Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

12th Edition

ISBN: 9781259144387

Author: Richard A Brealey, Stewart C Myers, Franklin Allen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 32PS

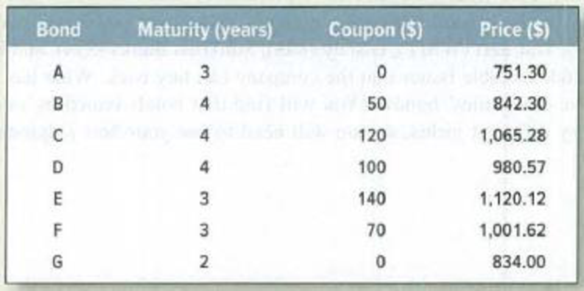

Price and spot interest rates Find the arbitrage opportunity(ies). Assume for simplicity that coupons are paid annually. In each case, the face

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Unlike the coupon interest rate, which is fixed, a bond's yield varies from day to day depending on market conditions. To be most useful, it should give us an estimate of the rate of return an investor

would earn if that investor purchased the bond today and held it for its remaining life. There are three different yield calculations: Current yield, yield to maturity, and yield to call.

A bond's current yield is calculated as the annual interest payment divided by the current price. Unlike the yield to maturity or the yield to call, it does not represent the actual return that investors

should expect because it does not account for the capital gain or loss that will be realized if the bond is held until it matures or is called. This yield was popular before calculators and computers came

along because it was easy to calculate; however, because it can be misleading, the yield to maturity and yield to call are more relevant.

The yield to maturity (YTM) is the rate of return earned on a…

Let's denote the price of a nonmaturing bond (called a consol) as P. The equation that indicates this price is Pn =-, where I is the annual net income the bond generates and r is the nominal market interest rate.

a. Suppose that a bond promises the holder $200 per year forever. The nominal market interest rate is 6 percent. Calculate the bond's current price: S. (Round your answer to the nearest whole dollar.)

If you have a coupon bond, its face value is $1,000 and the coupon rate is 4%. Complete the following table, then calculate the rate of return for the bond. If you know that it was purchased at the nominal value, comment on the results.

due date

return at maturity

the price

2

0.02

3

0.04

5

0.06

Present Value

Annuity

value

%

n

value

%

n

0.961

0.02

2

1.97

0.02

2

0.925

0.04

2

1.89

0.04

2

0.889

0.04

3

2.78

0.04

3

0.906

0.02

5

4.71

0.02

5

0.747

0.06

5

4.21

0.06

5

Chapter 3 Solutions

Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Ch. 3 - (PRICE) In February 2009, Treasury 8.5s of 2020...Ch. 3 - (YLD) On the same day, Treasury 3.5s of 2018 were...Ch. 3 - (DURATION) What was the duration of the Treasury...Ch. 3 - (MDURATION) What was the modified duration of the...Ch. 3 - Prob. 1PSCh. 3 - Bond prices and yields The following statements...Ch. 3 - Prob. 3PSCh. 3 - Bond prices and yields A 10-year German government...Ch. 3 - Bond prices and yields Construct some simple...Ch. 3 - Spot interest rates and yields Which comes first...

Ch. 3 - Prob. 7PSCh. 3 - Spot interest rates and yields Assume annual...Ch. 3 - Prob. 9PSCh. 3 - Prob. 10PSCh. 3 - Duration True or false? Explain. a....Ch. 3 - Duration Calculate the durations and volatilities...Ch. 3 - Term-structure theories The one-year spot interest...Ch. 3 - Real interest rates The two-year interest rate is...Ch. 3 - Duration Here are the prices of three bonds with...Ch. 3 - Prob. 16PSCh. 3 - Prob. 17PSCh. 3 - Spot interest rates and yields A 6% six-year bond...Ch. 3 - Spot interest rates and yields Is the yield on...Ch. 3 - Prob. 20PSCh. 3 - Prob. 21PSCh. 3 - Duration Find the spreadsheet for Table 3.4 in...Ch. 3 - Prob. 23PSCh. 3 - Prob. 25PSCh. 3 - Prob. 26PSCh. 3 - Prob. 27PSCh. 3 - Prob. 28PSCh. 3 - Prob. 29PSCh. 3 - Prices and yields If a bonds yield to maturity...Ch. 3 - Prob. 31PSCh. 3 - Price and spot interest rates Find the arbitrage...Ch. 3 - Prob. 33PSCh. 3 - Prices and spot interest rates What spot interest...Ch. 3 - Prices and spot interest rates Look one more time...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider a 10-year bond with a face value of $1,000 that has a coupon rate of 5.5%, with semiannual payments. a. What is the coupon payment for this bond? b. Draw the cash flows for the bond on a timelinearrow_forwardConsider a 25-year bond with a face value of $1,000 that has a coupon rate of 5.8%, with semiannual payments. a. What is the coupon payment for this bond? b. Draw the cash flows for the bond on a timeline. a. What is the coupon payment for this bond? The coupon payment for this bond is $ *** (Round to the nearest cent.)arrow_forwardAssume that the real risk-free rate is 2% and the average annual expected inflation rate is 4%. The DRP and LP for Bond A are each 2%, and the applicable MRP is 3%. What is Bond A's interest rate?arrow_forward

- Suppose that y is the yield on a perpetual government bond that pays interest at the rate of $1 per annum. Assume that y is expressed with simply com- pounding, that interest is paid annually on the bond, and that y follows the process dy = a(y0 −y)dt + oydWt, where a, y0, and o are positive constants and dWt is a Wiener process. (a) What is the process followed by the bond price? (b) What is the expected instantaneous return (including interest and capital gains) to the holder of the bond?arrow_forwardCalculate YTC using a financial calculator by entering the number of payment periods until call for N, the price of the bond for PV, the interest payments for PMT, and the call price for FV. Then you can solve for 1/YR YTC. Again, remember you need to make the appropriate adjustments for a semiannual bond and realize that the calculated 1/YR is on a periodic basis so you will need to multiply the rate by 2 to obtain the annual rate. In addition, you need to make sure that the signs for PMT and FV are identical and the opposite sign is used for PV; otherwise, your answer will be incorrect. A company is more likely to call its bonds if they are able to replace their current high-coupon debt with less expensive financing. A bond is more likely to be called if its price is above par-because this means that the going market interest rate is less than its coupon rate. Quantitative Problem: Ace Products has a bond issue outstanding with 15 years remaining to maturity, a coupon rate of 8.4%…arrow_forwardAssuming annual interest payments and a principal value of $100, what is the value of a 5-year 6.4% coupon bond when the discount rate is i) 4.6%, ii) 6.4%, and iii) 7.6% ? Show that your results are consistent with the relationship between the coupon rate, discount rate, and price relative to par value.arrow_forward

- In calculating the current price of a bond paying semiannual coupons, one needs to O use double the number of years for the number of payments made. O use the semiannual coupon. O use the semiannual rate as the discount rate. O All of the above needs to be done.arrow_forwardAssume that the real risk free rate is 3% and the average annual expected inflation rate is 5%. The DRP and LP for Bond A are each 1% and the applicable MRP is 2%. What is bond A’s interest rate?arrow_forwardConsider the following pure discount bonds with face value $1,000: Maturity Price 1 952.38 2 898.47 3 847.62 4 799.64 5 754.38 a). Find the spot rates and draw a yield curve.b). Assume that there is a constant liquidty premium that is equal to 1% across all maturities. Find the forward rates and the expected one period future interest rates.arrow_forward

- Consider a 20-year bond with a face value of $1,000 that has a coupon rate of 5.7%, with semiannual payments. a. What is the coupon payment for this bond? b. Draw the cash flows for the bond on a timeline. (Round to the nearest cent.)arrow_forwardSuppose that the prices of zero-coupon bonds with various maturities are given in the following table. The face value of each bond is $1,000. Maturity (Years) 1 2 3 4 5 Price $983.78 865.89 797.92 732.00 660.24 Required: a. Calculate the forward rate of interest for each year. b. How could you construct a 1-year forward loan beginning in year 3? c. How could you construct a 1-year forward loan beginning in year 4?arrow_forwardAssume that the real risk free rate is 2% and the average expected inflation rate is 3% for each future year. The default risk premium and the liquidity premium for bond x are each 1% and the applicable Maturity Risk premium is 2% what is bond x’s interest rate. Round to 2 decimal placesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Bond Valuation - A Quick Review; Author: Pat Obi;https://www.youtube.com/watch?v=xDWTPmqcWW4;License: Standard Youtube License