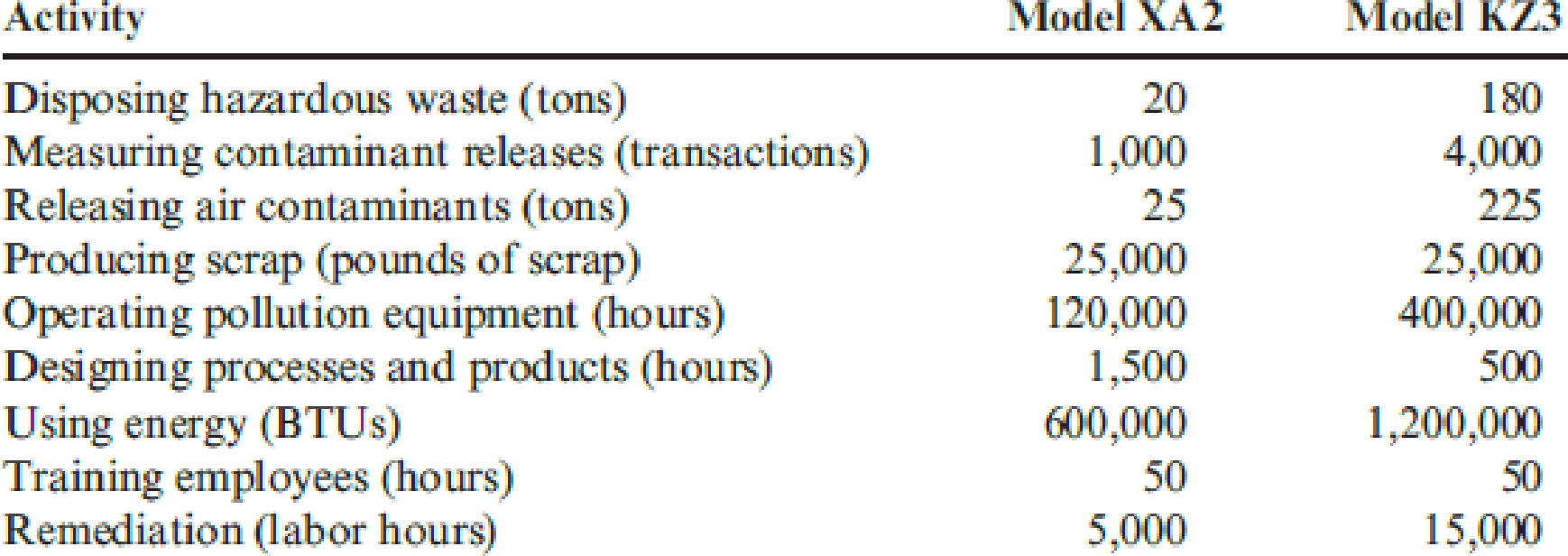

Refer to Problem 14.43. In 20x3, Jack Carter, president of Kartel, requested that environmental costs be assigned to the two major products produced by the company. He felt that knowledge of the environmental product costs would help guide the design decisions that would be necessary to improve environmental performance. The products represent two different models of a cellular phone (Model XA2 and Model KZ3). The models use different processes and materials. To assign the costs, the following data were gathered for 20x3:

During 20x3, Kartel’s division produced 200,000 units of Model XA2 and 300,000 units of Model KZ3.

Required:

- 1. Using the activity data, calculate the environmental cost per unit for each model. How will this information be useful?

- 2. Upon examining the cost data produced in Requirement 1, an environmental engineer made the following suggestions: (1) substitute a new plastic for a material that appeared to be the source of much of the hazardous waste (the new material actually cost less than the contaminating material it would replace), and (2) redesign the processes to reduce the amount of air contaminants produced.

As a result of the first suggestion, by 20x5, the amount of hazardous waste produced had diminished to 50 tons, 10 tons for Model XA2 and 40 tons for Model KZ3. The second suggestion reduced the contaminants released by 50 percent by 20x5 (15 tons for Model XA2 and 110 tons for Model KZ3). The need for pollution equipment also diminished, and the hours required for operating this equipment for Model XA2 and Model KZ3 were reduced to 60,000 and 200,000, respectively. Calculate the unit cost reductions for the two models associated with the actions and outcomes described (assume the same production as in 20x3). Do you think the efforts to reduce the environmental cost per unit were economically justified? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Kagle design engineers are in the process of developing a new green product, one that will significantly reduce impact on the environment and yet still provide the desired customer functionality. Currently, two designs are being considered. The manager of Kagle has told the engineers that the cost for the new product cannot exceed 550 per unit (target cost). In the past, the Cost Accounting Department has given estimated costs using a unit-based system. At the request of the Engineering Department, Cost Accounting is providing both unit-and activity-based accounting information (made possible by a recent pilot study producing the activity-based data). Unit-based system: Variable conversion activity rate: 100 per direct labor hour Material usage rate: 20 per part ABC system: Labor usage: 15 per direct labor hour Material usage (direct materials): 20 per part Machining: 75 per machine hour Purchasing activity: 150 per purchase order Setup activity: 3,000 per setup hour Warranty activity: 500 per returned unit (usually requires extensive rework) Customer repair cost: 25 per repair hour (average) Required: 1. Select the lower-cost design using unit-based costing. Are logistical and post-purchase activities considered in this analysis? 2. Select the lower-cost design using ABC analysis. Explain why the analysis differs from the unit-based analysis. 3. What if the post-purchase cost was an environmental contaminant and amounted to 10 per unit for Design A and 40 per unit for Design B? Assume that the environmental cost is borne by society. Now which is the better design?arrow_forwardMozaic Inc. has decided to introduce a new product, which can be manufactured by either a computer-assisted manufacturing system (CAM) or a labor-intensive production system (LIP). The manufacturing method will not affect the quality of the product. The estimated manufacturing costs by the two methods are as follows: www CAM System LIP System Direct Material $5.00 $5.60 Direct Labor (DLH) 0.5 DLH x $12 $6.00 0.8 DLH x $9 $7.20 Variable Overhead 0.5 DLH x $6 $3.00 0.8 DLH x $6 $4.80 Fixed Overhead* $2,440,000 $1,320,000 * These costs are directly traceable to the new product line. They would not be incurred if the new product were not produced. The company's marketing research department has recommended an introductory unit sales price of $30. Selling expenses are estimated to be $500,000 annually plus $2 for each unit sold. (Ignore income taxes.) Required: 1. Describe the circumstances under which the firm should employ each of the two manufacturing methods. 2. Identify some business…arrow_forwardAs you learned in the previous chapters, Current Designs has two main product lines-composite kayaks, which are handmade and very labor-intensive, and rotomolded kayaks, which require less labor but employ more expensive equipment. Current Designs' controller, Diane Buswell, is now evaluating several different methods of assigning overhead to these products. It is important to ensure that costs are appropriately assigned to the company's products. At the same time, the system that is used must not be so complex that its costs are greater than its benefits. Diane has decided to use the following activities and costs to evaluate the methods of assigning overhead. Activities Designing new models Creating and testing prototypes Creating molds for kayaks Cost $124,000 144,000 182,000 Operating oven for the rotomolded kayaks 41,000 Operating the vacuum line for the composite kayaks 28,000 Supervising production employees 168,000 Curing time (the time that is needed for the chemical processes…arrow_forward

- Perez Industries produces two electronic decoders, P and Q. Decoder P is more sophisticated and requires more programming and testing than does Decoder Q. Because of these product differences, the company wants to use activity-based costing to allocate overhead costs. It has identified four activity pools. Relevant information follows: b. Determine the overhead cost allocated to each product.arrow_forwardI am doing an activity table on ovens. I know the formula is: activity pool cost / activity base = activity rate 63237 / 370 =171 when I do this and get my numbers the system to input out findings says my numbers are wrong. we use the cengage. I don't know what I am doing wrong? I have pasted the numbers below. Please help. Beth McDonald Caldwell Home Appliances Inc. is estimating the activity cost associated with producing ovens and refrigerators. The indirect labor can be traced into four separate activity pools, based on time records provided by the employees. The budgeted activity cost and activity-base information are provided as follows: 1 Activity Activity Pool Cost Activity Base 2 Procurement $63,237.00 Number of purchase orders 3 Scheduling 3,933.00 Number of production orders 4 Materials handling 13,032.00 Number of moves 5 Product development 7,035.00 Number of engineering changes 6 Total cost…arrow_forwardData Master is a computer software consulting company. Its three major functional areas are computer programming, information systems consulting, and software training. Cynthia Moore, a pricing analyst in the Accounting Department, has been asked to develop total costs for the functional areas. These costs will be used as a guide in pricing a new contract. In computing these costs, Moore is considering three different methods of allocating overhead costs: the direct method, the step method, and the reciprocal method. Moore assembled the following data on overhead from its two service departments, the Information Systems Department and the Facilities Department. Service Departments User Departments Info Systems Facilities Computer Program Consulting $ 50,000 $110,000 600 $25,000 400 $75,000 1,100 400,000 200,000 600,000 information systems are allocated on the basis of hours of computer usage; facilities are allocated on the basis of floor space. Required: Allocate the service…arrow_forward

- Data Master is a computer software consulting company. Its three major functional areas are computer programming, information systems consulting, and software training. Cynthia Moore, a pricing analyst in the Accounting Department, has been asked to develop total costs for the functional areas. These costs will be used as a guide in pricing a new contract. In computing these costs, Moore is considering three different methods of allocating overhead costs-the direct method, the step method, and the reciprocal method. Moore assembled the following data on overhead from its two service departments, the Information Systems Department and the Facilities Department. Service Departments User Departments Info Systems Facilities Computer Program Consult Training Total Budgeted Overhead $ 50,000 $ 25,000 $ 75,000 $ 110,000 $ 85,000 $ 345,000 Info Systems (hrs.) 400 1,100 600 900 3,000 Facilities (Square feet) 200,000…arrow_forward3) Data Master is a computer software consulting company. Its three major functional areas are computer programming, information systems consulting, and software training. Cynthia Moore, a pricing analyst in the Accounting Department, has been asked to develop total costs for the functional areas. These costs will be used as a guide in pricing a new contract. In computing these costs, Moore is considering three different methods of allocating overhead costs: the direct method, the step method, and the reciprocal method. Moore assembled the following data on overhead from its two service departments, the Information Systems Department and the Facilities Department. Budgeted Overhead Service Departments User Departments Info Systems Facilities Computer Consulting Training Program $ 50,000 $ 25,000 $75,000 $110,000 $85,000 $ 345,000 Info Systems (hours) Facilities 200,000 (Square feet) Direct Cost Info System Facilities Total 400 1,100 400,000 600 900 Computer Program the Information…arrow_forward(b) Allocate MOH costs to the three products using the activity rates given. Total applied MOH Small Mouse Medium Mouse Large Mousearrow_forward

- Mariah Enterprises makes a variety of consumer electronic products. Its camera manufacturing plant is considering choosing between two different processes, named Alpha and Beta, which can be used to make two component parts A and B. To make the correct decision, the managers would like to compare the labor and multifactor productivity of process Alpha with that of process Beta. The value of process output for component A and B are $175 and $140 per unit, respectively. The corresponding overhead costs are $6,000 and $5,000, respectively. Process Alpha Process Beta Product A B C D Output (units) 50 60 30 80 Labor ($) $1,200 $1,400 $1,000 $2,000 Material ($) $2,500 $3,000 $1,400 $3,500 a. Which process, Alpha or Beta, is more productive? b. What conclusions can you draw from your analysis?arrow_forwardThe owner of Nia Systems suspects her allocation of indirect costs could be giving misleading results, so she decides to develop an ABC system. She identifies three activities: documentation preparation, information technology support, and training. She figures that documentation costs are driven by the number of pages, information technology support costs are driven by the number of software applications used, and training costs are driven by the number of direct labor hours worked.Estimates of the costs and quantities of the allocation bases follow: Activity Estimated Costs Allocation Base Estimated Quantity of Allocation Base Documentation preparation $47,400 Pages 1,530 pages Information technology support $120,600 Applications 700 applications Training $354,800 Direct labor hours 3,240 hours Total Indirect costs $522,800 1. Compute the predetermined overhead allocation rate for each activity. Round to the nearest dollar. Activity Total estimated overhead…arrow_forwardThe managers of Kingbird were determined to reduce product costs for the three versions of wireless mouses they carried-small, medium, and large-to be more competitive. All three product types went through production and packaging and generated the need for factory maintenance. The activity rates for these three key activities are as follows. Production Packaging Maintenance MOH rates $13 per DL hour $4 per packaging hour $2 per machine hour The following resources were consumed for the production of each type of mouse. Direct labour hours used Packaging hours used Machine hours used Units produced (b) Small Medium Large 4,400 3,800 Total applied MOH 2,500 4,600 32,000 Your answer is correct. 6,500 3,400 5,200 4,600 39,000 29,000 Allocate MOH costs to the three products using the activity rates given. 4,800 Small Mouse 68600 tA Medium Mouse 108500 Large Mouse 85600arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning