FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

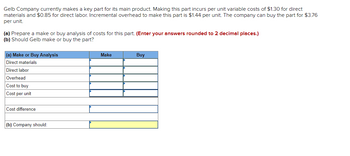

Transcribed Image Text:### Gelb Company Make or Buy Analysis

**Background:**

Gelb Company currently produces a key component for its primary product. The costs associated with producing this part internally include direct materials, direct labor, and incremental overhead. Alternatively, the company has the option to purchase the part from an external supplier.

**Cost Analysis Details:**

- **Internal Production Costs:**

- Direct materials: $1.30 per unit

- Direct labor: $0.85 per unit

- Incremental overhead: $1.44 per unit

- **External Purchase Cost:**

- Cost to buy the part: $3.76 per unit

**Decision-Making Task:**

(a) Conduct a make or buy analysis by comparing the detailed costs for both options. (Round answers to 2 decimal places.)

(b) Determine whether Gelb should continue making the part internally or opt to purchase it.

**Cost Comparison Framework:**

| (a) Make or Buy Analysis | Make | Buy |

|--------------------------|------|-----|

| Direct materials | | |

| Direct labor | | |

| Overhead | | |

| Cost to buy | | |

| **Cost per unit** | | |

| **Cost difference** | | |

**Recommendation:**

(b) Based on the completed analysis, provide a recommendation on whether the company should make or buy the part.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Factor Company estimates that producing a unit of product would require $8 per unit of direct materials and $24 per unit of direct labor. Factor Company normally applies overhead using a predetermined overhead rate of 150% of direct labor cost. Factor Company estimates incremental overhead of $16 per unit of product. An outside supplier offers to provide Factor Company with all the units it needs at a price of $46 per unit. Factor Company should choose to: Multiple Choice O O O Buy since the relevant cost to make it is $56. Make since the relevant cost to make it is $48. Buy since the relevant cost to make it is $48. Make since the relevant cost to make it is $32. Buy since the relevant cost to make it is $32.arrow_forwardPlease do not give solution in image format thankuarrow_forwardMemanarrow_forward

- Stancil Dry Cleaners has determined the following about its costs: Total variable expenses are$42,000,total fixed expenses are $24,000, and the sales revenue needed to break even is $48,000. Determine the company's current 1) sales revenue and 2) operating income. (Hint: First, find the contribution margin ratio; then prepare the contribution margin income statement.) Use the contribution margin income statement and the shortcut contribution margin approaches to determine Stancil's current (1) sales revenue and (2) operating income. Begin by computing the contribution margin ratio. (Enter the result as a whole number.) The contribution margin ratio is %.arrow_forwardplease help me to solve this problemarrow_forwardPtarmigan Company produces two products. Product A has a contribution margin of $20 and requires 4 machine hours. Product B has a contribution margin of $18 and requires 3 machine hours. Determine the most profitable product assuming the machine hours are the constraint. Contribution margin per machine hour: Product A $fill in the blank 1 Product B $fill in the blank 2 Product is the most profitable.arrow_forward

- Wess company... (see pictures)arrow_forwardJamison Company uses the total cost method of applying the cost-plus approach to product pricing. Jamison produces and sells Product X at a total cost of $1,200 per unit, of which $820 is product cost and $380 is selling and administrative expenses. In addition, the total cost of $1,200 is made up of $680 variable cost and $520 fixed cost. The desired profit is $180 per unit. Determine the markup percentage on total cost.fill in the blank 1 %arrow_forward! Required information [The following information applies to the questions displayed below.] Performance Products Corporation makes two products, titanium Rims and Posts. Data regarding the two products follow. Direct Labor- Hours per unit 0.60 0.60 Rims Posts Additional information about the company follows: a. Rims require $17 in direct materials per unit, and Posts require $14. b. The direct labor wage rate is $20 per hour. c. Rims are more complex to manufacture than Posts and they require special equipment. d. The ABC system has the following activity cost pools: Activity Cost Pool Machine setups Special processing General factory Annual Production 26,000 units 84,000 units Unit product cost of Rims Unit product cost of Posts Activity Measure Number of setups Machine-hours Direct labor-hours $ Estimated Overhead Cost $39,480 $ 146,160 $ 1,092,000 36.31 Estimated Activity Rims 80 3,000 15,600 Posts 320 0 50,400 2. Determine the unit product cost of each product according to the ABC…arrow_forward

- Sunland Corporation produces outdoor portable fireplace units. The following cost information per unit is available: direct materials $20, direct labour $14, variable manufacturing overhead $17, fixed manufacturing overhead $24, variable selling and administrative expenses $9, and fixed selling and administrative expenses $16. The company's ROI per unit is $17. (a) Calculate Sunland Corporation's markup percentage using absorption-cost pricing. (Round answer to 2 decimal places, e.g. 15.25%.) Markup percentage eTextbook and Media Save for Later % (b) The parts of this question must be completed in order. This part will be available when you complete the part above.arrow_forwardNeed Helparrow_forwardPharoah Enterprises is considering manufacturing a new product. It projects the cost of direct materials and rent for a range of output as follows. Output in Units 1,000 2,000 Rent Cost $6,940 6,940 3,000 11,104 4,000 11,104 5,000 11,104 6,000 11,104 7,000 11,104 8,000 11,104 9,000 13,880 10,000 13,880 11,000 13,880 Direct Materials $5,550 6,000 6,000 8,000 10,000 12,000 14,000 16,000 40,668 48,580 61,072arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education