Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 5, Problem 84BPSB

Aging Method

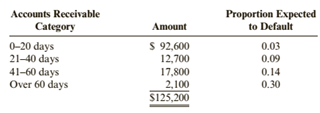

Carol Simon, the manager of Handy Plumbing has provided the following aging schedule for Handy’s accounts receivable:

Carol indicates that the $125,200 of accounts receivable identified in the table does not include $9,400 of receivables that should be written off.

Required:

1. Journalize the $9,400 write-off.

2. Determine the desired post adjustment balance in allowance for doubtful accounts.

3. If the balance in allowance for doubtful accounts before the $9,400 write-off was a debit of $550, compute bad debt expense. Prepare the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Background imformation:

The Lake Lucerne Company uses the allowance method of estimating bad debts expense. An aging schedule is prepared in order to calculate the balance in the allowance account.

The percentage uncollectible is calculated as followed:

1-30 days= 1.5%

31-60 days= 3.5%

61-90 days= 12%

91-365 days= 70%

Calculate the number of days each receivable is outstanding and Complete the Schedule of Accounts Receivable. Both are showed in the images attached for context and data. Make sure to show all work and formulas.

1)

Sustainable Supplies prepares the following aging of receivables analysis:

Accounts

receivable

Percent

uncollectible

$840.

Total

Days Past Due

Current 1 to 30

$

$

$

57,600 40,000 9,000

1%

3%

31 to 61 to Over 90

60

90

$

3,600

5%

$

2,000

8%

$

3,000

Prepare the adjusting entry to record bad debts expense assuming the unadjusted balance in the

Allowance for Doubtful Accounts is a $500 credit.

11%

A) Debit Bad Debts Expense $840; credit Allowance for Doubtful Accounts

B) Debit Allowance for Doubtful Accounts $840; credit Bad Debts Expense $840.

C) Debit Bad Debts Expense $1,840; credit Allowance for Doubtful Accounts $1,840.

D) Debit Allowance for Doubtful Accounts $1,840; credit Bad Debts Expense $1,840.

E) Debit Bad Debts Expense $1,340; credit Allowance for Doubtful Accounts $1,340.

An aging of a company's accounts receivable indicates that the estimate of uncollectible receivables totals $4,269. If Allowance for

Doubtful Accounts has a $1,349 credit balance, the adjustment to record the bad debt expense for the period will require a

Oa. debit to Bad Debt Expense for $4,269.

Ob. debit to Bad Debt Expense for $2,920.

Oc. debit to Bad Debt Expense for $5,618.

Od. credit to Allowance for Doubtful Accounts for $1,349.

Chapter 5 Solutions

Cornerstones of Financial Accounting

Ch. 5 - When is revenue recognized?Ch. 5 - When is a performance obligation satisfied?Ch. 5 - At what amount should sales revenue be recorded...Ch. 5 - Prob. 4DQCh. 5 - Prob. 5DQCh. 5 - Prob. 6DQCh. 5 - Prob. 7DQCh. 5 - Prob. 8DQCh. 5 - Prob. 9DQCh. 5 - Why is the direct write-off method not GAAP?

Ch. 5 - Prob. 11DQCh. 5 - Prob. 12DQCh. 5 - Prob. 13DQCh. 5 - How much interest will be due at maturity for each...Ch. 5 - A business borrows $1,000, signing a note that...Ch. 5 - Prob. 16DQCh. 5 - Describe what happens when receivables are...Ch. 5 - Prob. 18DQCh. 5 - Prob. 19DQCh. 5 - Prob. 20DQCh. 5 - Prob. 21DQCh. 5 - How may analyzing sales and receivables provide...Ch. 5 - Prob. 23DQCh. 5 - Prob. 1MCQCh. 5 - When is revenue from the sale of merchandise...Ch. 5 - What does the phrase, Revenue is recognized at the...Ch. 5 - Prob. 4MCQCh. 5 - Prob. 5MCQCh. 5 - Prob. 6MCQCh. 5 - Prob. 7MCQCh. 5 - All of the following are ways in which receivables...Ch. 5 - Which one of the following best describes the...Ch. 5 - If a company uses the direct write-off method of...Ch. 5 - Prob. 11MCQCh. 5 - Which of the following best describes the concept...Ch. 5 - The aging method is closely related to the a....Ch. 5 - Prob. 14MCQCh. 5 - Prob. 15MCQCh. 5 - Prob. 16MCQCh. 5 - Zenephia Corp. accepted a 9-month note receivable...Ch. 5 - Prob. 18MCQCh. 5 - Prob. 19MCQCh. 5 - ( Appendix 5A) Under the gross method, the seller...Ch. 5 - Service Revenue Kibitz Fitness received S30000...Ch. 5 - Service Revenue Softball Magazine Company received...Ch. 5 - Prob. 23CECh. 5 - Prob. 24CECh. 5 - Percentage of Credit Sales Clarissa Company has...Ch. 5 - Write-Off of Uncollectible Accounts The Rock has...Ch. 5 - Aging Method On January 1, 2019, Hungryman Inc....Ch. 5 - Aging Method On January 1, 2019, Smith Inc. has...Ch. 5 - Prob. 29CECh. 5 - Prob. 30CECh. 5 - Accounts Receivable Balance Beginning accounts...Ch. 5 - Accounts Receivable Balance Beginning accounts...Ch. 5 - Prob. 33CECh. 5 - Notes Receivable Metzler Communications designs...Ch. 5 - Notes Receivable Link Communications programs...Ch. 5 - Ratio Analysis The following information pertains...Ch. 5 - Ratio Analysis Diviney Corporations net sales and...Ch. 5 - Prob. 38CECh. 5 - Service Revenue H**R Wholesalers is a retailer...Ch. 5 - Service Revenue Melrose Milk Delivery provides...Ch. 5 - Prob. 41BECh. 5 - Prob. 42BECh. 5 - Prob. 43BECh. 5 - Write-Off of Uncollectible Accounts King...Ch. 5 - Aging Method Spotted Singer sells karaoke machines...Ch. 5 - Aging Method Ingrid Inc. has strict credit...Ch. 5 - Percentage of Credit Sales Method Ruby Red...Ch. 5 - Collection of Amounts Previously Written Off...Ch. 5 - Accounts Receivable Balance Hart Inc. began the...Ch. 5 - Accounts Receivable Balance XYZ Corp sells widgets...Ch. 5 - Accounts Receivable Balance Rays beginning and...Ch. 5 - Prob. 52BECh. 5 - Prob. 53BECh. 5 - Prob. 54BECh. 5 - Ratio Analysis Dobbys income statement lists net...Ch. 5 - Ratio Analysis Rose Corporation sells upscale...Ch. 5 - Prob. 57BECh. 5 - ( Appendix 5A) Sales Discounts Harry Gardner...Ch. 5 - ( Appendix 5A) Sales Discounts Ramsden Inc....Ch. 5 - Calculation of Revenue Wallace Motors buys and...Ch. 5 - Prob. 61ECh. 5 - Calculation of Revenue from Cash Collection...Ch. 5 - Prob. 63ECh. 5 - Sales and Sales Returns and Allowances Rubin...Ch. 5 - Average Uncollectible Account Losses and Bad Debt...Ch. 5 - Bad Debt Expense: Percentage of Credit Sales...Ch. 5 - Prob. 67ECh. 5 - Bad Debt Expense: Aging Method Glencoe Supply had...Ch. 5 - Aging Receivables and Bad Debt Expense Perkinson...Ch. 5 - Allowance for Doubtful Accounts At the beginning...Ch. 5 - Collection of Amounts Previously Written Off...Ch. 5 - Prob. 72ECh. 5 - Accounting for Notes Receivable On November 30,...Ch. 5 - Recording Notes Receivable: Issuance, Payment, and...Ch. 5 - Prob. 75ECh. 5 - Ratio Analysis The following information was taken...Ch. 5 - Ratio Analysis The following information was taken...Ch. 5 - Prob. 78ECh. 5 - Prob. 79APSACh. 5 - Prob. 80APSACh. 5 - Prob. 81APSACh. 5 - Prob. 82APSACh. 5 - Bad Debt Expense: Percentage of Credit Sales...Ch. 5 - Aging Method Bad Debt Expense Cindy Bagnal, the...Ch. 5 - Determining Bad Debt Expense Using the Aging...Ch. 5 - Accounting for Notes Receivable Yarnell...Ch. 5 - Prob. 87APSACh. 5 - Prob. 88APSACh. 5 - Prob. 79BPSBCh. 5 - Prob. 80BPSBCh. 5 - Prob. 81BPSBCh. 5 - Prob. 82BPSBCh. 5 - Prob. 83BPSBCh. 5 - Aging Method Bad Debt Expense Carol Simon, the...Ch. 5 - Determining Bad Debt Expense Using the Aging...Ch. 5 - Prob. 86BPSBCh. 5 - Prob. 87BPSBCh. 5 - Prob. 88BPSBCh. 5 - Ethics and Revenue Recognition Alan Spalding is...Ch. 5 - Prob. 89.2CCh. 5 - Prob. 89.3CCh. 5 - Prob. 90.1CCh. 5 - Prob. 90.2CCh. 5 - Prob. 90.3CCh. 5 - Prob. 91CCh. 5 - Prob. 92.1CCh. 5 - Prob. 92.2CCh. 5 - Prob. 93.1CCh. 5 - Prob. 93.2CCh. 5 - Prob. 94.1CCh. 5 - Prob. 94.2CCh. 5 - Prob. 95.1CCh. 5 - Prob. 95.2CCh. 5 - Prob. 95.3CCh. 5 - Prob. 95.4CCh. 5 - Prob. 95.5CCh. 5 - Prob. 95.6CCh. 5 - Prob. 95.7CCh. 5 - Comparative Analysis: Under Armour, Inc., versus...Ch. 5 - Prob. 96.2CCh. 5 - Prob. 96.3CCh. 5 - Prob. 96.4CCh. 5 - Prob. 96.5CCh. 5 - Prob. 96.6CCh. 5 - Prob. 97.1CCh. 5 - Prob. 97.2C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Aging Method Bad Debt Expense Cindy Bagnal, the manager of Cayce Printing Service, has provided the following aging schedule for Cayces accounts receivable Cindy indicates that the $121,100 of accounts receivable identified in the table does not include $4,600 of receivables that should be written off. Required: 1. Journalize the $4,600 write-off. 2. Determine the desired post adjustment balance in allowance for doubtful accounts (round each aging category to the nearest dollar). 3. If the balance in allowance for doubtful accounts before the $4,600 write-off was a debit of $700, compute bad debt expense. Prepare the adjusting entry to record bad debt expense.arrow_forwardEstimating allowance for doubtful accounts Evers Industries has a past history of uncollectible accounts, as follows. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule you completed in Exercise 8-8.arrow_forwardBad Debt Expense: Aging Method Glencoe Supply had the following accounts receivable aging schedule at the end of a recent year. The balance in Glencoes allowance for doubtful accounts at the beginning of the year was $58,620 (credit). During the year, accounts in the total amount of $62,400 were written off. Required: 1. Determine bad debt expense. 2. Prepare the journal entry to record bad debt expense. 3. If Glencoe had written off $90,000 of receivables as uncollectible during the year, how much would bad debt expense reported on the income statement have changed?arrow_forward

- Using data in Exercise 9-9, assume that the allowance for doubtful accounts for Waddell Industries has a credit balance of 6,350 before adjustment on August 31. Journalize the adjusting entry for uncollectible accounts as of August 31. Waddell Industries has a past history of uncollectible accounts, as follows. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule you completed in Exercise 9-8. The accounts receivable clerk for Waddell Industries prepared the following partially completed aging of receivables schedule as of the end of business on August 31: The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals: a. Determine the number of days past due for each of the preceding accounts as of August 31. b. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.arrow_forwardAging Receivables and Bad Debt Expense Perkinson Corporation sells paper products to a large number of retailers. Perkinsons accountant has prepared the following aging schedule for its accounts receivable at the end of the year. Before adjusting entries are entered, the balance in the allowance for doubtful accounts is a debit of $480. Required: 1. Calculate the desired postadjustment balance in Perkinsons allowance for doubtful accounts. 2. Determine bad debt expense for the year.arrow_forwardKirchhoff Industries has a past history of uncollectible accounts, as follows. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule you completed in Exercise 9-8.arrow_forward

- Entries for bad debt expense under the direct write-off and allowance methods The following selected transactions were taken from the records of Rustic Tables Company for the year ending December 31: A. Journalize the transactions under the direct write-off method. B. Journalize the transactions under the allowance method, assuming that the allowance account had a beginning balance of 36,000 at the beginning of the year and the company uses the analysis of receivables method. Rustic Tables Company prepared the following aging schedule for its accounts receivable: C. How much higher (lower) would Rustic Tables net income have been under the direct write-off method than under the allowance method?arrow_forwardWaddell Industries has a past history of uncollectible accounts, as follows. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule you completed in Exercise 9-8. The accounts receivable clerk for Waddell Industries prepared the following partially completed aging of receivables schedule as of the end of business on August 31: The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals: a. Determine the number of days past due for each of the preceding accounts as of August 31. b. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.arrow_forwardUNCOLLECTIBLE ACCOUNTSPERCENTAGE OF RECEIVABLES Britos Hundai Sales and Service estimates the amount of uncollectible accounts using the percentage of receivables method. Based on aging the accounts, it is estimated that 4,500 will not be collected. Record the end-of-period adjusting entry on December 31, in general journal form, for the estimated uncollectible accounts. Assume the following independent conditions existed prior to the adjustment: 1. Allowance for Doubtful Accounts has a credit balance of 710. 2. Allowance for Doubtful Accounts has a debit balance of 305.arrow_forward

- The following accounts receivable information pertains to Luxury Cruises. A. Determine the estimated uncollectible bad debt for Luxury Cruises in 2018 using the balance sheet aging of receivables method. B. Record the year-end 2018 adjusting journal entry for bad debt. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $187,450; record the year-end entry for bad debt, taking this into consideration. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $206,770; record the year-end entry for bad debt, taking this into consideration. E. On January 24, 2019, Luxury Cruises identifies Landon Walkers account as uncollectible in the amount of $4,650. Record the entry for identification.arrow_forwardAn aging of a company's accounts receivable indicates that estimate of the uncollectible accounts totals $4,145. If Allowance for Doubtful Accounts has a $1,241 credit balance, the adjustment to record the bad debt expense for the period will require a Select the correct answer. a-credit to Allowance for Doubtful for $4,145. b-debit to Bad Debt Expense for $2,904. c-debit to Allowance for Doubtful Accounts for $2,904. d-debit to Allowance for Doubtful Accounts for $4,145arrow_forwardAn aging of a company's accounts receivable indicates the estimate of uncollectible receivables totals $5,249. If Allowance for Doubtful Accounts has a $1,383 credit balance, the adjustment to record the bad debt expense for the period will require a Oa. debit to Bad Debt Expense for $3,866. Ob. credit to Allowance for Doubtful Accounts for $5,249. Oc. debit to Bad Debt Expense for $1.383. Od. debit to Bad Debt Expense for $5,249. Dasarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License