1.

Journalize the transactions for the year 2016-2018 in the books of Incorporation CA.

1.

Explanation of Solution

Warranty:

Warranty is a written guarantee that is given by the seller to the buyer for the product against product’s defect.

Prepare the

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2016 | Cash or Accounts receivable | 500,000 | |

| Sales | 500,000 | ||

| (To record the sale revenue) |

Table (1)

- Cash or an account receivable is an asset account and it is increased. Thus, debit cash or accounts receivable with $500,000.

- Sales are a revenue account and it increases the shareholders’ equity. Thus, credit sales with $500,000.

Prepare the journal entry to record the estimated warranty liability for the year 2016:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2016 | Warranty expense (1) | 75,000 | |

| Estimated warranty liability | 75,000 | ||

| (To record the estimated warranty liability) |

Table (2)

Working note (1):

Determine the amount of estimated warranty liability.

- Warranty expense is an expense account and it decreases the value of shareholders’ equity. Thus, debit warranty expense with $75,000.

- Estimated warranty liability is a liability and it is increased. Thus, credit estimated warranty liability with $75,000.

Prepare the journal entry to record the warranty cost incurred during the year 2016:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2016 | Estimated warranty liability | 62,000 | |

| Cash or other assets | 62,000 | ||

| (To record the warranty cost incurred during the year) |

Table (3)

- Estimated warranty liability is a liability and it is decreased. Thus, debit estimated warranty liability with $62,000.

- Cash or other asset is an asset account and it is decreased. Thus, credit cash or other assets with $62,000.

Prepare the journal entry to record the sales for the year 2017:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2017 | Cash or Accounts receivable | 650,000 | |

| Sales | 650,000 | ||

| (To record the sale revenue) |

Table (4)

- Cash or an account receivable is an asset account and it is increased. Thus, debit cash or accounts receivable with $650,000.

- Sales are a revenue account and it increases the shareholders’ equity. Thus, credit sales with $650,000.

Prepare the journal entry to record the estimated warranty liability for the year 2017:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2017 | Warranty expense (2) | 97,500 | |

| Estimated warranty liability | 97,500 | ||

| (To record the estimated warranty liability) |

Table (5)

Working note (2):

Determine the amount of estimated warranty liability.

- Warranty expense is an expense account and it decreases the value of shareholders’ equity. Thus, debit warranty expense with $97,500.

- Estimated warranty liability is a liability and it is increased. Thus, credit estimated warranty liability with $97,500.

Prepare the journal entry to record the warranty cost incurred during the year 2017:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2017 | Estimated warranty liability | 82,000 | |

| Cash or other assets | 82,000 | ||

| (To record the warranty cost incurred during the year) |

Table (6)

- Estimated warranty liability is a liability and it is decreased. Thus, debit estimated warranty liability with $82,000.

- Cash or other asset is an asset account and it is decreased. Thus, credit cash or other assets with $82,000.

Prepare the journal entry to record the sales for the year 2018:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2018 | Cash or Accounts receivable | 700,000 | |

| Sales | 700,000 | ||

| (To record the sale revenue) |

Table (7)

- Cash or an account receivable is an asset account and it is increased. Thus, debit cash or accounts receivable with $700,000.

- Sales are a revenue account and it increases the shareholders’ equity. Thus, credit sales with $700,000.

Prepare the journal entry to record the estimated warranty liability for the year 2018:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2018 | Warranty expense (3) | 105,000 | |

| Estimated warranty liability | 105,000 | ||

| (To record the estimated warranty liability) |

Table (8)

Working note (3):

Determine the amount of estimated warranty liability.

- Warranty expense is an expense account and it decreases the value of shareholders’ equity. Thus, debit warranty expense with $105,000.

- Estimated warranty liability is a liability and it is increased. Thus, credit estimated warranty liability with $105,000.

Prepare the journal entry to record the warranty cost incurred during the year 2018:

| Date | Account titles and explanation | Debit ($) |

Credit ($) |

| 2018 | Estimated warranty liability | 85,000 | |

| Cash or other assets | 85,000 | ||

| (To record the warranty cost incurred during the year) |

Table (9)

- Estimated warranty liability is a liability and it is decreased. Thus, debit estimated warranty liability with $85,000.

- Cash or other asset is an asset account and it is decreased. Thus, credit cash or other assets with $85,000.

2.

Determine the amount of liability that would be reported by Incorporation CA on its December 31, 2018 balance sheet.

2.

Explanation of Solution

Liabilities: The claims creditors have over assets or resources of a company are referred to as liabilities. These are the debt obligations owed by company to creditors. Liabilities are classified on the balance sheet as current liabilities and long-term liabilities.

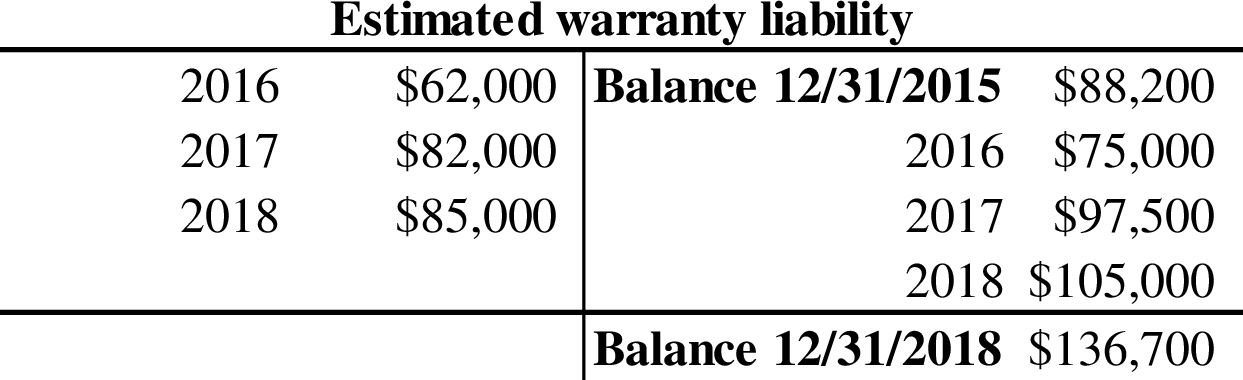

Prepare the T-account to determine the amount of estimated warranty liability:

The amount of liability that would be reported by Incorporation CA on its December 31, 2018 balance sheet is $136,700.

3.

Explain the manner in which the financial statements are affected for not recognizing the

3.

Explanation of Solution

According to the recognition principle, recognition of loss contingencies is to record the loss during the current period in which it is incurred. Thus, a loss must be recognized in the same period in which it is incurred and that would result in the probable decrease in an asset or the probable increase in the value of liability. If the loss contingencies are not recognized during the particular period, then it would understate the expense, overstate the earnings, overstate the shareholders’ equity, understate the liabilities in the beginning period and understate the earning of the future period.

Want to see more full solutions like this?

Chapter 9 Solutions

Cengagenowv2, 1 Term Printed Access Card For Wahlen/jones/pagach’s Intermediate Accounting: Reporting And Analysis, 2017 Update, 2nd

- Product A comes with a two year warranty when purchased by customers. The estimated warranty costs as a percentage of dollar sales are 3% in the year of sale and 5% in the second year after the sale. The following information relates to sales and warranty expenditures of Product A Actual warranty expenditures $ 10,000 $ 35,000 Year Year 1 Year 2 Sales $400,000 $500,000 Which of the following is NOT part of the required journal entry in Year 1 based on the above information? Multiple Choice Credit cash $10,000 Debit warranty expense $12,000 None of the other alternatives are correct Debit warranty expense $32,000 Credit sales $400,000arrow_forwardPHAGE COMPANY estimates its annual warranty expense at 4% of net sales. The following balances are given by EUSTASS: Net sales – 1,500,000; warranty liability – balance 12/31/2021 debit (before adjustment) of 10,000; warranty liability - balance 12/31/2021 credit (after adjustment) of 50,000. Which of the following entries was made to record the 2021 estimated warranty expense? a. Warranty expense 60,000 10,000 Retained earnings Warranty liability 50,000 b. Warranty expense Retained earnings Warranty liability 50,000 10,000 60,000 c. Warranty expense Warranty liability 40,000 40,000 d. Warranty expense Warranty liability 60,000 60,000arrow_forwardRequired information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Hitzu Company sold a copier (that costs $6,500) for $13,000 cash with a two-year parts warranty to a customer on August 16 of Year 1. Hitzu expects warranty costs to be 5% of dollar sales. It records warranty expense with an adjusting entry on December 31. On January 5 of Year 2, the copier requires on-site repairs that are completed the same day. The repairs cost $93 for materials taken from the parts inventory. These are the only repairs required in Year 2 for this copier. Exercise 9-13 (Algo) Financlal statement impact of warranty transactions LO P4 Analyze each of the following transactions: (a) the copier's sale; (b) the adjustment to recognize the warranty expense on December 31 of Year 1; and (c) the repairs that occur on January 5 of Year 2. Show each transaction's effect on the accounting equation-specifically, identify the…arrow_forward

- Kimber Sales offers warranties on all their electronic goods. Warranty expense is estimated at 3.5% of sales revenue. In 2018, Kimber had $333,000 of sales. In the same year, Kimber paid out $8,750 of warranty payments. Provide the journal entry to record the warranty expense. What is the balance of the liability account? Account name Debit Creditarrow_forwardDuring 2018, Stable Company introduced a new line of product that carry a three-year warranty against manufacturer’s defects. Based on industry experience, warranty costs are estimated at 2% of sales in the year of sale, 3% in the year after sale, and 4% in the second year after sale. Sales and actual warranty expenditures for the first three-year period were as follows: Sales Actual Warranty Expenditures 2018 P 400,000 P 6,000 2019 1,000,000 40,000 2020 1,400,000 90,000 P2,800,000 P136,000 What amount should Stable report as estimated warranty liability at December 31, 2020? What amount of warranty expense should be reported for 2019?arrow_forwardRequired Information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Hitzu Company sold a copier (that costs $5,500) for $11,000 cash with a two-year parts warranty to a customer on August 16 of Year 1. Hitzu expects warranty costs to be 5% of dollar sales. It records warranty expense with an adjusting entry on December 31. On January 5 of Year 2, the copier requires on-site repairs that are completed the same day. The repairs cost $147 for materials taken from the parts inventory. These are the only repairs required in Year 2 for this copier. Exercise 9-13 (Algo) Financial statement Impact of warranty transactions LO P4 Analyze each of the following transactions: (a) the copier's sale: (b) the adjustment to recognize the warranty expense on December 31 of Year 1; and (c) the repairs that occur on January 5 of Year 2. Show each transaction's effect on the accounting equation-specifically. identify the…arrow_forward

- Hall Company sells merchandise with a one-year warranty. In the current year, sales consist of 4,413 units. It is estimated that warranty repairs will average $15 per unit sold and 30% of the repairs will be made in the current year and 70% in the next year. In the current year's income statement, Hall should show warranty expense of a.$0 b.$66,195 c.$46,337 d.$19,859arrow_forwardMatthews Corporation warrants its products for two years. The estimated product warranty is 5% of sales. Assume that sales were $2,500,000 for 2011. In May of 2012, a customer received warranty repairs requiring $1,185 of parts and $250 of labor. Required: (1) Journalize the adjusting entry required at December 31, 2011 to record the accrued product warranty. (2) Journalize the entry to record the warranty work provided in May of 2012.arrow_forwardLachgar Industries warrants its products for one year. The estimated product warranty is 4% of sales. Assume that sales were $210,000 for June. In July, a customer received warranty repairs requiring $140 of parts and $95 of labor. a. Journalize the adjusting entry required at June 30, the end of the first month of the current fiscal year, to record the accrued product warranty. b. Journalize the entry to record the warranty work provided in July.arrow_forward

- A company manufactures electronic equipment and offers a one-year warranty with each unit sold. For the year, the company sold 25,000 units. Based on historical averages, management expects 4% of the units sold will need warranty work. The estimated warranty cost per unit is $100.Required:Estimate (a) the number of units that will need warranty work and (b) future warranty costs. (c) Prepare the year-end adjusting entry for estimated warranty costs, assuming none of the units sold in the current year required warranty work. (d) Alternatively, prepare the year-end adjusting entry for estimated warranty costs, assuming that 25% of the estimated warranty work has already occurred by the end of the current year. How would your answers change if management’s estimate of warranty work increases to 5% of units sold and the estimated warranty cost per unit increases to $120?arrow_forwardEmperor Pool Services provides pool cleaning and maintenance services to residential clients. It offers a one-year warranty on all services. Review each of the transactions: A. March 31: Emperor provides cleaning services for 17 pools during the month of March at a sales price per pool of $610 cash. Emperor records warranty estimates when sales are recognized and bases warranty estimates on 2 percent of sales. B. April 5: A customer files a warranty claim that Emperor honors in the amount of $130 cash. C. April 13: Another customer, J. Jones, files a warranty claim that Emperor does not honor due to customer negligence. D. June 8: J. Jones files a lawsuit requesting damages related to the dishonored warranty in the amount of $2,300. Emperor determines that the lawsuit is likely to end in the plaintiff's favor and the $2,300 is a reasonable estimate for damages. Prepare any necessary journal entries for each situation. If an amount box does not require an entry, leave it blank. If no…arrow_forwardAccounting for warranty expense and warranty payable The accounting records of Sculpted Ceramics included the following at January 1,2018: In the past, Sculpted’s warranty expense has been 9% of sales. During 2018, Sculpted made sales of $113,000 and paid $7,000 to satisfy warranty Claims. Requirements Journalize Sculpted’s warranty expense and warranty payments during 2018. Explanations are not required. What balance of Estimated Warranty Payable will Sculpted report on its balance sheet at December 31, 2018?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning