Concept explainers

To calculate: The rate of crossover for two projects and sketch the NPV profile.

Introduction:

The

Answer to Problem 11QP

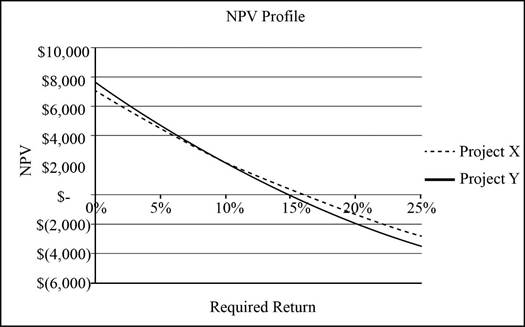

The crossover rate for the two projects is 7.62%. The NPV profiles shows that both projects have a higher NPV for the rate of discount below 7.62% and have a lower NPV for the rate above 7.62%.

Explanation of Solution

Given information:

The details of two projects are provided. The cash flows of project X for year 1, year 2, and year 3, are $13,100, $9,480, and $7,890 respectively. The initial investment is $23,400. The project Y cash flows for 4 years are $9,200, $10,620, $11,180 respectively and the initial investment is $23,400.

Note:

- NPV is the difference between the present values of the cash inflows and the present value of the cash outflows.

- The IRR is the rate of interest, which makes the project’s NPV equals zero. Hence, using the available information, assume that NPV is equal to zero and form an equation to compute the IRR.

Equation of NPV to compute IRR assuming that NPV is equal to zero:

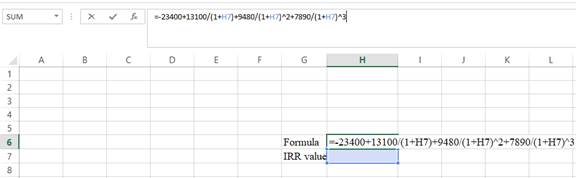

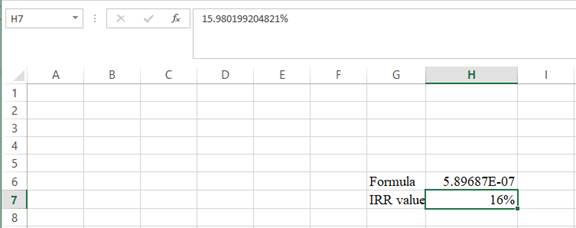

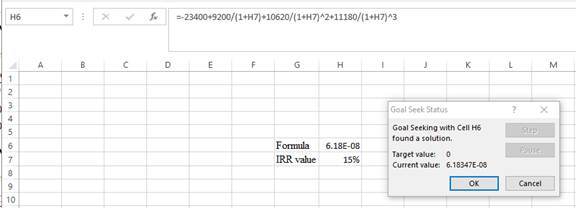

Compute IRR for project X using a spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the IRR value as H7.

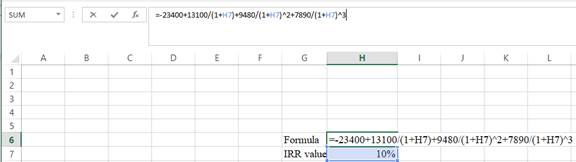

Step 2:

- Assume the IRR value as 10%.

Step 3:

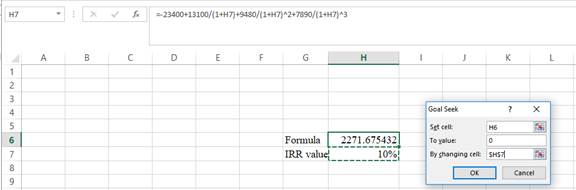

- In the spreadsheet, go to data and select the What-if analysis

- In What-if analysis, select Goal Seek.

- In “Set cell”, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for “By changing cell”.

Step 4:

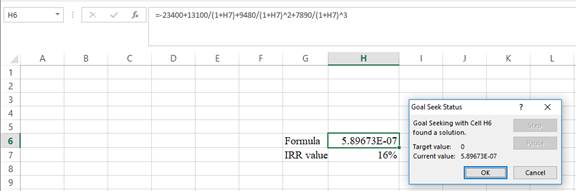

- Following the previous step, click OK in the Goal Seek Status. The Goal Seek Status appears with the IRR value.

Step 5:

- The value appears to be 15.980199204821%.

Hence, the IRRvalue is 15.98%.

Equation of NPV to compute IRR assuming that NPV is equal to zero:

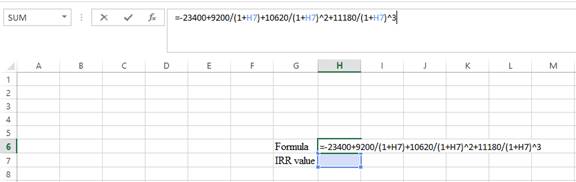

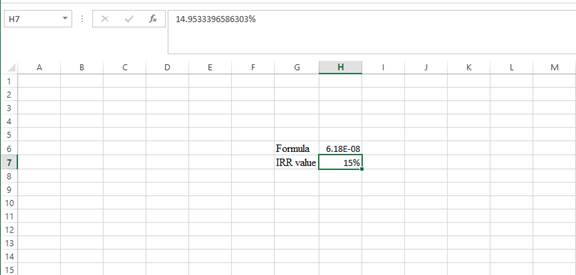

Compute IRR for project Y using a spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the IRR value as H7.

Step 2:

- Assume the IRR value as 10%.

Step 3:

- In the spreadsheet, go to data and select the What-if analysis.

- In What-if analysis, select Goal Seek.

- In “Set cell”, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for “By changing cell”.

Step 4:

- Following the previous step, click OK in the Goal Seek Status. The Goal Seek Status appears with the IRRvalue.

Step 5:

- The value appears to be 14.953339658603%.

Hence, the IRRvalue is 14.95%.

Formula to compute the crossover rate:

Equation of crossover rate to compute R:

Where,

“R” denotes the crossover rate.

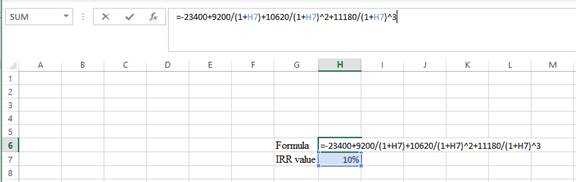

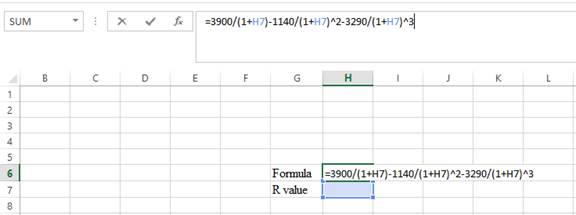

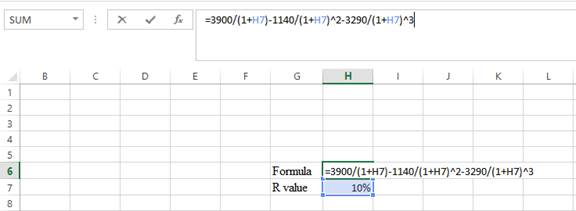

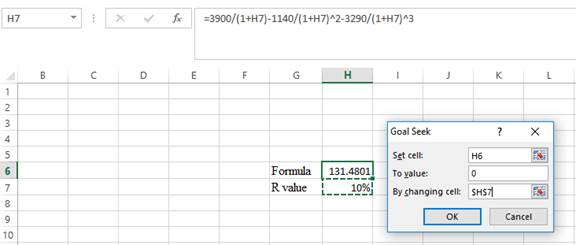

Compute R using a spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the IRR value as H7.

Step 2:

- Assume the IRR value as 10%.

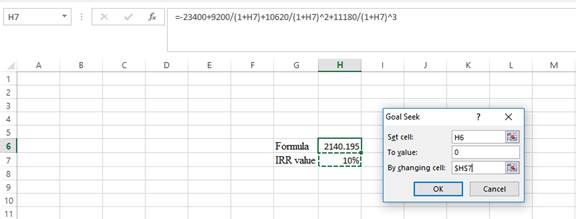

Step 3:

- In the spreadsheet, go to data and select the What-if analysis.

- In What-if analysis, select Goal Seek.

- In “Set cell”, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for “By changing cell”.

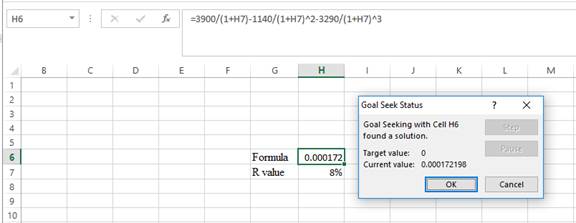

Step 4:

- Following the previous step, click OK in the Goal Seek Status. The Goal Seek Status appears with the IRRvalue.

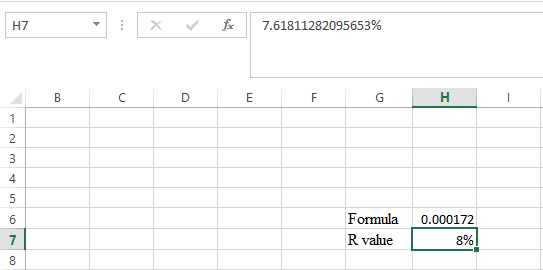

Step 5:

- The value appears to be 7.61811282095653%.

Hence, the R-value is 7.62%.

Formula to calculate the NPV:

Note: As the discount rate is over a range of 0% to 25%, calculate NPV for 0%, 5%, 10%, 15%, 20%, and 25%.

Compute the NPV with the discount rate of 0% for project X:

Compute the NPV with the discount rate of 0% for project Y:

Hence, the NPV for project X and Y at 0% are $7,070 and $7,600 respectively.

Compute the NPV with the discount rate of 5% for project X:

Compute the NPV with the discount rate of 5% for project Y:

Hence, the NPV for project X and Y at 5% are $4,490.51 and $4,652.26 respectively.

Compute the NPV with the discount rate of 10% for project X:

Compute the NPV with the discount rate of 10% for project Y:

Hence, the NPV for project X and Y at 10% are $2,271.68 and $2,140.20 respectively.

Compute the NPV with the discount rate of 15% for project X:

Compute the NPV with the discount rate of 15% for project Y:

Hence, the NPV for project X and Y at 15% are $347.35 and -$18.72 respectively.

Compute the NPV with the discount rate of 20% for project X:

Compute the NPV with the discount rate of 20% for project Y:

Hence, the NPV for project X and Y at 20% are -$1,334.03 and -$1,888.43 respectively.

Compute the NPV with the discount rate of 25% for project X:

Compute the NPV with the discount rate of 25% for project Y:

Hence, the NPV for project X and Y at 25% are -$2,813.12 and -$3,519.04 respectively.

NPV profile:

Want to see more full solutions like this?

Chapter 8 Solutions

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- Consider the following cash flows: C0=-$42 C1=+$38 C2=+$38 C3=+$38 C4=-$76 a. Which two of the following rates are the IRRs of this project? 2.5% 7.8% 14.3% 32.5% 40.0% b. What is project NPV if the discount rates are 5%, 20%, 40%? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 3 decimal places.)arrow_forwardConsider the following two projects: cash flows Project A Project B c0 -270 -2170 c1 115 143 c2 115 143 c3 115 143 c4 115 a. If the opportunity cost of capital is 10%, which of these 2 projects would you accept? b. Suppose that you can choose only one of these two projects. Which would you choose? The discount rate is still 10%. c. Which one would you choose if the cost of capital is 15%? d. What is the payback period for every project? e. Is the project with the shortest payback period also the one with the highest NPV? f. What are the internal rate of return on the two projects? g. Does the IRR rule in this case gives the same answer as NPV? h1. If the opportunity cost of capital is 10%, whats is the profitability index for each project? h2. Is the project with the highest profitability index also the…arrow_forward32. Consider the following three investments. Projects co. 2,500 2,500 2,500 Outflow c2 3,305 1,540 с1 1,540 2,875 inflow 1 y inflow 2 The discount rate is 12 % Compute the NPV & IRR for each project If you have to select one, which one would you select? Why?arrow_forward

- Consider the following cash flows: C0=-$42 C1=+$38 C2=+$38 C3=+$38 C4=-$76 a. Which two of the following rates are the IRRs of this project? check all that apply 2.5% 7.8% 14.3% 32.5% 40.0% b. What is project NPV if the discount rates are 5%, 20%, 40%? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 3 decimal places.)arrow_forwardYou are choosing between two projects. The cash flows for the projects are given in the attached table ($miilion) . a. What are the IRRs of the two projects? (A &B) b. If your discount rate is 4.9%,what are theNPVs of the two projects? (A & B) c. Why do IRR and NPV rank the two projects differently?arrow_forwardConsider the following teo mutually exclusive projects X 20600, 9000 9400 8950 Y 20600 10400 7950 8850 calculate the irr for each project, what is the crossover rate, what is the npv of the projects x and y with a discount rate of 0, 15, and 25%arrow_forward

- Start with the partial model in the file Ch10 P23 Build a Model.xlsx on the textbooks Web site. Gardial Fisheries is considering two mutually exclusive investments. The projects expected net cash flows are as follows: a. If each projects cost of capital is 12%, which project should be selected? If the cost of capital is 18%, what project is the proper choice? b. Construct NPV profiles for Projects A and B. c. What is each projects IRR? d. What is the crossover rate, and what is its significance? e. What is each projects MIRR at a cost of capital of 12%? At r = 18%? (Hint: Consider Period 7 as the end of Project Bs life.) f. What is the regular payback period for these two projects? g. At a cost of capital of 12%, what is the discounted payback period for these two projects? h. What is the profitability index for each project if the cost of capital is 12%?arrow_forwardConsider the following two mutually exclusive projects: Year Cash Flow (X) Cash Flow (Y) 0 1 2 3 -$20,000 8,850 9,100 8,800 2 Instruction: Sketch the NPV profiles for X and Y over a range of discount rates from 0% to 25%. What is the crossover rate for these two projects (when both projects have the same NPV)? Show your steps. -$20,000 10,100 7,800 8,700 A▾ B I = 18 1arrow_forward不 Data table You are choosing between two projects. The cash flows for the projects are given in the following table ($ million): a. What are the IRRS of the two projects? b. If your discount rate is 4.6% what are the NPVS of the two projects? c. Why do IRR and NPV rank the two projects differently? a. What are the IRRS of the two projects? The IRR for project A is ☐ %. (Round to one decimal place.) (Click on the following icon in order to copy its contents into a spreadsheet.) Project A Year 0 - $49 Year 1 $24 B - $99 $18 Year 2 $21 $40 Print Done Year 3 Year 4 $19 $14 $50 $61arrow_forward

- Consider the following payoff table that represents the profits earned for each alternative (A, B, and C) under the states of nature S1, S2, and S3. Using the Laplace criterion, what would be the highest expected payoff? S1 S2 S3 A $100 145 120 B $75 125 110 C $95 85 60arrow_forwardd. If the required return is 8 percent, what is the NPV for project B? e. At what discount rate would the company be indifferent between these two projects?arrow_forwardConsider the following two mutually exclusive projects: If the discount rate is 10%, what are the NPV of Project A and the IRR of Project B? Cash Flows ($) Project C0 C1 C2 C3 A -90 +60 +50 0 B -100 0 0 +140 Multiple Choice Then NPV for project A is $5.9 and the IRR for project B is 11.9% Then NPV for project A is $8 and the IRR for project B is 9% Then NPV for project A is $20 and the IRR for project B is 11.9% Then NPV for project A is $5.9 and the IRR for project B is 11.9%arrow_forward