Prepare a spreadsheet to support a

Explanation of Solution

Statement of cash flows: Cash flow statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period. Statement of cash flows includes the changes in cash balance due to operating, investing, and financing activities.

Worksheet: A worksheet is a spreadsheet used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

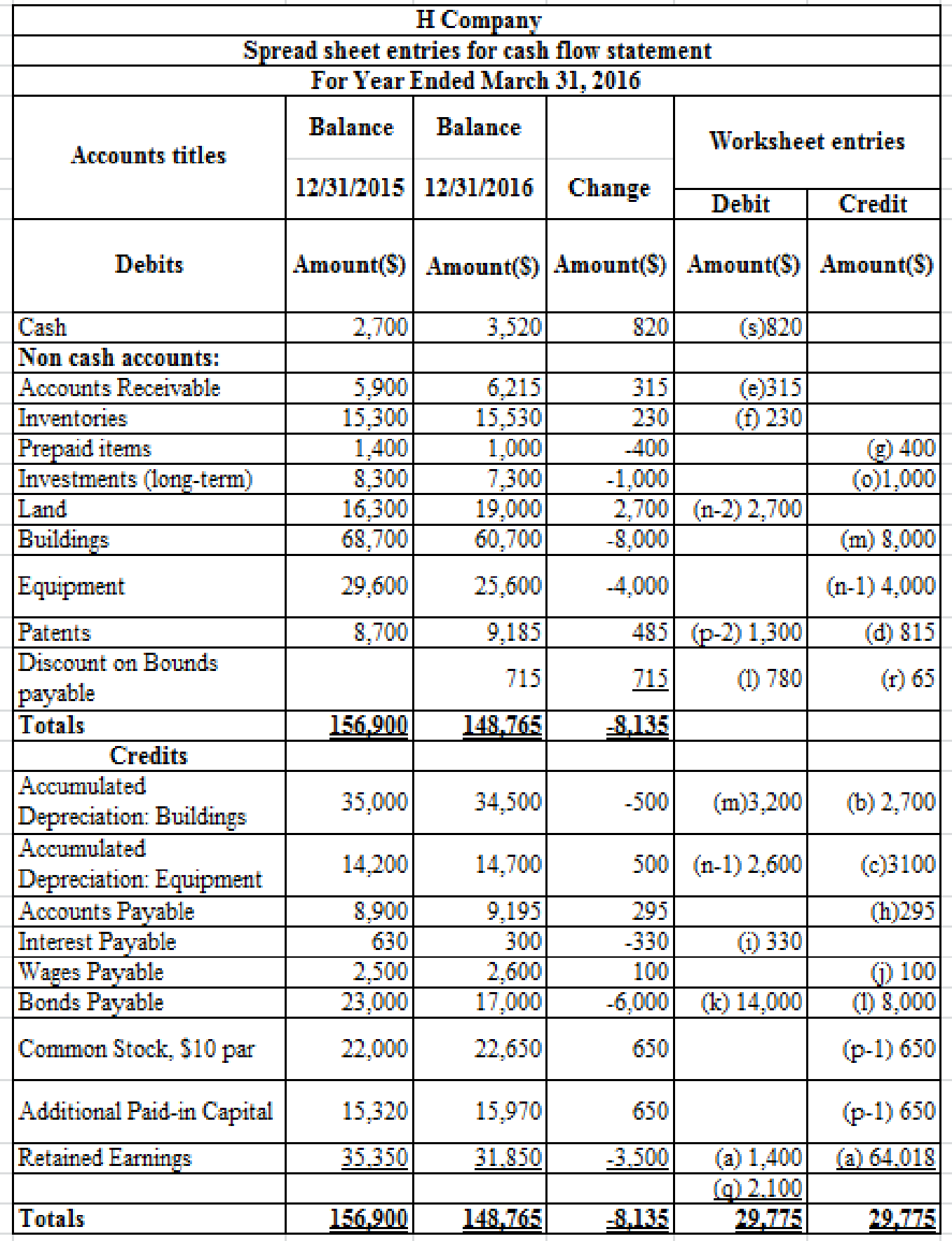

Prepare a spreadsheet to support the statement of cash flows.

Table (1)

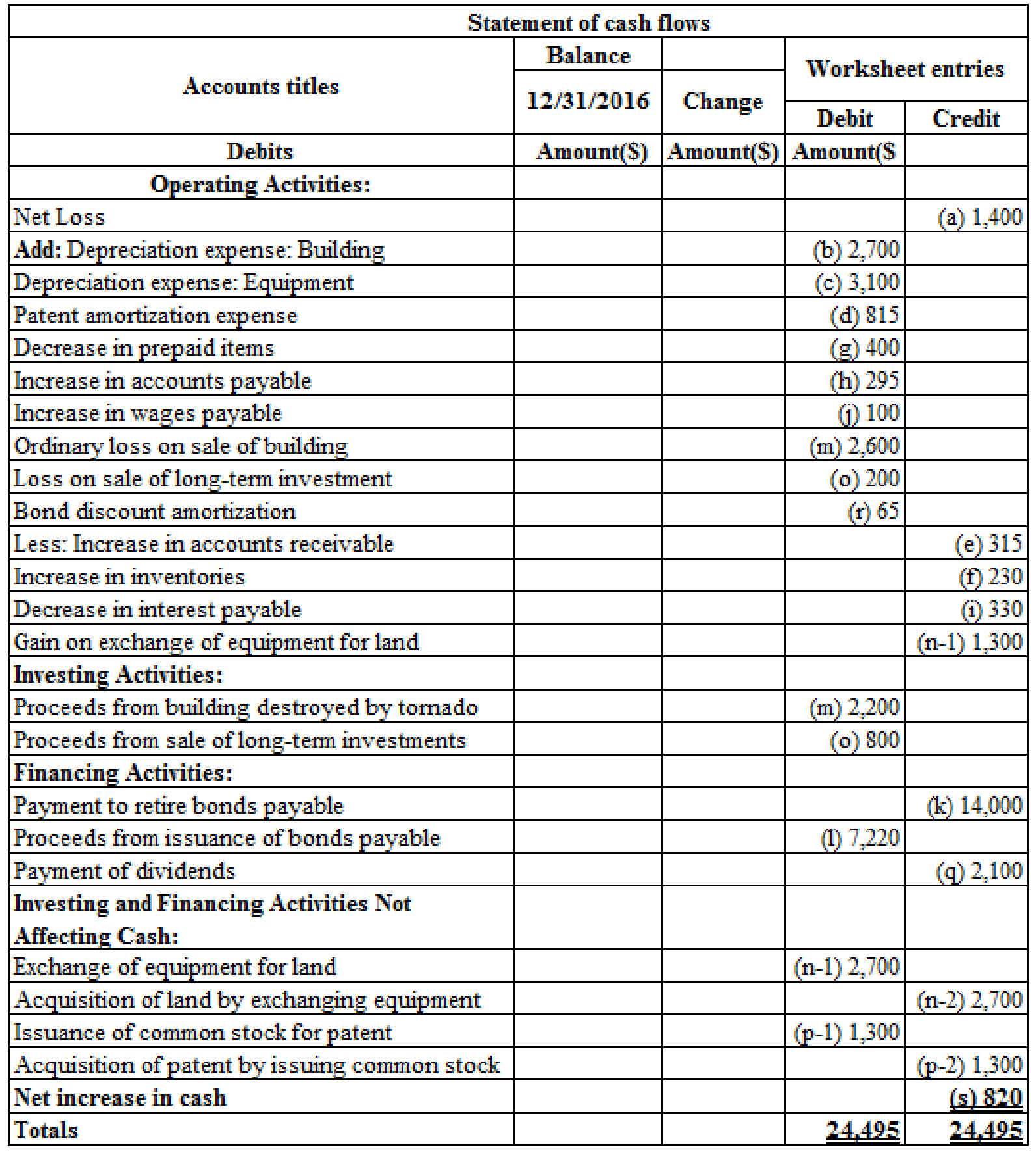

A statement of cash flows of H Company for the year 2016:

Table (2)

Working notes:

- (a) Calculate the net loss.

| Particulars | Amount($) | Amount($) |

| Revenues : | ||

| Sales | 49,550 | |

| Interest revenue | 790 | |

| Gain on exchange of assets | 1,300 | |

| Total revenue | 51,640 | |

| Expenses: | ||

| Cost of goods sold | 23,800 | |

| Wages expense | 16,510 | |

| Other operating expenses | 1,100 | |

| 2,700 | ||

| Depreciation expense: equipment | 3,100 | |

| Patent amortization | 815 | |

| Interest expense | 1,715 | |

| Loss on sale of investments | 200 | |

| Loss on sale of building | (2,600) | |

| Income tax expense | 500 | |

| Total expenses | (53,040) | |

| Net Loss | (1,400) |

Table (2)

Note: The $31,850 ending

(e) Calculate the increase in accounts receivable.

(f) Calculate the increase in inventories.

(g) Calculate the decrease in prepaid items.

(h) Calculate the increase in accounts payable.

- (i) Calculate the decrease in interest payable.

- (j) Calculate the increase in wages payable.

- (l) Proceeds from issuance of bonds payable.

- (m) Students may have difficulty with the extraordinary loss transaction. This may be shown in journal entry form as follows:

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| Proceeds from sale of building | 2,200 | ||

| Accumulated Depreciation | 3,200 | ||

| Ordinary Loss(net) | 2,600 | ||

| Buildings | 8000 | ||

| (To record the sale of building) |

Table (3)

(n-1) Calculate the exchange of equipment for land.

(o)Calculate the proceeds from sale of long-term investment.

(p-1) Calculate the issuance of common stock for patent.

(p-2) Acquisition of patent by issuing common stock is $1,300,

(r) Calculate the bond discount amortization.

(s) Calculate net increase in cash.

Therefore, the net increase in cash is $820.

Want to see more full solutions like this?

Chapter 21 Solutions

Cengagenowv2, 1 Term Printed Access Card For Wahlen/jones/pagach’s Intermediate Accounting: Reporting And Analysis, 2017 Update, 2nd

- In Orchard Company’s December 31, 2022 statement of financial position, a note receivable was reported as a non-current asset and its accrued interest for eight months was reported as a current asset. Which of the following terms would fit Orchard’s note receivable? A.) Both principal and accrued interest amounts are payable on April 30, 2023 and April 30, 2024 B.) Principal and interest amounts are payable on December 31, 2023 C.) Both Principal and interest amounts are payable on December 31, 2023 and December 31, 2024. D.) Principal is due on April 30, 2024 and interest is due on April 30, 2023 and April 30, 2024.arrow_forwardThe balance sheet for Ivanhoe Company reports the following information on July 1, 2022. IVANHOE COMPANYBalance Sheet (partial) Long-term liabilities Bonds payable $400,000 Less: Discount on bonds payable 9,000 $391,000 Ivanhoe decides to redeem these bonds at 109 after paying annual interest.Prepare the journal entry to record the redemption on July 1, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit July 1 enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amountarrow_forwardPrepare the appropriate journal entries for each of the following transactions in 2014. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) 2. Novak Analysts purchased $312,000 of its bonds on June 30, 2014, at 101 and immediately retired them. The carrying value of the bonds on the retirement date was $306,000. The bonds pay semiannual interest and the interest payment due on June 30, 2014 has been made and recorded. Prepare the journal entry for the retirement of the bond. No. Account Titles and Explanation 2. Debit Creditarrow_forward

- Cypress Oil Company's December 31, 2024, balance sheet listed $905,000 of notes receivable and $22,400 of interest receivable included in current assets. The following notes make up the notes receivable balance: Note 1 Dated 8/31/2024, principal of $450,000 and interest at 8% due on 2/28/2025. Note 2 Dated 6/30/2024, principal of $260,000 and interest due 3/31/2025. Note 3 $200,000 face value noninterest-bearing note dated 9/30/2024, due 3/31/2025. Note was issued in exchange for merchandise. The company records adjusting entries only at year-end. There were no other notes receivable outstanding during 2024. Required: 1. Determine the rate used to discount the noninterest-bearing note. 2. Determine the explicit interest rate on Note 2. 3. What is the amount of interest revenue that appears in the company's 2024 income statement related to these notes? Answer is complete but not entirely correct. 1. Discount rate 10 % 2. Interest rate 80 % 3. Interest revenue $ 53,696arrow_forwardAdjusting Entries for InterestAt December 31, 2011, Hoffman Corporation had two notes payable outstanding (notes 1 and 2). At December 31, 2012, Hoffman also had two notes payable outstanding (notes 3 and 4). These notes are described below: Date of note Principal Amount Interest Rate Number of Days December 31, 2011 Note 1 Novemer 16, 2011 $14,000 8% 120 Note 2 December 04, 2011 18,000 9% 60 December 31, 2012 Note 3 December 07, 2012 11,000 9% 60 Note 4 December 21, 2012 20,000 10% 30 Requireda. Prepare the adjusting entries for interest at December 31, 2011.b. Assume that the adjusting entries were made at December 31, 2011. Prepare the 2012 journal entries to record payment of the notes that were outstanding at December 31, 2011.c. Prepare the adjusting entries for interest at December 31, 2012.Round answers to nearest dollar. Use 360 days for interest calculations when applicable.arrow_forwardAt December 31, 2017, Hyasaki Corporation has the following account balances: Bonds payable, due January 1, 2026 $2,000,000 Discount on bonds payable 88,000 Interest payable 80,000 Show how the above accounts should be presented on the December 31, 2017, balance sheet, including the proper classifications.arrow_forward

- Ramsay's Company Statement of Financial Position as at December 31, shows notes payable totaling $115,000 with Rednail Bank. These are 90-day notes, renewable for another 90-day period. These notes should be classified on the statement of financial position of Ramsay Company as Select one: а. non-current liabilities. O b. deferred charges. O c. intermediate debt. O d. current liabilitiesarrow_forwardSpreadsheet from Trial Balance Heinz Companys post closing trial balance as of December 31, 2018, and the adjusted trial balance as of December 31, 2019, are shown here: A review of the accounting records reveals the following additional information: a. Bomb payable with a face value, book value, and market value of 14,000 were retired on June 30, 2019. b. Bonds payable with a face value of 8,000 were issued at 90.25 on August 1, 2019. They mature on August 1, 2024. The company uses the straight-line method to amortize the bond discount. c. The company sold a building that had an original cost of 8,000 and a book value of 4,800. The company received 2,200 in cash for the building and recorded a loss of 2,600. d. Equipment with a cost of 4,000 and a book value of 1,400 was exchanged for an acre of land valued at 2,700. No cash was exchanged. e. Long-term investments in bonds being held to maturity with a cost of 1,000 were sold for 800. f. Sixty-five shares of common stock were exchanged for a patent. The common stock was selling for 20 per share at the time of the exchange. Required: Prepare a spreadsheet to support a statement of cash flows for 2019.arrow_forwardMillennium Associates records bad debt using the allowance, balance sheet method. They recorded $299,420 in accounts receivable for the year, and $773,270 in credit sales. The uncollectible percentage is 3.2%. On November 22, Millennium Associates identifies one uncollectible account from Angels Hardware in the amount of $3,650. On December 18, Angels Hardware unexpectedly pays its account in full. Record journal entries for the following. A. Year-end adjusting entry for 2017 bad debt B. November 22, 2018 identification entry C. Entry for payment on December 18, 2018arrow_forward

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: Note: Round answers to two decimal places. 1. Calculate the times-interest-earned ratio. 2. Calculate the debt ratio. 3. Calculate the debt-to-equity ratio.arrow_forwardMillennium Associates records bad debt using the allowance, income statement method. They recorded $299,420 in accounts receivable for the year, and $773,270 in credit sales. The uncollectible percentage is 3.2%. On February 5, Millennium Associates identifies one uncollectible account from Molar Corp in the amount of $1,330. On April 15, Molar Corp unexpectedly pays its account in full. Record journal entries for the following. A. Year-end adjusting entry for 2017 bad debt B. February 5, 2018 identification entry C. Entry for payment on April 15, 2018arrow_forwardNotes Receivable Transactions The following notes receivable transactions occurred for Harris Company during the last three months of the current year. (Assume all notes are dated the day the transaction occurred.) Required: 1. Prepare the journal entries to record the preceding note transactions and the necessary adjusting entries on December 31. (Assume that Harris does not normally sell its notes and uses a 360-day year for the purpose of computing interest. Round all calculations to the nearest penny.) 2. Show how Harris notes receivable would be disclosed on the December 31 balance sheet. (Assume these are the only note transactions encountered by Harris during the year.)arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning