Concept explainers

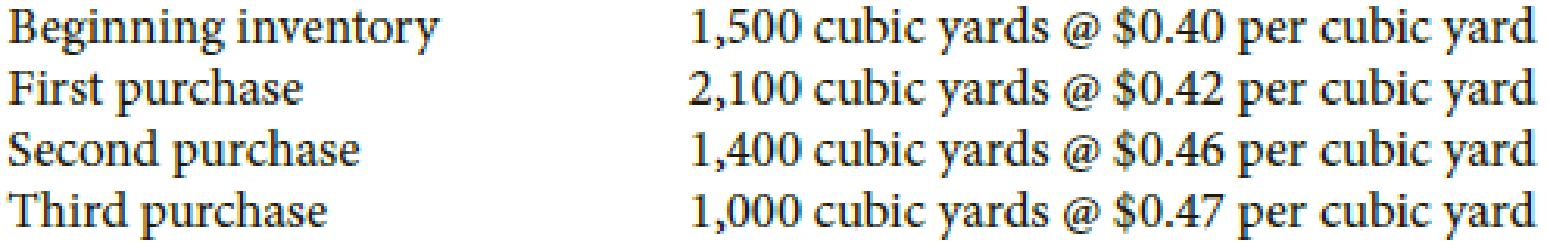

Bean Nursery sells bark to its customers at retail. Bean buys bark from a plywood mill in bulk and transports the bark in its own trucks. Information relating to the beginning inventory and purchases of bark is as follows:

Required

Find the cost of 1,200 cubic yards in the ending inventory by the weighted-average-cost method. Carry average cost per cubic yard to four decimals.

Check Figure

Cost of ending inventory, $519.24

Compute the cost of ending inventory using weighted-average-cost method.

Explanation of Solution

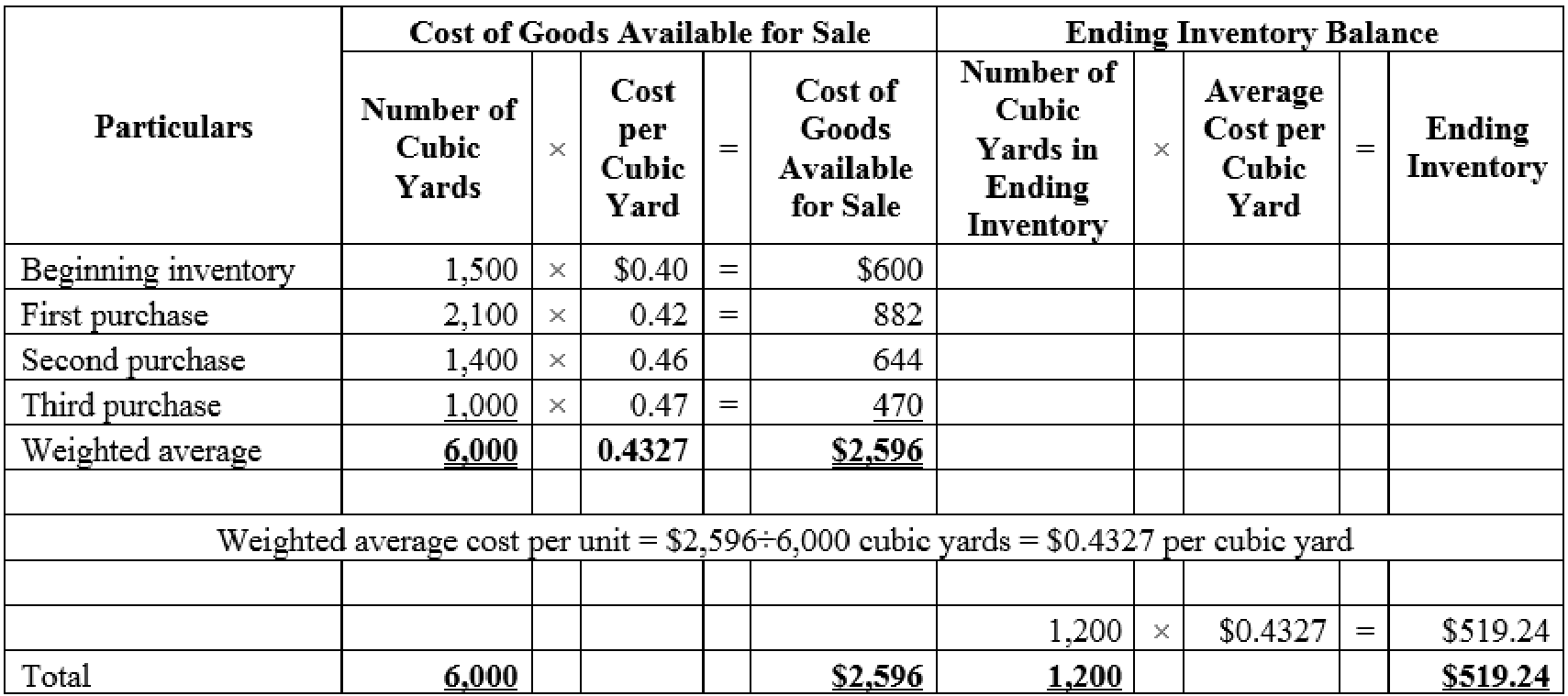

Weighted-average cost method: Under average cost method, company calculates a new average after every purchase. It is determined by dividing the cost of goods available for sale by the units on hand.

Compute the cost of ending inventory of 1,200 cubic yards using weighted-average-cost method.

Table (1)

Thus, the cost of 1,200 cubic yards using weighted-average-cost is $519.24.

Want to see more full solutions like this?

Chapter C Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Fundamentals of Cost Accounting

Advanced Financial Accounting

Auditing and Assurance Services (16th Edition)

Managerial Accounting: Tools for Business Decision Making

Financial Accounting, Student Value Edition (5th Edition)

Fundamentals Of Cost Accounting (6th Edition)

- Use the information presented in Problem C-1 to solve this problem. Required Find the cost of the ending inventory by the last-in, first-out method. PROBLEM C-1 Bean Nursery sells bark to its customers at retail. Bean buys bark from a plywood mill in bulk and transports the bark in its own trucks. Information relating to the beginning inventory and purchases of bark is as follows: Required Find the cost of 1,200 cubic yards in the ending inventory by the weighted-average-cost method. Carry average cost per cubic yard to four decimals. Check Figure Cost of ending inventory, 480arrow_forwardGolf Haven Superstore carries an inventory of putters and other golf clubs. The sales price of each putter is $144. Company records indicate the following for a particular line of Golf Haven Superstore's putters View the records. Read the requirements. Requirement 1. Prepare Golf Haven Superstore's perpetual inventory record for the putters assuming Golf Haven Supersto Round weighted average cost per unit to the nearest cent and all other amounts to the nearest dollar. Then identify the cost Start by entering the beginning inventory balances. Enter the transactions in chronological order, calculating new inventory been entered into the perpetual record, calculate the quantity and total cost of inventory purchased, sold, and on hand at the Date Jun. 1 Jun 6 Jun 8 Quantity 12 Purchases Unit Cost 75 Total Cost 900 Cost of Goods Sold Unit Cost Quantity Total Cost 2 $ 72 $ 144 Inventory on Hand Unit Quantity Cost 8 $ 65 6 72 S 72 S Total Cost 576 432 450 Records Date Jun. 1 Jun. 6 Jun. 8…arrow_forwardSeif Company sells many products. chairs is one of its popular items. Below is an analysis of the inventory purchases and sales of chairs for the month of April. Seif’s Company uses the periodic inventory system. Ending Inventory is determined to be 150 unit. Purchases Units Unit Cost 3/1 Beginning inventory 150 $40 3/3 Purchase 50 $50 3/10 Purchase 250 $55 3/30 Purchase 100 $65 Instructions (a) Using the FIFO assumption, calculate the amount charged to cost of goods sold for April. (Show computations) (b) Using the weighted average method, calculate the amount assigned to the inventory…arrow_forward

- Gallery Leather is using the following information to compute it's cost of goods sold: March - 1 - beginning inventory = 30 units @ $5 March - 3 - purchased 15 units @ $4 March - 9 - sold 25 units @ $8 What is the cost of goods sold for Gallery Leather assuming it uses LIFO?arrow_forwardGenuine Accessories Inc. uses a perpetual inventory system and records purchases at the net cost and sales at gross invoice price. The following are recent merchandising transactions:Mar. 6 Purchased 60 machines from Village Hardware on account. Invoice price, $350 per unit. The terms of purchase were 3/10, n/30. Mar. 11 Sold 15 of these machines on account for $525 each to White Electric Inc. (2/10, n/60).Mar. 16 Collected cash within the discount period. Mar. 19 Paid in cash to Village Hardware. Payment was made after discount period. Mar. 25 3 units were returned by White Electric Inc. d. The income statement of a merchandising company includes a major type of cost that does notappear in the income statement of a service type business. Identify the cost and explain what it represents. e. In your opinion which companies prefer perpetual inventory system over periodic to record theinventory related transactions and which companies do the opposite. Furthermore, why do you think that…arrow_forwardThe 123 Accounting Company sells accounting videos. The following information has been extracted from the records of 123 Accounting Co. January 1: Opening Inventory is 60 units @ $10/each January 10: Bought 100 units @ $11 each January 15: Bought 100 units @ $13 each January 20: Sold 220 units @ $20 each January 25: Bought 40 units @ $15 each If 123 Accounting uses the weighted average method of inventory and the perpetual method then the average cost of each unit charged to cost of sales when the sale is made will be: Multiple Choice $13.27 None of the other alternatives are correct $10.63 $11.54 $10arrow_forward

- Genuine Accessories Inc. uses a perpetual inventory system and records purchases at the net cost and sales at gross invoice price. The following are recent merchandising transactions:Mar. 6 Purchased 60 machines from Village Hardware on account. Invoice price, $350 per unit. The terms of purchase were 3/10, n/30. Mar. 11 Sold 15 of these machines on account for $525 each to White Electric Inc. (2/10, n/60).Mar. 16 Collected cash within the discount period. Mar. 19 Paid in cash to Village Hardware. Payment was made after discount period. Mar. 25 3 units were returned by White Electric Inc. a. Prepare journal entries to record these transactions. b. Assume that Genuine Accessories did pay Village Hardware within the discount period. Prepare journal entries to record this payment assuming that the original liability had been recorded at Net cost and at Gross invoice price. c. Hensley Inc. is a retailer of dentistry equipment. You are told that Hensley’s ending inventory is $258,000 and…arrow_forwardThe following information is available for Goode Company: May 1 Beginning inventory 18 units @ $4 per unit May 7 Purchase 12 units @ $5 per unit May 10 Sale 14 units May 17 Purchase 10 units @ $6 per unit May 19 Sale 4 units Required:Answer the following questions for Goode Company: a. If perpetual FIFO is used, what is the total ending inventory in dollars?$ b. If perpetual LIFO is used, what is the cost of goods sold for the month?$ c. If weighted average is used, what is the ending inventory? Do not round intermediate calculations. Round your final answer to two decimal places.$ d. If moving average is used, what is the cost per unit sold for the May 10 sale? Round your answer to two decimal places.$arrow_forwardSeif Company sells many products. chairs is one of its popular items. Below is an analysis of the inventory purchases and sales of chairs for the month of April. Seif’s Company uses the periodic inventory system. Ending Inventory is determined to be 150 unit. Purchases Units Unit Cost 3/1 Beginning inventory 150 $40 3/3 Purchase 50 $50 3/10 Purchase 250 $55 3/30 Purchase 100 $65 Instruction (a) Using the FIFO assumption, calculate the amount charged to cost of goods sold for April. (Show computations) (b) Using the weighted average method, calculate the amount assigned to the inventory on hand on April 30. (Show computations) (c) Using the LIFO assumption, calculate the amount assigned to…arrow_forward

- Glasgow Enterprises started the period with 60 units in beginning inventory that cost $2.00 each. During the period, the company purchased inventory items as follows. Glasgow sold 300 units after purchase 3 for $10.20 each. Number of Purchase Items Cost 390 $ 2.50 2 105 2.60 3 55 3.00 If the company uses the FIFO cost flow method, Glasgow's cost of goods sold would be: Multiple Choice $720. $600.arrow_forwardCanadian Tire sells soccer balls and uses a perpetual inventory system. Canadian Tires inventory records show that at March 1, there were 50 units on hand at a cost of $15 each. Transactions related to purchase and sale of soccer balls in March were as follows: Per unit Cost 17 $14 Date Mar 2 Transaction Purchase Sale Units Sales price Mar 5 60 $20 Mar 15 Purchase 80 $12 Mar 30 Sale 50 $20 Instructions a. For each of the following cost formulas, calculate the ending inventory as at March 31 and the cost of goods sold for the month of March. i. FIFO ii. Average b. Assume that Canadian Tire is motivated to report the highest profit possible. Which method will they prefer?arrow_forwardSales during the year were 1,220 units. Beginning inventory was 380 units at a cost of $6 per unit. Purchase 1 was 610 units at $7 per unit. Purchase 2 was 940 units at $8 per unit. Required: a. Assume the periodic inventory system is used. Calculate cost of goods sold and ending inventory using FIFO method. (Enter all values as a positive value.) b. Assume the periodic inventory system is used. Calculate cost of goods sold and ending inventory using LIFO method. (Enter all values as a positive value.)arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,