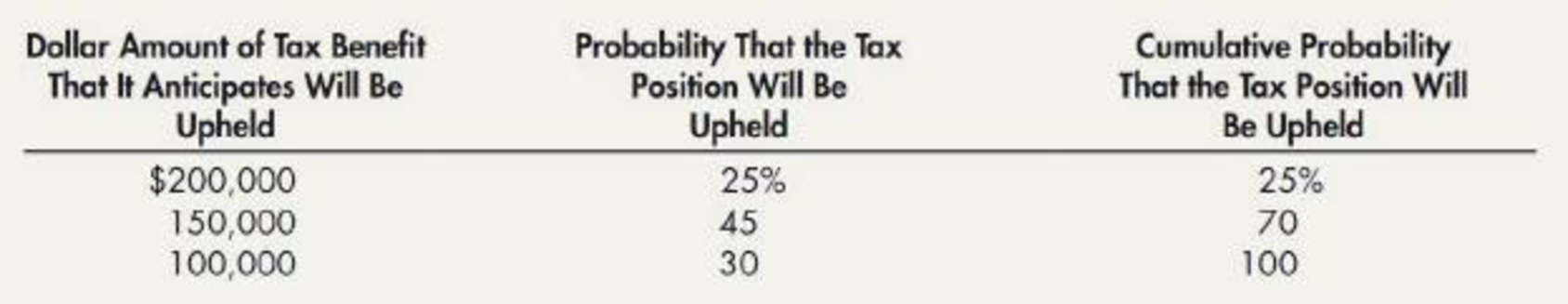

Uncertain Tax Position At the end of the current year, Boyd Company claims a $200,000 tax credit on its income tax return. Boyd is uncertain whether the IRS will accept this credit. It studies the IRS regulations and determines that it is more likely than not that the IRS will accept all or some of this tax credit. Based on this research, Boyd estimates the following probability distribution of possible outcomes:

Required:

For the current year, determine (1) the amount that Boyd will recognize as a current tax benefit and (2) the amount that it will record as the unrecognized tax benefit.

Want to see the full answer?

Check out a sample textbook solution

Chapter 18 Solutions

Intermediate Accounting: Reporting And Analysis

Additional Business Textbook Solutions

Auditing And Assurance Services

Advanced Financial Accounting

Fundamentals of Cost Accounting

INTERMEDIATE ACCOUNTING

Financial Accounting

FINANCIAL ACCT.FUND.(LOOSELEAF)

- How do the all events and economic performance requirements apply to the following transactions by an accrual basis taxpayer? a. The company guarantees its products for six months. At the end of 2019, customers had made valid claims for 600,000 that were not paid until 2020. Also, the company estimates that another 400,000 in claims from 2019 sales will be filed and paid in 2020. b. The accrual basis taxpayer reported 200,000 in corporate taxable income for 2019. The state income tax rate was 6%. The corporation paid 7,000 in estimated state income taxes in 2019 and paid 2,000 on 2018 state income taxes when it filed its 2018 state income tax return in March 2019. The company filed its 2019 state income tax return in March 2020 and paid the remaining 5,000 of its 2019 state income tax liability. c. An employee was involved in an accident while making a sales call. The company paid the injured victim 15,000 in 2019 and agreed to pay the victim 15,000 a year for the next nine years.arrow_forwardAs a tax consultant you receive on continuous basis inquiries and tax forms from your clients. Following are independent inquires that you have to check and reply back to your clients. For each enquiry below, Comment on whether the given calculations are correct or not by providing the necessary calculations. a-Government A decided to increase the income tax rate from 12% to 16% in year 2021. The total tax base for the year 2020 is $4,200,000. The government is expecting to collect $169,000 additional revenue in year 2021. Quarter of the individual taxpayers decided to quit. The government collected $ 169,000 additional tax revenue.arrow_forwardSpamela Hamderson Inc. reports the following pretax income (loss) for both financial reporting purposes and tax purposes. Year Pretax Income(Loss) Tax Rate 2018 $120,000 17 % 2019 90,000 17 % 2020 (280,000) 19 % 2021 300,000 19 % The tax rates listed were all enacted by the beginning of 2018. Assuming that based on the weight of available evidence, it is more likely than not that one-fourth of the benefits of the loss carryforward will not be realized, prepare the income tax section of the 2020 income statement, beginning with the line “Operating loss before income taxes.” (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)arrow_forward

- As of December 31, 2024, Duffy Company believed it was probable that an unfavorable outcome would result from a dispute with the Massachusetts State tax authorities. In-house tax experts estimated that Duffy would owe between $2113 - $4362 of additional taxes, with $3369 being the most likely amount. What is the journal entry, if any, that Duffy should record to reflect this in the 2024 financial statements? a. A journal entry is not booked since this is a gain contingency. b. Debit to Contingent Loss for $3369; Credit to Contingent Liability for $3369 c. Debit to Contingent Loss for $2113; Credit to Contingent Liability for $2113 d. Debit to Contingent Liability for $4362; Credit to Contingent Loss for $4362arrow_forwardNow assume that Syer does account for its NOL under the CARES Act. Prepare the appropriate journal entry to record Syer’s 2020 income taxes, and indicate Syer’s 2020 net income(loss). Syer Company reports net operating income (loss) for financial reporting and tax purposes in each year as follows ($ in millions): 2016 2017 2018 2019 2020 $ 330) $ 130 $ 0 $0 $ (660) Syer’s 2020 NOL is driven by an unfortunate obsolescence of its primary product. Given great uncertainty in Syer’s future profitability, Syer’s management does not believe it is more likely than not that it will be able to realize deferred tax assets in future years. Syer’s federal tax rate decreased from 35% to 21% starting in 2018.arrow_forwardHow do I answer this? Carrot Company has been profitable in the past and expects to remain profitable in the future. Carrot sells a product for which it provides a 5-year warranty. For financial reporting purposes, Carrot estimates its future warranty costs and records a warranty expense and liability at year-end, whereas for income tax purposes the company deducts its warranty costs when paid. At the beginning of the current year, Carrot had a deferred tax asset of $500 related to the warranty liability on its balance sheet. At the end of the current year, the company estimates that its ending warranty liability is $2,000 Carrot had current year taxable income of $10,000 and is subject to an enacted future tax rate of 30%. Prepare a schedule to compute Carrot's (a) ending future deductible amount, (b) ending deferred tax asset, and (c) change in deferred tax asset for the current year (deferred tax benefit). For those boxes in which you must enter subtractive or negative number, use…arrow_forward

- 1. A tax payer receives an assessment notice from the BIR informing him that his total deficiency tax is 25,000 that is due last April 15. Upon receiving the notice the tax payers immediately filed and pay his tax on August 15. How much would be the total amount due? 2. Income tax return for the calendar year 2019 was due for filing on April 15, 2021 but the tax payer voluntarily filed his return without assessment notice from the BIR on June 30, 2021. The tax due per return amounts to 280,000. How much would be the total amount due? 3. The taxpayer's 2020 income tax return is to be filed through authorized agent bank under the jurisdiction of RDO East Manila. Without prior authorization from the BIR, the taxpayer filed his tax return and paid the tax through the authorized agent bank under the jurisdiction of RDO Laoag City? The tax due per return is 100,000. How much would be the total amount due? 4. In connection with problem number 3, the taxpayer also filed his return 3 months…arrow_forwardHallick, Incorporated has a fiscal year ending June 30. Taxable income was $7,100,000 for its year ended June 30, 2018, and it projects similar taxable income for its 2023 fiscal year. Use 2017 tax rate schedule if needed. Required: a. Compute Hallick's regular tax liability for its June 30, 2018, tax year. b. Compute Hallick's projected regular tax liability for its June 30, 2023, tax year. Answer is complete but not entirely correct. a. Regular tax liability b. Projected regular tax liability $ 2,414,000 $ 1,491,000€arrow_forwardBlossom Inc reports the following pre-tax incomes (losses) for both financial reporting purposes and tax purposes Accounting Income Year (Loss) Tax Rate i 2021 $124,000 2022 91,000 2023 (287,000) 2024 218,000 The tax rates lated were all enacted by the beginning of 2021. Blossom reports under the ASPE future Income tavas method. Prepare the journal entries for each of the years 2021 to 2024 to record Income tax. Assume the texclosa la first carried back and that at the end of 2023, the loss carry forward benefits are judged more likely than not to be realized in the future. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem) Date Account Titles and Explanation (To record benefit from losa canryback) (To record deferred benefit from loss…arrow_forward

- IMPORTANT: PLEASE ANSWER CORRECTLY AND ILL LIKE THE QUESTION. Exercise 19-04 (Part Level Submission) Kingbird Company reports pretax financial income of $73,500 for 2020. The following items cause taxable income to be different than pretax financial income. 1. Depreciation on the tax return is greater than depreciation on the income statement by $17,600. 2. Rent collected on the tax return is greater than rent recognized on the income statement by $19,900. 3. Fines for pollution appear as an expense of $10,500 on the income statement. Kingbird’s tax rate is 30% for all years, and the company expects to report taxable income in all future years. There are no deferred taxes at the beginning of 2020.arrow_forwardAs the accountant for Monroe Trucking Company, you are preparing the company’s annual return, Form 940 andSchedule A. Use the following information to complete Form 940 and Schedule A on pages 5-52 to 5-54.The net FUTA tax liability for each quarter of 2019 was as follows: 1st, $97.00; 2nd, $87.00; 3rd, $69.70; and 4th,$59.50.Since the net FUTA tax liability did not exceed $500, the company was not required to make its first deposit ofFUTA taxes until January 31, 2020. Assume that the electronic payment was made on time.a. One of the employees performs all of his duties in another state—Louisiana.b. Total payments made to employees during calendar year 2019:Texas..........................$53,450Louisiana ...................22,150Total ..........................$75,600c. Employer contributions into employees’ 401(k) retirement plan: $1,250.d. Payments made to employees in excess of $7,000: $22,150.e. Form is to be signed by Vernon Scott, Vice President, and dated 1/31/20.f. Phone…arrow_forwardCurrent Attempt in Progress Sheridan Inc. reports the following pretax income Doss) for both financial reporting purposes and tax purposes. Year 2018 2019 2020 2021 The tax rates listed were all enacted by the beginning of 2018. (c) Prepare the journal entries for the years 2018-2021 to record income tax expense (benefit) and income taxes payable (refundable) and the tax effects of the loss carryforward, assuming that at the end of 2020 the benefits of the loss carryforward are judged more likely than not to be realized in the future. (Credit account titles are automatically indented when amount is entered Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts) 2018 Pretax Income (Loss) $128.000 96.000 (214.000) 310.000 2019 Date Account Titles and Explanation 2020 2021 Tax Rate 17 % 17% 19 % 19 % List of Accounts Safor Later Debit Credit Attempts:0 of 4 used Sub (b) The parts of this question must be completed in order. This…arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT