Concept explainers

COACHED PROBLEMS

Recording Nonquantitative Journal Entries

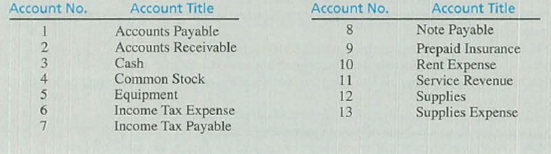

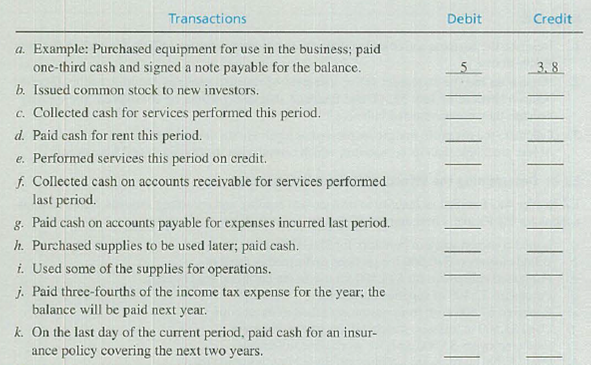

The following list includes a series of accounts for B-ball Corporation, which has been operating for three years. These accounts are listed alphabetically and numbered for identification. Following the accounts is a series of transactions. For each transaction, indicate the account(s) that should be debited and credited by entering the appropriate account number(s) to the right of each transaction. If no

TIP: In transaction (h), remember what the expense recognition principle says.

TIP: Think of transaction (j) as two transactions: (1) incur expenses and liability and (2) pay part of the liability.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Fundamentals Of Financial Accounting

- Maddie Inc. has the following transactions for its first month of business. A. What are the individual account balances, and the total balance, in the accounts receivable subsidiary ledger? B. What is the balance in the accounts receivable general ledger (control) account?arrow_forward1. Journalize each transaction in a two-column journal starting on Page 1, referring to the chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Note: Scroll down to access pages 2 through 4 of the journal. PAGE 1 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16…arrow_forwardFill in each of the following T-accounts for Belle Co.’s seven transactions listed here. The T-accounts represent Belle Co.’s general ledger. Code each entry with transaction number 1 through 7 (in order) for reference.arrow_forward

- Journalize the entries to record the transactions. Refer to the chart of accounts for the exact wording of the account titles. journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. journals will automatically indent a credit entry when a credit amount is entered. Assume a 360-day year when calculating interest. JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 2 3 4 5 6 7 8 9 10 11 12 13 14…arrow_forwardOn July 31, 2025, Sheridan Company engaged Minsk Tooling Company to construct a special-purpose piece of factory machinery. Construction began immediately and was completed on November 1, 2025. To help finance construction, on July 31 Sheridan issued a $296,400, 3-year, 12% note payable at Netherlands National Bank, on which interest is payable each July 31. $190,400 of the proceeds of the note was paid to Minsk on July 31. The remainder of the proceeds was temporarily invested in short-term marketable securities (trading securities) at 10% until November 1. On November 1, Sheridan made a final $106,000 payment to Minsk. Other than the note to Netherlands, Sheridan's only outstanding liability at December 31, 2025, is a $31,800, 8%, 6-year note payable, dated January 1, 2022, on which interest is payable each December 31. (a) Your answer is correct. Calculate weighted average accumulated expenditures, avoidable interest, and total interest cost to be capitalized during 2025.…arrow_forwardRequired Provide all journal entries pertaining to Singer's line of credit for the first three months of Year 1. (Round your final answers to the nearest dollar amount. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list 1 Record the cash borrowed. 2 Record the interest expenses paid. 3 Record the cash borrowed. Record the interest expenses paid. 5 Record the repayment of borrowed amount. 4 6 Record the interest expenses paid. ****** X w**** 2 of 4 # Next >arrow_forward

- Transactions are first journalized and then posted to ledger accounts. In this exercise, however, your understanding of the relationship between the journal and the ledger is tested by asking you to study some ledger accounts and determine the journal entries that probably were made to produce these ledger entries. The following accounts show the first six transactions of Avenson Insurance Company. Prepare a journal entry (including a written explanation) for each transaction. Cash Vehicles 144,000 Nov. 8 40,320 Nov. 30 11,280 Nov. 1 Nov. 25 14,400 Nov. 30 1,680 Land Notes Payable Nov. 8 84,000 Nov. 25 14,400 Nov. 8 114,000 Nov. 30 9,600 Building Accounts Payable Nov. 8 70,320 Nov. 21 576 Nov. 15 3,840 Office Equipment Capital Stock Nov. 15 3,840 Nov. 21 576 Nov. 1 144,000 Using the information in the ledger accounts presented in Exercise 3.3, prepare a trial balance for Avenson Insurance Company dated November 30.arrow_forwardPlease see below. Please be sure to use exact terms and dates for this. Need asap please and thank you. Selected transactions for Pharoah Company are presented below in journal form (without explanations). Date Account Title Debit Credit May 5 Accounts Receivable 4,070 Service Revenue 4,070 12 Cash 1,340 Accounts Receivable 1,340 15 Cash 2,120 Service Revenue 2,120 Post the transactions to T-accounts. (Post entries in the order of journal entries presented in the question.)arrow_forwardGeneral Ledger Tab - To see the detail of all transactions that affect a specific account, or the balance in an account at a specific point in time, click on the General Ledger tab. Abnormal balances appear in parentheses. Click on any amount to see the underlying journal entry. Pam Fisher opens a web consulting business called Fisher Consulting and completes the following transactions in March.Using the following transactions, record journal entries, create financial statements, and assess the impact of each transaction on the financial statements. Mar. 1 Fisher invested $237,000 cash along with $24,900 in office equipment in the company. Mar. 2 The company prepaid $8,000 cash for six months’ rent for an office. The company's policy is to record prepaid expenses in balance sheet accounts. Mar. 3 The company made credit purchases of office equipment for $5,900 and office supplies for $4,100. Payment is due within 10 days. Mar. 6 The company completed…arrow_forward

- The debits and credits from two transactions are presented in the following customer account: NAME Mobility Products Inc. ADDRESS 46 W. Main St. Date Item Post. Ref. Debit Credit Balance Aug. 1 Balance ✔ 540 Aug. 10 Invoice No. 59 CR24 103 437 Aug. 17 Invoice No. 64 R35 129 566 Select the choice that describes each transaction and the source of each posting. Date Action Invoice No. Posted From Journal page Aug. 10 fill in the blank 2 fill in the blank 4 Aug. 17 fill in the blank 6 fill in the blank 8arrow_forwardSales and notes receivable transactionsThe following were selected from among the transactions completed byCaldemeyer Co. during the current year. Caldemeyer Co. sells andinstalls home and business security systems. (attached) InstructionsJournalize the entries to record the transactions.arrow_forwardThe debits and credits from three related transactions are presented in the following customer's account taken from the accounts receivable subsidiary ledger: Mission Design 1319 Elm Street NAME ADDRESS Post. Date Item Ref. Debit Credit Balance 20Υ7 Apr. 3 R44 740 740 J11 60 680 CR81 24 680 Describe each transaction and identify the source of each posting.arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College