Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 17P

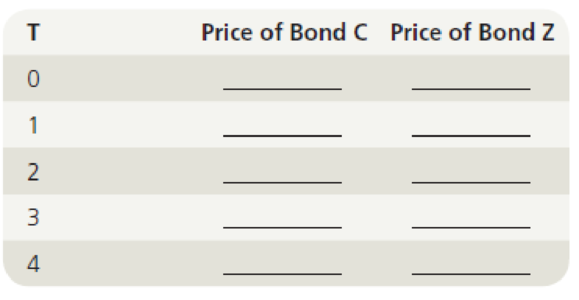

Bond Value as Maturity Approaches

An investor has two bonds in his portfolio. Each bond matures in 4 years, has a face value of $1,000, and has a yield to maturity equal to 9.6%. One bond, Bond C, pays an annual coupon of 10%; the other bond, Bond Z, is a zero coupon bond. Assuming that the yield to maturity of each bond remains at 9.6% over the next 4 years, what will be the price of each of the bonds at the following time periods? Fill in the following table:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A bond with a face value of $1,000 has 10 years until maturity, carries a coupon rate of 9%, and sells for $1,100. Interest is paid annually. Assume a face value of $1,000 and annual coupon payments.a) If the bond has a yield to maturity of 9% 1 year from now, what will its price be at that time?b) What will be the rate of return on the bond? c) If the inflation rate during the year is 3%, what is the real rate of return on the bond? Assume annual interest payments.

An investor has two bonds in his portfolio. Each bond matures in 4 years, has a face value of $1000, and has a yield to maturity equal to 9.6%. One bond, Bond C pays an annual coupon of 10%; the other bond, Bond Z, is a zero coupon bond. Assuming that the yield to maturity of each bind remains at 9.6% over the next 4 years, what will be the price of each bond at the following time periods? Fill in the following table:

T

Price of Bind C

Price of Bind Z

O

1

2

3

4

An investor has two bonds in his portfolio. Each bond matures in 4 years, has a face value of $1,000, and has a yield to maturity equal to 8.5%. One bond, Bond C, pays an annual coupon of 12%; the other bond, Bond Z, is a zero coupon bond. Assuming that the yield to maturity of each bond remains at 8.5% over the next 4 years, what will be the price of Bond Z at the following time periods? At the end of year 2.

Chapter 4 Solutions

Intermediate Financial Management (MindTap Course List)

Ch. 4 - Short-term interest rates are more volatile than...Ch. 4 - The rate of return on a bond held to its maturity...Ch. 4 - If you buy a callable bond and interest rates...Ch. 4 - A sinking fund can be set up in one of two ways....Ch. 4 - Prob. 1PCh. 4 - Prob. 2PCh. 4 - Current Yield for Annual Payments Heath Food...Ch. 4 - Determinant of Interest Rates

The real risk-free...Ch. 4 - Default Risk Premium A Treasury bond that matures...Ch. 4 - Prob. 6P

Ch. 4 - Bond Valuation with Semiannual Payments

Renfro...Ch. 4 - Prob. 8PCh. 4 - Bond Valuation and Interest Rate Risk The Garraty...Ch. 4 - Prob. 10PCh. 4 - Prob. 11PCh. 4 - Bond Yields and Rates of Return A 10-year, 12%...Ch. 4 - Yield to Maturity and Current Yield You just...Ch. 4 - Current Yield with Semiannual Payments

A bond that...Ch. 4 - Prob. 15PCh. 4 - Interest Rate Sensitivity

A bond trader purchased...Ch. 4 - Bond Value as Maturity Approaches An investor has...Ch. 4 - Prob. 18PCh. 4 - Prob. 19PCh. 4 - Prob. 20PCh. 4 - Bond Valuation and Changes in Maturity and...Ch. 4 - Yield to Maturity and Yield to Call

Arnot...Ch. 4 - Prob. 23PCh. 4 - Prob. 1MCCh. 4 - Prob. 2MCCh. 4 - How does one determine the value of any asset...Ch. 4 - Prob. 4MCCh. 4 - What would be the value of the bond described in...Ch. 4 - Suppose a 10-year, 10% semiannual coupon bond with...Ch. 4 - Prob. 9MCCh. 4 - Prob. 10MCCh. 4 - Prob. 11MCCh. 4 - Prob. 12MCCh. 4 - Prob. 14MCCh. 4 - Prob. 15MCCh. 4 - Prob. 16MCCh. 4 - Prob. 17MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose a 10-year, 10% semiannual coupon bond with a par value of 1,000 is currently selling for 1,135.90, producing a nominal yield to maturity of 8%. However, the bond can be called after 5 years for a price of 1,050. (1) What is the bonds nominal yield to call (YTC)? (2) If you bought this bond, do you think you would be more likely to earn the YTM or the YTC? Why?arrow_forwardBond Yields and Rates of Return A 10-year, 12% semiannual coupon bond with a par value of 1,000 may be called in 4 years at a call price of 1,060. The bond sells for 1,100. (Assume that the bond has just been issued.) a. What is the bonds yield to maturity? b. What is the bonds current yield? c. What is the bonds capital gain or loss yield? d. What is the bonds yield to call?arrow_forwardAn investor has two bonds in his portfolio. Each bond matures in 4 years, has a face value of $1,000, and has a yield to maturity equal to 9.8%. One bond, Bond C, pays an annual coupon of 10%; the other bond, Bond Z, is a zero coupon bond. Assuming that the yield to maturity of each bond remains at 9.8% over the next 4 years, what will be the price of each of the bonds at the following time periods? Assume time 0 is today. Fill in the following table. Round your answers to the nearest cent. T 0 1 2 3 4 Price of Bond C $ 00000 Price of Bond Z $ 00000arrow_forward

- Madsen Motors's bonds have 25 years remaining to maturity. Interest is paid annually, they have a $1,000 par value, the coupon interest rate is 10%, and the yield to maturity is 12%. What is the bond's current market price? Round your answer to the nearest cent.arrow_forwardAn investor has two bonds in his portfolio that have a face value of $1,000 and pay an 11% annual coupon. Bond Y matures in 19 years, while Bond A matures in 1 year. 1. What will the value of the Bond Ybe if the going interest rate is 7%, 8%, and 12%? Assume that only one more interest payment is to be made on Bond A at its maturity and that 19 more payments are to be made on Bond Y. Round your answers to the nearest cent.arrow_forwardAn investor has two bonds in his portfolio that have a face value of $1,000 and pay an 11% annual coupon. Bond L matures in 17 years, while Bond S matures in 1 year. a. What will the value of the Bond L be if the going interest rate is 7%, 8%, and 12%? Assume that only one more interest payment is to be made on Bond S at its maturity and that 17 more payments are to be made on Bond L. Round your answers to the nearest cent. 7% 12% 8% $ Bond L $ Bond S $ $ b. Why does the longer-term bond's price vary more than the price of the shorter-term bond when interest rates change? 1. Long-term bonds have lower interest rate risk than do short-term bonds. II. Long-term bonds have lower reinvestment rate risk than do short-term bonds. III. The change in price due to a change in the required rate of return increases as a bond's maturity decreases. IV. Long-term bonds have greater interest rate risk than do short-term bonds. V. The change in price due to a change in the required rate of return…arrow_forward

- A bond with a face value of $1,000 has 10 years until maturity, carries a coupon rate of 9%, and sells for $1,100. Interest is paid annually. Assume a face value of $1,000 and annual coupon payments. 1) If the bond has a yield to maturity of 9% 1 year from now, what will its price be at that time? 2) What will be the rate of return on the bond? 3) If the inflation rate during the year is 3%, what is the real rate of return on the bond? Please show workings with formulas.arrow_forwardBond Value as Maturity Approaches An investor has two bonds in his portfolio. Each bond matures in 4 years, has a face value of $1,000, and has a yield to maturity equal to 8.9%. One bond, Bond C, pays an annual coupon of 11%; the other bond, Bond Z, is a zero coupon bond. Assuming that the yield to maturity of each bond remains at 8.9% over the next 4 years, what will be the price of each of the bonds at the following time periods? Assume time 0 is today. Fill in the following table. Round your answers to the nearest cent. T Price of Bond C Price of Bond Z 0 $ $ 1 2 3 4arrow_forwardAn investor has two bonds in her portfolio, Bond C and Bond Z. Each bond matures in 4 years, has a face value of $1,000, and has a yield to maturity of 8.0%. Bond C pays a 11.5% annual coupon, while Bond Z is a zero coupon bond. a. Assuming that the yield to maturity of each bond remains at 8.0% over the next 4 years, calculate the price of the bonds at each of the following years to maturity. Round your answers to the nearest cent. Years to Maturity Price of Bond C Price of Bond Z $ $ 3 $ 2$ 2 $ $ 1 $ $ $arrow_forward

- An investor has two bonds in her portfolio, Bond C and Bond Z. Each bond matures in 4 years, has a face value of $1,000, and has a yield to maturity of 8.2%. Bond C pays a 11.5% annual coupon, while Bond Z is a zero coupon bond. a. Assuming that the yield to maturity of each bond remains at 8.2% over the next 4 years, calculate the price of the bonds at each of the following years to maturity. Round your answers to the nearest cent. Years to Maturity Price of Bond C Price of Bond Z $ 432 1 OT 0 $ A A AA tA tA tA $ A Aarrow_forwardAn investor has two bonds in his portfolio that have a face value of $1,000 and pay an 11% annual coupon. Bond L matures in 12 years, while Bond S matures in 1 year. a. What will the value of the Bond L be if the going interest rate is 5%, 7%, and 12%? Assume that only one more interest payment is to be made on Bond S at its maturity and that 12 more payments are to be made on Bond L. Round your answers to the nearest cent. 5% 7% Bond L $ Bond S $ $ $ 12% $ b. Why does the longer-term bond's price vary more than the price of the shorter-term bond when interest rates change? I. The change in price due to a change in the required rate of return decreases as a bond's maturity increases. II. Long-term bonds have lower interest rate risk than do short-term bonds. III. Long-term bonds have lower reinvestment rate risk than do short-term bonds. -Select- ✓ IV. The change in price due to a change in the required rate of return increases as a bond's maturity decreases. V. Long-term bonds have…arrow_forwardAn investor has two bonds in his portfolio. Each bond matures in 4 years,has a face value of $1,000, and has a yield to maturity equal to 9.6%. Onebond, Bond C, pays an annual coupon of 10%; the other bond, Bond Z, is azero coupon bond. Assuming that the yield to maturity of each bond remainsat 9.6% over the next 4 years, what will be the price of each of the bonds atthe following time periods?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Journalizing Bonds Payable/Amortization of a Premium; Author: TLC Tutoring;https://www.youtube.com/watch?v=5gEpAFFnIE8;License: Standard YouTube License, CC-BY

Investing Basics: Bonds; Author: TD Ameritrade;https://www.youtube.com/watch?v=IuyejHOGCro;License: Standard YouTube License, CC-BY