Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

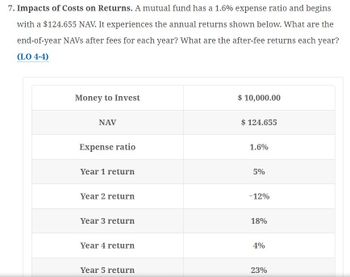

Transcribed Image Text:7. Impacts of Costs on Returns. A mutual fund has a 1.6% expense ratio and begins

with a $124.655 NAV. It experiences the annual returns shown below. What are the

end-of-year NAVS after fees for each year? What are the after-fee returns each year?

(LO 4-4)

Money to Invest

NAV

Expense ratio

Year 1 return

Year 2 return

Year 3 return

Year 4 return

Year 5 return

$ 10,000.00

$ 124.655

1.6%

5%

-12%

18%

4%

23%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- D3) Finance You invest in a mutual fund that charges a 3% front-end load, 1% operating costs, and a 1% 12b-1 fees. What are the total fees in year 1 on an initial investment of $20,000 with 10% annual growth in fund's asset value, or NAV? Note that "initial investment" means it is before the deduction of frontend load.arrow_forwardCreate a data table that calculates the Future Value of a 401(k) using the following information: Future Value = -FV(APR/12, 12 Years, Monthly Deposit) Vary the number of years investing from 12 to 36 by 2 Vary the APR from 1.0% to 12.0% by 1.0% If you client invests $100 per month every month earning 6.0% APR, how many years will it take before their investment exceeds $100,000?arrow_forwardB. At time 0, K is deposited into Fund X, which accumulates at a force of interest of t + 3 t² + 6t+9 8₁ At time m, 2K is deposited into Fund Y, which accumulates at an interest of 10.25%, convertible quarterly. At time n, where n > m, the accumulated value of each fund is 3K. Calculate m.arrow_forward

- 1. Discounted Payback (DCPB) and IRR analysis. Use the cash flow situation (table below) to answer. a. Determine the DCPB based on a MARR rate of 8.0% b. Determine the IRR Year Cash Flow (in $1000's) 0 1 -5500 +1500 2 +1800 3 +1500 4 +1800 5 6 +1500 +1800 7 +1500arrow_forward5. You invest in a mutual fund that charges a 6% front-end load and 2% total annual fees. How much will you pay in loads and fees on a $10,300 investment that does not grow, if you cash out after three years of no gain? A. $208 B. $618 C. $1,003 D. $1,187arrow_forwardSuppose you invest $50 each month (starting today) into a mutual fund. You reinvest distributions. At the end of 5 years, you sell all your shares and receive $3,485. Calculate your rate of return.arrow_forward

- The value in pounds of a fund at time t = 0 is V0 = 50, 000. After one year (at t = 1) it has increased to V1 = 51, 500 and at that time £1, 500 is withdrawn. After two years (at t = 2) the fund is worth V2 = 50, 800. (a) Compute the time-weighted rate of return. (b) If the fund is liquidated after two years what is the yield that has been achieved?arrow_forwardFor the following levered total cash flow returns, what is the levered NPV, and should you pursue the investment if your levered discount rate is 14%? Year Total Cash Flow (Pre-Tax) $ 31,795; yes 31,795; no x-31,795; yes -31,795; no 0 (400,000) $ 1 30,000 $ 2 30,900 $ 3 4 31,827 $ 32,782 $ 5 533,765arrow_forward1. A pension fund portfolio begins with $500,000 and earns 15% the first year and 10% the second year. At the beginning of the second year, the sponsor contributes another $500,000. What were the time-weighted and dollar-weighted rates of return?arrow_forward

- Suppose you invest $5,000 into a mutual fund that is expected to earn a rate of return of 7%. The amount of money you will have in 10 years is closest to which of the following? The amount you will have in 25Lyears is closest to which of the following? O 1) $53,500; $802,500 O 2) $2,552.56; $3,257.79 O 3) $9,835.76; $27,137.16 O 4) $3,138; $ 1,311,892 5) None of the answers are correctarrow_forwardHigh Growth Fund has a front load of 5% and expected return of 14.5%. Normal Fund has no load. And expected return of 13.8%. Which fund would you hold if you expect to hold the fund for 5 years? How about holding the fund for 10 years? Please show how to solve in excelarrow_forwardWhat would be your future account value if you invested $175 each month into a growth mutual fund for 20 years? Assume an average annual rate of return of 13 percent. O $212,675.99 O $246,485.08 O $186,476.36 O $198,317.41arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education