Concept explainers

Use the information presented in Problem C-1 to solve this problem.

Required

Find the cost of the ending inventory by the last-in, first-out method.

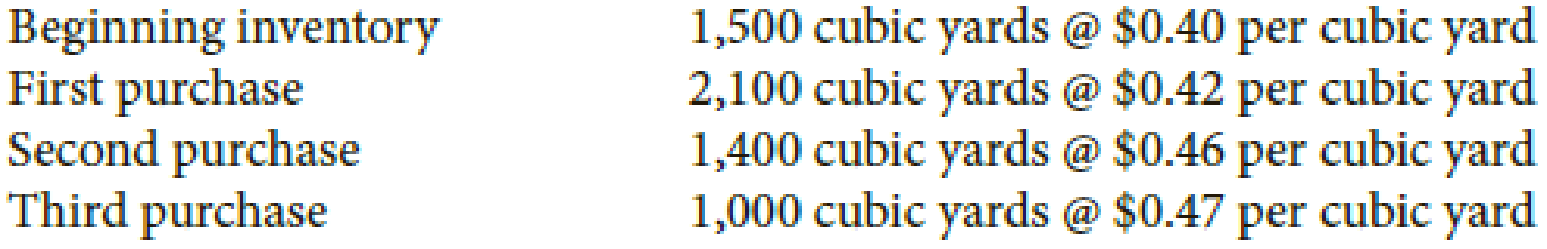

PROBLEM C-1 Bean Nursery sells bark to its customers at retail. Bean buys bark from a plywood mill in bulk and transports the bark in its own trucks. Information relating to the beginning inventory and purchases of bark is as follows:

Required

Find the cost of 1,200 cubic yards in the ending inventory by the weighted-average-cost method. Carry average cost per cubic yard to four decimals.

Check Figure

Cost of ending inventory, $480

Want to see the full answer?

Check out a sample textbook solution

Chapter C Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Advanced Financial Accounting

Managerial Accounting

Principles Of Taxation For Business And Investment Planning 2020 Edition

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Financial Accounting

Accounting for Governmental & Nonprofit Entities

- Use the information presented in Problem C-1 to solve this problem. Bean Nursery sells bark to its customers at retail. Bean buys bark from a plywood mill in bulk and transports the bark in its own trucks. Information relating to the beginning inventory and purchases of bark is as follows: Required Find the cost of the ending inventory by the first-in, first-out method. Check Figure Cost of ending inventory, $562arrow_forwardBean Nursery sells bark to its customers at retail. Bean buys bark from a plywood mill in bulk and transports the bark in its own trucks. Information relating to the beginning inventory and purchases of bark is as follows: Required Find the cost of 1,200 cubic yards in the ending inventory by the weighted-average-cost method. Carry average cost per cubic yard to four decimals. Check Figure Cost of ending inventory, 519.24arrow_forwardAssume that AB Tire Store completed the following perpetual inventory transactions for a line of tires: (Click the icon to view the transactions.) Requirements 1. 2. 3. 4. Compute cost of goods sold and gross profit using the FIFO inventory costing method. Compute cost of goods sold and gross profit using the LIFO inventory costing method. Compute cost of goods sold and gross profit using the weighted-average inventory costing method. (Round weighted-average cost per unit to the nearest cent and all other amounts to the nearest dollar.) Which method results in the largest gross profit, and why? X More info 4 Dec. 1 Beginning merchandise inventory Dec. 11 Purchase Dec. 23 Sale Dec. 26 Purchase Dec. 29 Sale 24 tires @ $61 each 6 tires @ $76 each 16 tires @ $83 each 14 tires @ $86 each 17 tires @ $83 eacharrow_forward

- A home improvement store, like Lowe’s, carries the following items:Required:1. Compute the total cost of inventory.2. Determine whether each inventory item would be reported at cost or net realizable value. Multiply the quantity of each inventory item by the appropriate cost or NRV amount and place the total in the “Lower of Cost and NRV” column. Then determine the total of that column.3. Compare your answers in requirement 1 and requirement 2 and then record any necessary adjustment to write down inventory from cost to net realizable value.4. Discuss the financial statement effects of using lower of cost and net realizable value to report inventory.arrow_forwardCem's Company sells custom-order paintings made with watercolor pastels and recycled canvases. Cem's company is located in Nashville, TN. Following is partial information for the income statement of Cem's Company under three different inventory costing methods, assuming the use of a periodic inventory system Required: 1. Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods. 2. Prepare an income statement through pretax income for each method. Sales, 150 units; unit sales price, $50, Expenses, $1,500 3. Rank the three methods in order of preference based on income taxes paid (favorable cash flow) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods. Average Cost Cost of goods sald Beginning inventory O50 units @530) Purchases (150 units @129) Goods available for sale Ending inventory (560 units) Cost of goods…arrow_forwardWeathertough Boot Company manufactures two types of boots-rain boots and snow boots. Information related to both products is presented in the following table. (Click the icon to view the data.) Determine the ending inventory value per unit using the lower-of-cost-or-market rule assuming that WeathertoughBoot uses the group-by-group approach to LCM. WeathertoughBoot uses FIFO for inventory costing purposes. (Assume that Weathertough Boot Company is a U.S. GAAP reporter.) Begin by completing the table below to identify the market value for each group and to determine the ending inventory value per unit using the lower-of-cost-or-market. FIFO Cost Group Rain boots Snow boots Market Lower of Cost Value or Market Data table Group Rain Snow Current Replacement Cost $ 68 85 Selling Disposal Normal Profit Price Costs $93 115 $ 23 $ 25 Print Done Margin 8 14 $ Cost 61 97 - Xarrow_forward

- Ravenna Candles recently purchased candleholders for resale in its shops. Which of thefollowing costs would be part of the cost of the candleholder inventory?a. Advertising costsb. Freight inc. Freight outd. Purchasing agent wagesarrow_forwardeBook Question Content Area Challenge Problem Bhushan Company has been using LIFO for inventory purposes because it would prefer to keep gross profits low for tax purposes. In its second year of operation (20-2), the controller pointed out that this strategy did not appear to work and suggested that FIFO cost of goods sold would have been higher than LIFO cost of goods sold for 20-2. Is this possible? 20 - 1 Units Cost/Unit Purchase 1 100 $1.00 Purchase 2 200 2.00 Purchase 3 300 3.00 Ending inventory 200 20-2 Units Cost/Unit Beginning inventory 200 Purchase 4 150 $4.00 Purchase 5 250 5.00 Purchase 6 350 6.00 Ending inventory 50 Required: Question Content Area Using the information provided, complete the various charts below and compute the cost of goods sold for 20 - 1 and 20-2 comparing the LIFO and FIFO methods. If units are in inventory at two different costs, enter the OLDEST units first.Check My Work determine units sold and the cost of goods sold under each method.arrow_forwardMercado Company's inventory transactions in the fiscal year ended December 31, 2002, follow: Beginning Inventory Jan. 10 Purchase Jan. 1 Feb. 13 Purchase Jul. 21 Purchase 775 units @ $52/unit Feb. 15 Sales @ 600 units @ $53/unit 225 units @ $54/unit Aug. 10 Sales @ 285 units @ $55/unit Aug. 5 Purchase Mercado Company uses a perpetual inventory system. Its inventory had a selling price of $115 per unit, and it entered into the following current-year sales transactions: 450 units @ $56/unit 515 units $115/unit 275 units $115/unitarrow_forward

- Calculate the gross cost of merchandise sold. Present your answer with a dollar sign, comma separator, and rounded to the dollar (i.e. $19,642). NOTE. In order to get the answer on the key, you have to use the cost value of Physical Inventory NOT the cost value of Closing Book Inventory. Physical inventory is the more correct number, so this is the appropriate approach. NOTE. In order to get the answer on the key, you have to compute the cost percent, rounded to four decimal places (i.e. 53.1234%). This is a short-coming of the key that came with your textbook - and the authors' computation of the answer using Excel instead of a caluclator. NOTE. There are four questions associated with this data. You will ultimately complete a complete RIM exercise. Cost ($) Retail ($) Opening inventory 130,410 201,543 Gross purchases 418,390 884,916 Returns to vendors 1,726 3,514 Cash discounts 2,040 Alteration costs 1,620 Freight 1,690 Gross Sales 806,430…arrow_forwardUse the following information (in random order) from a merchandising company and from a service company. McNeil Merchandising Company Accumulated depreciation Beginning inventory Ending inventory Expenses Net purchases $ 700 8,500 4,500 1,800 9,500 Net sales 16,500 Krug Service Company Expenses $ 8,100 21,000 Revenues Cash 600 Prepaid rent Accounts payable Equipment 640 200 1,900 a. Compute the goods available for sale, the cost of goods sold and gross profit for the merchandiser. Hint. Not all information may be necessary. b. Compute net income for each company. a. Goods available for sale a. Cost of goods sold a. Gross profit b. Net income for Krug Service Company b. Net income for McNeil Merchandising Companyarrow_forwardfor each of the following cost flow assumptions, calculate cost of goods sold, ending inventory and gross profit 1 lifo 2 fifo moving average cost Question 6 of 7 Sheffield Inc. is a retailer operating in British Columbia. Sheffield uses the perpetual inventory system. All sales returns from customers result in the goods being returned to inventory; the inventory is not damaged. Assume that there are no credit transactions; all amounts are settled in cash. You are provided with the following information for Sheffield Inc. for the month of January 2022. Date January 1 Beginning inventory January 5 Purchase January 8 January 10 January 15 January 16 January 20 January 25 (a1) January 1 - Your answer is partially correct. January 5 January 8 January 10 January 15 Question 6 of 7 ya January 15 January 16 January 20 January 25 eTextbook Save for Later (a2) Calculate the Moving-average cost per unit at January 1, 5, 8, 10, 15, 16, 20, & 25. (Round moving-average cost per unit answers to 3…arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub