Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

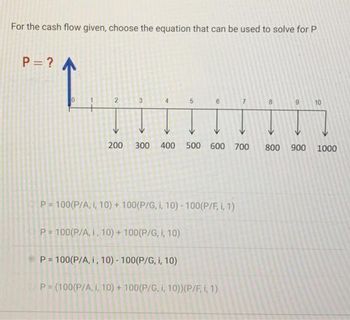

Transcribed Image Text:For the cash flow given, choose the equation that can be used to solve for P

P = ? A

2

200 300 400 500 600 700

P=100(P/A, I, 10)+100(P/G, I, 10) - 100(P/F, 1, 1)

P=100(P/A, I, 10)+100(P/G, I, 10)

P= 100(P/A, i, 10)- 100(P/G, i, 10)

P = (100(P/A, I, 10)+100(P/G, i, 10)) (P/F, 1, 1)

9 10

800 900 1000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Accountingarrow_forwardPlease don't provide answer in image format thank you.arrow_forwardA B D E F A B C D E 2 Market Capitalization, in millions 2 YUM ZTS AAPL Market (OEX) 4 3 31/01/18 28506.29 37389.63 369899.4 15851230 4 5 Monthly prices 7 6 Dates YUM ZTS АAPL Market (OEX) 8 7 31/01/18 84.59 76.73 87.3 1251.42 8 28/02/18 81.38 80.86 75.74 1201.87 10 11 9 30/03/18 85.13 83.51 74.61 1157.37 30/04/18 31/05/18 12 10 87.1 83.48 77.75 1160.73 13 11 81.33 83.7 81.24 1188.91 12 29/06/18 78.22 85.19 82.73 1194.5 14 15 13 31/07/18 79.29 86.48 81.51 1241.76 16 14 31/08/18 86.89 90.6 80.17 1286.9 17 15 28/09/18 90.91 91.56 85.02 1294.27 18 Please show full working 19 a. What is the beta for each stock 3.arrow_forward

- Lenci Corporation manufactures and sells a single product. The company uses units as the measure of activity in its budgets and performance reports. During May, the company budgeted for 5,100 units, but its actual level of activity was 5,050 units. The company has provided the following data concerning the formulas used in its budgeting and its actual results for May: Data used in budgeting: Revenue Direct labor Direct materials Manufacturing overhead Selling and administrative expenses Total expenses Actual results for May: Revenue Direct labor Direct materials Fixed element per month $0 $0 0 41,500 22,700 $ 64,200 $ 197,810 $ 28,565 $ 80,265 $ 47,905 $ 22,680 Manufacturing overhead Selling and administrative expenses The spending variance for manufacturing overhead in May would be closest to: Variable element per unit $ 39.60 $ 5.50 15.70 1.30 0.20 $ 22.70arrow_forwardVitalSource Account Center: Use X chapter05/4/2/28/6/40/2/2/4 G Sign in - Google Accounts Determine the future value of the following single amounts: 1234 Invested Amount $15.000 20,000 30,000 50,000 Interest Rate 6% 8 12 4 No. of Periods 12 ខសង 10 20 12 QA Aug 13, 2023, 12:15 PMarrow_forwardImagine an emerging market with only 15 years of data. Compute the historical ERP using the geometric mean. (Hint: Compute the annual ERP=Rm- Rrf first and then calculate the geometric mean of it). Save the data to answer Question 2. Rm Rrf 0.100 0.035 0.120 0.045 3 0.300 0.068 4 0.200 0.060 5 0.050 0.030 6 -0.030 0.020 7 0.050 0.010 0.100 0.030 0.450 0.060 10 0.230 0.050 11 0.150 0.040 12 0.100 0.030 13 0.060 0.020 14 0.020 0.020 15 -0.100 0.010 1 2arrow_forward

- 00 X + Create 24 Find text or tools Q ℗ 4 Question 4 The following cash book receipts can be found in the books of Bushveld Traders for April 2024: X 2024 Al Assistant (Marks:15) Doc No Day e DR510 1 Jock Bush Α B/S 04 8 00 Jedi Dealers Internet sales A Details Fol. Analysis of Receipts (R) Bank (R) Debtors Control (R) Output VAT (R) Sales Sundries (R) Amount Fol. Details 82 080 00 82 080 00 82 080 00 Capital 75 753 00 9 880 83 65 872 17 B C B/S 04 15 Blah Bank: Interest 906 30 on deposit D E FL G DS327 21 Stuart Smith cash 17 907 12 17 907 12 sales H DS328 24 Commercial 8 406 36 8 406 36 B/S 04 DS329 27 DR511 30 26 Tenant: Bill Tong Norma Edwards J K L 6 947 35 6.947 35 B Belton cash sales 84 303 00 84 303 00 10 996 04 73 306 96 Steve Brown ? M N 352 431 01 O 154 750 54 ? Abbreviations in the Document Number column: DR, B/S, and DS, indicate Duplicate Receipts, Bank Statement and Duplicate Cash Slips respectively. Required: ments Fill in the missing amounts/details for the letters A…arrow_forwardAllegience Insurance Company's management is considering an advertising program that would require an initial expenditure of $172,120 and bring in additional sales over the next five years. The projected additional sales revenue in year 1 is $79,000, with associated expenses of $27,000. The additional sales revenue and expenses from the advertising program are projected to increase by 10 percent each year. Allegience's tax rate is 30 percent. (Hint: The $172,120 advertising cost is an expense.) Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Required: 1. Compute the payback period for the advertising program. 2. Calculate the advertising program's net present value, assuming an after-tax hurdle rate of 10 percent. (Round your intermediate calculations and final answer to the nearest whole dollar.) 1. Payback period 2. Net present value yearsarrow_forwardCurrent Attempt in Progress Suppose the following items were taken from the December 31, 2025, assets section of the Boeing Company balance sheet. (All dollars are in millions.) F2 w S Inventory Notes receivable-due after December 31, 2026 Notes receivable-due before December 31, 2026 Accumulated depreciation-buildings Current Assets Patents #3 80 F3 E D $ 4 Prepare the assets section of a classified balance sheet. (List the Current Assets in order of liquidity. Enter amounts in millions.) F4 R F % 5 F5 T $15,840 4,950 G 340 12,930 December 31, 2025 6 Patents Buildings BOEING COMPANY Partial Balance Sheet Cash F6 Accounts receivable Debt investments (short-term) (in millions) Y MacBook Air Assets & 7 H 8 Ad F7 U CV B N # * 00 8 J 11,980 DII F8 $11,980 1 21,620 ( 9 M 7,800 5,580 1.580 DD K ) 0 4 F10 L < Parrow_forward

- Capital Rationing Decsion Involving Four Proposals Kopecky Industries Inc. Is considering allocating a limited amount of capital Investment funds among four proposals. The amount of proposed Investment, estimated income from operations, and net cash flow for each proposal are as follows: Project Uniform victor Sierra Tango Name Investment $900,000 Investment $2,770,865 Investment $1,762,515 Investment $1,040,013 Income Income Income Income Net Cash Net Cash Net Cash Net Cash from from from from Flows Flows Flows Flows Year Operations Operations Operations Operations $84,000 $240,000 $294,500 $950,000 $207,000 $450,000 $109,000 $390,000 84,500 240,000 294,775 950,000 207,000 450,000 109,000 390,000 85,000 240,000 295,050 950,000 207,000 450,000 109,000 390,000 85,500 240,000 295,325 950,000 207,000 450,000 109,000 390,000 5. 86,000 240,000 295,600 950,000 207,000 450,000 109,000 390,000 Total $425,000 $1,200,000 $1,475,250 $4,750,000 S1,035,000 $2,250,000 $545,000 $1,950,000 Present…arrow_forward11:51 SS 令ull 90% openstax.org opENstax" Log < Principles of Accounting, Volume 1: Financial Ac. Exercise Set A Updates Available Update Click below to use the most recent version of this software. EA1. LO 11.1 Fombell, Incorporated has the following assets in its trial balance: $ 10,000 60,000 3,000 4,000 16,000 10,000 100,000 Cash Equipment Accounts receivable Copyright Inventory Patent Building What is the total balance of its Property, Plant, and Equipment? EA2. LO 11.2 Jada Company had the following transactions during the year: • Purchased a machine for $500,000 using a long-term note to finance it • Paid $500 for ordinary repair • Purchased a patent for $45,000 cash • Paid $200,000 cash for addition to an 4 IIarrow_forwardIndo 37 1 2 B S 0 Clipboard Sales Espresso Drip Coffee A Food/Beverage Merchandise 1 P 3 Expenses Computer Total Sales = First Q alculation Mode: Automatic 74°F Haze $ $ Font fx 26400 B JAN C Downtown Internet Café First Quarter Forecast $ 11,100 $ 5,300 $ $ $ 1,050 $ First Q Goal Seek FEB D 26,400 $ 27,200 $ 26,500 $ 14,400 $ 14,500 $ 14,800 $ 11,000 $ 10,800 $ 4,400 $ 4,500 $ 1,165 $ 1,245 $ Workbook Statistics MAR E Minivan Loan + Alignment TOTAL F AVG Proportion 80,100 $ 26,700 43,700 $14,567 32,900 $10,967 14,200 $ 4,733 3,460 $ 1,153 OL Number H E Iarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education