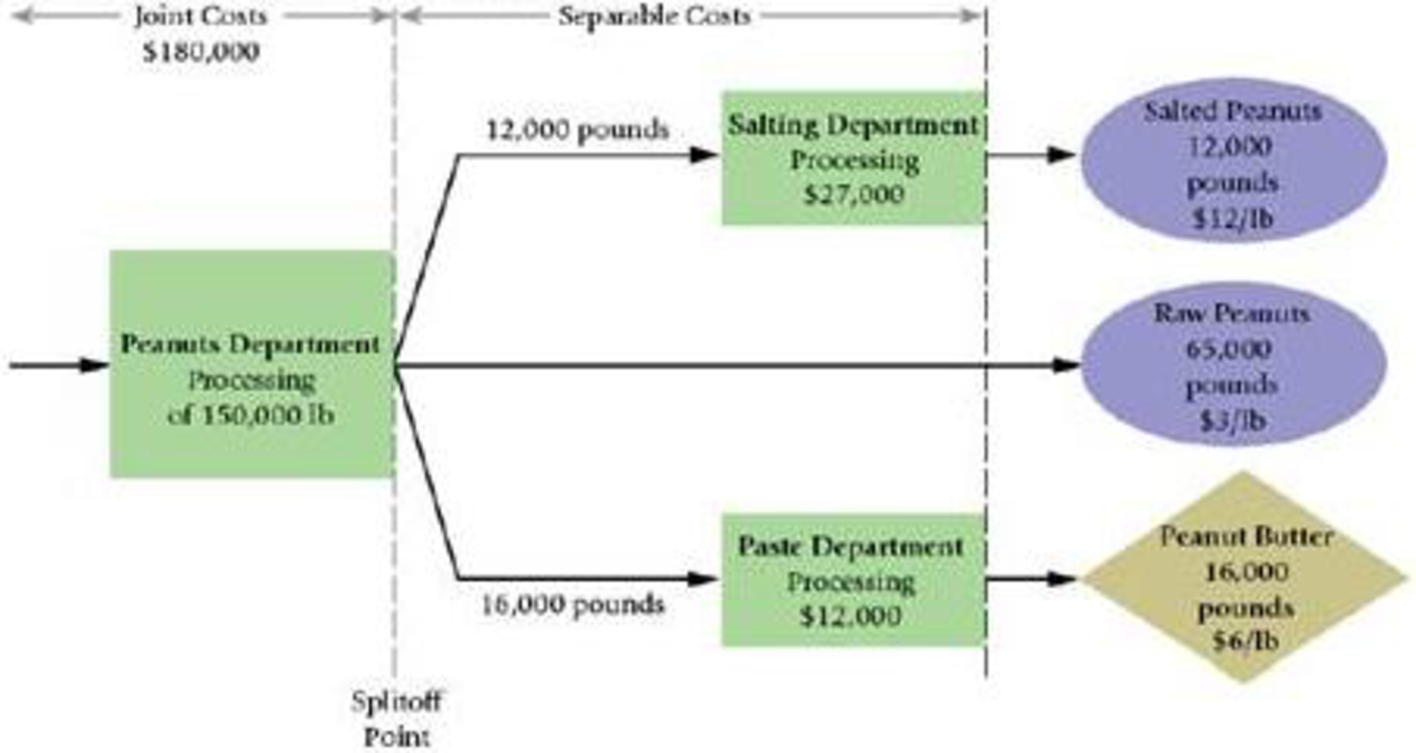

Joint costs and byproducts. (W. Crum adapted) Royston, Inc., is a large food-processing company. It processes 150,000 pounds of peanuts in the peanuts department at a cost of $180,000 to yield 12,000 pounds of product A, 65,000 pounds of product B, and 16,000 pounds of product C.

- Product A is processed further in the salting department at a cost of $27,000. It yields 12,000 pounds of salted peanuts, which are sold for $12 per pound.

- Product B (raw peanuts) is sold without further processing at $3 per pound.

- Product C is considered a byproduct and is processed further in the paste department at a cost of $12,000. It yields 16,000 pounds of peanut butter, which are sold for $6 per pound.

The company wants to make a gross margin of 10% of revenues on product C and needs to allow 20% of revenues for marketing costs on product C. An overview of operations follows:

- 1. Compute unit costs per pound for products A, B, and C, treating C as a byproduct. Use the NRV method for allocating joint costs. Deduct the NRV of the byproduct produced from the joint cost of products A and B.

Required

- 2. Compute unit costs per pound for products A, B, and C, treating all three as joint products and allocating joint costs by the NRV method.

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Chapter 16 Solutions

Cost Accounting (15th Edition)

Additional Business Textbook Solutions

Financial Accounting

Intermediate Accounting (2nd Edition)

Construction Accounting And Financial Management (4th Edition)

Financial Accounting, Student Value Edition (4th Edition)

Principles of Accounting Volume 2

- Thompson Industrial Products Inc. (TIPI) is a diversified industrial-cleaner processing company. The company's Dargan plant produces two products: a table cleaner and a floor cleaner from a common set of chemical inputs (CDG). Each week, 945,000 ounces of chemical input are processed at a cost of $213,000 into 630,000 ounces of floor cleaner and 315,000 ounces of table cleaner. The floor cleaner has no market value until it is converted into a polish with the trade name FloorShine. The additional processing costs for this conversion amount to $244,200, Floor Shine sells at $20 per 30-ounce bottle. The table cleaner can be sold for $21 per 25-ounce bottle. However, the table cleaner can be converted into two other products by adding 315,000 ounces of another compound (TCP) to the 315,000 ounces of table cleaner. This joint process will yield 315,000 ounces each of table stain remover (TSR) and table polish (TP). The additional processing costs for this process amount to $102,000. Both…arrow_forwardThompson Industrial Products Inc. (TIPI) is a diversified industrial-cleaner processing company. The company’s Dargan plant produces two products: a table cleaner and a floor cleaner from a common set of chemical inputs (CDG). Each week, 927,000 ounces of chemical input are processed at a cost of $212,100 into 618,000 ounces of floor cleaner and 309,000 ounces of table cleaner. The floor cleaner has no market value until it is converted into a polish with the trade name FloorShine. The additional processing costs for this conversion amount to $245,000.FloorShine sells at $18 per 30-ounce bottle. The table cleaner can be sold for $18 per 25-ounce bottle. However, the table cleaner can be converted into two other products by adding 309,000 ounces of another compound (TCP) to the 309,000 ounces of table cleaner. This joint process will yield 309,000 ounces each of table stain remover (TSR) and table polish (TP). The additional processing costs for this process amount to $109,000. Both…arrow_forwardThompson Industrial Products Inc. (TIPI) is a diversified industrial-cleaner processing company. The company’s Dargan plant produces two products: a table cleaner and a floor cleaner from a common set of chemical inputs (CDG). Each week, 927,000 ounces of chemical input are processed at a cost of $212,100 into 618,000 ounces of floor cleaner and 309,000 ounces of table cleaner. The floor cleaner has no market value until it is converted into a polish with the trade name FloorShine. The additional processing costs for this conversion amount to $245,000.FloorShine sells at $18 per 30-ounce bottle. The table cleaner can be sold for $18 per 25-ounce bottle. However, the table cleaner can be converted into two other products by adding 309,000 ounces of another compound (TCP) to the 309,000 ounces of table cleaner. This joint process will yield 309,000 ounces each of table stain remover (TSR) and table polish (TP). The additional processing costs for this process amount to $109,000. Both…arrow_forward

- Carla Vista Industrial Products Inc. is a diversified industrial-cleaner processing company. The company’s Dargan plant produces two products: a table cleaner and a floor cleaner from a common set of chemical inputs (CDG). Each week, 931,500 ounces of chemical input are processed at a cost of $207,300 into 621,000 ounces of floor cleaner and 310,500 ounces of table cleaner. The floor cleaner has no market value until it is converted into a polish with the trade name FloorShine. The additional processing costs for this conversion amount to $257,400.FloorShine sells at $20 per 30-ounce bottle. The table cleaner can be sold for $21 per 25-ounce bottle. However, the table cleaner can be converted into two other products by adding 310,500 ounces of another compound (TCP) to the 310,500 ounces of table cleaner. This joint process will yield 310,500 ounces each of table stain remover (TSR) and table polish (TP). The additional processing costs for this process amount to $106,000. Both table…arrow_forwardCarla Vista Industrial Products Inc. is a diversified industrial-cleaner processing company. The company’s Dargan plant produces two products: a table cleaner and a floor cleaner from a common set of chemical inputs (CDG). Each week, 931,500 ounces of chemical input are processed at a cost of $207,300 into 621,000 ounces of floor cleaner and 310,500 ounces of table cleaner. The floor cleaner has no market value until it is converted into a polish with the trade name FloorShine. The additional processing costs for this conversion amount to $257,400.FloorShine sells at $20 per 30-ounce bottle. The table cleaner can be sold for $21 per 25-ounce bottle. However, the table cleaner can be converted into two other products by adding 310,500 ounces of another compound (TCP) to the 310,500 ounces of table cleaner. This joint process will yield 310,500 ounces each of table stain remover (TSR) and table polish (TP). The additional processing costs for this process amount to $106,000. Both table…arrow_forwardCarla Vista Industrial Products Inc. is a diversified industrial-cleaner processing company. The company’s Dargan plant produces two products: a table cleaner and a floor cleaner from a common set of chemical inputs (CDG). Each week, 931,500 ounces of chemical input are processed at a cost of $207,300 into 621,000 ounces of floor cleaner and 310,500 ounces of table cleaner. The floor cleaner has no market value until it is converted into a polish with the trade name FloorShine. The additional processing costs for this conversion amount to $257,400.FloorShine sells at $20 per 30-ounce bottle. The table cleaner can be sold for $21 per 25-ounce bottle. However, the table cleaner can be converted into two other products by adding 310,500 ounces of another compound (TCP) to the 310,500 ounces of table cleaner. This joint process will yield 310,500 ounces each of table stain remover (TSR) and table polish (TP). The additional processing costs for this process amount to $106,000. Both table…arrow_forward

- Carina Company produces sanitation products after processing specialized chemicals; The following relates to its activities: 1 Kilogram of chemicals purchased for $2000 and with an additional $1000 is processed into 400 grams of Crystals and 80 litres of a Cleaning agent. At split-off, agram of Crystal can be sold for $1 and the Cleaning agent can be sold for $4 per litre. At an additional cost of $400, Carina can process the 400 grams of Crystal into 500 grams of Detergent that can be sold for $2 per gram. The 80 litres of Cleaning agent is packaged at an additional cost of $300 and made into 200 packs of Softener that can be sold for $2 per pack. Required:1. Allocate the joint cost to the Detergent and the Softener using the following: a. Sales value at split-off method b. NRV method 2. Should Carina have processed each of the products further? What effect does the allocation method have on this decision?arrow_forwardBrevall Industries makes corn oil and corn meal from harvested corn in a joint process. The corn oil can be further processed into margarine, and the corn meal can be further processed into corn muffin mix. The joint cost incurred to process the corn to the split-off point is $140,000. Information on the quantities, value, and further processing costs for the joint products appear below: Sales Value Estimated Further Sales Value Quantity At Split-off Processing Cost After Processing Corn Oil 800,000 lbs. $0.30/lb. $0.15/lb. $0.60/lb. Corn Meal 1,600,000 lbs. 0.10/lb. 0.46/lb. 0.55/lb. Brevall allocates the joint cost to the products based on the relative sales value at split-off point. How much joint cost should be assigned to the corn meal?…arrow_forwardBrevall Industries makes corn oil and corn meal from harvested corn in a joint process. Corn oil can be further processed into margarine, and the corn meal can be further processed into corn muffin mix. The joint cost incurred to process the corn to the split-off point is $140,000. Information on the quantities, value, and further processing costs for the joint product appears below: Sales Value Estimated Further Sales Value Quantity At Split-off Processing Cost After Processing Corn Oil 800,000 lbs. $0.30/lb. $0.35/lb. $0.60/lb. Corn Meal 1,600,000 lbs. 0.10/lb. 0.40/lb. 0.55/lb. Brevall allocates the joint cost to the products based on physical units. Corn oil is assigned $46,667 of joint cost and corn meal is assigned $93,333 of joint cost. Which…arrow_forward

- Caribu Company produces sanitation products after processing specialized chemicals; The following relates to its activities: 1 Kilogram of chemicals purchased for $2000 and with an additional $1000 is processed into 400 grams of Crystals and 80 litres of a Cleaning agent. At split-off, agram of Crystal can be sold for $1 and the Cleaning agent can be sold for $4 per litre. At an additional cost of $400, Caribu can process the 400 grams of Crystal into 500 grams of Detergent that can be sold for $2 per gram. The 80 litres of Cleaning agent is packaged at an additional cost of $300 and made into 200 packs of Softener that can be sold for $2 per pack. 1. Allocate the joint cost to the Detergent and the Softener using the following: a. Sales value at split-off method b. NRV method ] 2. Should Caribu have processed each of the products further? What effect does the allocation method have on this decision?arrow_forwardCarina Company produces sanitation products after processing specialized chemicals; Thefollowing relates to its activities: 1 Kilogram of chemicals purchased for $2000 and with an additional $1000 isprocessed into 400 grams of Crystals and 80 litres of a Cleaning agent. At split-off, agram of Crystal can be sold for $1 and the Cleaning agent can be sold for $4 per litre. At an additional cost of $400, Carina can process the 400 grams of Crystal into 500 grams of Detergent that can be sold for $2 per gram. The 80 litres of Cleaning agent is packaged at an additional cost of $300 and made into 200 packs of Softener that can be sold for $2 per pack. Required: 1. Allocate the joint cost to the Detergent and the Softener using the following: a. Sales value at split-off method b. NRV method 2. Should Carina have processed each of the products further? What effect does the allocationmethod have on this decision? Make full references to Question 1 when possiblearrow_forwardCarina Company produces sanitation products after processing specialized chemicals; Thefollowing relates to its activities: 1 Kilogram of chemicals purchased for $2000 and with an additional $1000 isprocessed into 400 grams of Crystals and 80 litres of a Cleaning agent. At split-off, agram of Crystal can be sold for $1 and the Cleaning agent can be sold for $4 per litre. At an additional cost of $400, Carina can process the 400 grams of Crystal into 500grams of Detergent that can be sold for $2 per gram. The 80 litres of Cleaning agent ispackaged at an additional cost of $300 and made into 200 packs of Softener that canbe sold for $2 per pack.Required:1. Allocate the joint cost to the Detergent and the Softener using the following:a. Sales value at split-off method b. NRV method 2. Should Carina have processed each of the products further? What effect does the allocation method have on this decision?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education