Concept explainers

Mallette Manufacturing, Inc., produces washing machines, dryers, and dishwashers. Because of increasing competition, Mallette is considering investing in an automated manufacturing system. Since competition is most keen for dishwashers, the production process for this line has been selected for initial evaluation. The automated system for the dishwasher line would replace an existing system (purchased one year ago for $6 million). Although the existing system will be fully

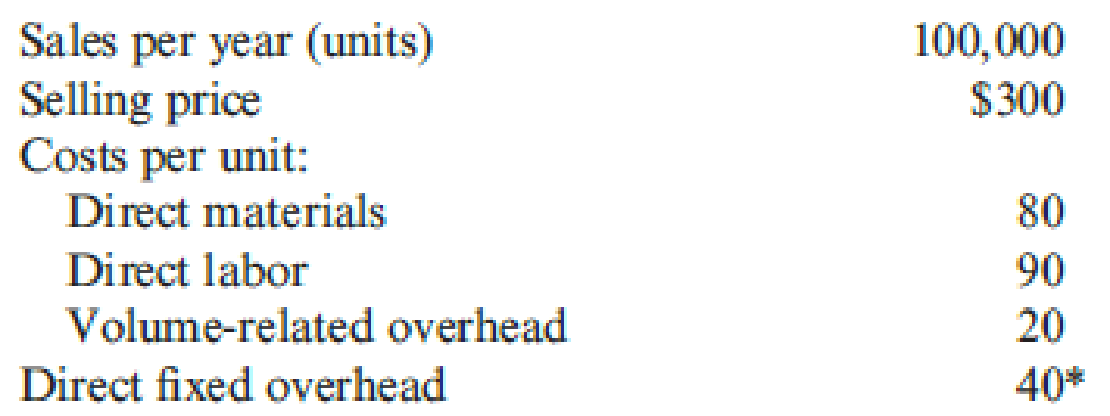

The existing system is capable of producing 100,000 dishwashers per year. Sales and production data using the existing system are provided by the Accounting Department:

*All cash expenses with the exception of depreciation, which is $6 per unit. The existing equipment is being depreciated using straight-line with no salvage value considered.

The automated system will cost $34 million to purchase, plus an estimated $20 million in software and implementation. (Assume that all investment outlays occur at the beginning of the first year.) If the automated equipment is purchased, the old equipment can be sold for $3 million.

The automated system will require fewer parts for production and will produce with less waste. Because of this, the direct material cost per unit will be reduced by 25 percent. Automation will also require fewer support activities, and as a consequence, volume-related overhead will be reduced by $4 per unit and direct fixed overhead (other than depreciation) by $17 per unit. Direct labor is reduced by 60 percent. Assume, for simplicity, that the new investment will be depreciated on a pure straight-line basis for tax purposes with no salvage value. Ignore the half-life convention.

The firm’s cost of capital is 12 percent, but management chooses to use 20 percent as the required rate of return for evaluation of investments. The combined federal and state tax rate is 40 percent.

Required:

- 1. Compute the

net present value for the old system and the automated system. Which system would the company choose? - 2. Repeat the net present value analysis of Requirement 1, using 12 percent as the discount rate.

- 3. Upon seeing the projected sales for the old system, the marketing manager commented: “Sales of 100,000 units per year cannot be maintained in the current competitive environment for more than one year unless we buy the automated system. The automated system will allow us to compete on the basis of quality and lead time. If we keep the old system, our sales will drop by 10,000 units per year.” Repeat the net present value analysis, using this new information and a 12 percent discount rate.

- 4. An industrial engineer for Mallette noticed that salvage value for the automated equipment had not been included in the analysis. He estimated that the equipment could be sold for $4 million at the end of 10 years. He also estimated that the equipment of the old system would have no salvage value at the end of 10 years. Repeat the net present value analysis using this information, the information in Requirement 3, and a 12 percent discount rate.

- 5. Given the outcomes of the previous four requirements, comment on the importance of providing accurate inputs for assessing investments in automated manufacturing systems.

1.

Ascertain the net present value for both the old and automated system, and state the system that the company would choose.

Explanation of Solution

Net present value method (NVP): Net present value method is the method which is used to compare the initial cash outflow of investment with the present value of its cash inflows. In the net present value, the interest rate is desired by the business based on the net income from the investment, and it is also called as the discounted cash flow method.

Ascertain the net present value for both the old and automated system, and state the system that the company would choose:

For Old system (in thousands):

| Year | Revenue | Expenses | Depreciation after tax | Cash flow | Discount factor @ 20% | Present value |

| (1) (a) | (2) (b) | (3) (c) | (e) | |||

| 1 | $18,000 | ($13,440) | $240 | 4,800 | 0.833 | 3,998 |

| 2 | $18,000 | ($13,440) | $240 | 4,800 | 0.694 | 3,331 |

| 3 | $18,000 | ($13,440) | $240 | 4,800 | 0.579 | 2,779 |

| 4 | $18,000 | ($13,440) | $240 | 4,800 | 0.482 | 2,314 |

| 5 | $18,000 | ($13,440) | $240 | 4,800 | 0.402 | 1,930 |

| 6 | $18,000 | ($13,440) | $240 | 4,800 | 0.335 | 1,608 |

| 7 | $18,000 | ($13,440) | $240 | 4,800 | 0.279 | 1,339 |

| 8 | $18,000 | ($13,440) | $240 | 4,800 | 0.233 | 1,118 |

| 9 | $18,000 | ($13,440) | $240 | 4,800 | 0.194 | 931 |

| 10 | $18,000 | ($13,440) | - | 4,560 | 0.162 | 739 |

| 20,088 | ||||||

| Less: Initial investment | 0 | |||||

| Net present value | 20,088 | |||||

Table (1)

Working note (1):

Compute the amount of revenue:

Working note (2):

Compute the amount of expense:

Working note (3):

Compute the amount of after tax depreciation expense:

For New system (in thousands):

| Year | Revenue | Expenses | Depreciation after tax | Cash flow | Discount factor | Present value |

| (1) (a) | (4) (b) | (6) (c) | (e) | |||

| 0 | (50,040) (7) | 1.000 | $(50,040) | |||

| 1 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.833 | 3,998 |

| 2 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.694 | 3,331 |

| 3 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.579 | 2,779 |

| 4 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.482 | 2,314 |

| 5 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.402 | 1,930 |

| 6 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.335 | 1,608 |

| 7 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.279 | 1,339 |

| 8 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.233 | 1,118 |

| 9 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.194 | 931 |

| 10 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.162 | 739 |

| Net present value | 2,025 | |||||

Table (2)

Working note (4):

Step 1: Compute the total cost:

| Particulars | Total cost |

| Direct materials | $60 |

| Direct labor | $36 |

| Volume-related overhead | $16 |

| Direct fixed overhead | $17 |

| Unit cost | $129 |

Table (3)

Step 2: Compute the amount of expense:

Working note (5):

Compute the loss on sale of old machinery:

Working note (6):

Compute the depreciation expense for cash outflow:

Working note (7):

Compute the cash outflow:

Description:

The company should choose the old system because it has the higher net present value.

2.

Ascertain the net present value for both the old and automated system under 12% discount rate, and state the system that the company would choose.

Explanation of Solution

Ascertain the net present value for both the old and automated system under 12% discount rate, and state the system that the company would choose:

For Old system (in thousands):

| Year | Revenue | Expenses | Depreciation after tax | Cash flow | Discount factor | Present value |

| (1) (a) | (2) (b) | (3) (c) | (e) | |||

| 1 | $18,000 | ($13,440) | $240 | 4,800 | 0.893 | 4,286 |

| 2 | $18,000 | ($13,440) | $240 | 4,800 | 0.797 | 3,826 |

| 3 | $18,000 | ($13,440) | $240 | 4,800 | 0.712 | 3,418 |

| 4 | $18,000 | ($13,440) | $240 | 4,800 | 0.636 | 3,053 |

| 5 | $18,000 | ($13,440) | $240 | 4,800 | 0.567 | 2,722 |

| 6 | $18,000 | ($13,440) | $240 | 4,800 | 0.507 | 2,434 |

| 7 | $18,000 | ($13,440) | $240 | 4,800 | 0.452 | 2,170 |

| 8 | $18,000 | ($13,440) | $240 | 4,800 | 0.404 | 1,939 |

| 9 | $18,000 | ($13,440) | $240 | 4,800 | 0.361 | 1,733 |

| 10 | $18,000 | ($13,440) | - | 4,560 | 0.322 | 1,468 |

| 27,048 | ||||||

| Less: Initial investment | 0 | |||||

| Net present value | 27,048 | |||||

Table (4)

For New system (in thousands):

| Year | Revenue | Expenses | Depreciation after tax | Cash flow | Discount factor | Present value |

| (1) (a) | (4) (b) | (6) (c) | (e) | |||

| 0 | (50,040) (7) | 1.000 | $(50,040) | |||

| 1 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.893 | 11,091 |

| 2 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.797 | 9,899 |

| 3 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.712 | 8,843 |

| 4 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.636 | 7,899 |

| 5 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.567 | 7,042 |

| 6 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.507 | 6,297 |

| 7 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.452 | 5,614 |

| 8 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.404 | 5,018 |

| 9 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.361 | 4,484 |

| 10 | $18,000 | ($7,740) | $2,160 | 12,420 | 0.322 | 3,999 |

| Net present value | 20,145 | |||||

Table (5)

Description:

The company should choose the old system because it has the higher net present value. However when using 12% discount rate, the automated system becomes more attractive because under 10% discount rate the NPV was $ 2,025, whereas under 12% discount rate the NPV was $ 20,145.

3.

Ascertain the net present value for the 12% discount rate using this given information.

Explanation of Solution

Ascertain the net present value for the 12% discount rate using this given information.

| Year | Revenue | Expenses | Depreciation after tax | Cash flow | Discount factor | Present value |

| (8) (a) | (9) (b) | (6) (c) | (e) | |||

| 0 | $0 | 1.000 | $0 | |||

| 1 | $18,000 | ($13,440) | $240 | 4,800 | 0.893 | 4,286 |

| 2 | $16,200 | (12,300) | $240 | 4,140 | 0.797 | 3,300 |

| 3 | $14,400 | (11,160) | $240 | 3,480 | 0.712 | 2,478 |

| 4 | $12,600 | (10,020) | $240 | 2,820 | 0.636 | 1,794 |

| 5 | $10,800 | (8,880) | $240 | 2,160 | 0.567 | 1,225 |

| 6 | $9,000 | ($7,740) | $240 | 1,500 | 0.507 | 761 |

| 7 | $7,200 | (6,600) | $240 | 840 | 0.452 | 380 |

| 8 | $5,400 | (5,460) | $240 | 180 | 0.404 | 73 |

| 9 | $3,600 | (4,320) | $240 | (480) | 0.361 | (173) |

| 10 | $1,800 | (3,180) | - | (1,380) | 0.322 | (444) |

| Net present value | $13,680 | |||||

Table (6)

Working Note (8):

Compute the amount of revenue:

| Year | Sales units | Selling price | Revenue | |

| (a) | (b) | (c) | ||

| 1 | $100,000 | $300 | 60% | $18,000 |

| 2 | $90,000 | $300 | 60% | $16,200 |

| 3 | $80,000 | $300 | 60% | $14,400 |

| 4 | $70,000 | $300 | 60% | $12,600 |

| 5 | $60,000 | $300 | 60% | $10,800 |

| 6 | $50,000 | $300 | 60% | $9,000 |

| 7 | $40,000 | $300 | 60% | $7,200 |

| 8 | $30,000 | $300 | 60% | $5,400 |

| 9 | $20,000 | $300 | 60% | $3,600 |

| 10 | $10,000 | $300 | 60% | $1,800 |

Table (7)

Working Note (9):

Compute the amount of expense:

| Year | Sales units | Total cost per unit | Purchase cost | Expense | |

| (a) | (b) | (c) | (c) | ||

| 1 | $100,000 | $190 | $3,400,000 | 60% | $(13,440,000) |

| 2 | $90,000 | $190 | $3,400,000 | 60% | $(12,300,000) |

| 3 | $80,000 | $190 | $3,400,000 | 60% | $(11,160,000) |

| 4 | $70,000 | $190 | $3,400,000 | 60% | $(10,020,000) |

| 5 | $60,000 | $190 | $3,400,000 | 60% | $(8,880,000) |

| 6 | $50,000 | $190 | $3,400,000 | 60% | $(7,740,000) |

| 7 | $40,000 | $190 | $3,400,000 | 60% | $(6,600,000) |

| 8 | $30,000 | $190 | $3,400,000 | 60% | $(5,460,000) |

| 9 | $20,000 | $190 | $3,400,000 | 60% | $(4,320,000) |

| 10 | $10,000 | $190 | $3,400,000 | 60% | $(3,180,000) |

Table (8)

4.

Ascertain the net present value for the given analysis; use the information in Requirement 3,

Explanation of Solution

Compute the salvage value for the new system:

Compute the net present value for the new system:

Thereby, the salvage value of the new system would increase the after-tax cash flows by $2,400,000. On the other hand, the NPV of the new system has been increased by $772,800, whereas, the NPV analysis for the old system remains unchanged. Thus this makes the new investment more attractive.

5.

Interpret the significance of providing accurate inputs for evaluating investments in automated manufacturing systems.

Explanation of Solution

Interpret the significance of providing accurate inputs for evaluating investments in automated manufacturing systems:

The key importance is that the usage of correct discount rate. Under requirement 2, the usage of 20% discount rate made the automated alternative system look entirely unappealing. Thus when using the correct discount rate (12%), the automated system results in a larger NPV, even though it was less than the NPV of the old system. However, the projections of future revenues for the old system were overly optimistic. On the other hand, the old system was not able to produce the same level of quality as the new system could produce. Thus, by considering the correct discount rate, the new system dominated the old. Moreover, the addition of salvage value simply increased this dominance.

Want to see more full solutions like this?

Chapter 19 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Newmarge Products Inc. is evaluating a new design for one of its manufacturing processes. The new design will eliminate the production of a toxic solid residue. The initial cost of the system is estimated at 860,000 and includes computerized equipment, software, and installation. There is no expected salvage value. The new system has a useful life of 8 years and is projected to produce cash operating savings of 225,000 per year over the old system (reducing labor costs and costs of processing and disposing of toxic waste). The cost of capital is 16%. Required: 1. Compute the NPV of the new system. 2. One year after implementation, the internal audit staff noted the following about the new system: (1) the cost of acquiring the system was 60,000 more than expected due to higher installation costs, and (2) the annual cost savings were 20,000 less than expected because more labor cost was needed than anticipated. Using the changes in expected costs and benefits, compute the NPV as if this information had been available one year ago. Did the company make the right decision? 3. CONCEPTUAL CONNECTION Upon reporting the results mentioned in the postaudit, the marketing manager responded in a memo to the internal audit department indicating that cash inflows also had increased by a net of 60,000 per year because of increased purchases by environmentally sensitive customers. Describe the effect that this has on the analysis in Requirement 2. 4. CONCEPTUAL CONNECTION Why is a postaudit beneficial to a firm?arrow_forwardArnold Inc. is considering a proposal to manufacture high-end protein bars used as food supplements by body builders. The project requires use of an existing warehouse, which the firm acquired three years ago for $1 million and which it currently rents out for $128,000. Rental rates are not expected to change going forward. In addition to using the warehouse, the project requires an upfront investment into machines and other equipment of $1.5 million. This investment can be fully depreciated straight-line over the next 10 years for tax purposes. However, Arnold Inc. expects to terminate the project at the end of eight years and to sell the machines and equipment for $438,000. Finally, the project requires an initial investment into net working capital equal to 10% of predicted first-year sales. Subsequently, net working capital is 10% of the predicted sales over the following year. Sales of protein bars are expected to be $4.9 million in the first year and to stay constant…arrow_forwardArnold Inc. is considering a proposal to manufacture high-end protein bars used as food supplements by body builders. The project requires use of an existing warehouse, which the firm acquired three years ago for $1 million and which it currently rents out for $108,000. Rental rates are not expected to change going forward. In addition to using the warehouse, the project requires an upfront investment into machines and other equipment of $1.5 million. This investment can be fully depreciated straight-line over the next 10 years for tax purposes. However, Arnold Inc. expects to terminate the project at the end of eight years and to sell the machines and equipment for $432,000. Finally, the project requires an initial investment into net working capital equal to 10 percent of predicted first-year sales. Subsequently, net working capital is 10 percent of the predicted sales over the following year. Sales of protein bars are expected to be $4.8 million in the first year and to…arrow_forward

- Arnold Inc. is considering a proposal to manufacture high-end protein bars used as food supplements by body builders. The project requires use of an existing warehouse, which the firm acquired three years ago for $4 million and which it currently rents out for $139,000. Rental rates are not expected to change going forward. In addition to using the warehouse, the project requires an upfront investment into machines and other equipment of $1.3 million. This investment can be fully depreciated straight-line over the next 10 years for tax purposes. However, Arnold Inc. expects to terminate the project at the end of eight years and to sell the machines and equipment for $422,000. Finally, the project requires an initial investment into net working capital equal to 10 percent of predicted first-year sales. Subsequently, net working capital is 10 percent of the predicted sales over the following year. Sales of protein bars are expected to be $4.9 million in the first year and to…arrow_forwardArnold Inc. is considering a proposal to manufacture high-end protein bars used as food supplements by body builders. The project requires use of an existing warehouse, which the firm acquired three years ago for $4 million and which it currently rents out for $121,000. Rental rates are not expected to change going forward. In addition to using the warehouse, the project requires an upfront investment into machines and other equipment of $ 1.4 million. This investment can be fully depreciated straight-line over the next 10 years for tax purposes. However, Arnold Inc. expects to terminate the project at the end of eight years and to sell the machines and equipment for $474,000. Finally, the project requires an initial investment into net working capital equal to 10% of predicted first-year sales. Subsequently, net working capital is 10% of the predicted sales over the following year. Sales of protein bars are expected to be $4.6 million in the first year and to stay constant…arrow_forwardArnold Inc. is considering a proposal to manufacture high-end protein bars used as food supplements by body builders. The project requires use of an existing warehouse, which the firm acquired three years ago for $3 million and which it currently rents out for $137,000. Rental rates are not expected to change going forward. In addition to using the warehouse, the project requires an upfront investment into machines and other equipment of $1.4 million. This investment can be fully depreciated straight-line over the next 10 years for tax purposes. However, Arnold Inc. expects to terminate the project at the end of eight years and to sell the machines and equipment for $440,000. Finally, the project requires an initial investment into net working capital equal to 10% of predicted first-year sales. Subsequently, net working capital is 10% of the predicted sales over the following year. Sales of protein bars are expected to be $4.7 million in the first year and to stay constant for eight…arrow_forward

- Arnold Inc. is considering a proposal to manufacture high-end protein bars used as food supplements by body builders. The project requires use of an existing warehouse, which the firm acquired three years ago for $3 million and which it currently rents out for $119,000. Rental rates are not expected to change going forward. In addition to using the warehouse, the project requires an upfront investment into machines and other equipment of $1.3 million. This investment can be fully depreciated straight-line over the next 10 years for tax purposes. However, Arnold Inc. expects to terminate the project at the end of eight years and to sell the machines and equipment for $482,000. Finally, the project requires an initial investment into net working capital equal to 10 percent of predicted first-year sales. Subsequently, net working capital is 10 percent of the predicted sales over the following year. Sales of protein bars are expected to be $4.8 million in the first year and to stay…arrow_forwardArnold Inc. is considering a proposal to manufacture high-end protein bars used as food supplements by body builders. The project requires use of an existing warehouse, which the firm acquired three years ago for $1 million and which it currently rents out for $133,000. Rental rates are not expected to change going forward. In addition to using the warehouse, the project requires an upfront investment into machines and other equipment of $1.4 million. This investment can be fully depreciated straight-line over the next 10 years for tax purposes. However, Arnold Inc. expects to terminate the project at the end of eight years and to sell the machines and equipment for $439,000. Finally, the project requires an initial investment into net working capital equal to 10% of predicted first-year sales. Subsequently, net working capital is 10% of the predicted sales over the following year. Sales of protein bars are expected to be $4.8 million in the first year and to stay constant for eight…arrow_forwardArnold Inc. is considering a proposal to manufacture high-end protein bars used as food supplements by body builders. The project requires use of an existing warehouse, which the firm acquired three years ago for $4 million and which it currently rents out for $136,000. Rental rates are not expected to change going forward. In addition to using the warehouse, the project requires an upfront investment into machines and other equipment of $1.2 million. This investment can be fully depreciated straight-line over the next 10 years for tax purposes. However, Arnold Inc. expects to terminate the project at the end of eight years and to sell the machines and equipment for $497,000. Finally, the project requires an initial investment into net working capital equal to 10 percent of predicted first-year sales. Subsequently, net working capital is 10 percent of the predicted sales over the following year. Sales of protein bars are expected to be $4.7 million in the first year and to…arrow_forward

- Difend Cleaners has been considering the purchase of an industrial dry-cleaning machine. The existing machine is operable for three more years and will have a zero disposal price. If the machine is disposed now, it may be sold for $170,000. The new machine will cost $360,000 and an additional cash investment in working capital of $170,000 will be required. The new machine will reduce the average amount of time required to wash clothing and will decrease labor costs. The investment is expected to net $130,000 in additional cash inflows during the first year of acquisition and $290,000 each additional year of use. The new machine has a three-year life, and zero disposal value. These cash flows will generally occur throughout the year and are recognized at the end of each year. Income taxes are not considered in this problem. The working capital investment will not be recovered at the end of the asset's life. What is the net present value of the investment, assuming the required rate of…arrow_forwardArnold Inc. is considering a proposal to manufacture high-end protein bars used as food supplements by body builders. The project requires use of an existing warehouse, which the firm acquired three years ago for $3 million and which it currently rents out for $101,000. Rental rates are not expected to change going forward. In addition to using the warehouse, the project requires an upfront investment into machines and other equipment of $1.5 million. This investment can be fully depreciated straight-line over the next 10 years for tax purposes. However, Arnold Inc. expects to terminate the project at the end of eight years and to sell the machines and equipment for $468,000. Finally, the project requires an initial investment into net working capital equal to 10 percent of predicted first-year sales. Subsequently, net working capital is 10 percent of the predicted sales over the following year. Sales of protein bars are expected to be $4.5 million in the first year and to stay…arrow_forwardMercedes is considering upgrading their existing manufacturing line with state-of-the-art robotics. They will start with a pilot project at a single plant, and will assess profitability and potential scalability following the pilot. Your branch has been chosen as the pilot project test site, and you (the manager of the plant) need to assess your budget before launch the pilot. The installed cost of the new machinery is $200,000 and is expected to last for 10 years. The salvage value is expected to be $2.5×10,000 in today's dollars. Revenue is expected to increase by $40,000 while operating costs are expected to increase $5000 (both actual). Determine the present worth of the project, assuming an (actual) MARR of 12% , a CCA rate of 12% and a corporate tax rate of 25%arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning