FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

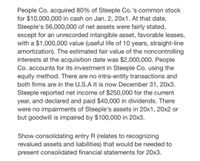

Transcribed Image Text:People Co. acquired 80% of Steeple Co.'s common stock

for $10,000,000 in cash on Jan. 2, 20x1. At that date,

Steeple's 56,000,000 of net assets were fairly stated,

except for an unrecorded intangible asset, favorable leases,

with a $1,000,000 value (useful life of 10 years, straight-line

amortization). The estimated fair value of the noncontrolling

interests at the acquisition date was $2,000,000. People

Co. accounts for its investment in Steeple Co. using the

equity method. There are no intra-entity transactions and

both firms are in the U.S.A It is now December 31, 20x3.

Steeple reported net income of $250,000 for the current

year, and declared and paid $40,000 in dividends. There

were no impairments of Steeple's assets in 20x1, 20x2 or

but goodwill is impaired by $100,000 in 20x3.

Show consolidating entry R (relates to recognizing

revalued assets and liabilities) that would be needed to

present consolidated financial statements for 20x3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- PreviousBalance AnnualPercentageRate (APR)(as a %) MonthlyPeriodicRate FinanceCharge(in $) Purchasesand CashAdvances PaymentsandCredits NewBalance(in $) $2,490.00 % 1 1 4 % $ $1,374.98 $300.00 $arrow_forwardWhat is the present value of the following cash flow stream at a rate of 6.25%? $411.57 $433.23 $456.03 $480.03 $505.30arrow_forward9. What is the capital balance of Tak at December 31, 20x2? 28 A a. P180,000 b. P170,000 c. P165,000 d. Not given SIXOS mot and 100 to stile si 10. What is the capital balance of Gu at December 31, 20x2? a. P220,000 b. P215,000 c. P200,000 d. Not given 007 0902 3 nevig Vo ordub juongoro att mi to side odd ei four we 17 000.08 I s 000.079 000/03/1 8arrow_forward

- Hi There, I need ask a favor... How to calculate "Current Liabilites" if I only know, these following data : - Cash and Equivalents : $ 100.00 - Fixed Assets : # 283.50 - Sales : $ 1,000.00 - Net Income : $ 50.00 - Quick Ratio : 2.0 x - Current Ratio : 3.0 x - DSO : 40 Days - ROE : 12% Thank youarrow_forwardThe accounting department of a large limousine company is analyzing the costs of its services. The cost data and level of activity for the past 16 months follow. Month Special Analyses CustomerAccounts PaychecksProcessed AccountingService Costs 1 2 325 1,029 $ 63,800 2 4 310 993 68,900 3 2 302 1,268 64,000 4 1 213 1,028 61,300 5 2 222 984 61,600 6 0 214 712 50,800 7 1 131 762 51,020 8 1 123 739 54,300 9 0 115 708 50,500 10 2 296 1,232 64,800 11 2 213 978 58,000 12 1 222 929 57,500 13 2 217 1,059 62,200 14 2 132 942 54,900 15 4 300 1,299 71,530 16 4 315 1,283 64,800 Totals 30 3,650 15,945 $ 959,950 In…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education