Concept explainers

The preference of one alternative out of the three based on economic criteria by using the present worth, equivalent annual cost, benefit-cost ratio and rate of return methods.

Answer to Problem 14P

Alternative 3- Intersection widening

Explanation of Solution

Given:

Analysis period = 20 years

Annual interest rate = 15 percent

Calculation:

Determine the present worth of alternative 1 (Traffic signals):

Determine the present worth of alternative 2 (Intersection widening):

Determine the present worth of alternative 3 (Grade separation):

The project with the highest present worth is alternative 2.

Determine the equivalent annual cost of alternative 1 (Traffic signals):

Determine the equivalent annual cost of alternative 2 (Intersection widening):

Determine the equivalent annual cost of alternative 3 (Grade separation):

The project with the highest equivalent annual costis alternative 2.

Determine the benefit-cost ratioof alternative 1 (Traffic signals):

Determine the benefit-cost ratio of alternative 2 (Intersection widening):

Since BCR >1, we would select Alternative 2.

Determine the benefit-cost ratio of alternative 3 (Grade separation):

Since BCR is less than 1, we would not select Alternative 3

Determine the benefit-cost ratio of alternative 2 with respect to 1:

We reachthe same conclusion as previously, which is to select Alternative 2

Determine the rate of return (ROR)of alternative 1versus 2:

It is very difficult to solve this explicitly for i. By trial and error, we can easily find the i that makes the right side of the equation equal to the left side.

Try

For

Then, we can try

Since ROR is greater than 15 percent, we select Alternative 2

Determine the rate of return (ROR) of alternative 3 versus 1:

By trial and error, we can easily find the i that makes the right side of the equation equal to the left side.

Try

For

By interpolation 11.428 % is the rate of return to make the left side to equal to the right side.

Since the ROR is lower than 15 percent, we discard Alternative 3.

Conclusion:

The second alternative i.e. Intersection widening is selected by using the three economic methods.

Want to see more full solutions like this?

Chapter 13 Solutions

Traffic and Highway Engineering

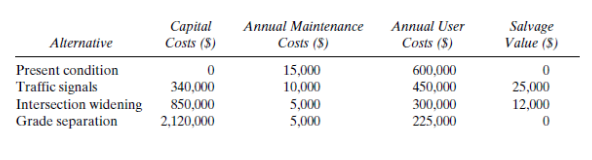

- The City of Gainesville and FDOT, in an attempt to proactively address the growing need for capacity in the western area of Gainesville, has identified a potential alignment for a new freeway to UF campus. The FDOT district has contracted you to design this new freeway and identify any additional concerns with this potential freeway. Note that this is an open question, and you may need to make the following assumptions during your work: Lane width (e.g., 12 ft. or 11 ft) Shoulder width (e.g., 6 ft.) Interchange density (e.g., 1 interchange/2 miles) Number of lanes (e.g., 3 or 2 lanes each direction) Hourly volume V= * D*AADT (e.g., =10%, directional distribution D=50%) A design structural number (e.g., SN= 5.0) The following traffic characteristics are expected on this freeway: AADT=30,000 veh PHF=0.95 85% passenger cars Two 2-kip single axles 7% RVs One 10-kip single axle One 24-kip tandem axle 5% single-unit trucks One 12-kip single axle Two 32-kip tandem axles 3% tractor-trailer…arrow_forwardThe Department of Traffic is considering three improvement plans for a heavily traveled intersection within the city. The intersection improvement is expected to achieve three goals: improve travel speeds, increase safety, and reduce operating expenses for motorists. The annual dollar value of savings compared with existing conditions for each criterion as well as additional construction and maintenancecosts is shown in the table below. If the economic life of the road is considered to be 60 years and the discount rate is 3.5%, which alternative should be selected? Solve the problem using the four methods for economic analysis.arrow_forwardWhat are the main considerations when a new interchange is proposed? List the main considerations and briefly discuss each one.arrow_forward

- Create a new highway design. Choose any area of the Philippines where you believe a road infrastructure would be necessary to enhance the city's or province's current transportation system and stimulate the local economy. This study must include the following: - Considering alignment, cross-section, pavement design, signage use, and safety features during design or improvement. -Create a maintenance and rehabilitation plan for the new highway you propose, or for the proposed renovation of the current highway.arrow_forwardWhat is the lane distribution factor recommended by the AASHTO design guide for a 6-lane highway (3 lanes in each direction)? Group of answer choices a. 80-100% b. 60-80% c. 50-75% d. 70-90%arrow_forwardEvaluate common highway faults and highlight effective maintenance regimes as preventative measuresarrow_forward

- An urban freeway presently has three 12-ft lanes on a 3 percent upgrade 1.75 mi long. The traffic includes 8 percent trucks and buses (recreational vehicles are negligible). There are no lateral obstructions. Design speed is 70 MPH. (a) What is the present capacity of the upgrade? (b) How much could the capacity be increased by widening and remarking the existing traveled way to provide four 10-ft lanes up the grade?arrow_forwardDiscuss techniques and methods which can improve the effectiveness and conditions of a highwayarrow_forwardA state toll highway authority is planning to expand the pavement deflection monitoring program for its 500 miles of toll highways. The requirements state that a 20 percent change in pavement deflection should be detectable in at least 9 out of every 10 tests. If the state authority currently monitors 100, 1-mile-long segments, determine the expansion needed in its deflection program to comply with the new requirements.arrow_forward

- List five conditions (i.e., “triggers”) under which a traffic impact analysis report would be prepared for a proposed site development:arrow_forward4. TXDOT is working on the design of I-69 north of Victoria. They project a demand volume of 52,000 vehicles per day with a K factor of 0.12 and a directional distribution of 56/44 in level terrain with a target LOS of B and 17% trucks and buses. They plan to have roughly one diamond interchange every 2 miles. What number of lanes is required to achieve these design requirements? What LOS would occur for a typical 4-lane rural interstate design? DHV = AADT * K * D DHV – design hourly volume AADT - average annual daily traffic K- peak hour adjustment factor D- directional distribution (make design conservative)arrow_forwardThe Pokuase Interchange is a newly commissioned four-tier interchange that connects the Nsawam Road to the George Walker Bush Highway. The Road Ministry and the Ghana Police Service are worried about hawkers, passengers that are likely to board vehicles at prescribed venues, road fittings thieves as well as the indiscriminate use of the roads by both drivers and commuters. As a planner, identify and justify the use of a planning theory or theories that you would recommend to ensure safe and efficient use of the road.arrow_forward

Traffic and Highway EngineeringCivil EngineeringISBN:9781305156241Author:Garber, Nicholas J.Publisher:Cengage Learning

Traffic and Highway EngineeringCivil EngineeringISBN:9781305156241Author:Garber, Nicholas J.Publisher:Cengage Learning