FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

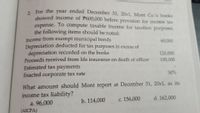

Transcribed Image Text:. For the year ended December 31, 20x1, Mont Co's books

showed income of P600,000 before provision for income tax

expense. To compute taxable income for taxation purposes,

the following items should be noted:

Income from exempt municipal bonds

Depreciation deducted for tax purposes in excess of

depreciation recorded on the books

Proceeds received from life insurance on death of officer

Estimated tax payments

60,000

120,000

100,000

30%

Enacted corporate tax rate

What amount should Mont report at December 31, 20x1, as its

income tax liability?

a. 96,000

(AICPA)

b. 114,000

c. 156,000

d. 162,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardE18-11 Multiple Tax Rates For the year ended December 31, 2019, Nelson Co.’s income statement showed income of $435,000 before income, tax expense. To compute taxable income, the following differences were noted: Income from tax-exempt municipal bonds $60,000 Depreciation deducted for tax purposes in excess of depreciation recorded on the books $120,000 Proceeds received from life insurance on death of an insured employee $100,00 Corporate tax rate for 2019 30% Enacted tax rate for future periods 35% Required: 1. Calculate taxable income and tax payable for tax purposes. 2. Prepare Nelson’s income tax journal entry at the end of 2019.arrow_forwardLNS Corporation reports book income of $2,940,000. Included in the $2,940,000 is $17,500 of tax-exempt interest income. LNS reports $2,560,000 in ordinary and necessary business expenses. What is LNS Corporation's taxable income for the year? Answer is complete but not entirely correct. $ 640,000 Taxable incomearrow_forward

- LNS Corporation reports book income of $2,890,000. Included in the $2,890,000 is $32,750 of tax-exempt interest income. LNS reports $2,597,500 in ordinary and necessary business expenses. What is LNS Corporation's taxable income for the year? Taxable incomearrow_forwardCompany K operates in a jurisdiction that levies an income tax with the following rate structure: Percentage Rate Bracket Income from -0- to $75,000 Income from $75,001 to $150,000 Income in excess of $150,000 Company K incurs a $35,000 deductible expense. Required: a. Compute the current year tax savings from the deduction assuming that Company K's taxable income before considering the additional deduction is $71,600. b. Compute the current year tax savings from the deduction assuming that Company K's taxable income before considering the additional deduction is $178,000. c. Compute the current year tax savings from the deduction assuming that Company K has a $7,250 loss before considering the additional deduction. 7% 10 15 Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the current year tax savings from the deduction assuming that Company K's taxable income before additional deduction is $71,600. Tax savingsarrow_forwardvn.2 At the end of the year, the deferred tax asset account had a balance of $8 million attributable to a temporary difference of $32 million in a liability for estimated expenses. Taxable income is $88 million. No temporary differences existed at the beginning of the year, and the tax rate is 25%.Prepare the journal entry(s) to record income taxes, assuming it is more likely than not that three-fourths of the deferred tax asset will not ultimately be realized.arrow_forward

- 7arrow_forwardSubject: acountingarrow_forwardFor its first year of operations, Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows: Pretax accounting income $ 290,000 Permanent difference (15,000 ) 275,000 Temporary difference-depreciation (20,100 ) Taxable income $ 254,900 Tringali's tax rate is 25%. Assume that no estimated taxes have been paid. What should Tringali report as its deferred income tax liability as of the end of its first year of operations? $20,100. $35,100. $5,025. $8,775.arrow_forward

- On January 1, year 1 $1,000,000 was collected in advance for rental of a building for a five-year period. The entire $1,000,000 was reported as taxable income for the year. The enacted tax rate for this year is 44%. The enacted tax rate for all future years was 46%. As the result of a change in the tax law, the enacted tax rate for years all years after year 3 is 45%. Make the journal entry to record income tax expense at December 31, year 2, assuming income tax payable is $1,749,000. SHOW COMPUTATIONSarrow_forwardVishnuarrow_forwardpvn.3arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education