ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:xation)

12

11

20

9.

1.

1

6.

S

4

3-

2-

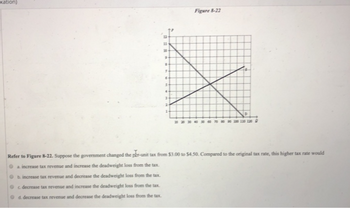

Figure 8-22

90 300 130 120

Refer to Figure 8-22. Suppose the government changed the per-unit tax from $3.00 to $4.50. Compared to the original tax rate, this higher tax rate would

a. increase tax revenue and increase the deadweight loss from the tax.

b. increase tax revenue and decrease the deadweight loss from the tax.

c. decrease tax revenue and increase the deadweight loss from the tax

d. decrease tax revenue and decrease the deadweight loss from the tax.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 3) Are excise taxes, like those on tobacco, gasoline, and alcohol, Progressive, Proportional, or Regressive? Why do you think they are?arrow_forwardCase II: Attached is a graph diagram depicting the market for soft drinks. If an excise tax equal to $1 per liter is levied on soft drink sellers, please answer the following questions: 1. Buyers would spend a total of $____________ million on soft drinks. 2. Sellers would receive a total of $____________ million (after-tax) from selling soft drinks. 3. The government revenue from this tax would be $_____________ million.arrow_forwardSupply of a good is more elastic than the demand for the good. Who will bear the larger burden of taxation in this case? A. Consumers and producers will share the burden of taxation in equal proportion B. Consumers will bear the larger share of burden of taxation C. Producers will bear the larger share of burden of taxation D. We can’t tell who will bear the larger burdenarrow_forward

- 2. When airfares between Santa Rosa and Los Angeles averages $69, the quantity consumed is 42,500 tickets. One day, an airline tax is levied equal to $10.00 and output falls to 37,000 tickets. Assume that air travelers end up paying 75% of the tax. Total expenditures or sales of air travel will be____. Total revenues generated by airlines will be _____ Total tax revenue generated by the government will be ____ Total taxes paid by air travelers will be ____ Total taxes paid by airlines will be ____ Calculate the price elasticity of demand and & interpret coefficient. Use the general formula, not the mid point formula Calculate the price elasticity of supply and interpret coefficient. Use the general formula, not the mid point formula. How do total sales in the airline market before and after the tax support your answer in (n) and/or (o)?arrow_forward4arrow_forward53. The side of the market with the relatively higher elasticity will face more of the tax burden. Select one: a. False b. Truearrow_forward

- Price 65 60 55 50 45 40 35 30 25 20 15 10 5 0 0 50 100 Type your answers in all of the blanks and submit X, X' S2- the market, the equilibrium quantity is 200 Type your answer here 150 200 Quantity in total tax revenue. DI 250 S₁ 300 Consider the market in the figure where D1 denotes demand and S1 denotes supply. When a unit tax of 15 is imposed on sellers in 350 The government collects 400arrow_forwardFigure 8-6 The vertical distance between points A and B represents a tax in the market. ↑ Price Supply Demand 100 200 300 400 500 600 700 800 900 1000 Quantity Refer to Figure 8-6. What happens to producer surplus when the tax is imposed in this market? a. Producer surplus falls by $1,800. Ob. Producer surplus falls by $600. Oc. Producer surplus falls by $2,100. d. Producer surplus falls by $900. 22 20+ 18 16 14 12 10 8 6arrow_forwardIn which S is the before-tax supply curve and St is the supply curve after the imposition of an excise tax. The burden of this tax is borne: P St B A 0 C E G only by consumers. F most heavily by consumers. D S most heavily by producers. equally by consumers and producers. Qarrow_forward

- I. Refer to the following Graphs a.) When a per unit tax is imposed on the consumer of the product, identify how the consumer and producer surplus changes, identify the deadweight loss and the amount of the total tax that will be received by the government. Price PTax B C PE F G E I P1 Dm1 H K DmTax QE QE2 Quantity Producer Surplus before tax = Consumer Surplus before tax = Producer Surplus after tax = %3D Consumer Surplus after tax = Deadweight Loss Total Taxarrow_forwardWhich of the following statement is true about tax? A. The burden shared by consumers and producers doesn’t change regardless of which party the tax is imposed onB. Market functions less efficiently, while not all suffer from a lossC. Both supply and demand curve have something to do with tax incidenceD. all of the abovearrow_forward7. Within the context of taxation policy, many economists have preferred the use of consumption tax to income tax. Explain.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education