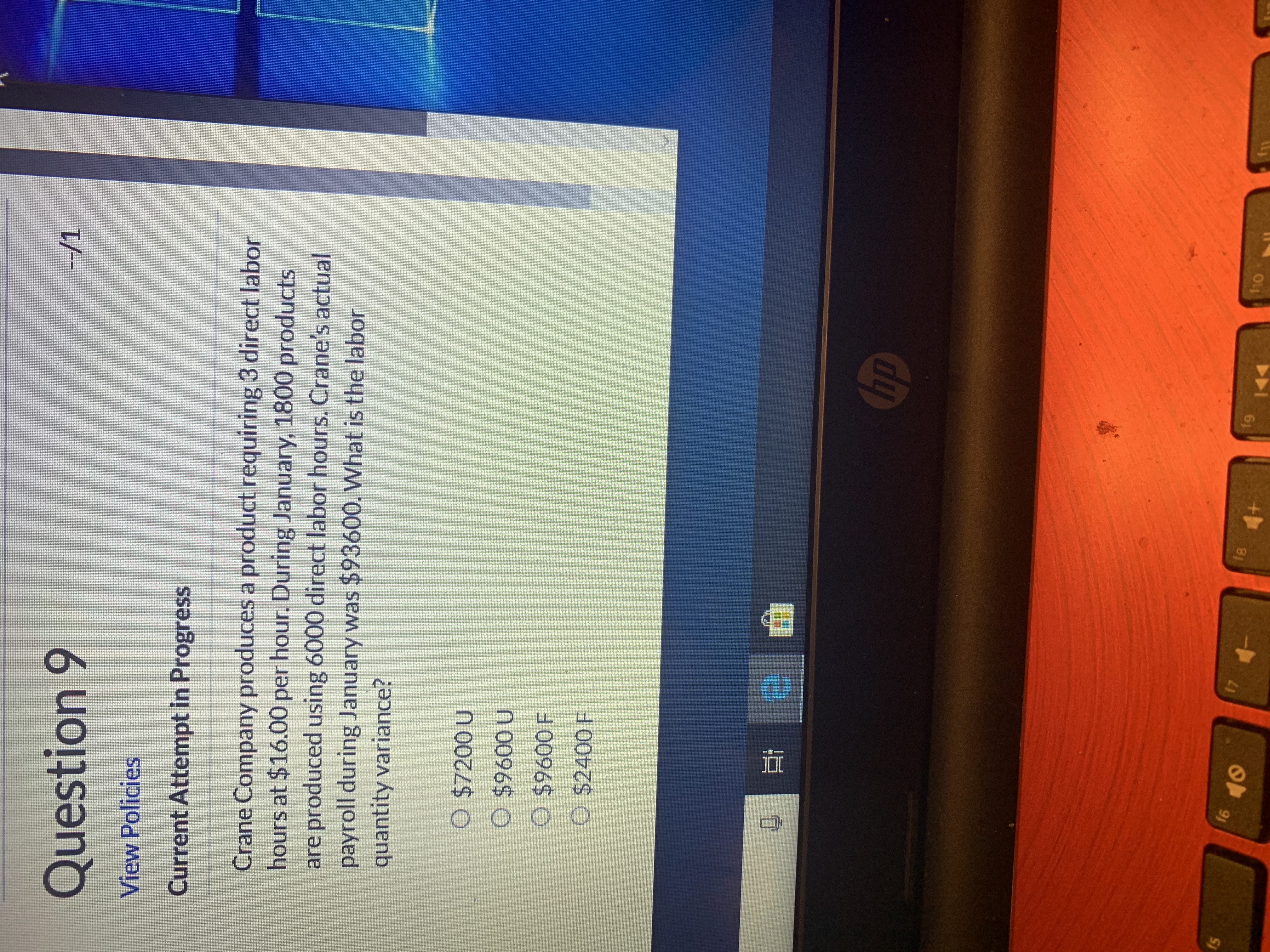

Question 9

View Policies

Current Attempt in Progress

Crane Company produces a product requiring 3 direct labor

hours at $16.00 per hour. During January, 1800 products

are produced using 6000 direct labor hours. Crane's actual

payroll during January was $93600. What is the labor

quantity variance?

O $7200 U

O $9600 U

O $9600 F

$2400 F

hp

110

f9

f8

17

16

15

4+

10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- eBook Question Content Area Ellis Company’s labor information for September is as follows: Direct labor hourly rate paid $31.00 Total standard direct labor hours for units produced 10,000.00 Direct labor hours worked 9,850.00 Direct labor rate variance $6,895.00 (favorable) Round your answers to two decimal places. A. Compute the standard direct labor rate per hour. $fill in the blank 1 standard rate B. Compute the direct labor time variance. Direct labor time variance $fill in the blank 2 C. Compute the standard direct labor rate if the direct labor rate variance was $2,462.50 (unfavorable). $fill in the blank 4 standard labor ratearrow_forwardE 8-17 Calculating factory overhead: two variances Munoz Manufacturing Co. normally produces 10,000 units of product X each month. Each unit requires 2 hours of direct labor, and factory overhead is applied on a direct labor hour basis. Fixed costs and variable costs in factory overhead at the normal capacity are $2.50 and $1.50 per direct labor hour, respectively. Cost and production data for May follow: Production for the month. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .9,000 units Direct labor hours used . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .18,500 hours Factory overhead incurred for: Variable costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$28,500 Fixed costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $52,000 a. Calculate the flexible-budget variance. b. Calculate the production-volume variance. c. Was the total factory overhead under- or overapplied? By what amount? Use this…arrow_forwardWeek 11 Absorption Costing & Marginal Costing Profit Statement Answer all questions Fantasia Berhad plans to manufacture a new product next month. The expected average monthly sales and production volumes are 3,000 units. Budgeted cost per unit of a product based on the average monthly production volume is as follows: Direct material Direct labour (RM16 per hour) Variable production overhead RM 110 Required: 48 Other information are as follows: Selling Price per unit Variable selling and administration overhead Fixed selling and administration overhead Fixed production overhead Additional information: i. Fixed selling and administration overhead is to be treated as period cost in the monthly Income Statement. b. 24 182 ii. The budgeted production for the first month is 3,720 units but only 2,680 units are expected to be sold. RM400 10% of selling price RM168,000 per month RM126,000 per month Prepare the Statement of Profit or Loss of Fantasia Berhad for the first month using the…arrow_forward

- Please do not give solution in image format thankuarrow_forwardPlease help me with show all calculation thankuarrow_forwardQuestion 6 View Policies Current Attempt in Progress Crane Company determines that 59000 pounds of direct materials are needed for production in July. There are 3700 pounds of direct materials on hand at July 1 and the desired ending inventory is 3300 pounds. If the cost per unit of direct materials is $3, what is the budgeted total cost of direct materials purchases? ort $175800 O $180600. O $178200. O $173400. ea Chp ins prt sc fho 12 home delete % 5 & 7 backspace lock T P hom G H K enter B pause t shift ctri NM Narrow_forward

- Dengerarrow_forward-/1 Question 21 View Policies Current Attempt in Progress Oriole has a standard of 1.5 pounds of materials per unit, at $6 per pound. In producing 2200 units, Oriole used 3500 pounds of materials at a total cost of $20475. Oriole's materials quantity variance is O $2100 U. O $675 F. O $525 U. O $1200 U. hp ins prt sc f12 f11 f1o f9 f5 f8 17 f6 080 %3D 11 7arrow_forwardPrint Item Penny Company manufactures only one product and uses a standard cost system. The following information is from Penny's records for May: Direct labor rate variance $15,000 favorable Direct labor time variance $29,700 unfavorable Standard hours per unit produced 2.00 Standard rate per hour $27 During May, the company used 12.50% more hours than the standard allowed. A. What were the total standard hours allowed for the units manufactured during the month? standard hours B. What were the actual hours worked? actual hours C. How many actual units were produced during May? units producedarrow_forward

- --/1 Question 18 View Policies Current Attempt in Progress A company developed the following per unit materials standards for its product: 3 pounds of direct materials at $5 per pound. If 24000 units of product were produced last month and 73000 pounds of direct materials were used, the direct materials quantity variance was $5000 favorable. O $3000 unfavorable. $5000 unfavorable. O $3000 favorable. op 12 f11 f10 f9 f8 f7 f6 f5 8. 11 60 96 96arrow_forwardProblem 3-E. Indirect Cost Variances XULA Products Co. charges factory overhead into production at the rate of PT0 per direct labor hour, based on a standard, production of 15,000 direct labor hours for 15,000 units; 60% of factory overhead costs are variable. Production data for May and June are: June 14,200 hrs. May 12,000 hrs. 12,000 P140,100 Production... 15,000 Units produced.. Actual factory overhead. P149,300 Required: Prepare a factory overhead variance analysis for May and June, using the two-variance method. (Indicate whether each variance is favorable or unfavorable.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education