Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 4CMA

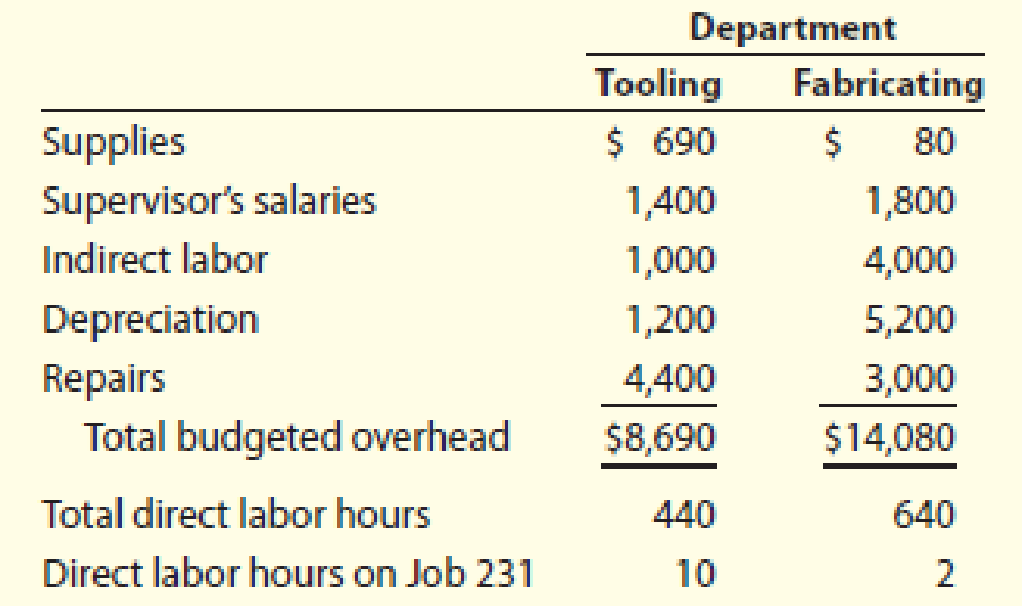

Cynthia Rogers, the cost accountant for Sanford Manufacturing, is preparing a management report that must include an allocation of overhead. The budgeted overhead for each department and the data for one job are as follows:

Using the departmental overhead application rates, and allocating overhead on the basis of direct labor hours, overhead applied to Job 231 in the Tooling Department would be:

- a. $44.00.

- b. $197.50.

- c. $241.50.

- d. $501.00.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The denominator in the single plantwide factory overhead rate calculation is

a.total budgeted plantwide allocation base.

b.total budgeted general and administrative expenses.

c.total budgeted factory overhead in dollars.

d.total budgeted selling expenses.

Using the direct method, compute for the factory overhead rate of the D department if it apply overhead based on direct labor hours and budgeted direct labor hours for the period total to 75,000 hours.

Pigot Corporation uses job costing and has two production departments, M and A. Budgeted manufacturing costs for the year are as follows:

Dept. M

$700,000 $100,000

200,000

600,000

Dept. A

Direct materials

Direct labor

Factory overhead

800,000

400,000

The actual direct materials and direct labor costs charged to Job. No. 432 during the year were as follows:

Direct materials

$25,000

Direct labor:

Department M

Department A

$ 8,000

12,800

20,000

Pigot applies manufacturing overhead to production orders on the basis of direct labor cost using departmental rates predetermined at the beginning of

the year based on the annual budget. The total cost associated with Job. No. 432 for the year should be:

Chapter 4 Solutions

Managerial Accounting

Ch. 4 - Why would management be concerned about the...Ch. 4 - Why would a manufacturing company with multiple...Ch. 4 - Prob. 3DQCh. 4 - Prob. 4DQCh. 4 - How does activity-based costing differ from the...Ch. 4 - Prob. 6DQCh. 4 - Prob. 7DQCh. 4 - Under what circumstances might the activity-based...Ch. 4 - Prob. 9DQCh. 4 - Prob. 10DQ

Ch. 4 - Single plantwide factory overhead rate The total...Ch. 4 - Multiple production department factory overhead...Ch. 4 - Activity-based costing: factory overhead costs The...Ch. 4 - Activity-based costing: selling and administrative...Ch. 4 - Activity-based costing for a service business...Ch. 4 - Kennedy Appliance Inc.s Machining Department...Ch. 4 - Bach Instruments Inc. makes three musical...Ch. 4 - Scrumptious Snacks Inc. manufactures three types...Ch. 4 - Isaac Engines Inc. produces three productspistons,...Ch. 4 - Handy Leather, Inc., produces three sizes of...Ch. 4 - Eclipse Motor Company manufactures two types of...Ch. 4 - The management of Nova Industries Inc....Ch. 4 - Comfort Foods Inc. uses activity-based costing to...Ch. 4 - Nozama.com Inc. sells consumer electronics over...Ch. 4 - Hercules Inc. manufactures elliptical exercise...Ch. 4 - Lonsdale Inc. manufactures entry and dining room...Ch. 4 - Activity cost pools, activity rates, and product...Ch. 4 - Handbrain Inc. is considering a change to...Ch. 4 - Prob. 14ECh. 4 - Activity-based costing and product cost distortion...Ch. 4 - Prob. 16ECh. 4 - Evaluating selling and administrative cost...Ch. 4 - Prob. 18ECh. 4 - Prob. 19ECh. 4 - Activity-based costing for a service company...Ch. 4 - Bounce Back Insurance Company carries three major...Ch. 4 - Gwinnett County Chrome Company manufactures three...Ch. 4 - The management of Gwinnett County Chrome Company,...Ch. 4 - Activity-based and department rate product costing...Ch. 4 - Activity-based product costing Mello Manufacturing...Ch. 4 - Allocating selling and administrative expenses...Ch. 4 - Product costing and decision analysis for a...Ch. 4 - Single plantwide factory overhead rate Spotted Cow...Ch. 4 - Multiple production department factory overhead...Ch. 4 - Activity-based department rate product costing and...Ch. 4 - Activity-based product costing Sweet Sugar Company...Ch. 4 - Allocating selling and administrative expenses...Ch. 4 - Product costing and decision analysis for a...Ch. 4 - Life Force Fitness, Inc., assembles and sells...Ch. 4 - Prob. 2MADCh. 4 - Prob. 3MADCh. 4 - Production run size and activity improvement...Ch. 4 - Prob. 5MADCh. 4 - Ethics in Action The controller of Tri Con Global...Ch. 4 - Communication The controller of New Wave Sounds...Ch. 4 - Pelder Products Company manufactures two types of...Ch. 4 - The Chocolate Baker specializes in chocolate baked...Ch. 4 - Young Company is beginning operations and is...Ch. 4 - Cynthia Rogers, the cost accountant for Sanford...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- John Sheng, a cost accountant at Starlet Company, is developing departmental factory overhead application rates for the companys Tooling and Fabricating departments. The budgeted overhead for each department and the data for one job are as follows: Using the departmental overhead application rates, total overhead applied to Job 231 in the Tooling and Fabricating departments will be: a. 225. b. 303. c. 537. d. 671.arrow_forwardProfessional labor cost budget for a service company Based on the data in Exercise 7 and assuming that the average compensation per hour for staff is 40 and for partners is 175, prepare a professional labor cost budget for each department forLundquist Fretwell, CPAs, for the year ending May 31, 20Y8. Use the following column headings:arrow_forwardJob order cost sheets show the following costs assigned to each job: The company assigns overhead at $1.25 for each direct labor dollar spent. What is the total cost for each of the jobs?arrow_forward

- Minor Co. has a job order cost system and applies overhead based on departmental rates. Service Department 1 has total budgeted costs of 168,000 for next year. Service Department 2 has total budgeted costs of 280,000 for next year. Minor allocates service department costs solely to the producing departments. Service Department 1 cost is allocated to producing departments on the basis of machine hours. Service Department 2 cost is allocated to producing departments on the basis of direct labor hours. Producing Department 1 has budgeted 8,000 machine hours and 12,000 direct labor hours. Producing Department 2 has budgeted 2,000 machine hours and 12,000 direct labor hours. What is the total cost allocation from the two service departments to Producing Department 1? a. 173,600 b. 140,000 c. 134,400 d. 274,400arrow_forward4. Care Corp. uses a job order costing sytem. It has three production departments, X, Y, and Z. The Manufacturing cost budget for May is presented in Table 1. For Job No. 0198 which was completed in May, direct materials cost was P75,000 and direct labor cost are presented in Table 2. The Corporation applies manufacturing overhead to each job order on the basis of direct labor cost, using departmental rates predetermined at the beginning og the year based on the manufacturing cost budget.What is the total manufacturing cost of Job No. 0198 which was completed in May?arrow_forwardA cost driver is used to allocate support department expenses. Match each of the following cost drivers with the appropriate department. Clear All Number of work orders Number of employees Number of payroll checks Number of purchase requisitions Payroll Accounting Maintenance President's Office Purchasing Human Resourcesarrow_forward

- Precision instruments uses job order costing and apples manufacuring overhead to individual jobs by using predetermined overhead rates. In dept A, overhead is applied on the basis of machine hours and Dept B on thebasis of direct labor hous. At the beginning of the yea, managementmade th efollowing budget estimats as a step toward determining the overhead application rates. Dept A Dept B Direct Labor $420,000 $300000 Manufacturing overhead $540,000 $412,500 Machine hours 18000 1900 Direct labor hours 28000 25000 Production of 4000 tachometers (job 399) was started in the middle of January and completed 2 weeks later. Thecost records for this job show the following information Dept A Dept B Job 399 4000 units of product Cost of materials $6800 $4500 Direct labor costs 8100 7200 Direct labor hours 540 600 Machine hours 250 100 a. determine the overhead rate that should be used for each department in applying overhead costs to job 399 b. What is the…arrow_forwardK Dakota Products uses a job-costing system with two direct-cost categories (direct materials and direct manufacturing labor) and one manufacturing overhead cost pool. Dakota allocates manufacturing overhead costs using direct manufacturing labor costs. Dakota provides the following information (Click the icon to view the information.) Read the requirements Requirement 1. Compute the actual and budgeted manufacturing overhead rates for 2020 (Enter your answer as a number [not as a percentage] rounded to two decimal places, XXX) Actual manufacturing overhead rate = 1.95 Budgeted manufacturing overhead rate 1.7 = Requirements BES 4 1. Compute the actual and budgeted manufacturing overhead rates for 2020 2. During March, the job-cost record for Job 626 contained the following information Direct materials used $55,000 Direct manufacturing labor costs $45,000 Compute the cost of Job 626 using (a) actual costing and (b) normal costing 3. At the end of 2020, compute the under- or…arrow_forwardD. Avery Company uses a predetermined overhead rate based on direct labor hours. For the month of October, Avery's budgeted overhead was P300,000 based on a budgeted volume of 100,000 direct labor hours. Actual overhead amounted to P325,000 with actual direct labor hours totaling 110,000. Compute for the following: _17. Predetermined overhead rate _18. Factory overhead charged to Work in Process account _19. Under / (Over) applied factory overhead _20 - 22. Assume the following amounts of applied FOH in each account. Allocate the under / over applied to these three accounts: Cost of Goods sold Ending Finished Goods inventory Ending Work in Process inventory P200,000 100,000 30,000arrow_forward

- D. Avery Company uses a predetermined overhead rate based on direct labor hours. For the month of October, Avery's budgeted overhead was P300,000 based on a budgeted volume of 100,000 direct labor hours. Actual overhead amounted to P325,000 with actual direct labor hours totaling 110,000. Compute for the following: _17. Predetermined overhead rate _18. Factory overhead charged to Work in Process account _19. Under / (Over) applied factory overheadarrow_forwardGreenway Irrigation Systems uses job order costing and applies manufacturing overhead to individual jobs by using predetermined overhead rates. In the Fabrication Department, overhead is applied on the basis of machine-hours, and in the Installation Department, it is applied on the basis of direct labor hours. At the beginning of the current year, management made the following budget estimates as a step toward determining the overhead application rates. Fabrication Installation Direct labor $ 132,000 $ 300,000 Manufacturing overhead $ 600,000 $ 180,000 Machine-hours 8,000 1,200 Direct labor hours 6,000 15,000 Production of a 5,350 linear-foot irrigation system for Thompson Orchards (job no. 399) was started and completed in March of the current year. Cost records for this job reveal the following information. Fabrication Installation Job no. 399 (5,350 linear-foot system): Cost of materials used on job…arrow_forwardanalysis using activity-based costing (ABC). The management accountant accumulates the following information about overhead for the year ended December 31, 2019. Activity Cost Pools Cost Drivers Estimated Expected Use of Overhead Cost Drivers Purchasing Number of $1,200,000 40,000 orders Machine setups Number of 900,000 18,000 setups Machine hours Machining Quality Control 4,800,000 700,000 120,000 28,000 Number of inspections The cost drivers used: Cost Drivers TRI-X Product Purchase orders Machine setupS Machine hours Inspections 17,000 5,000 75,000 11,000 Required: 1. Calculate the activity rates for each of the overhead items using the four cost drivers. 2. Using the rates in (1) determine the unit cost for TRI-X 3. Calculate the gross profit of each model of TRI-X based on ABC costings and recommend whether or not TRI-X should be discontinued.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

What is Cost Allocation? Definition & Process; Author: FloQast;https://www.youtube.com/watch?v=hLhvvHvZ3JM;License: Standard Youtube License