Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

16th Edition

ISBN: 9780134475585

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 9.21E

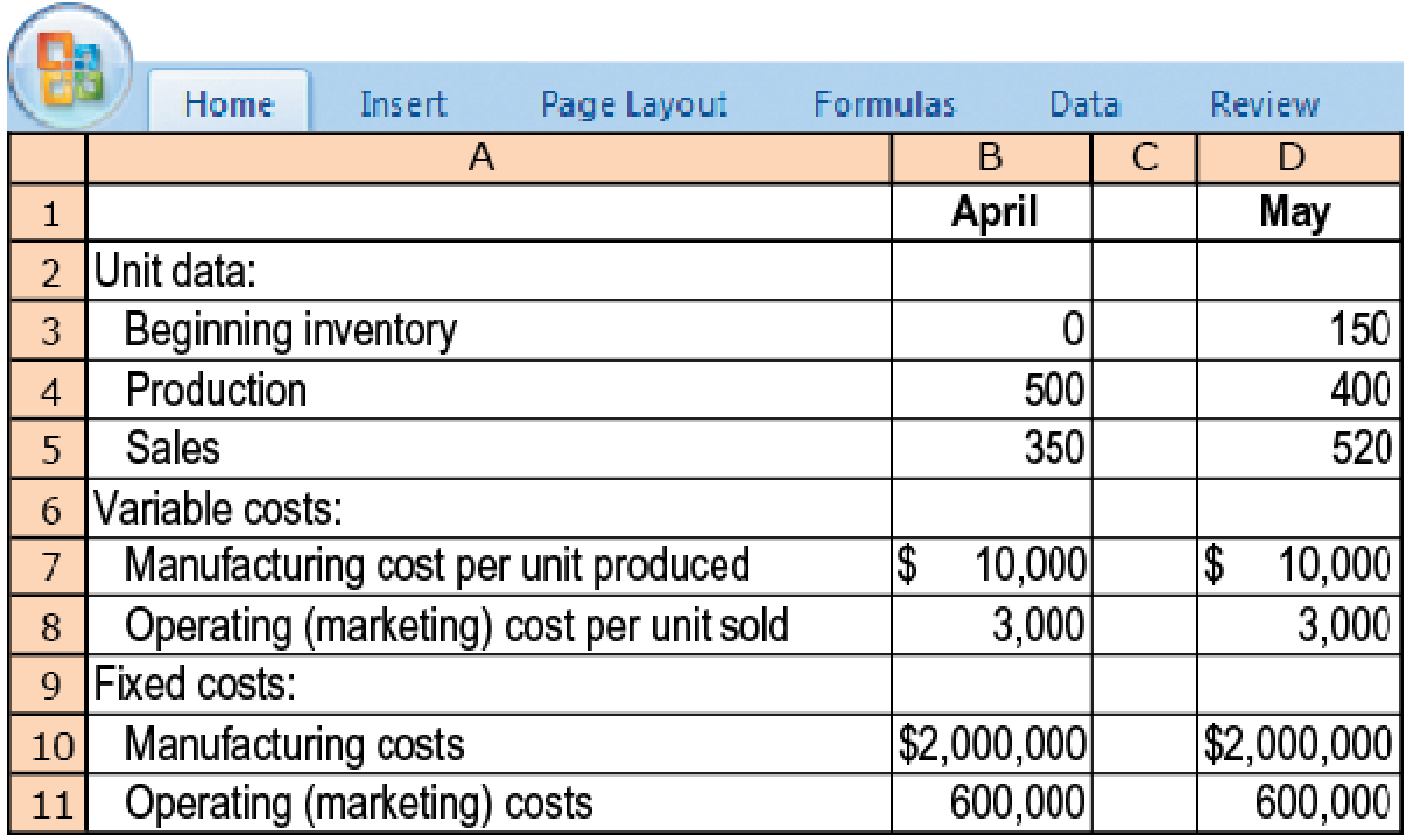

Variable and absorption costing, explaining operating-income differences. Nascar Motors assembles and sells motor vehicles and uses

The selling price per vehicle is $24,000. The budgeted level of production used to calculate the budgeted fixed

- 1. Prepare April and May 2017 income statements for Nascar Motors under (a) variable costing and (b) absorption costing.

Required

- 2. Prepare a numerical reconciliation and explanation of the difference between operating income for each month under variable costing and absorption costing.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Cool Car Motors assembles and sells motor vehicles and uses standard costing. Actual data relating to April and May 2014 are as follows:

The selling price per vehicle is $29,000. The budgeted level of production used to calculate the budgeted fixed manufacturing cost per unit is 500 units. There are no price, efficiency, or spending variances. Any production-volume variance is written off to cost of goods sold in the month in which it occurs.

Requirements:

Prepare April and May 2014 income statements for Cool Car Motors under (a) variable costing and (b) absorption costing.

Prepare a numerical reconciliation and explanation of the difference between operating income for each month under variable costing and absorption costing.

The selling price per unit is $3,300. The budgeted level of production used to calculate the budgeted fixed manufacturing cost per unit is 1,500 units. There are no price, efficiency, or spending variances. Any production-volume variance is written off to cost of goods sold in the month in which it occurs.

Q. Prepare income statements for EntertainMe in January, February, and March 2017 under (a) variable costing and (b) absorption costing.

Speedy

Motors assembles and sells motor vehicles and uses standard costing. Actual data relating to April and May

2020

are as follows:

LOADING...

(Click

the icon to view the data.)

The selling price per vehicle is

$25,000.

The budgeted level of production used to calculate the budgeted fixed manufacturing cost per unit is

500

units. There are no price, efficiency, or spending variances. Any production-volume variance is written off to cost of goods sold in the month in which it occurs.

Read the

requirements

LOADING...

.

Requirement 1. Prepare April and May

2020

income statements for

Speedy

Motors under (a) variable costing and (b) absorption costing.

(a) Prepare April and May

2020

income statements for

Speedy

Motors under variable costing. Complete the top half of the income statement for each month first, then complete the bottom portion. (Complete all input fields. Enter a "0" for any zero balance accounts.)

April 2020

May 2020…

Chapter 9 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Ch. 9 - Differences in operating income between variable...Ch. 9 - Why is the term direct costing a misnomer?Ch. 9 - Do companies in either the service sector or the...Ch. 9 - Explain the main conceptual issue under variable...Ch. 9 - Companies that make no variable-cost/fixed-cost...Ch. 9 - The main trouble with variable costing is that it...Ch. 9 - Give an example of how, under absorption costing,...Ch. 9 - What are the factors that affect the breakeven...Ch. 9 - Critics of absorption costing have increasingly...Ch. 9 - What are two ways of reducing the negative aspects...

Ch. 9 - Prob. 9.11QCh. 9 - Describe the downward demand spiral and its...Ch. 9 - Will the financial statements of a company always...Ch. 9 - Prob. 9.14QCh. 9 - The difference between practical capacity and...Ch. 9 - In comparing the absorption and variable cost...Ch. 9 - Queen Sales, Inc. has just completed its first...Ch. 9 - King Tooling has produced and sold the following...Ch. 9 - The following information relates to Drexler Inc.s...Ch. 9 - Prob. 9.20MCQCh. 9 - Variable and absorption costing, explaining...Ch. 9 - Throughput costing (continuation of 9-21). The...Ch. 9 - Variable and absorption costing, explaining...Ch. 9 - Throughput costing (continuation of 9-23). The...Ch. 9 - Variable versus absorption costing. The Tomlinson...Ch. 9 - Absorption and variable costing. (CMA) Miami,...Ch. 9 - Absorption versus variable costing. Horace Company...Ch. 9 - Candyland uses standard costing to produce a...Ch. 9 - Capacity management, denominator-level capacity...Ch. 9 - Denominator-level problem. Thunder Bolt Inc., is a...Ch. 9 - Variable and absorption costing and breakeven...Ch. 9 - Variable costing versus absorption costing. The...Ch. 9 - Throughput Costing (continuation of 9-32) 1....Ch. 9 - Variable costing and absorption costing, the Z-Var...Ch. 9 - Comparison of variable costing and absorption...Ch. 9 - Effects of differing production levels on...Ch. 9 - Alternative denominator-level capacity concepts,...Ch. 9 - Motivational considerations in denominator-level...Ch. 9 - Denominator-level choices, changes in inventory...Ch. 9 - Variable and absorption costing and breakeven...Ch. 9 - Downward demand spiral. Market.com is about to...Ch. 9 - Absorption costing and production-volume...Ch. 9 - Operating income effects of denominator-level...Ch. 9 - Variable and absorption costing, actual costing....Ch. 9 - Prob. 9.45PCh. 9 - Cost allocation, responsibility accounting, ethics...Ch. 9 - Absorption, variable, and throughput costing....Ch. 9 - Costing methods and variances, comprehensive. Rob...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Absorption versus variable costing. Horace Company manufactures a professional-grade vacuum cleaner and began operations in 2017. For 2017, Horace budgeted to produce and sell 25,000 units. The company had no price, spending, or efficiency variances and writes off production-volume variance to cost of goods sold. Actual data for 2017 are given as follows:arrow_forwardAccelerate Motors assembles and sells motor vehicles and uses standard costing Actual data relating to April and May 2020 are as follows: (Click the icon to view the data.) The selling price per vehicle is $28,000. The budgeted level of production used to calculate the budgeted fixed manufacturing cost per unit is 600 units. There are no price, efficiency, or spending variances. Any production-volume variance is writ off to cost of goods sold in the month in which it occurs. Read the requirements. Requirement 1. Prepare April and May 2020 income statements for Accelerate Motors unde(a) variable costing and (b) absorption costing. (a) Prepare April and May 2020 income statements for Accelerate Motors under variable costing Complete the top half of the income statement for each month first, then complete the bottom portion (Complete all input fields. Enter a "0" for any zero balance accounts.) April 2020 May 2020 Data table 1 2 3 4 5 Sales 6 Variable costs: 7 A Unit data: Beginning…arrow_forwardCorporation manufactures and sells 50-inch television sets and uses standard costing. Actual data relating to January, February, and March 2017 are as follows: The selling price per unit is $2,800. The budgeted level of production used to calculate the budgeted fixed manufacturing cost per unit is 1,250 units. There are no price, efficiency, or spending variances. Any production-volume variance is written off to cost of goods sold in the month in which it occurs. 1. Prepare income statements for HD in January, February, and March 2017 under (a) variable costing and (b) absorption costing. 2. Explain the difference in operating income for January, February, and March under variable costing and absorption costing.arrow_forward

- Horace Company manufactures a professional-grade vacuum cleaner and began operations in 2017. For 2017, Horace budgeted to produce and sell 25,000 units. The company had no price, spending, or efficiency variances and writes off production-volume variance to cost of goods sold. Actual data for 2017 are given in attatched picture: Q.Prepare a 2017 income statement for Horace Company using variable costing.arrow_forwardThe Shatontola Co. Ltd is a single-product manufacturing company, which uses a marginal costing system for internal management purposes. The year-end external reports are converted to absorption costs. Variances are charged to the cost of goods sold. The following data refers to the years ended 31 December 2020 and 2021: 2020 2021 K K Sales price per unit 80 90 Standard marginal cost per unit: Direct materials 21 23 Direct Labour…arrow_forwardspeedt Motors assembles and sells motor vehicles and uses standard costing. Actual data relating to April and May 2020are as follows the selling price per vehicle is $30,000.The budgeted level of production used to calculate the budgeted fixed manufacturing cost per unit is 400units. There are no price, efficiency, or spending variances. Any production-volume variance is written off to cost of goods sold in the month in which it occurs. a) Prepare April and May 2020 income statements for Speedy Motors under variable costing. Complete the top half of the income statement for each month first, then complete the bottom portioarrow_forward

- The Mulenga & Co. Ltd is a single-product manufacturing company, which uses a marginal costing system for internal management purposes. The year-end external reports are converted to absorption costs. Variances are charged to the cost of goods sold. The following data refers to the years ended 31 December 2020 and 2021: 2020 2021 K K Sales price per unit 80 90 Standard marginal cost per unit: Direct materials 21 23 Direct Labour…arrow_forwardCool Car Motors assembles and sells motor vehicles and uses standard costing. Actual data relating to April and May 2018 are provided. (Click to view the data.) The selling price per vehicle is $28,000. The budgeted level of production used to calculate the budgeted fixed manufacturing cost per unit is 500 units. There are no price, efficiency, or rate variances. Any production-volume variance is written off to COGS in the month in which it occurs. Required 1. Prepare April and May 2018 statements of comprehensive income for Cool Car Motors under (a) variable costing and (b) absorption costing. 2. Prepare a numerical reconciliation and explanation of the difference between operating income for each month under variable costing and absorption costing. Requirement 1a. Prepare April and May 2018 statements of comprehensive income for Cool Car Motors under variable costing. Complete the top half of the statement of comprehensive income for each month first, and then complete the bottom…arrow_forwardHorace Company manufactures a professional-grade vacuum cleaner and began operations in 2017. For 2017, Horace budgeted to produce and sell 25,000 units. The company had no price, spending, or efficiency variances and writes off production-volume variance to cost of goods sold. Actual data for 2017 are given in attatched picture: Q.Prepare a 2017 income statement for Horace Company using absorption costingarrow_forward

- KALIBO CORP. prepared the following absorption-costing income statement for the year ended May 31, 2019 Sales (16,000 units) Cost of goods sold Gross margin Selling and administrative expenses Operating income Additional information follows: Selling and administrative expenses include P1.50 of variable cost per unit sold. There was no beginning inventory, and 17,500 units were produced. Variable manufacturing costs were P11 per unit. Actual fixed costs were equal to budgeted fixed costs. REQUIREMENT: Prepare a variable-costing income statement for the same period. P 320,000 216.000 P104,000 46.000 P 58,000 Absorption Costing Income Statement (Conversion from Variable Net Income) 4. LEGAZPI COMPANY manufactures and sells premium tomato juice by the gallon. LEGAZPI just finished its first year of operations. The following data relates to this first year:arrow_forwardManey Televisions utilizes a traditional overhead allocation method, and has determined that overhead costs are driven by direct labor hours. Relevant cost information is provided below. Total estimated overhead costs $650,000 Total estimated DL hours 130,000 Actual overhead costs $640,300 Actual DL hours 127,500 The unadjusted cost of goods sold balance at the end of the year is $56,000. What is the overhead variance? Please provide your answer as a positive number rounded to the nearest whole dollar.arrow_forwardVariable and absorption costing, explaining operating-income differences. Nascar Motors assembles and sells motor vehicles and uses standard costing. Actual data relating to April and May 2017 are as follows:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY