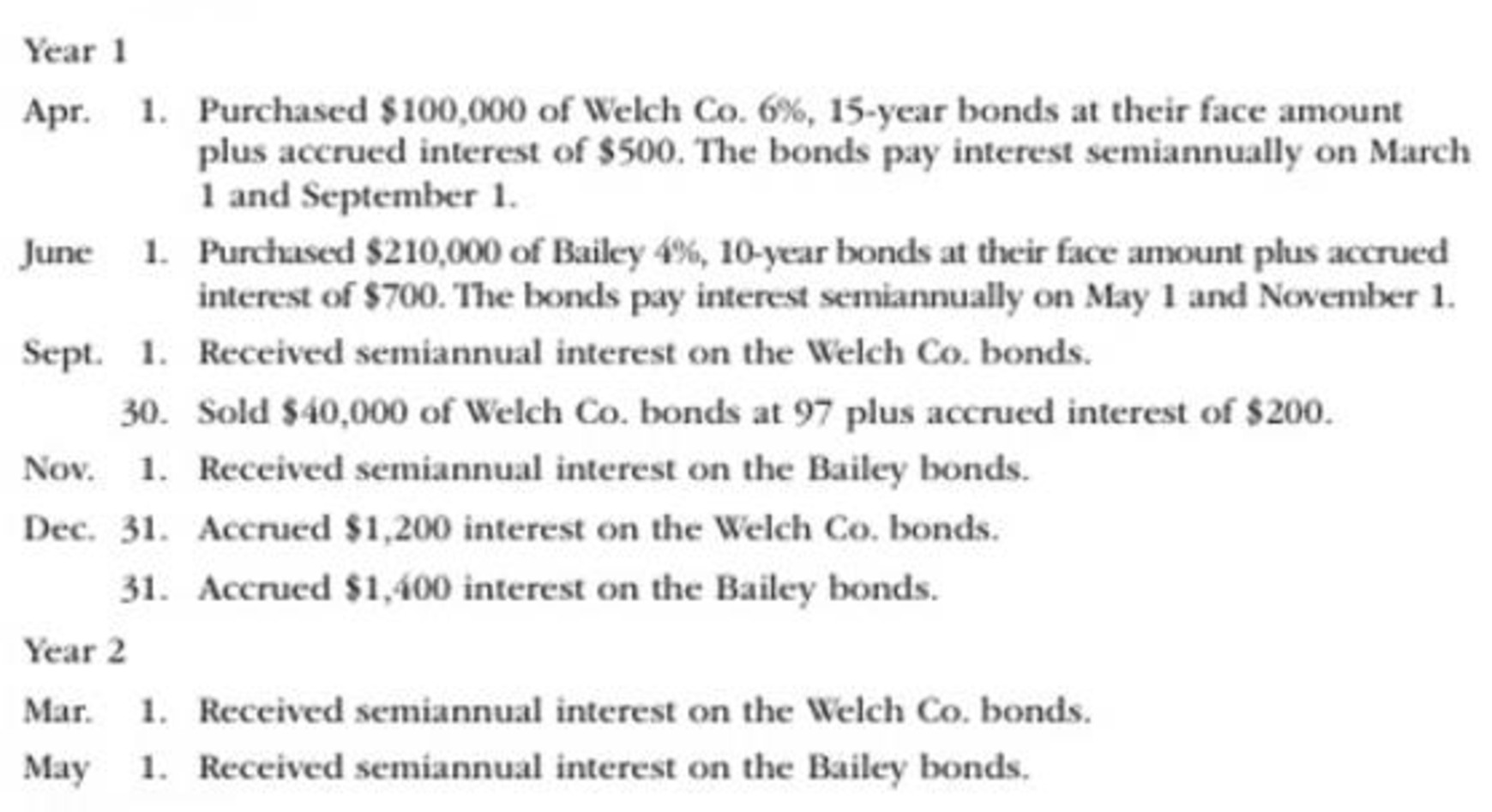

Soto Industries Inc. is an athletic footware company that began operations on January 1, Year 1. The following transactions relate to debt investments acquired by Soto Industries Inc., which has a fiscal year ending on December 31:

Instructions

- 1.

Journalize the entries to record these transactions. - 2. If the bond portfolio is classified as available for sale, what impact would this have on financial statement disclosure?

(1)

Journalize the bond investment transactions in the books of Company G.

Explanation of Solution

Bond investment: Bond investments are debt securities which pay a fixed interest revenue to the investor.

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare journal entry for purchase of $100,000 bonds of Company W, at face amount with an accrued interest of $500.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 1 | |||||

| April | 1 | Investments–Company W Bonds | 100,000 | ||

| Interest Receivable | 500 | ||||

| Cash | 100,500 | ||||

| (To record purchase of Company W bonds for cash) | |||||

Table (1)

- Investments–Company W Bonds is an asset account. Since bonds investments are purchased, asset value increased, and an increase in asset is debited.

- Interest Receivable is an asset account. Since interest to be received has increased, asset value increased, and an increase in asset is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Prepare journal entry for purchase of $210,000 bonds of Company B, at face amount with an accrued interest of $700.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 1 | |||||

| June | 1 | Investments–Company B Bonds | 210,000 | ||

| Interest Receivable | 700 | ||||

| Cash | 210,700 | ||||

| (To record purchase of Company B bonds for cash) | |||||

Table (2)

- Investments–Company B Bonds is an asset account. Since bonds investments are purchased, asset value increased, and an increase in asset is debited.

- Interest Receivable is an asset account. Since interest to be received has increased, asset value increased, and an increase in asset is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Prepare journal entry to record the interest revenue received from Company W bonds.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 1 | |||||

| September | 1 | Cash | 3,000 | ||

| Interest Receivable | 500 | ||||

| Interest Revenue | 2,500 | ||||

| (To record receipt of interest revenue) | |||||

Table (3)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Interest Receivable is an asset account. Since interest to be received is received, asset value decreased, and a decrease in asset is credited.

- Interest Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

Working Notes:

Compute amount of interest received from Company W.

Prepare journal entry for $40,000 bonds of Company W sold at 97%, with an accrued interest of $200.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 1 | |||||

| September | 30 | Cash | 39,000 | ||

| Loss on Sale of Investments | 1,200 | ||||

| Interest Revenue | 200 | ||||

| Investments–Company W Bonds | 40,000 | ||||

| (To record sale of M City bonds) | |||||

Table (3)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Loss on Sale of Investments is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Interest Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

- Investments–Company W Bonds is an asset account. Since bond investments are sold, asset value decreased, and a decrease in asset is credited.

Working Notes:

Calculate the cash received from the sale of bonds.

| Particulars | Amount ($) |

| Cash proceeds from sale of $40,000 bonds | 38,800 |

| Add: Accrued interest revenue | 200 |

| Cash received | $39,000 |

Table (4)

Calculate the realized gain (loss) on sale of $40,000 bonds.

| Particulars | Amount ($) |

| Cash proceeds from sale of $40,000 bonds | 38,800 |

| Cost of bonds sold | (40,000) |

| Gain (loss) on sale of bonds | $(1,200) |

Table (5)

Prepare journal entry to record the interest revenue received from Company B bonds.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 1 | |||||

| November | 1 | Cash | 4,200 | ||

| Interest Receivable | 700 | ||||

| Interest Revenue | 3,500 | ||||

| (To record receipt of interest revenue) | |||||

Table (6)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Interest Receivable is an asset account. Since interest to be received is received, asset value decreased, and a decrease in asset is credited.

- Interest Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

Working Notes:

Compute amount of interest received from Company B.

Prepare journal entry for accrued interest.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 1 | |||||

| December | 31 | Interest Receivable | 1,200 | ||

| Interest Revenue | 1,200 | ||||

| (To record interest accrued) | |||||

Table (7)

- Interest Receivable is an asset account. Since interest to be received has increased, asset value increased, and an increase in asset is debited.

- Interest Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

Prepare journal entry for accrued interest.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 1 | |||||

| December | 31 | Interest Receivable | 1,400 | ||

| Interest Revenue | 1,400 | ||||

| (To record interest accrued) | |||||

Table (8)

- Interest Receivable is an asset account. Since interest to be received has increased, asset value increased, and an increase in asset is debited.

- Interest Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

Prepare journal entry to record the interest revenue received from Company W bonds.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 2 | |||||

| May | 1 | Cash | 1,800 | ||

| Interest Receivable | 1,200 | ||||

| Interest Revenue | 600 | ||||

| (To record receipt of interest revenue) | |||||

Table (9)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Interest Receivable is an asset account. Since interest to be received is received, asset value decreased, and a decrease in asset is credited.

- Interest Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

Working Notes:

Compute amount of interest received from Company W.

Prepare journal entry to record the interest revenue received from Company B bonds.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 2 | |||||

| May | 1 | Cash | 4,200 | ||

| Interest Receivable | 1,400 | ||||

| Interest Revenue | 1,800 | ||||

| (To record receipt of interest revenue) | |||||

Table (10)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Interest Receivable is an asset account. Since interest to be received is received, asset value decreased, and a decrease in asset is credited.

- Interest Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

Working Notes:

Compute amount of interest received from Company B.

(2)

Explain the impact of bonds, if the portfolio is classified as available-for-sale investment.

Explanation of Solution

Available-for-sale investments are reported at fair value. If the bond portfolio is classified as available-for-sale investment, the bond portfolio should be reported at fair value. The changes in the cost and fair value would be adjusted using the valuation account and unrealized gain (loss) account.

Want to see more full solutions like this?

Chapter 15 Solutions

Financial Accounting

- Rekya Mart Inc. is a general merchandise retail company that began operations on January 1, Year 1. The following transactions relate to debt investments acquired by Rekya Mart Inc., which has a fiscal year ending on December 31: Instructions 1. Journalize the entries to record these transactions. 2. If the bond portfolio is classified as available for sale, what impact would this have on financial statement disclosure?arrow_forwardRios Financial Co. is a regional insurance company that began operations on January 1, Year 1. The following transactions relate to trading securities acquired by Rios Financial Co., which has a fiscal year ending on December 31: Instructions 1. Journalize the entries to record these transactions. 2. Prepare the investment-related current asset balance sheet presentation for Rios Financial Co. on December 31, Year 2. 3. How are unrealized gains or losses on trading investments presented in the financial statements of Rios Financial Co.?arrow_forwardEntries for investment in bonds, interest and sale of bondsThe following bond investment transactions were completed during arecent year by Starks Company: a. Journalize the entries for these transactions.b. Provide the December 31, Year 1, adjusting journal entry forsemiannual interest earned on the bonds.arrow_forward

- You are in charge of auditing PLM (PopoyLangMalakas) Company's investment accounts for the year ended December 31, 2021, which was incorporated last March 3, 2020. During the course of the audit, you have obtained the balances and the related journal entries of its investment related transactions and have revealed the following information: Investment in Bonds P101,258 Investment in Stocks 62,400 Total P163,658 Journal Entries: Investment in bonds - 10% treasury bonds from the Banko Sentral ng Pilipinas. The investment is in a portfolio which has the objective of collecting contractual cash flows. Date Account Debit Credit July 1, 2020 Investment in BSP bonds 105, 242 Cash 105, 242 To record the acquisition of P100,000 face value BSP bonds December 31, 2020 Unrealized Gain / (Loss) on market changes 2,242 Investment in BSP bonds…arrow_forwardYou are in charge of auditing PLM (PopoyLangMalakas) Company's investment accounts for the year ended December 31, 2021, which was incorporated last March 3, 2020. During the course of the audit, you have obtained the balances and the related journal entries of its investment related transactions and have revealed the following information: Investment in Bonds P101,258 Investment in Stocks 62,400 Total P163,658 Journal Entries: Investment in bonds - 10% treasury bonds from the Banko Sentral ng Pilipinas. The investment is in a portfolio which has the objective of collecting contractual cash flows. Date Account Debit Credit July 1, 2020 Investment in BSP bonds 105, 242 Cash 105, 242 To record the acquisition of P100,000 face value BSP bonds December 31, 2020 Unrealized Gain / (Loss) on market changes 2,242 Investment in BSP bonds…arrow_forwardGecko Investments has the following data regarding their debt investments as of December 31, 2021: Original Cost Amortized Cost Market Value Trading Bonds 95 96 97 Available for Sale Bonds 95 96 97 Held-to-Maturity Bonds 95 96 97 1. What is the total amount of gain or loss to be reported as part of other comprehensive income? Give both the amount and whether it is a gain or loss.arrow_forward

- Prepare Natura Company's journal entries to record the following transactions involving its short-term investments in held-to-maturity debt securities, all of which occurred during the current year. a. On June 15, paid $180,000 cash to purchase Remed's 90-day short-term debt securities ($180,000 principal), dated June 15, that pay 7% interest. b. On September 16, received a check from Remed in payment of the principal and 90 days' interest on the debt securities purchased in transaction a. Note: Use 360 days in a year. Do not round your intermediate calculations. View transaction list Journal entry worksheet < 1 2 On June 15, paid $180,000 cash to purchase Remed's 90-day short-term debt securities ($180,000 principal), dated June 15, that pay 7% interest. Note: Enter debits before credits. Transaction a. Record entry General Journal Clear entry Debit Credit View general journalarrow_forward(a.) Prepare any journal entries you consider necessary, including year end entries (December 31), assuming these investments are managed to profit from changes in market interest rates (held for trading). Mayor Company doesn’t have debt investment before 2020. (b.) Prepare a partial statement of financial position showing the Investment account at December 31, 2020. (c.) If Mayor Company purchase the debt investment to collect the contractual cash flow (held the debt investment to maturity), explain how the journal entries would differ from those in part (a).arrow_forwardThe following information pertains to BARU NUTS Company's issuance of bonds on July 1, 2021: What should be the issue price of the bonds? ANSWER IN GOOD ACCOUNTING FORM. THANK YOU :)arrow_forward

- Prepare Natura Company's journal entries to record the following transactions involving its short-term investments in held-to-maturity debt securities, all of which occurred during the current year. a. On June 15, paid $114,000 cash to purchase Remed's 90-day short-term debt securities ($114,000 principal), dated June 15, that pay 9% interest. b. On September 16, received a check from Remed in payment of the principal and 90 days' interest on the debt securities purchased in transaction a. (Use 360 days in a year. Do not round your intermediate calculations.) View transaction list Journal entry worksheet 1 2 On June 15, paid $114,000 cash to purchase Remed's 90-day short-term debt securities ($114,000 principal), dated June 15, that pay 9% interest. Note: Enter debits before credits. Transaction a. Record entry General Journal Clear entry Debit Credit View general journalarrow_forward1a) What was the issue price on January 1 of this year? 1b) What amount of interest expense should be recorded on June 30 and December 31 of this year? 1c) What amount of cash is owed to investors on June 30 and December 31 of this year? 1d) What is the book value of the bonds on December 31 of this year? December 31 of next year? Required information [The following information applies to the questions displayed below.] On January 1 of this year, Nowell Company issued bonds with a face value of $290,000 and a coupon rate of 7.5 percent. The bonds mature in five years and pay interest semiannually every June 30 and December 31. When the bonds were sold, the annual market rate of interest was 7.5 percent. (FV of $1, PV of $1, FVA of $1, and PVA of $1) Note: Use appropriate factor(s) from the tables provided.arrow_forwardPrepare journal entries to record the following transactions involving short-term debt investments. a. On May 15, paid $100 cash to purchase Muni’s 120-day short-term debt securities ($100 principal), dated May 15, that pay 6% interest (categorized as held-to-maturity securities). b. On September 13, received a check from Muni in payment of the principal and 120 days’ interest on the debt securities purchased in transaction a.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning