Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

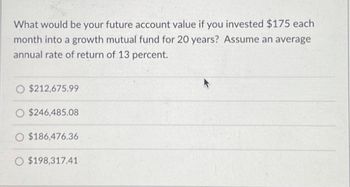

Transcribed Image Text:What would be your future account value if you invested $175 each

month into a growth mutual fund for 20 years? Assume an average

annual rate of return of 13 percent.

O $212,675.99

O $246,485.08

O $186,476.36

O $198,317.41

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- if you invested $3,580 in a mutual fund and 14 years later it's worth $9,247, what annual rate of return did you earn on the investmentarrow_forwardYou invest $280 in a mutual fund today that pays 5.7 percent interest annually. How long will it take to double your money? (Round final answer to 0 decimal place, e.g. 25.) Number of yearsarrow_forwardSuppose you invest $2,500 in a fund earning 15% simple interest. Further suppose that you have the effective interest rasing this account and opening an account earning compound interest at an annual option at any time of 9%. At what instant should you do so in order to maximize your accumulation at the end of five years? (Round your answer to two decimal places.) 4.53 years How about if you wish to maximize the accumulation at the end of ten years? (Round your answer to two decimal places.) 4.53 yearsarrow_forward

- you want to go to Europe 4 years from now, and you can save $3300 per year, beginning one year from today. You plan to deposit the funds in a mutual fund that you think will retum 8.5% per year. Under these conditions, how much would you have in your account by the time you are ready for your trip? O a. $12, 344.53. b. $13,799.76 O c. $15, 765.34 O d. $11, 235.11 • e. $14,980.40arrow_forwardYou deposit the following at the end of each year into a growth mutual fund that earns 11 percent per year: How much should the fund be worth at the end of 5 years How much interest have you earned in total?arrow_forwardSuppose you deposit $650 per month in a mutual fund that is expected to bear 10% interest compounded monthly. If you do this faithfully, how much will your account be worth after 29 years? Round your answer to the nearest whole number.arrow_forward

- You are going to invest in a stock mutual fund with a front-end load of 6 percent and an expense ratio of 1.39 percent. You also can invest in a money market mutual fund with a return of 2.6 percent and an expense ratio of 0.10 percent. If you plan to keep your investment for 2 years, what annual return must the stock mutual fund earn to exceed an investment in the money market fund? What if your investment horizon is 9 years? Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. 2 Years 9 Years Annual Return % %arrow_forwardSuppose you invest $5,000 into a mutual fund that is expected to earn a rate of return of 7%. The amount of money you will have in 10 years is closest to which of the following? The amount you will have in 25Lyears is closest to which of the following? O 1) $53,500; $802,500 O 2) $2,552.56; $3,257.79 O 3) $9,835.76; $27,137.16 O 4) $3,138; $ 1,311,892 5) None of the answers are correctarrow_forwardYou deposit the following, at the end of each year, into a growth mutual fund that earns 8% per year. Calculate the future total value of the fund at the end of 5 years. Enter Your answer rounded to decimal places, no dollar sign, ex. 5100.54 Year Deposit 1 8,000 2 6,000 3 4,500 4 9,500 5 6,000arrow_forward

- Suppose that you have an opportunity to invest in a fund that pays 12% interest compoundedannually. Today, you invest P10,000 into this fund. Three years later, you borrow P5,000 from alocal bank at 10% effective annual interest and invest it in the fund. Two years later, you withdrawenough money from the fund to repay the bank loan and all interest due on it. Three years laterfrom this withdrawal you start taking P2,000 per year for 5 years out of the fund. After 5 years, youhave withdrawn your original P10,000. The amount remaining in the fund is earned interest. Howmuch remains?arrow_forwardSuppose you deposit $550 per month in a mutual fund that is expected to bear 9% interest compounded monthly. If you do this faithfully, how much will your account be worth after 27 years? Round your answer to the nearest whole number.arrow_forwardHelp me pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education