Horngren's Accounting (11th Edition)

11th Edition

ISBN: 9780133856781

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

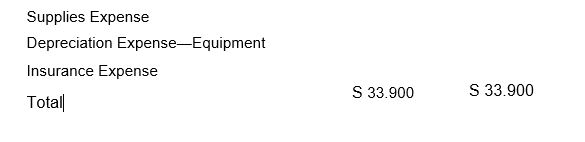

Chapter 3, Problem E3.25E

Journalizing

I h unadjusted

FIRST CLASS MAIDS COMPANY

Unadjusted Trial Balance

December 31, 2016

| Balance | ||

| Account Title | Debit | Credit |

| Cash | $ 1.200 | |

| Office Supplies | 3,000 | |

| Prepaid Insurance | 700 | |

| Equipment | 20.000 | |

| S 6.000 | ||

| Accounts Payable | 2,200 | |

| Salaries Payaole | ||

| Unearned Revenue | 600 | |

| Maltos, Capital | 8,100 | |

| Maltos. Withdrawals | 3.000 | |

| Service Revenue | 17.000 | |

| Salar.es Expense | 6,000 | |

During the 12 months ended December 31,2016, First Class Maids:

- used office supplies of $ 1,900.

- used prepaid insurance of $560.

- depreciated equipment, $510.

- accrued salaries expense of $250 that hasn’t been paid yet.

- earned $420 of unearned revenue.

Requirements

- Open a T-account for each account using the unadjusted balances.

- Journalize the adjusting entries using the letter and December 31 date in the date column.

- Post the adjustments to the T-accounts, entering each adjustment by letter. Show each accounts adjusted balance.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The income statement approach:

journalizing bad debts expense

and writing off accounts

00 (25 min)

Aug, 23

Dr. Allowance for

Doubtful Accounts

$950

Cr. Accounts Receivable,

Jill O'Reilly

GROUP B PROBLEMS

P12-18. Yuen Co. of Windsor has requested that you prepare journal entries from the

following (this company uses the Allowance for Doubtful Accounts method

based on the income statement approach):

2021

Dec. 31 Recorded bad debts expense of $14,800.

2022

Jan. 8

Mar. 5

Wrote off Woody Tree's account of $1,200 as uncollectible.

Wrote off Jim Lantz's account of $600 as uncollectible.

Recovered $600 from Jim Lantz.

July 9

Aug, 20

23

Wrote off Mabel Hest's account of $750 as uncollectible.

Wrote off Jim O'Reilly's account of $950 as uncollectible.

Recovered $500 from Mabel Hest.

Nov. 19

Complete the accounting cycle using the adjusted trial balance below.

JM PHOTOCOPYING CENTER

Adjusted Trial Balance

December 31, 2019

Account Title

Debit

Credit

Cash

P 16.500.00

Accounts Receivable

7.500.00

Allowance for doubtful accounts

P 150.00

Note Receivable

5,527.50

3.000.00

Unused Supplies

Prepaid rent

5.000.00

Photocopying Equipment

30,000.00

450.00

Accumulated Depreciation - Photocopying

Equipment

Furniture and Fixtures

5.000.00

Accumulated Depreciation - Furniture & Fixtures

75.00

Accounts payable

2.500.00

Loan payable

50,000.00

Notes payable

5.000.00

Salaries Payable

816.67

Unearned Photocopying Revenues

1,800.00

Mercado, Capital

10,000.00

Mercado, Drawing

500.00

Photocopying Revenues

24,227.50

Taxes and Licenses Expense

2,000.00

Salaries expense

4.800.00

Supplies expense

7,000.00

Utilities expense

2,500.00

Rent expense

5,000.00

525.00

Depreciation Expense

Bad debts expense

166.67

P 95,019.17 P 95,019.17

Totals

Requirements:

1. Prepare Financial Statements: Profit and loss…

Preparing an Aging Schedule to Estimate Allowance for Doubtful Accounts

A review of open invoices of Sketchers Inc. results in the following report.

Invoice

Amount

Date(Each from this year)

#496

$458.48

5-Dec

#495

685.77

2-Dec

#427

274.16

5-Nov

#100

109.06

28-Jun

#300

741.43

3-Oct

#410

670.26

31-Oct

#204

62.69

25-Aug

#498

760.84

28-Dec

#499

276.15

28-Dec

#487

747.28

28-Nov

#310

207.65

8-Oct

#178

643.21

7-Aug

#497

335.03

5-Dec

#488

142.90

29-Nov

#105

18.73

5-Jul

$6,133.64

Required

a. Organize the list of open invoices as of December 31 into a table with the following aging categories across the top: (1) less than 30 days, (2) 31-60 days, (3) 60-90 days, and (4) greater than 90 days.

b. Assume that the company estimates the allowance for doubtful accounts based upon the following percentages applied to the appropriate aging categories: (1) 1% for less than 30 days, (2) 5% for 31-60 days, (3) 30% for 60-90 days, and (4) 60% for greater…

Chapter 3 Solutions

Horngren's Accounting (11th Edition)

Ch. 3 - Prob. 1QCCh. 3 - Get Fit Now gains a client who prepays S540 for a...Ch. 3 - The revenue recognition principle requires...Ch. 3 - Adjusting the accounts is the process of Learning...Ch. 3 - Which of the following is an example of a deferral...Ch. 3 - Assume that the weekly payroll of In the Woods...Ch. 3 - Prob. 7QCCh. 3 - A equity overstated income statement: expense...Ch. 3 - A worksheet Learning Objective 6 is a journal used...Ch. 3 - On February 1, Clovis Wilson Law Firm contracted...

Ch. 3 - What is the difference between cash basis...Ch. 3 - Which method of accounting (cash or accrual basis)...Ch. 3 - Prob. 3RQCh. 3 - What is a fiscal year? Why might companies choose...Ch. 3 - Under the revenue recognition principle, when is...Ch. 3 - Under the matching principle, when are expenses...Ch. 3 - When are adjusting entries completed and what is...Ch. 3 - What are the two basic categories of adjusting...Ch. 3 - What is a deferred expense? Provide an example.Ch. 3 - What is the process of allocating the cost of a...Ch. 3 - What is a contra account?Ch. 3 - Prob. 12RQCh. 3 - What does accumulated depreciation represent?Ch. 3 - Prob. 14RQCh. 3 - What is a deferred revenue? Provide an example.Ch. 3 - What is an accrued expense? Provide an example.Ch. 3 - What is an accrued revenue? Provide an example.Ch. 3 - What are the two rules to remember about adjusting...Ch. 3 - When is an adjusted trial balance prepared, and...Ch. 3 - Prob. 20RQCh. 3 - What is a worksheet, and how is it used to help...Ch. 3 - If a payment of a deferred expense was recorded...Ch. 3 - If a payment of a deferred expense was recorded...Ch. 3 - Prob. S3.1SECh. 3 - Prob. S3.2SECh. 3 - Prob. S3.3SECh. 3 - Prob. S3.4SECh. 3 - S3-5 Identifying types of adjusting entries...Ch. 3 -

S3-6 Journalizing and posting adjusting entries...Ch. 3 - Prob. S3.7SECh. 3 - Prob. S3.8SECh. 3 - Prob. S3.9SECh. 3 - Prob. S3.10SECh. 3 - Prob. S3.11SECh. 3 - Journalizing an adjusting entry for accrued...Ch. 3 - Prob. S3.13SECh. 3 - Determining the effects on financial statements...Ch. 3 - Prob. S3.15SECh. 3 - Prob. S3A.16SECh. 3 - Prob. S3A.17SECh. 3 - E3-18 Comparing cash and accrual basis accounting...Ch. 3 - Comparing cash and accrual basis accounting and...Ch. 3 - Prob. E3.20ECh. 3 - Prob. E3.21ECh. 3 -

E3-22) Journalizing adjusting entries

Consider...Ch. 3 - Prob. E3.23ECh. 3 - Journalizing adjusting entries and posting to...Ch. 3 - Journalizing adjusting entries and posting to...Ch. 3 - Prob. E3.26ECh. 3 - Prob. E3.27ECh. 3 - Journalizing adjusting entries and analyzing their...Ch. 3 - Prob. E3.29ECh. 3 - Prob. E3.30ECh. 3 - Prob. E3A.31ECh. 3 - Prob. E3A.32ECh. 3 - Prob. P3.33APGACh. 3 - Prob. P3.34APGACh. 3 - Prob. P3.35APGACh. 3 - Prob. P3.36APGACh. 3 - Prob. P3.37APGACh. 3 - Prob. P3A.38APGACh. 3 - Prob. P3.39BPGBCh. 3 - Prob. P3.40BPGBCh. 3 - Prob. P3.41BPGBCh. 3 - Prob. P3.42BPGBCh. 3 - Prob. P3.43BPGBCh. 3 - Understanding the alternative treatment of prepaid...Ch. 3 - Prob. P3.45CPCh. 3 - Prob. P3.46PSCh. 3 - One year ago, Tyler Stasney founded Swift...Ch. 3 - Prob. 3.1EICh. 3 - Prob. 3.1FCCh. 3 - Prob. 3.1FSC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nillsons Nursery uses the direct write-off method for recording bad debts. Required Journalize the following selected entries: 2012 Apr. 10Write off the account of P. A. Seldon as uncollectible, 458. July 27Write off the account of J. M. Weller as uncollectible, 268. Check Figure Total amount debited to Bad Debts Expense 726arrow_forwardHardys Landscape Services total revenue on account for 2018 amounted to 273,205. The company, which uses the allowance method, estimates bad debts at percent of total revenue on account. Required Journalize the following selected entries: 2012 Dec. 12Record services performed on account for E. E. Morton, 245. 31Record the adjusting entry for Bad Debts Expense. 31Record the closing entry for Bad Debts Expense. 2013 Feb. 18Write off the account of E. E. Morton as uncollectible, 245. Check Figure Adjusting entry amount, 1,366.03arrow_forwardJournalize the adjusting entry for the bad expenses - picture attattached to show the format Also prepare the journal entry for the transaction for 2024 using the allowance method Transactions for 2024 1-Sales revenue on account, $113,600 (ignore Cost of Goods Sold). 2-Collections on account, $92,895 3-Write-offs of uncollectibles, $760. 4- The Company accepted a 90-day, 9%, $13,500 note receivable from a customer in exchange for 4 his account receivable. a Journalize the issuance of the note. b Journalize the collection of the principal and interest at maturity. (use 360 days) 5 Bad debts expense of $?? was recorded. (Refer to requirement 3)(about the write off) The image attached also has the data and imformation.arrow_forward

- Balance of Accounts Receivable The trial balance for Ariel Certified Cleaners appears as follows: Ariel Certified Cleaners Trial Balance Sept. 30, 2015 Debit Credit Cash B117,880 Accounts Receivable 264,940 Prepaid Insurance 34,000 Cleaning Supplies 73,740 Land 180,000 Building 1,850,000 Accumulated Depreciation - Building B456,000 Accounts Payable 204,000 Uneamed Cleaning Revenues 16,000 Mortgage Payable 1,100,000 Ariel, Capital 565,600 Ariel, Withdrawals 100,000 Cleaning Revenues Salaries Expense 1,576,340 1,013,300 Cleaning Equipment Rental Expense 60,000 Delivery Truck Expense 43,740 Interest Expense 110,000 Other Expense 70,340 Total : P3,917,940 P3,917,940arrow_forwardDirect Write-off Method Maria Rivera, owner of Rivera Pharmacy, uses the direct write- off method in accounting for uncollectible accounts. Record the following transactions in general journal form: y Wrote off $2,240 owed by Joe Balouka, who has no 20 assets. n Wrote off $1,480 owed by Alice Rose, who declared bankruptey. Page DATE Accou m D CRE RE.arrow_forwardmy worK Number of Days Unpaid Not yet due 1-30 days past due 31-60 days past due Over 60 days past due Receivable Uncollectible $128,400 91,100 55,500 33,700 5% 10% 16% 33% Required: a. The unadjusted balance of the Allowance for Doubtful Accounts of Johnston Supplies, Inc. is a credit balance in the amount of $29,517 on July 31, 2019. Prepare the required adjusting entry to record Bad Debt Expense for the year. b. Johnston Supplies, Inc. writes off $3,271 of uncollectible accounts on August 15, 2019. Prepare the required adjusting entry to record the write-off. c. Use a T-account to determine the account balance in the Allowance for Doubtful Accounts on August 15, 2019. Complete this question by entering your answers in the tabs below. Required A Required B Required C The unadjusted balance of the Allowance for Doubtful Accounts of Johnston Supplies, Inc. is a credit balance in the amount of $29,517 on July 31, 2019. Prepare the required adjusting entry to record Bad Debt Expense for…arrow_forward

- Preparing an Aging Schedule to Estimate Allowance for Doubtful Accounts A review of open invoices of Sketchers Inc. results in the following report. Date (Each from this Invoice Amount year) #496 $305.65 5-Dec #495 457.18 2-Dec #427 182.77 5-Nov #100 72.71 28-Jun #300 494.29 3-Oct #410 446.84 31-Oct #204 41.80 25-Aug #498 507.23 28-Dec #499 184.10 28-Dec #487 498.19 28-Nov #310 138.43 8-Oct # 178 428.81 7-Aug #497 223.36 5-Dec #488 #105 95.27 29-Nov 12.49 $4,089.12 5-Jul Required a. Organize the list of open invoices as of December 31 into a table with the following aging categories across the top: (1) less than 31 days, (2) 31-60 days, (3) 61-90 days, and (4) greater than 90 days. b. Assume that the company estimates the allowance for doubtful accounts based on the following percentages applied to the appropriate aging categories: (1) 1% for less than 31 days, (2) 5% for 31-60 days, (3) 30% for 61-90 days, and (4) 60% for greater than 90 days. What is the ending balance of the…arrow_forwardName: Time: Queen City Vidadape Trial Balance December 31, 2019 Accaunt Titles Debit Credit Cashin Bank 125,000 30,000 Accounts Receivable Allowance for Uhcollectibe Accaurts Unused Supplies Videdtape Inventory Fumiture and Fixtures 10,000 105,000 80,000 Accumlated Depreciation-Fumiture and Fixtures Notes Payable Accaunts Payabe 50,000 35,000 Accrued Interest Edgar Datbya, Captal Edgar Detoya, Withdrawels Rental Income 162,000 180,000 18000 Other Income Uncallectible Accounts Depreciation Expense InterestExpeanse Damaged Videctape Suplies Used Salaries Expense 95,000 445,000 Tdal 445,000 The following errors and omissions were discovered at year-end prior to closing of the books: a. Uncollectible accounts should be provided at 1% of the outstanding receivable balance. b. Actual cost of supplies used amounted to P6,000. Physical inventory conducted on December 31, 2019 were found to have P15,000 cost of videotapes to have been damaged. Furniture was acquired on October 1, 2019 with an…arrow_forwardHide or show questions Progress:11/15 items Morry Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31: Customer Amount J. Jackson $10,000 L. Stanton 9,500 C. Barton 13,100 S. Fenton 7,400 Total $40,000 Required: a. Journalize the write-offs for the current year under the direct write-off method. If an amount box does not require an entry, leave it blank. Bad Debt Expense Bad Debt Expense Accounts Receivable-J. Jackson Accounts Receivable-J. Jackson Accounts Receivable-L. Stanton Accounts Receivable-L. Stanton Accounts Receivable-C. Barton Accounts Receivable-C. Barton Accounts Receivable-S. Fenton Accounts Receivable-S. Fenton b. Journalize the write-offs for the current year under the allowance method. Also, journalize the adjusting entry for uncollectible receivables assuming the company made…arrow_forward

- Prior to recording adjusting entries, the Office Supplies account had a $393 debit balance. A physical count of the supplies showed $95 of unused supplies available. The required adjusting entry is: 14 Multiple Choice Debit Office Supplies $95 and credit Office Supplies Expense $95 Debit Office Supplies Expense $95 and credit Office Supplies $95. 14 of 19 Next > Mc Graw Hill < Prev 457 PM a 9/17/2019 pe here to searcharrow_forwardAging of receivables; estimating allowance for doubtful accounts Wig Creations Company supplies wigs and hair care products to beauty salons throughout Texas and the Southwest. The accounts receivable clerk for Wig Creations prepared the following partially completed aging of receivables schedule as of the end of business on December 31, 20Y7: The following accounts were unintentionally omitted from the aging schedule. Assume all due dates are for the current year except for Visions Hair Nail, which is due in the next year. Wig Creations has a past history of uncollectible accounts by age category, as follows: Instructions 1. Determine the number of days past due for each of the preceding accounts. 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals. 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule. 4. Assume that the allowance for doubtful accounts for Wig Creations has a credit balance of 7,375 before adjustment on December 31. Journalize the adjustment for uncollectible accounts. 5. Assume that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income statement?arrow_forwardWrite-Off of Uncollectible Accounts King Enterprises had 27 customers utilizing its financial planning services in 2019. Each customer paid King $25,000 for receiving Kings assistance. King estimates that 2% of its $675,000 credit sales in 2019 will be uncollectible. During 2020, King wrote off $2,700 related to services performed in 2019. Required: 1. Prepare the journal entry to record the defaulted balance. 2. Prepare the adjusting entry to record the bad debt expense for 2019.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY