Concept explainers

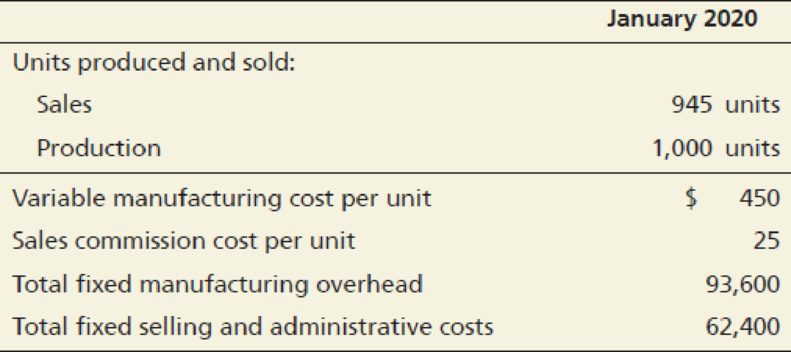

This problem continues the Piedmont Computer Problem situation from Chapter 20. Piedmont Computer Company manufactures personal computers and tablets. Based on the latest information from the cost accountant, using the current sales mix, the weighted-average sales price per unit is $750 and the weighed-

Requirements

- 1. Compute the product cost per unit produced under absorption costing and under variable costing.

- 2. Prepare income statements for January 2020 using:

- a. absorption costing.

- b. variable costing.

- 3. Is operating income higher under absorption costing or variable costing in January? What causes the difference?

Want to see the full answer?

Check out a sample textbook solution

Chapter 21 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Additional Business Textbook Solutions

Fundamentals Of Financial Accounting

Accounting for Governmental & Nonprofit Entities

Principles of Accounting Volume 1

PRINCIPLES OF TAXATION F/BUS.+INVEST.

Horngren's Accounting (11th Edition)

Financial Accounting, Student Value Edition (4th Edition)

- Furniture, Inc., estimates the following number of mattress sales for the first four months of 2019: Month Sales January 32,000 February 36,800 March 29,600 April 43,200 Finished goods inventory at the end of December is 7,100 units. Target ending finished goods inventory is 20% of the next month's sales. Required: Calculate the How many mattresses should be produced in each month of the first quarter of 2019?arrow_forwardBackground It is the 1st April 2021. Jang is the Management Accountant for the business Chinese Lantern Imports. Based on the previous month sales (March 2021) Jang sets the following targets for April 2021. April 2021 targets Targeted Lantern sales = 2,300 units Targeted Lantern unit price = $230 (per lantern) Jang calculates the cost of the Lanterns he will need to purchase in during the month as 50% of the expected sales revenue. However, at the 1st April 2021, Jang already currently has $12,400 of Lanterns stock already in his shop. Jang does not intend to buy an extra Lanterns for May 2021. Question Referring to above information, what is the cost of the Lanterns that Jang needs to purchase in, for the month of April? Select one: a. Cost of Lanterns to purchase in = $237,900 O b. Cost of Lanterns to purchase in = $0 O c. Cost of Lanterns to purchase in = $252,100 O d. Cost of Lanterns to purchase in = $264,500arrow_forwardTurney Company produces and sells automobile batteries, the heavy-duty HD-240. The 2017 sales forecast is as follows. Quarter HD-240 1 5,100 2 7,320 3 8,280 4 10,430 The January 1, 2017, inventory of HD-240 is 2,040 units. Management desires an ending inventory each quarter equal to 40% of the next quarter’s sales. Sales in the first quarter of 2018 are expected to be 25% higher than sales in the same quarter in 2017.Prepare quarterly production budgets for each quarter and in total for 2017. TURNEY COMPANYProduction Budgetchoose the accounting period Product HD-240 Quarter 1 2 3 4 Year select an opening Production Budget item Enter a number of units Enter a number of units Enter a number of units Enter a number of units select between addition and deduction…arrow_forward

- Jacob’s Landing Inc. has sales of 2,000 for the first quarter of 2019. The company incurred the following costs and expenses from making sales. Variable Fixed Cost of goods sold $70 60 Selling expense $50 80 Administrative expenses $95 66 Instructions: Prepare a CVP income statement for the quarter ended March 2010.arrow_forwardCarla Vista Company produces and sells automobile batteries, the heavy duty HD-240. The 2022 sales forecast is as follows. Quarter 1 2 3 4 HD-240 5.900 8.260 9,440 11.800 The January 1, 2022, inventory of HD-240 is 2,360 units. Management desires an ending inventory each quarter equal to 40% of the next quarter's sales Sales in the first quarter of 2023 are expected to be 25% higher than sales in the same quarter in 2022. Prepare quarterly production budgets for each quarter and in total for 2022. The January 1, 2022, inventory of HD-240 is 2.360 units Management desires an ending inventory each quarter equal to 40% of the next quarter's sales, Sales in the first quarter of 2023 are expected to be 25% higher than sales in the same quarter in 2022 Prepare quarterly production budgets for each quarter and in total for 2022 CARLA VISTA COMPANY Production Budget Product HD-240arrow_forwardShow the solution in good accounting form The home office bills its branch at 40% above cost. During the year 2020, goods costing 150,000 were shipped to the branch. The account allowance for overvaluation of branch inventory, after adjustment, shows a balance of P25,000 at the end of the year. Compute the amountof ending inventory at: a. Cost and b. Billed Pricearrow_forward

- Use the following information for Problems 32 and 33.Tristan, Inc., uses the LIFO cost-flow assumption to value inventory. It began the current year with 2,000 units of inventory carried at LIFO cost of $20 per unit. During the first quarter, it purchased 8,000 units at an average cost of $40 per unit and sold 9,500 units at $60 per unit.Assume the company expects to replace the units of beginning inventory sold in April at a cost of $45 per unit and expects inventory at year-end to be between 2,100 and 2,500 units. What amount of cost of goods sold should be recorded for the quarter ended March 31?a. $335,000b. $350,000c. $380,000d. $387,500arrow_forwardWhat is the food inventory turnover for 2020? The Robot Lounge's beginning and ending inventory for 2020 are $22,000 and $15,000, respectively. Activities during 2020 were: Food purchase is $ 44,000. Employee meals are $ 8,000. Promotion meals are $ 8,500. Food sales is $ 1,200,000. Please use 365 days per year, 31 days per month calendar. O 1.42 O 12 O 1.86 O 0.98 O 1.65arrow_forwardEddie’s Galleria sells billiard tables. The company has the following purchases and sales for 2021. Date Transactions Units Unit Cost Total Cost January 1 Beginning inventory 150 $540 $ 81,000 March 8 Purchase 120 570 68,400 August 22 Purchase 100 600 60,000 October 29 Purchase 80 640 51,200 450 $260,600 Jan. 1–Dec. 31 Sales ($700 each) 400 Eddie is worried about the company’s financial performance. He has noticed an increase in the purchase cost of billiard tables, but at the same time, competition from other billiard table stores and other entertainment choices have prevented him from increasing the sales price. Eddie is worried that if the company’s profitability is too low, stockholders will demand he be replaced. Eddie does not want to lose his job. Since 60 of the 400 billiard tables sold have not yet been picked up by the customers as of December 31, 2021, Eddie decides incorrectly to include these tables in ending inventory. He appropriately includes…arrow_forward

- Case 2:Muscat Tubes Manufacturing LLC are the manufacturer of picture tubes for T.V. The following are the details of their operation during 2019. Rate of consumption per week is 200 units for Muscat Tubes Manufacturing LLC. Company estimated inventory carrying cost at 20% per annum. The ordering cost per order is RO 100. The cost incurred for purchasing a tube is RO 500. The rate of consumption per week is 100 to 300 units and lead time to supply is 6 to 8 weeks. During emergency purchase the lead time is 2 weeks.Calculate the following: a. Reorder levelb. Maximum level of stockc. Minimum level of stockd. Average level of stocke. Danger Levelarrow_forwardkeep costs down, CGC maintains a warehouse but no showroom or retail sales outlets. CGC has the following information for the second quarter of the year: 1. Expected monthly sales for April, May, June, and July are $180,000, $150,000, $270,000, and $50,000, respectively. 2. Cost of goods sold is 45 percent of expected sales. 3. CGC's desired ending inventory is 55 percent of the following month's cost of goods sold. 4. Monthly operating expenses are estimated to be: . Salaries: $33,000. ° Delivery expense: 8 percent of monthly sales. • Rent expense on the warehouse: $2,500. • Utilities: $500. • Insurance: $330. • Other expenses: $430. Required: 1. Compute the budgeted cost of purchases for each month in the second quarter. 2. Complete the budgeted income statement for each month in the second quarter. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the budgeted cost of purchases for each month in the second quarter. Total Cost of…arrow_forwardTurney Company produces and sells automobile batteries, the heavy-duty HD-240. The 2020 sales forecast is as follows. Quarter 1 2 3 4 HD-240 5,400 7,430 8,450 10,230 The January 1, 2020, inventory of HD-240 is 2,160 units. Management desires an ending inventory each quarter equal to 40% of the next quarter's sales. Sales in the first quarter of 2021 are expected to be 25% higher than sales in the same quarter in 2020. Prepare quarterly production budgets for each quarter and in total for 2020.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education