Concept explainers

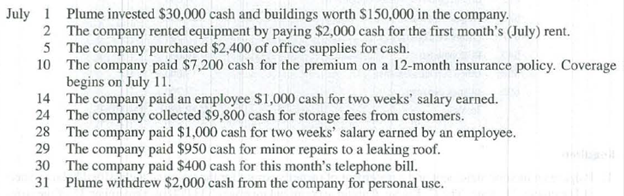

On July 1, Lula Plume created a new self-storage business, Safe Storage Co. The following transactions occurred during the company’s first month.

The company’s chart of accounts follows:

Required

- 1. Use the balance column format to set up each ledger account listed in its chart of accounts.

- 2. Prepare

journal entries to record the transactions for July and post them to the ledger accounts. Record prepaid and unearned items inbalance sheet accounts. - 3. Prepare an unadjusted

trial balance as of July 31. - 4. Use the following information to journalize and post

adjusting entries for the month:- a. Prepaid insurance of $400 has expired this month.

- b. At the end of the month, $1,525 of office supplies are still available.

- c. This month’s

depreciation on the buildings is $1,500. - d. An employee earned $100 of unpaid and unrecorded salary as of month-end.

- e. The company earned $1,150 of storage fees that are not yet billed at month-end.

- 5. Prepare the adjusted trial balance as of July 31. Prepare the income statement and the statement of owner’s equity for the month of July and the balance sheet at July 31.

- 6. Prepare journal entries to close the temporary accounts and post these entries to the ledger.

- 7. Prepare a post-closing trial balance.

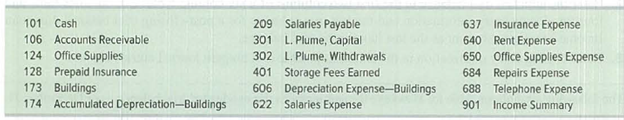

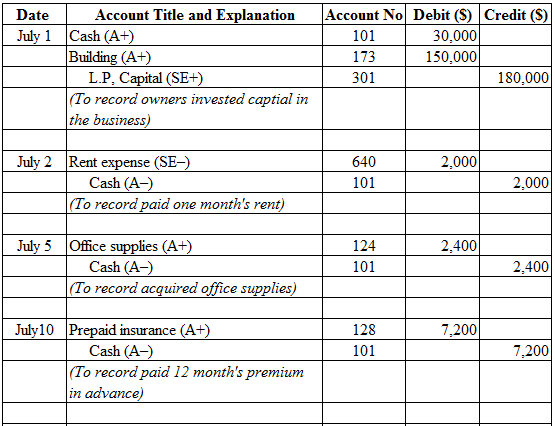

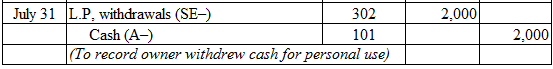

Requirement 2:

Prepare journal entries to record the transactions for July 31.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Prepare journal entries to record the transactions for July 31:

Table (1)

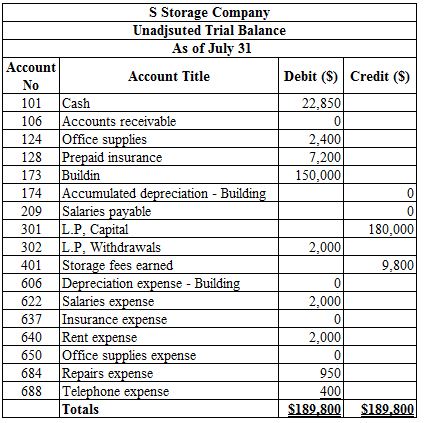

Requirement 3:

Prepare an unadjusted trial balance as of July 31.

Explanation of Solution

Unadjusted trial balance:

The unadjusted trial balance is the summary of all the ledger accounts that appear on the ledger accounts before making adjusting journal entries.

Prepare an unadjusted trial balance as of July 31:

Table (2)

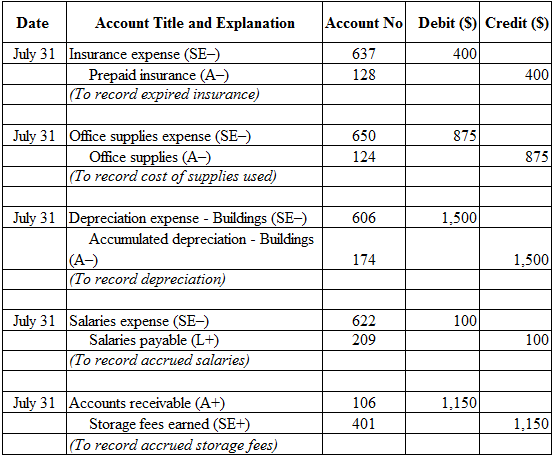

Requirement 4:

Journalize the adjusting entries.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Journalize the adjusting entries:

Table (3)

Working note:

Calculate the amount of office supplies used:

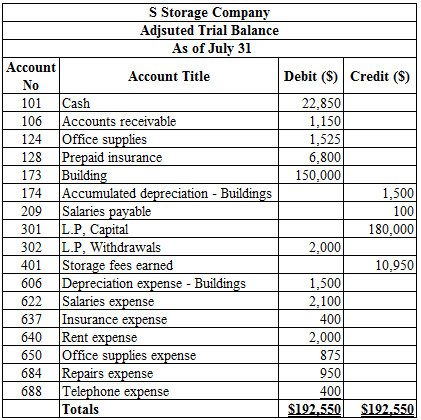

Requirement 5:

Prepare the following:

- Adjusted trial balance as of July 31.

- Income statement for the month ended July 31.

- Statement of owner’s equity for the month ended July 31.

- Balance sheet at July 31.

Explanation of Solution

Adjusted Trial Balance: Adjusted trial balance is the statement which contains complete list of accounts with their adjusted balances after all the relevant adjustments has been made. This statement is prepared at the end of every financial period.

Prepare the adjusted trial balance as of July 31:

Table (4)

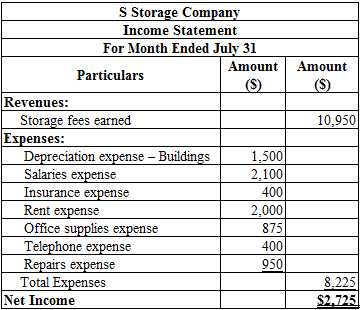

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for the month ended July 31:

Table (5)

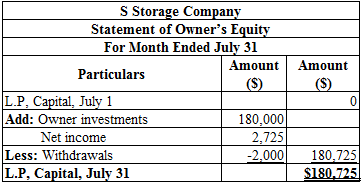

Statement of owners’ equity: This statement reports the beginning owner’s equity and all the changes, which led to ending owners’ equity. Additional capital, net income from income statement is added to and a drawing is deducted from beginning owner’s equity to arrive at the result, ending owner’s equity.

Prepare the statement of owners’ equity for the month ended July 31:

Table (6)

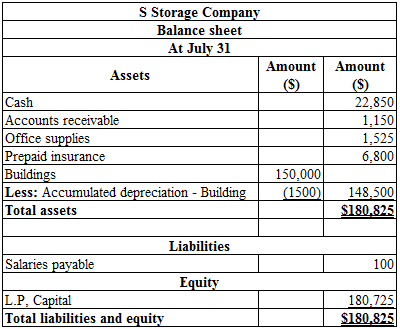

Balance sheet: This financial statement reports about the company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Prepare the balance sheet at July 31:

Table (7)

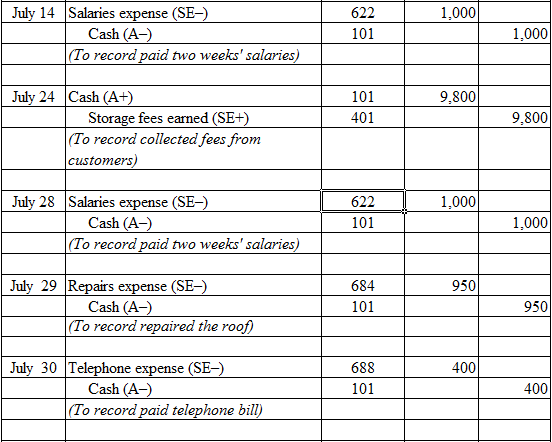

Requirement 5:

Prepare journal entries to close the temporary accounts.

Explanation of Solution

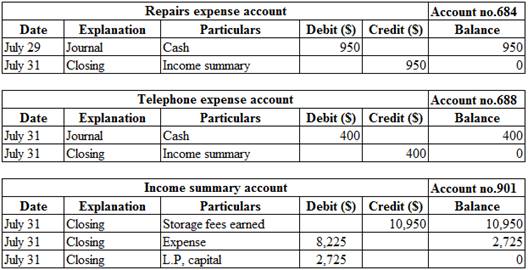

Closing entries: The journal entries prepared to close the temporary accounts to permanent account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Prepare the closing entries:

| Date | Accounts and Explanation |

Account Number |

Debit ($) | Credit ($) |

| July 31 | Storage fees earned (SE–) | 401 | 10,950 | |

| Income summary (SE+) | 901 | 10,950 | ||

| (To close the revenue account) | ||||

| July 31 | Income summary (SE–) | 901 | 8,225 | |

| Depreciation expense - Buildings (SE+) | 606 | 1,500 | ||

| Salaries expense (SE+) | 622 | 2,100 | ||

| Insurance expense (SE+) | 637 | 400 | ||

| Rent expense (SE+) | 640 | 2,000 | ||

| Office supplies expense (SE+) | 650 | 875 | ||

| Repairs expense (SE+) | 684 | 950 | ||

| Telephone expense (SE+) | 688 | 400 | ||

| (To close the expense accounts) | ||||

| July 31 | Income Summary (SE–) | 901 | 2,725 | |

| L.P’s Capital (SE+) | 301 | 2,725 | ||

| (To close the income summary accounts) | ||||

| July 31 | L.P’s Capital (SE–) | 301 | 2,000 | |

| L.P’s Withdrawals (SE+) | 302 | 2,000 | ||

| (To close withdrawals account.) |

Table (8)

Working Note:

Calculate the amount of L.P’s capital (transferred):

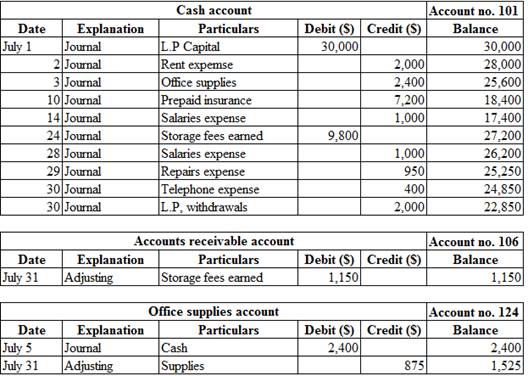

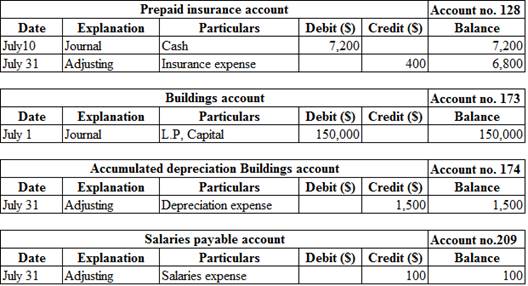

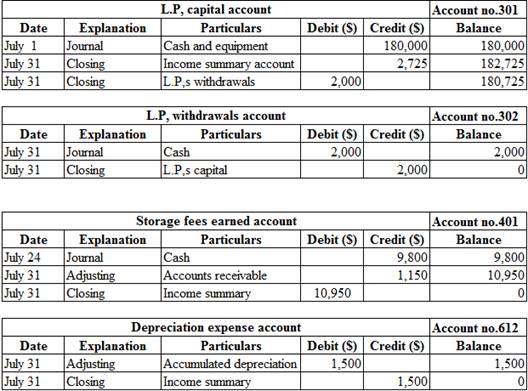

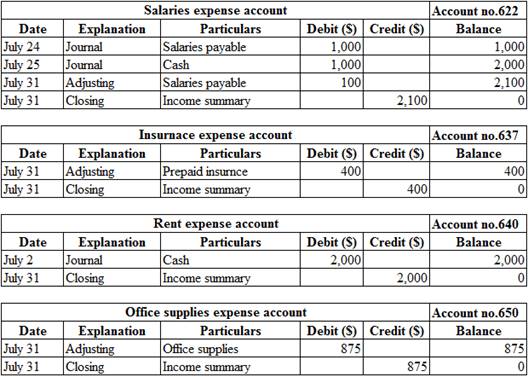

Requirement 1,2,4, and 6:

Post the journal entries, adjusting entries and closing entries to the ledger account:

Explanation of Solution

Ledger:

Ledger is the book, where the debit and credit entries recorded in the journal book are transferred to their relevant accounts. The entire accounts of the company are collectively called the ledger.

Posting the journal entries, adjusting entries and closing entries to the ledger account:

Table (9)

Requirement 7:

Prepare a post-closing trial balance.

Explanation of Solution

Post-closing trial balance:

The post-closing trial balance is a summary of all ledger accounts, and it shows the debit and the credit balances after the closing entries are journalized and posted. The post-closing trial balance contains only permanent (balance sheet) accounts, and the debit and the credit balances of permanent accounts should agree.

Prepare a post-closing trial balance:

| S Storage Company | ||

| Post-Closing Trial Balance | ||

| July 31 | ||

| Particulars | Debit($) | Credit ($) |

| Cash | 22,850 | |

| Accounts receivable | 1,150 | |

| Office supplies | 1,525 | |

| Prepaid insurance | 6,800 | |

| Buildings | 150,000 | |

| Accumulated depreciation – Buildings | 1,500 | |

| Salaries payable | 100 | |

| L.P’s Capital | 180,725 | |

| Totals | $182,325 | $182,325 |

Table (10)

Want to see more full solutions like this?

Chapter 4 Solutions

Principles of Financial Accounting.

- Catherines Cookies has a beginning balance in the Accounts Payable control total account of $8,200. In the cash disbursements journal, the Accounts Payable column has total debits of $6,800 for November. The Accounts Payable credit column in the purchases journal reveals a total of $10,500 for the current month. Based on this information, what is the ending balance in the Accounts Payable account in the general ledger?arrow_forwardThe transactions completed by AM Express Company during March, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of March 1: 2. Journalize the transactions for March, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and twocolumn general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardThe transactions completed by Revere Courier Company during December, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of December 1: 2. Journalize the transactions for December, using the following journals similar to those illustrated in this chapter: cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), single-column revenue journal (p. 35), cash payments journal (p. 34), and two-column general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forward

- Sage Learning Centers was established on July 20 to provide educational services. The services provided during the remainder of the month are as follows: Instructions 1. Journalize the transactions for July, using a single-column revenue journal and a two-column general journal. Post to the following customer accounts in the accounts receivable ledger and insert the balance immediately after recording each entry: D. Chase; J. Dunlop; F. Mintz; T. Quinn; K. Tisdale. 2. Post the revenue journal and the general journal to the following accounts in the general ledger, inserting the account balances only after the last postings: 3. a. What is the sum of the balances of the customer accounts in the subsidiary ledger at July 31? b. What is the balance of the accounts receivable controlling account at July 31? 4. Assume Sage Learning Centers began using a computerized accounting system to record the sales transactions on August 1. What are some of the benefits of the computerized system over the manual system?arrow_forwardPiedmont Inc. has the following transactions for its first month of business: A. What are the individual account balances, and the total balance, in the accounts payable subsidiary ledger? B. What is the balance in the Accounts Payable general ledger account?arrow_forwardDuring the month of October 20--, The Pink Petal flower shop engaged in the following transactions: Selected account balances as of October 1 were as follows: The Pink Petal also had the following subsidiary ledger balances as of October 1: REQUIRED 1. Record the transactions in a sales journal (page 7), cash receipts journal (page 10), purchases journal (page 6), cash payments journal (page 11), and general journal (page 5). Total, verify, and rule the columns where appropriate at the end of the month. 2. Post from the journals to the general ledger, accounts receivable ledger, and accounts payable ledger accounts. Use account numbers as shown in the chapter.arrow_forward

- Miss Angela recently joined A2A Limited as an accounting clerk. As a part of the financial reporting process, she receives the following source documents to prepare journal vouchers for general ledger entries. purchase orders, sales invoices, and vendor invoices Angela posts the journal vouchers to the general ledger and the related subsidiary ledgers at the end of each day. Each month the clerk reconciles the subsidiary accounts to their control accounts in the general ledger to ensure that they balance. Required: Discuss any control weaknesses and risks associated with the accounting information system of A2A Limited.arrow_forwardThe transactions completed by the MJW Company during January, its first month of operations, are listed below. Assume that MJW Company uses the following journals: Cash Receipts (CR), Cash Payments (CP), Revenue (R), Purchases (P), and General (G). Assume that it uses an Accounts Receivable and an Accounts Payable Subsidiary Ledgers as well as a General Ledger. Indicate by letters which journal would be used to record each transaction (a journal may be used multiple times). Also, indicate with a “Yes” (in the “Posting” column) if recording the entry requires a posting to a subsidiary ledger (note: there are only 5 of the 10 that require a posting to the subsidiary ledger). Journal Posting _____ ____ (1) Purchased equipment on account. _____ ____ (2) Issued an invoice to a customer. _____ ____ (3) Received a check from a customer for payment on account. _____ ____ (4) Issued check for advertising expense. _____ ____…arrow_forwardThe following is information related to Blossom Company for its first month of operations. Jan, 7- 15 23 Credit Sales Austin Co. Diaz Co. Noble Co. $11,800 7,300 11,100 Balance of Accounts Receivable Jan. 17 24 Austin Co. 29 Cash Collections Austin Co. Diaz Co. Noble Co. $7,900 4,900 Identify the balances that appear in the accounts receivable subsidiary ledger and the accounts receivable balance that appears in the general ledger at the end of January. 11.100 Subsidary Ledger Diaz Co, $ Noble Co. General Ledarrow_forward

- Sunrise Coffee Shop, in an effort to streamline its accounting system, has decided to utilize a cash receipts journal. Record the following transactions for the first two weeks in March, total the columns, and include the posting references. A partial chart of accounts is given below. After recording the transactions, indicate if there are any additional columns you would add to this journal. March 1 Cash received for beverages, $375. Cash received for food, $250. Cash received for customer sales of Sunrise's signature coffee mugs, $130. Cash received for beverages, $480. Cash received for food, $325. Cash received for customer sales of Sunrise's signature coffee mugs, $115. 10 Cash received on account from Central.com, $900. Chart of Accounts (Partial) 10 Cash 41 Beverage Revenue 12 Accounts Receivable 42 Food Revenue 15 Retail Items 43 Retail Revenue MacBook Air DII 80 F10 F11 F12 esc F6 F7 F8 F9 F1 F2 F3 F4 F5 23 & 3 4 5 8 тarrow_forwardMarx Supply uses a sales journal, a purchases journal, a cash receipts journal, a cash disbursements journal, and a general journal. The following transactions occur in the month of April. Identify the journal in which each transaction should be recorded.arrow_forwardTransactions related to revenue and cash receipts completed by Sycamore Inc. during the month of March 20Y8 are as follows: Prepare a single-column revenue journal and a cash receipts journal to record these transactions. Use the following column headings for the cash receipts journal: Fees Earned Cr., Accounts Receivable Cr., and Cash Dr. Place a check mark () in the Post. Ref. column to indicate when the accounts receivable subsidiary ledger should be posted.arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning